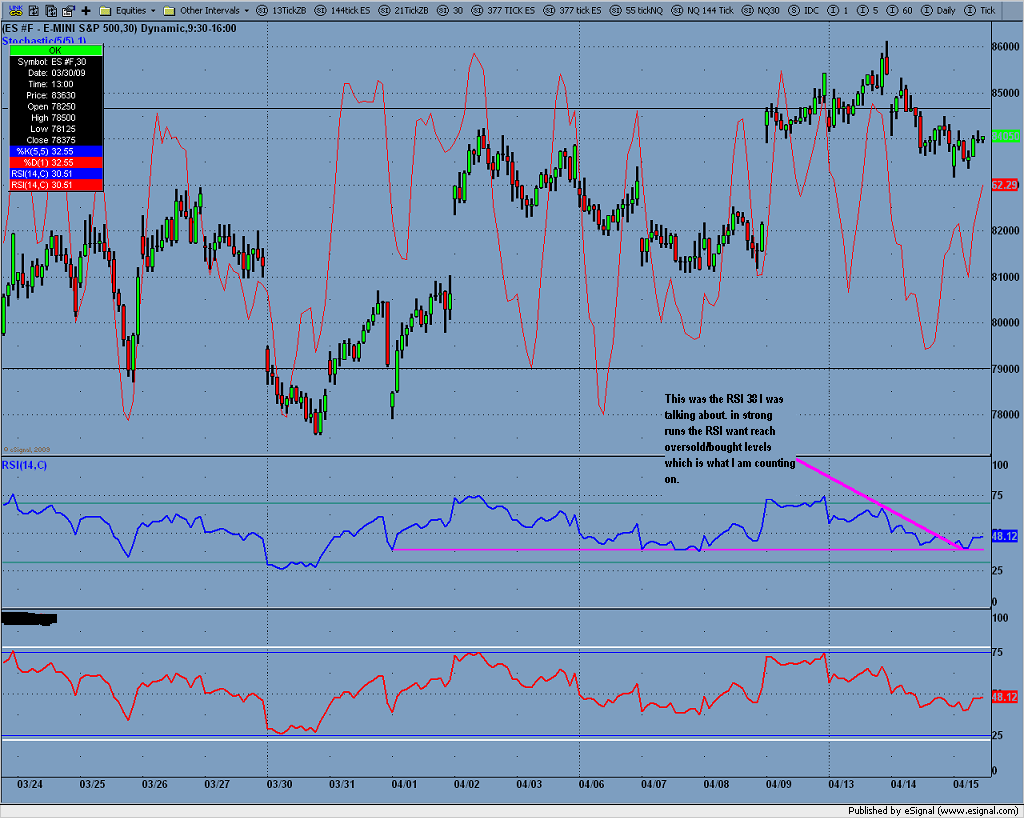

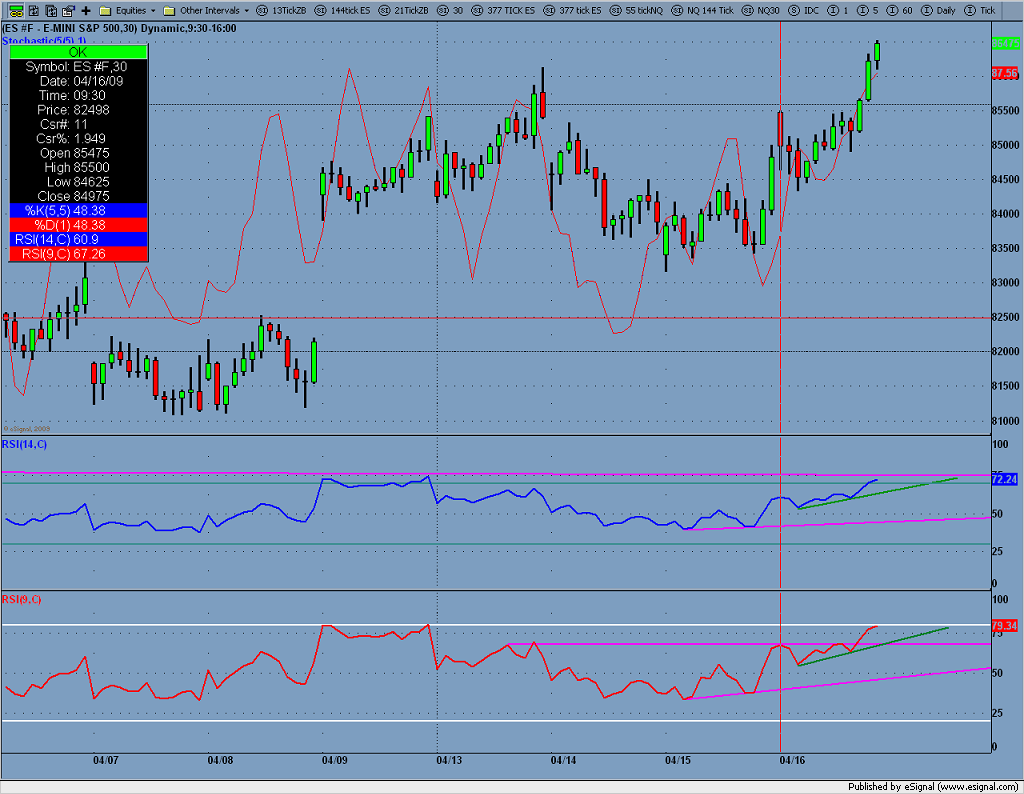

ES 30min RSI overbought/oversold

In a normal trending market it takes 25 about 30min bars to go from overbought to oversold, and visa versa. In a slower market it takes 35 30min bars. We are in the 35 bar rotation now, and 11 bars into it, which tells me we will make a high around 865-870 in about 20 bars or 13:00 time Monday.

Also overbought/oversold is a point of view of the trader. When a market keeps making new highs and trending well by the time you get a RSI reading of 30 the move will be done its likely to retrace no more than 45. And the same going up...

Also overbought/oversold is a point of view of the trader. When a market keeps making new highs and trending well by the time you get a RSI reading of 30 the move will be done its likely to retrace no more than 45. And the same going up...

quote:

Originally posted by CharterJoe

I wonder if there is a way to overlay a MA envelope over the RSI?

Not with E-signal, ohh well. I will plot it by hand I guess. I'll post if anything interesting occurs...

