2 to 1

Wanted to offer the following in the hope that others might review with a constructive eye and, perhaps, conduct additonal backtesting. My technical abilities are limited, so I backtest manually.

The results for the 28 trading days between Apr 2 - May 12 on NQ June show 19 trades. 13 W 164 points 5L 29.75 points 1 BE. Gross of 134.25 points - $2685 before commission

Methodology

Chart set up: On a day session chart plot the 5 period average true range. Also plot a 5 period simple moving average of both the close and the open. Longs are taken only when the 5 period SMA of the close is above the 5 period SMA of the open. Shorts only when below.

Entries and Exits: If taking longs, add 50% of yesterday's ATR to today's open. This is the entry. Exits are either - a stop order at today's open, limit order at 50% of yesterday's ATR added to today's open, or MOC. For shorts simply reverse.

Having a target that is twice the stop really helped when I manually tested this for the same period as above on the 10 yr note (ZN June). 18 trades were taken. 8 W 83.5 points 10 L 47.5 points Gross of 36.5 points - $1140.62 before commission.

Thanks in advance for your constructive ideas for improvement and any additional backtesting you might undertake.

edit - 25% atr changed to 50%

The results for the 28 trading days between Apr 2 - May 12 on NQ June show 19 trades. 13 W 164 points 5L 29.75 points 1 BE. Gross of 134.25 points - $2685 before commission

Methodology

Chart set up: On a day session chart plot the 5 period average true range. Also plot a 5 period simple moving average of both the close and the open. Longs are taken only when the 5 period SMA of the close is above the 5 period SMA of the open. Shorts only when below.

Entries and Exits: If taking longs, add 50% of yesterday's ATR to today's open. This is the entry. Exits are either - a stop order at today's open, limit order at 50% of yesterday's ATR added to today's open, or MOC. For shorts simply reverse.

Having a target that is twice the stop really helped when I manually tested this for the same period as above on the 10 yr note (ZN June). 18 trades were taken. 8 W 83.5 points 10 L 47.5 points Gross of 36.5 points - $1140.62 before commission.

Thanks in advance for your constructive ideas for improvement and any additional backtesting you might undertake.

edit - 25% atr changed to 50%

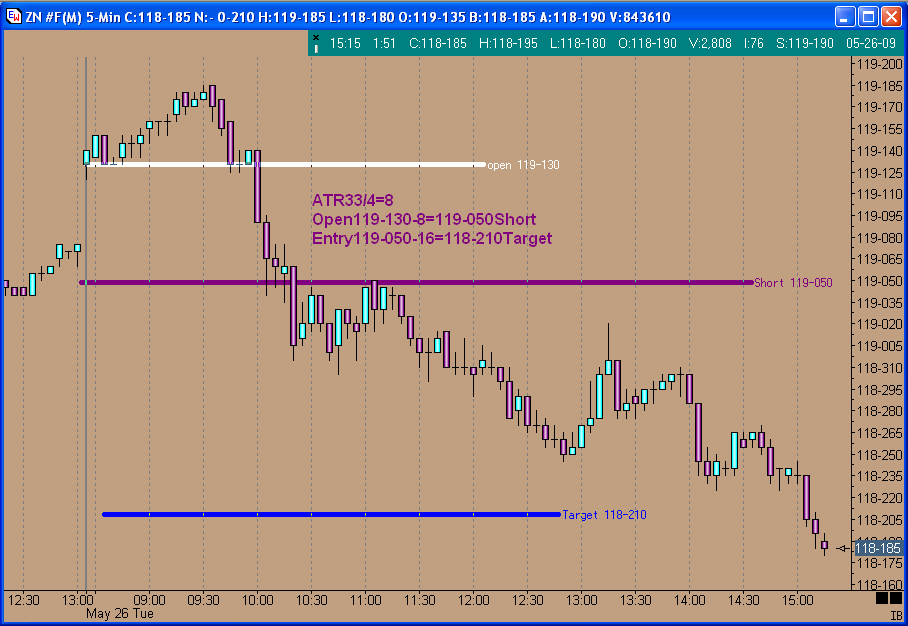

Last Friday would've worked well. No trades triggered on NQ or ES, but ZN caught a nice 16/32's.$500 on 1 contract.

