Mini I.B.

Set-up is VERY simple take the first 1/2 hour of RTH and if price trades above buy, and if it goes below sell short.

For mini Russell 2000 use targets of 2 points and a stop of 2 points.

For mini S&P500 use targets of 2.5 points and a stop of 2.5 points.

So far this March the ES has triggered 4 profits and 2 lossers or a gain of +$896.00 trading 4 contracts. It tends to perform better over a longer period. But the TF continues to outperform the ES month after month.

And trading 4 contracts in the past month would have yielded +$3150.00 on the ES

The TF on the other hand trading in the past month has yeilded +$6400.00 via trading 4 contracts

*these are actual results that counted my slippage but not comm.

For mini Russell 2000 use targets of 2 points and a stop of 2 points.

For mini S&P500 use targets of 2.5 points and a stop of 2.5 points.

So far this March the ES has triggered 4 profits and 2 lossers or a gain of +$896.00 trading 4 contracts. It tends to perform better over a longer period. But the TF continues to outperform the ES month after month.

And trading 4 contracts in the past month would have yielded +$3150.00 on the ES

The TF on the other hand trading in the past month has yeilded +$6400.00 via trading 4 contracts

*these are actual results that counted my slippage but not comm.

Thanks for sharing this with us Joe. Do the losing trades follow any common pattern?

For example:

Are we buying above previous days highs or VA's on losing long trades?

What happens when you get stopped for the 2 pt loss and the market goes back and generates another signal ? Does that one tend to make back the previous loss ? Lots of different scenarios to look at but I just thought of some of the obvious ones...

Bruce

For example:

Are we buying above previous days highs or VA's on losing long trades?

What happens when you get stopped for the 2 pt loss and the market goes back and generates another signal ? Does that one tend to make back the previous loss ? Lots of different scenarios to look at but I just thought of some of the obvious ones...

Bruce

quote:

Originally posted by BruceM

Thanks for sharing this with us Joe. Do the losing trades follow any common pattern?

For example:

Are we buying above previous days highs or VA's on losing long trades?

What happens when you get stopped for the 2 pt loss and the market goes back and generates another signal ? Does that one tend to make back the previous loss ? Lots of different scenarios to look at but I just thought of some of the obvious ones...

