Best Trade of the Week 3888

I don't know what came over me last night. I was hitting 3 contracts and scaling out. Some didn't make it, stopped at BE +1 tick or 2 pt stop. Some just bailed out at +3 pts, minimum target was 5 pts. But this is the best by far. Ran accordingly.

I must say that the 610T chart is a lot easier to spot crossovers than using the 1 min. I was trying out the whole weekend simulated data feed using last week's data.

I must say that the 610T chart is a lot easier to spot crossovers than using the 1 min. I was trying out the whole weekend simulated data feed using last week's data.

Hi LA. Are you still using the same method that you posted on the "Trading the 54ema"?

I was wondering how you work out your targets please? Are you using price projection or fibs?

Great trade though.

I was wondering how you work out your targets please? Are you using price projection or fibs?

Great trade though.

I am using the 3 and 9 ema crossover with Ninja indicator MAxOver. Just found this over the weekend to use. Nothing spectacular but marks the crossover points. The 54 ema works well on the 1 min not on the 610T chart. I have discovered that it is easier to anticipate a crossover using the 610T than using the 1 min. The 1 min can be very frustrating to read for a trend.

I'll change the chart to the 1 min with 54 ema with regression channel at lunch time to trade the consolidation volatility. Does not always work. Like yesterday, I failed in a reverse and so I scraped the trade.

As for the targets, I did not use the fib extensions. I am still amateurish at this. I just took a simple 5 and 10 profit target with the last one at 11 as a free to move target.

This trade did make me anxious twice. Once when the crossover downward happened(see the red marker downwards), then it went up, relief. I was about to put that "broker free lunch trade" BE +1.

It trended steadily up to +5 points. I took one off and moved the stop to the recent crossover.

When I had my 2nd at +10 points, I got greedy and moved the target to 872. It rebounded and this time I asked for more at 873.75 and moved the stop to 869.75.

I figured I was winning so I am assured of the 10 points, I just need a bonus. At this time the anxiety was getting the bonus. I was denied but it was exciting.

Mean time I was taking some scalps along the way up. I have to check the records, I think I raked in another 9pts.

I took another 4 pts at Globex before 2359. It was a good day.

I hope the fires in OZ are under control.

I'll change the chart to the 1 min with 54 ema with regression channel at lunch time to trade the consolidation volatility. Does not always work. Like yesterday, I failed in a reverse and so I scraped the trade.

As for the targets, I did not use the fib extensions. I am still amateurish at this. I just took a simple 5 and 10 profit target with the last one at 11 as a free to move target.

This trade did make me anxious twice. Once when the crossover downward happened(see the red marker downwards), then it went up, relief. I was about to put that "broker free lunch trade" BE +1.

It trended steadily up to +5 points. I took one off and moved the stop to the recent crossover.

When I had my 2nd at +10 points, I got greedy and moved the target to 872. It rebounded and this time I asked for more at 873.75 and moved the stop to 869.75.

I figured I was winning so I am assured of the 10 points, I just need a bonus. At this time the anxiety was getting the bonus. I was denied but it was exciting.

Mean time I was taking some scalps along the way up. I have to check the records, I think I raked in another 9pts.

I took another 4 pts at Globex before 2359. It was a good day.

I hope the fires in OZ are under control.