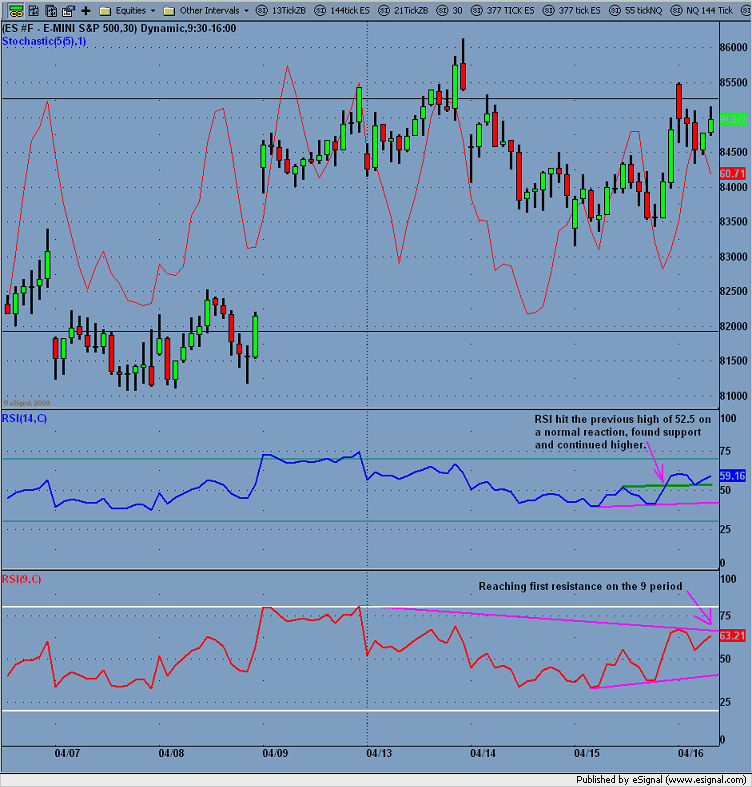

You can also a low and high on RSI and get the 50% mark which this last move it would be 57.5, the level we have been hovering around since the open. The 50% retrace marked the low of the gap down on monday 4/13 at 842 when we ran too 861....

Alright +$1.00 on those calls better than 33%. Markets looking overbought going to pick up some puts near the close hopefully around 871. Should have been +1.50 but error on my part and clicked the wrong options contract.

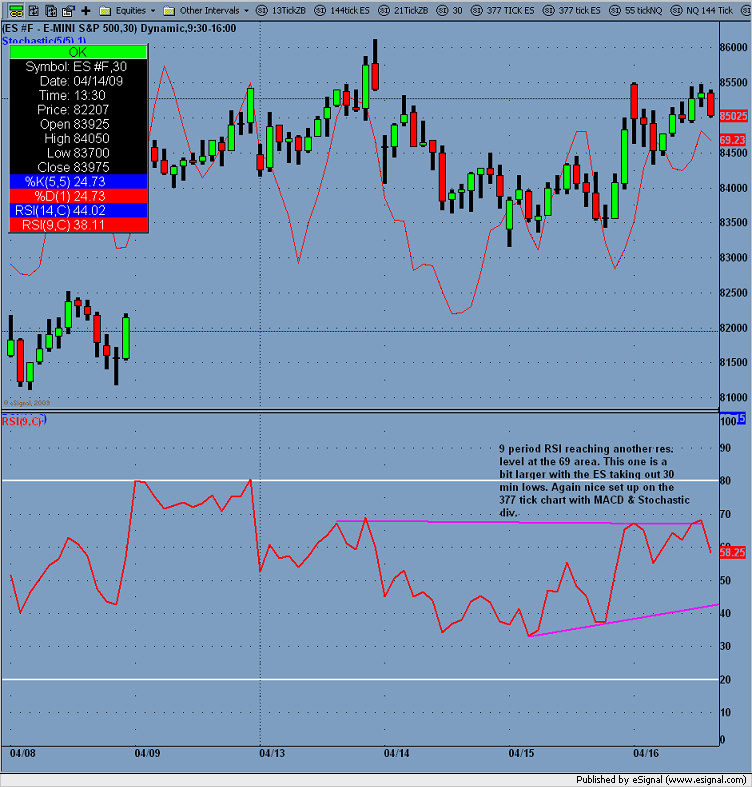

According to my charts looks like we are going to get a pull back around RSI 74-75...

According to my charts looks like we are going to get a pull back around RSI 74-75...