Bruce

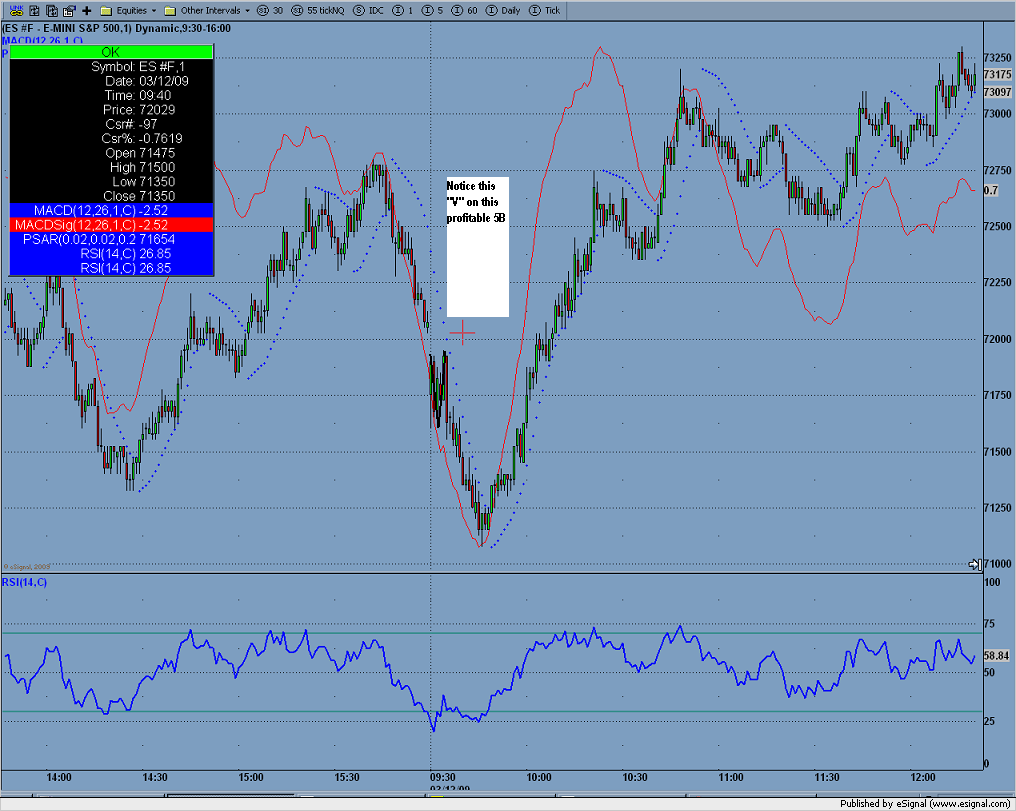

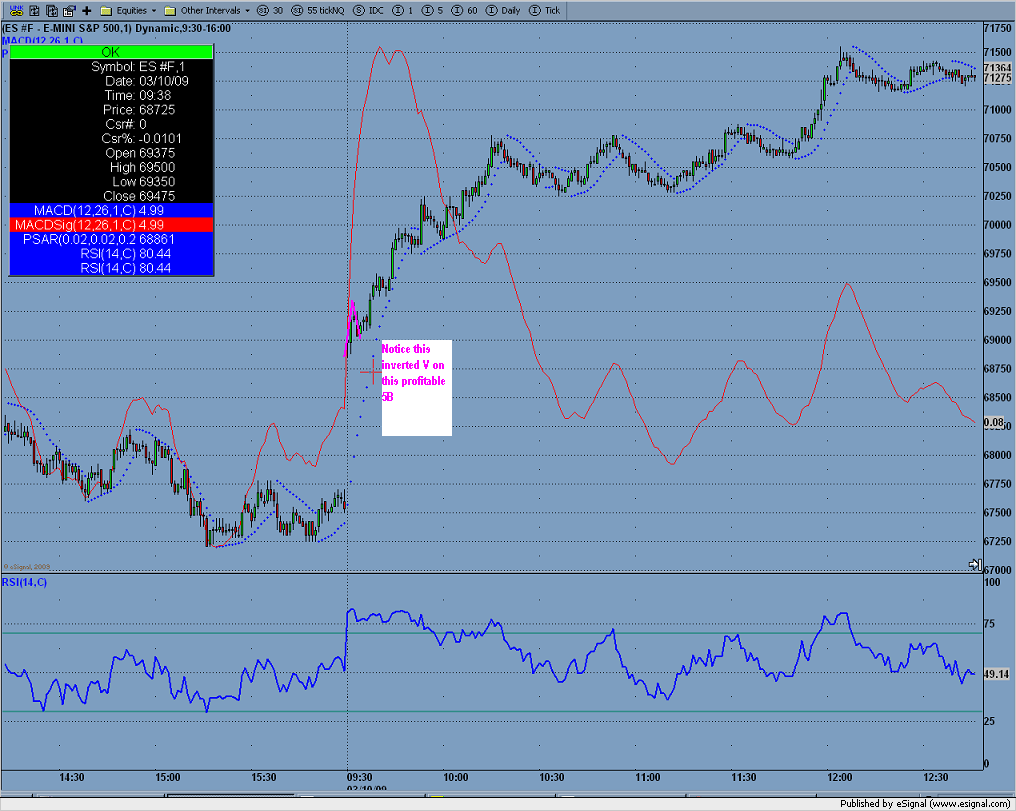

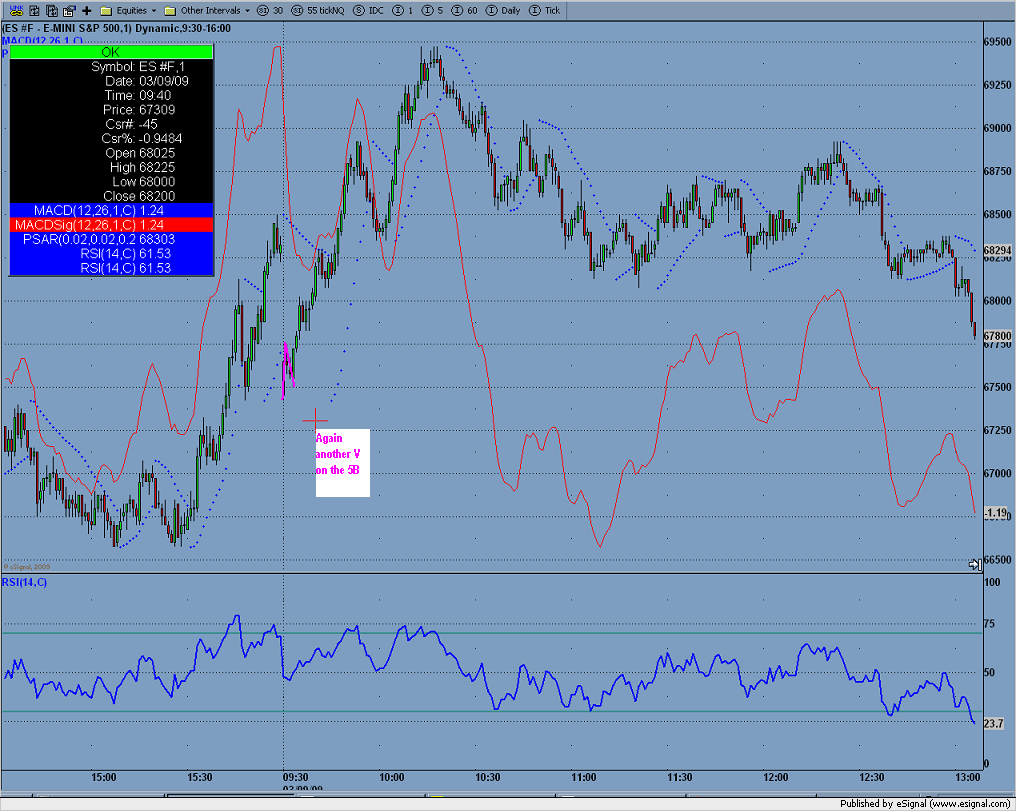

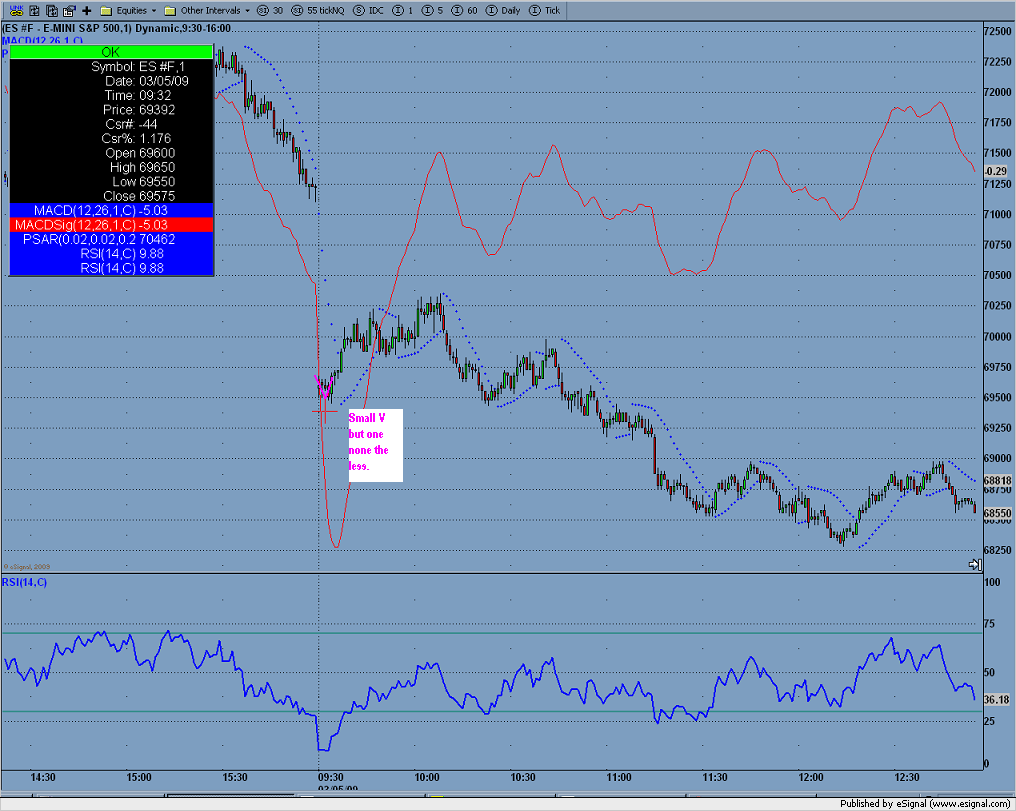

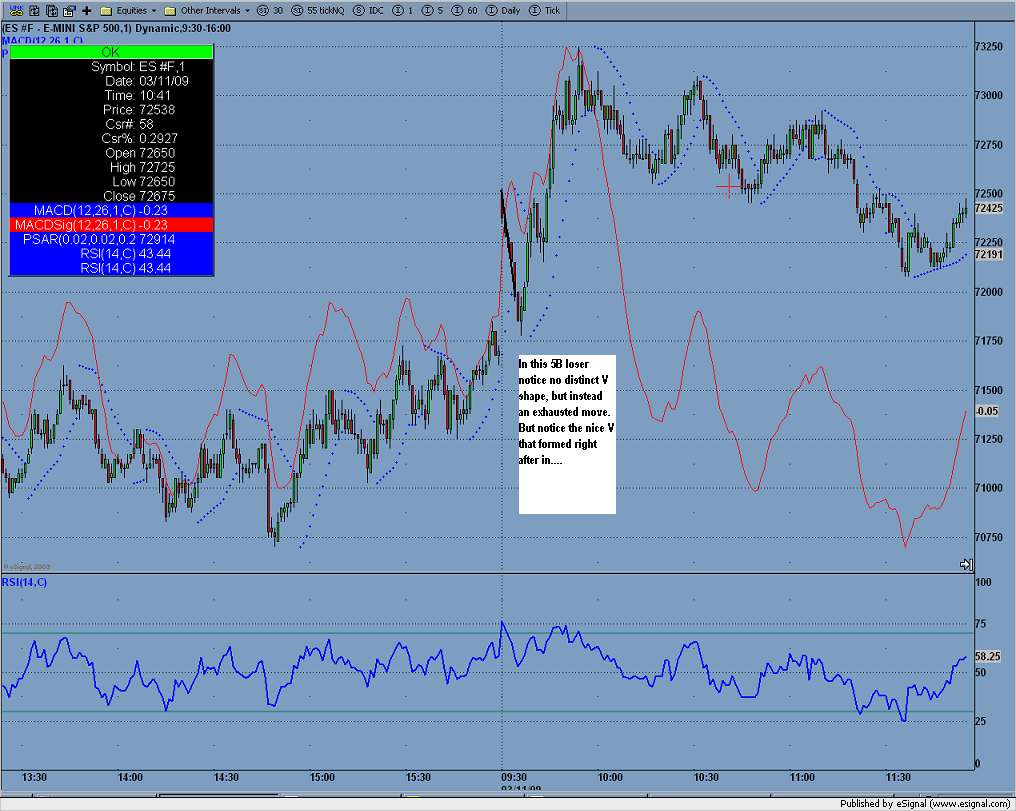

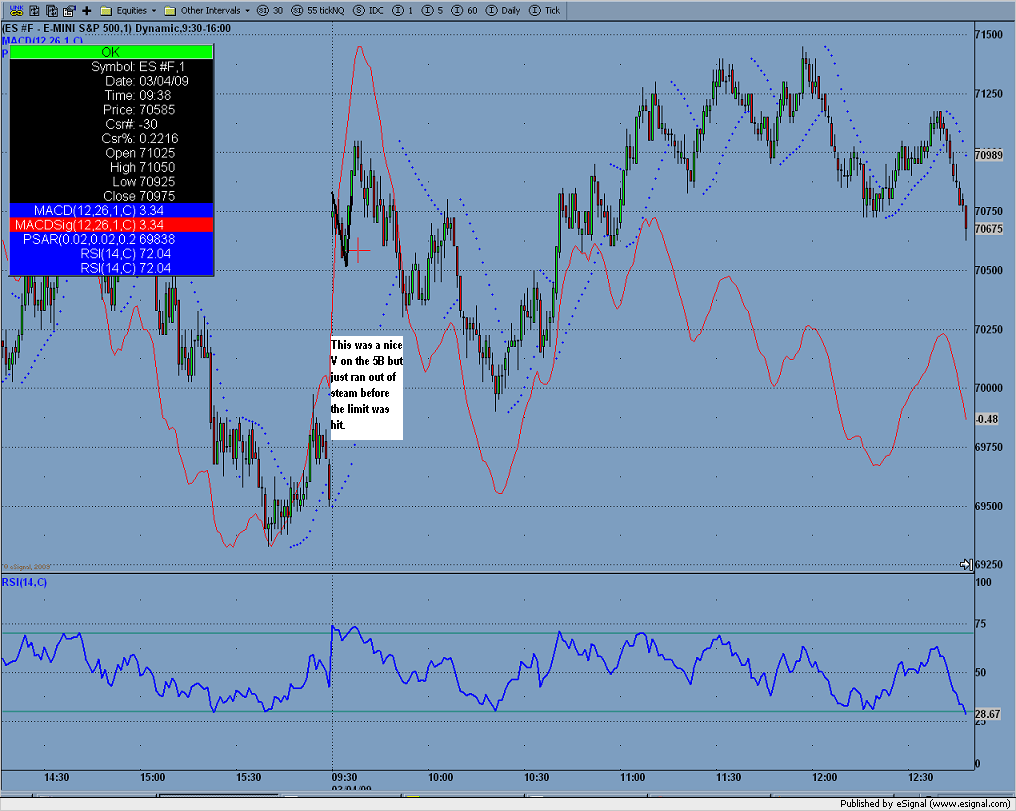

There is something in common to the losers. I have noticed that "most" of the winners form a small "V" or "inverted V" This is what you want to see on the 5B pattern...Bear with me with all these indicators its my main chart, here are some common factors in profitable 5B's....

quote:

Originally posted by BruceM

What happens when you get stopped for the 2 pt loss and the market goes back and generates another signal ? Does that one tend to make back the previous loss ? Lots of different scenarios to look at but I just thought of some of the obvious ones...