For today: Short ZN @ 8/32's lower than open with a target of 16. Short ES @ 4.50 lower than open with target of 9. Short NQ @ 8.25 lower than open, targeting 16.50.

For today: Short ZN @ 8/32's lower than open with a target of 16. Short ES @ 4.50 lower than open with target of 9. Short NQ @ 8.25 lower than open, targeting 16.50.

Today's entries are: Short ZN 7.5 less than open with 15/32 target.

ES long 5.25 above open with 10.50 target. NQ long 9.75 above open with 19.50 target.

Is anyone doing any backtesting on this? Or any ideas for improving the approach? Is this useful?

ES long 5.25 above open with 10.50 target. NQ long 9.75 above open with 19.50 target.

Is anyone doing any backtesting on this? Or any ideas for improving the approach? Is this useful?

PaulR, I've been following along and I really like what your doing with the 2 to 1. Whats nice is that you can have a hit rate of less that 50% and still be probitable. I will try to backtest when I get a little more time. Thanks for sharing! How long have you been trading this?

trade4dough...been trading it for about a month now. I manually back tested the ES and NQ from the beginning of the year, ZN for over a month. Let me know how your testing turns out, partuicularly on other instruments.

Frustrating day. ES didn't fire. But ZN and NQ did. Both were looking good for a while. The NQ was ahead 10+ points and then it dropped quickly back to our stop for a 9.75 loss. ZN also made progress. Then came back to nick our stop by a tick! A 7.5 loss there. Then it ran right down to our 15 target!

It's ez to get discouraged with a day like this. But, if I look back at my testing and last month's trades, days like this will happen....and overall the approach is profitable. For example on the NQ over the past 100 trading days there were 35 days where nothing triggered - 1 BE - 23 losses for an average of 7.42 and 41 wins at an average of 13.35. That's a 63% win rate coupled with a 2 to 1 target to stop ratio. The math seems to work. Sorry to go on about this. Guess I just needed to reassure myself to stick with it. LOL.

It's ez to get discouraged with a day like this. But, if I look back at my testing and last month's trades, days like this will happen....and overall the approach is profitable. For example on the NQ over the past 100 trading days there were 35 days where nothing triggered - 1 BE - 23 losses for an average of 7.42 and 41 wins at an average of 13.35. That's a 63% win rate coupled with a 2 to 1 target to stop ratio. The math seems to work. Sorry to go on about this. Guess I just needed to reassure myself to stick with it. LOL.

Ok a new day. Enough whining and self doubt about yesterday.

For today: ZN short @ 9/32's less than open. Stop @ open with target of 18/32's. Long ES @ 5.25 above open. Stop @ open and target of 10.50. NQ long @ 9.25 above open. Stop @ open and target of 18.50.

For today: ZN short @ 9/32's less than open. Stop @ open with target of 18/32's. Long ES @ 5.25 above open. Stop @ open and target of 10.50. NQ long @ 9.25 above open. Stop @ open and target of 18.50.

All 3 triggered and all 3 lost. ES -5.25. ZN -9. NQ -1.5.

Interesting that none of these triggered in the morning, but from noon on. That left less time for the trades to work and all covered a fair amount of ground on the opposite side of the open before triggering. Tracking results by morning VS afternoon entry trigger might offer some insights. Disappointing day. But still well ahead with this approach.

Interesting that none of these triggered in the morning, but from noon on. That left less time for the trades to work and all covered a fair amount of ground on the opposite side of the open before triggering. Tracking results by morning VS afternoon entry trigger might offer some insights. Disappointing day. But still well ahead with this approach.

5/29/09

ES Long @ 5.50 above open. Stop @ open. Target @ +11.

NQ Long @ 9 above open. Stop @ open. Target + 18.

ZN Short @ 9 below open. Stop @ open. Target + 18.

ES Long @ 5.50 above open. Stop @ open. Target @ +11.

NQ Long @ 9 above open. Stop @ open. Target + 18.

ZN Short @ 9 below open. Stop @ open. Target + 18.

quote:

Originally posted by PAUL9

that's OK daytrading, I just have to make a few more posts. But when I saw that RUSS had 9 I wondered, how many do you need?

hi,

you please check if my levels are correct?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.