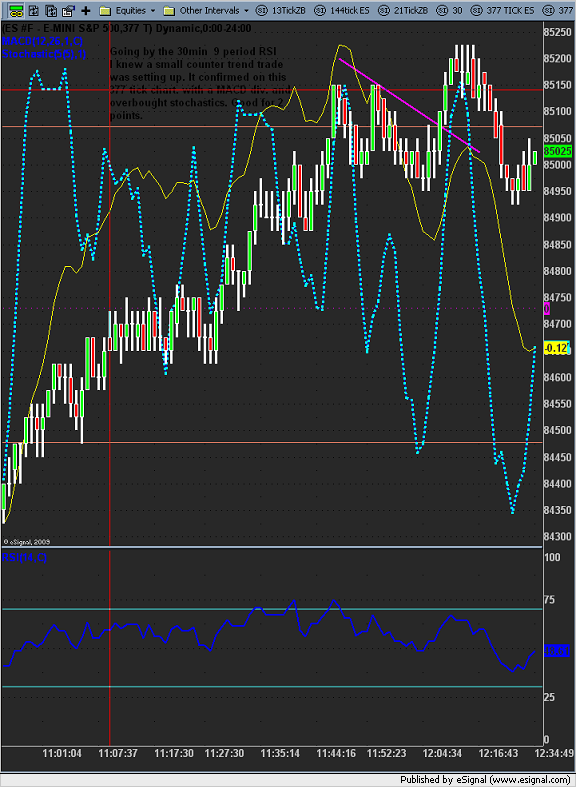

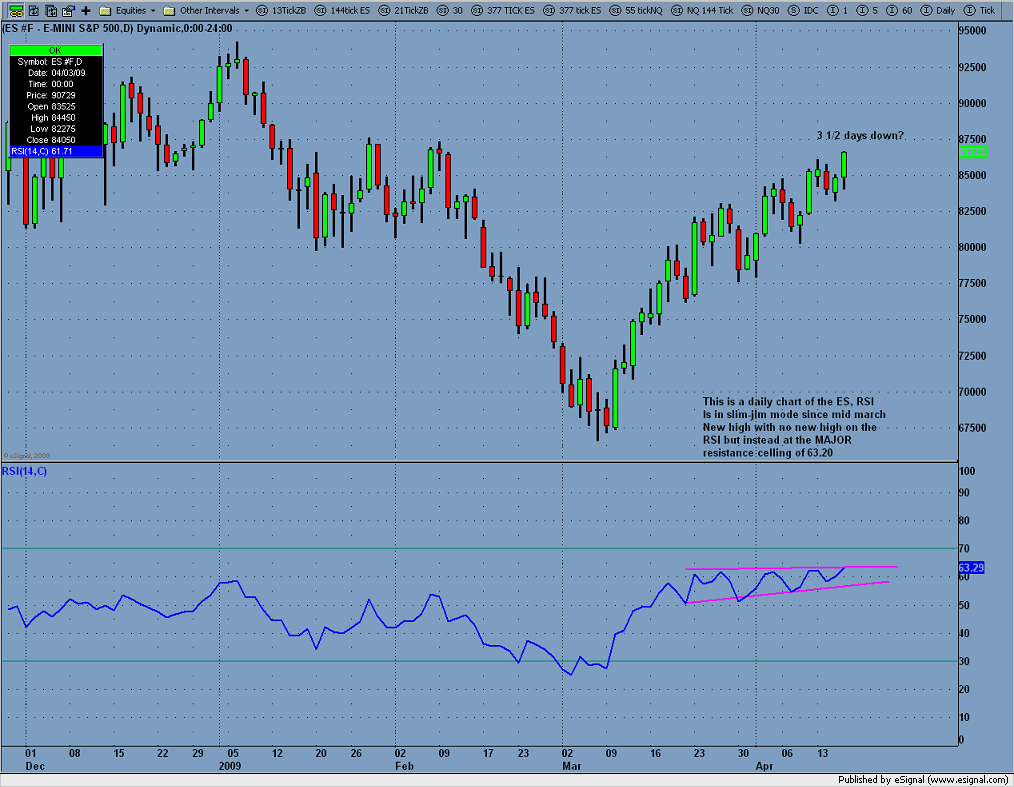

Looks like a good short with both RSI arriving at overbought and RSI 14 ahead of some major resistance looks good for at least -25 points.

Picked up some SPY may 86 puts @ 3.25 ES @ 864

<edit;looking for 1 point on those puts thats ES @ 840ish level>

Always makes me a bit nervous going the opposite way of big trends like these puts I have with the ES 200pts off the lows. But if your trading in your comfort zone your not making anything.

Joe;

Have you used the ADX. If so what time frame?

Thanks

Have you used the ADX. If so what time frame?

Thanks

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.