Bruce

So far on the small backtesting I have done about 50% of the losers generate a 2nd signal that makes back the losses. About 25% of them just chop around or have very long candles for a while. The other 25% or so has another signal that is also a loser.

Here are some 5B (first 5min breakout) loser's

Thanks for all the input everyone...thats why I love this room, I am not afraid to share my methods because I know we can make them better if we know how. I know this system works because I trade it every day. But would like to make it better....as the draw downs are ruff. I am afraid to use filters because to be honest I could filter every single trade I take.

I am looking at a way of scaling out on the 5B to try and hold 1 contract for 4+ points, possibly trail it with a 2 point stop once it hits 2.5. Not sure if that could improve the overall returns. Just a quick glance I can see at least four 4+ point runners in March on the ES.

wirechild,

The rule I use for the 5B is the target and the stop is the size of the first 5 min of trading. So today it was 3.50 points that was a 3.50 profit, thats what it is on most days 3-4.5 points on average. But I see what your saying it is possible because if its a winner its not returning to those prices for 15-20 min...My dad scalps this set up and just leaves the trade cooking until the momentum dies and does quite well. I like rules and game plans, even if I don't do as well

The rule I use for the 5B is the target and the stop is the size of the first 5 min of trading. So today it was 3.50 points that was a 3.50 profit, thats what it is on most days 3-4.5 points on average. But I see what your saying it is possible because if its a winner its not returning to those prices for 15-20 min...My dad scalps this set up and just leaves the trade cooking until the momentum dies and does quite well. I like rules and game plans, even if I don't do as well

5B was a loser on the S&P 5oo -4.00 points -$800.00, and just like the last loser all 5 one min bars were red bodies. I may have found a good filter.