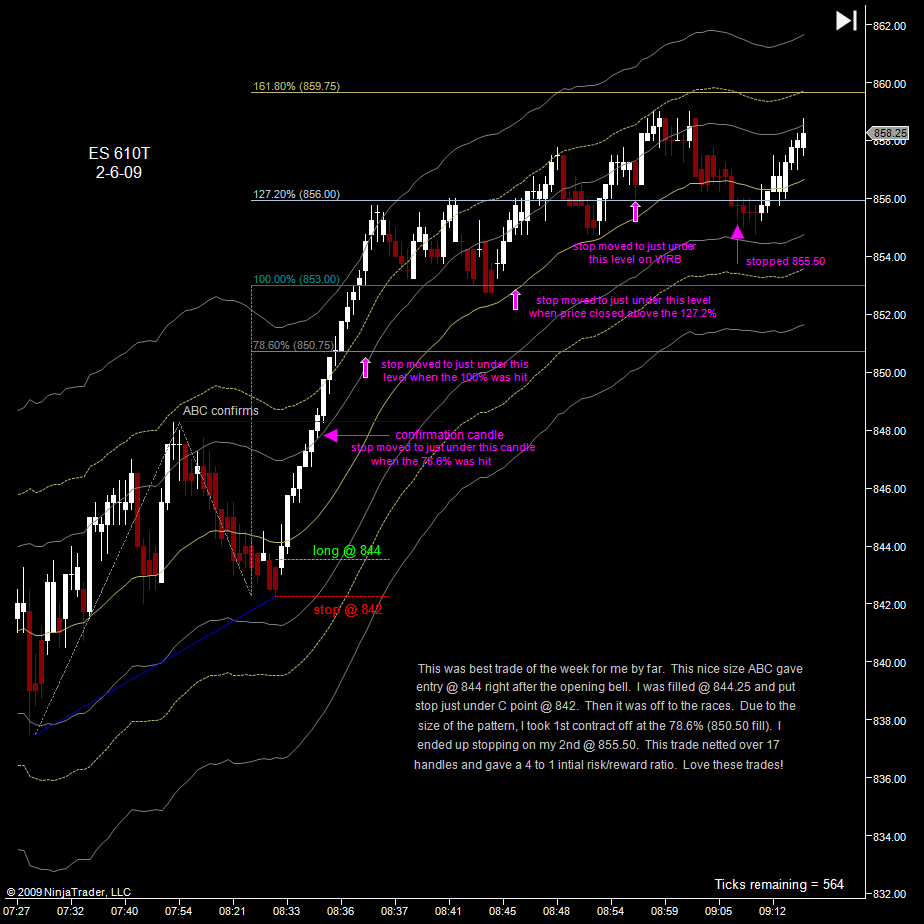

Following VO's ABC technique.

Though my entry was wrong. I was anticipating an MA crossover. Gave 2 false signals.

Then an ABC was formed and I took profits from there.

Though my entry was wrong. I was anticipating an MA crossover. Gave 2 false signals.

Then an ABC was formed and I took profits from there.

Bear with me. This is a big image.

My entry was based on the crossover 3 and 9 ema on the 610T chart. It shows less influenced by noise.

Then I saw the ABC formed on the 5 min chart and plotted.

I took profits at 61.8% ext. 854.50 but I asked for more at 854.00.

I did move my stop but looking at the ABC, I want to trust that all the signals of previous days, the market sentiments and the fib extensions is projecting lower. So my stop stayed above 860.00.

I added on the retrace at 859.25. Just 1 contract. I was confident on the bearish weak market but who knows, never put all the eggs in 1 basket.

I took more on this big scalp at 852.25.

Took the 2nd target at 844.00 figuring that I won't want to wait for the retrace to play out. 16pts is enough. Originally it was at 161.8%, 841.75. Got imapatient, I am not giving back this gain. It was 16pts!

I played the last contract using daily pivots. Placed it just above S2 at 838.25, S2 was 838.00

Finally reached it.

I did some scalps in between. I scalp on the faster 233 Tick chart. Still easier to read than the 1 min. Though I still reference it.

50.75pt gain. This is a good haul.

A lot of what could have happened if I played the last contract to 820. But gain is a gain and we should walk away with gains, greed can work against all that work.

My entry was based on the crossover 3 and 9 ema on the 610T chart. It shows less influenced by noise.

Then I saw the ABC formed on the 5 min chart and plotted.

I took profits at 61.8% ext. 854.50 but I asked for more at 854.00.

I did move my stop but looking at the ABC, I want to trust that all the signals of previous days, the market sentiments and the fib extensions is projecting lower. So my stop stayed above 860.00.

I added on the retrace at 859.25. Just 1 contract. I was confident on the bearish weak market but who knows, never put all the eggs in 1 basket.

I took more on this big scalp at 852.25.

Took the 2nd target at 844.00 figuring that I won't want to wait for the retrace to play out. 16pts is enough. Originally it was at 161.8%, 841.75. Got imapatient, I am not giving back this gain. It was 16pts!

I played the last contract using daily pivots. Placed it just above S2 at 838.25, S2 was 838.00

Finally reached it.

I did some scalps in between. I scalp on the faster 233 Tick chart. Still easier to read than the 1 min. Though I still reference it.

50.75pt gain. This is a good haul.

A lot of what could have happened if I played the last contract to 820. But gain is a gain and we should walk away with gains, greed can work against all that work.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.