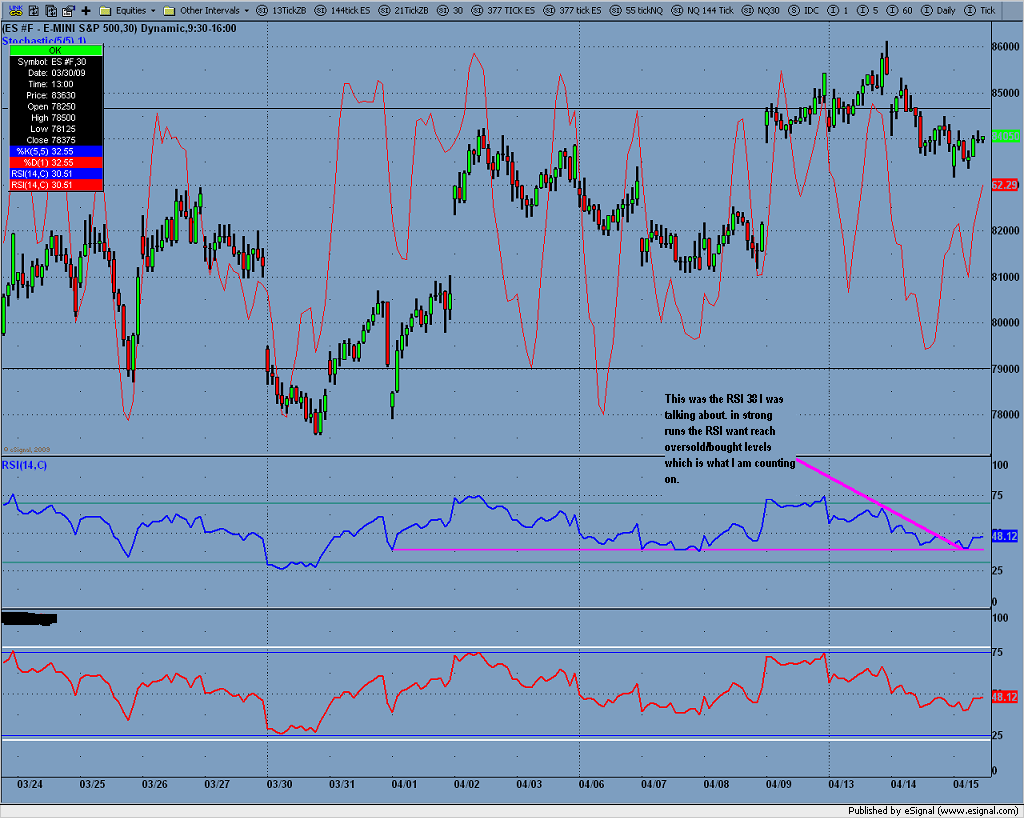

ES 30min RSI overbought/oversold

A little out of touch this week so far, was a nice winning streak though. I am looking to add at the 904.75 level.

2nd inside day in a row with a NR4 today. When we break this 3 day range in either direction I think we'll get some good moves for swing trading. Today was a good day for scalping though, starting to look like summer now, I love it. Can't wait to try MP buy low/ sell high all summer long it did good today.

avg @ 904.5, avg price now 906.625

quote:

Originally posted by CharterJoe

avg @ 904.5, avg price now 906.625

Covered 1/2 @ 914

I'll buy more if 1) the 30 min RSI starts an uptrend channel, we are currently in a downtrend channel 2)We get a clean break from Fridays high on the RSI not ES.

ES gapped to a new high, the RSI failed to register a new high thus putting it in a minor downtrend in a major uptrend & . The RSI is now breaking the lows on the minor downtrend on the RSI. Buys @ the 40(RSI) will most likely yield some nice profits, call options on teh SPY will be better than the emini since we had a new high and a large sell off thus driving the prem. of the calls to low levels.

Picked up some calls here ES @ 903...RSI 41.5 targeting 1pt ( ES would be at @ 928) swing trade on these June calls. I think the S&P is going down a couple more points but best fill I can do I'm actually supposed to be off. I am sneaking on my PDA and laptop LOL I need help.

Covered those calls @ +1.00 and picked up some puts at the close targeting 1pt on those.

The rsi seems to wanting to go to about the 51 level. We are getting some strong readings got an 80 today at Sq 9 @ 946. Looks like we are starting another predictable up cycle...putting the low @ around close tomorrow on the RSI at the low 50 level. And another up run after that.

The rsi seems to wanting to go to about the 51 level. We are getting some strong readings got an 80 today at Sq 9 @ 946. Looks like we are starting another predictable up cycle...putting the low @ around close tomorrow on the RSI at the low 50 level. And another up run after that.

Joe;

Have you used the ADX. If so what time frame?

Thanks

Have you used the ADX. If so what time frame?

Thanks

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.