30B was a 2.5 winner +500.00

30B was a 2.5 winner +500.00

5b and 30B was +$1950.00 for this week

A couple things I am finding as I backtest the 5B. For me backtesting means going back and replaying the first ~25mins or so and watching the actual market action. I am compiling the numbers from 1/9 - 3/13 and will post the results when I am done, it may be a few days though.

This is for ES

-A strict 2 point stop tends to yield better overall results than a variable range stop, although only slightly better.

-Entering 2 ticks above or below the hi/lo also yields slightly better results so far 4 of the losers were avoided in Feb alone.

-Using the first 6 one min bars instead of 5 also seems to keep you out of some of the losers.

-As CharterJoe mentioned, don't take the trade if the first 5(or 6) candles are red and form a up/down trend. The ones that form a V or chop around seem to work out better.

-And as I mentioned already, holding one contract for maximum gains improves the overall results as well. Basically trailing with a 2 point stop and then selling at 6+ points.

Just something to look at and consider. My backtesting is very slow, but it works out well. I will post Jan and Feb results using a few different methods to compare.

This is for ES

-A strict 2 point stop tends to yield better overall results than a variable range stop, although only slightly better.

-Entering 2 ticks above or below the hi/lo also yields slightly better results so far 4 of the losers were avoided in Feb alone.

-Using the first 6 one min bars instead of 5 also seems to keep you out of some of the losers.

-As CharterJoe mentioned, don't take the trade if the first 5(or 6) candles are red and form a up/down trend. The ones that form a V or chop around seem to work out better.

-And as I mentioned already, holding one contract for maximum gains improves the overall results as well. Basically trailing with a 2 point stop and then selling at 6+ points.

Just something to look at and consider. My backtesting is very slow, but it works out well. I will post Jan and Feb results using a few different methods to compare.

(duplicate post in "Mini I.B. vs 7am-9am Breakout" thread)

I have been a member of mypivots for a little over a year now, using the posts as a springboard for learning about the futures and currency markets – I’ve really appreciated the research and insight of so many of the contributors.

I’m now at the point where I’d like to begin systematically back testing one or two strategies for potential trading. I like the concept of breakouts (just finished Fisher, currently reading Crabel) – this thread and Charter Joe's 7am-9am GBP/USD Breakout thread are especially interesting in this regard.

I’d appreciate some advice from the folks here. The IB and 7-9 threads are now over a year old: do both concepts still perform reasonably well in live trading? If so, which of these would you recommend that I begin my back testing with:

1. The 30B

2. The 5B

3. The 7-9 currency breakout

I have a full time job so I need a scheduled window of time to trade in. I plan to trade single lots, primarily intraday. I am methodical by nature and prefer smaller, steady gains to wild gains… and wild losses.

Any thoughts gratefully received! Thanks.

Isaac

I have been a member of mypivots for a little over a year now, using the posts as a springboard for learning about the futures and currency markets – I’ve really appreciated the research and insight of so many of the contributors.

I’m now at the point where I’d like to begin systematically back testing one or two strategies for potential trading. I like the concept of breakouts (just finished Fisher, currently reading Crabel) – this thread and Charter Joe's 7am-9am GBP/USD Breakout thread are especially interesting in this regard.

I’d appreciate some advice from the folks here. The IB and 7-9 threads are now over a year old: do both concepts still perform reasonably well in live trading? If so, which of these would you recommend that I begin my back testing with:

1. The 30B

2. The 5B

3. The 7-9 currency breakout

I have a full time job so I need a scheduled window of time to trade in. I plan to trade single lots, primarily intraday. I am methodical by nature and prefer smaller, steady gains to wild gains… and wild losses.

Any thoughts gratefully received! Thanks.

Isaac

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.