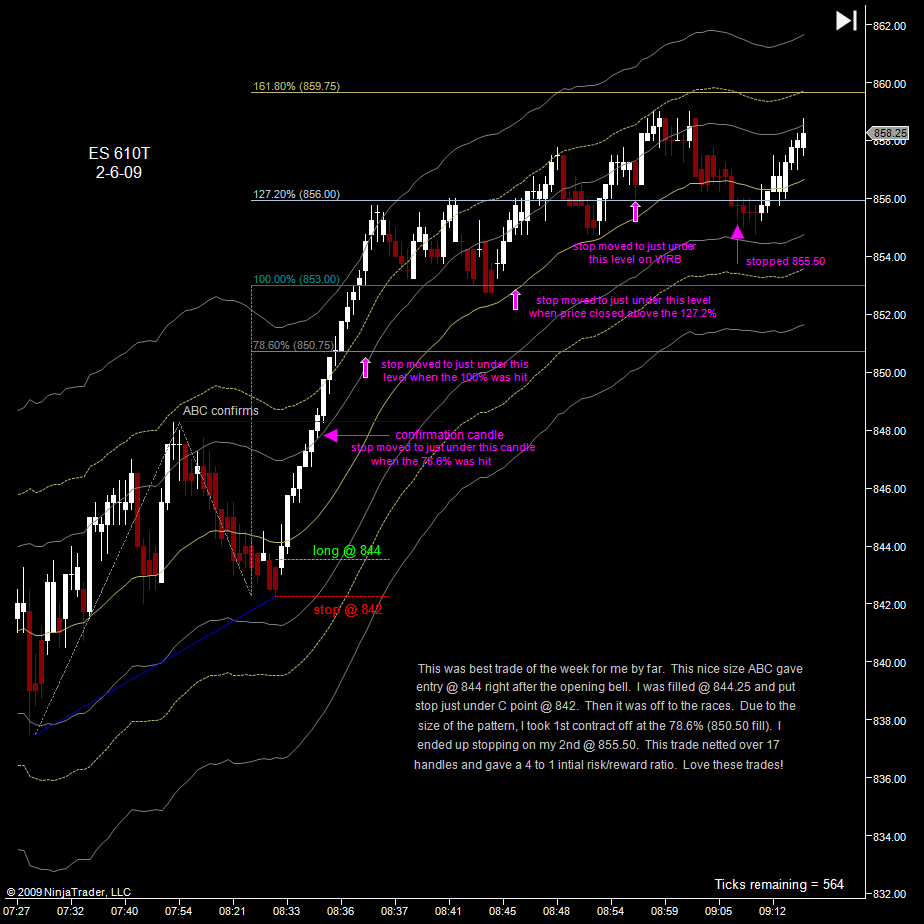

Best Trade of the Week 3888

Great Trade VO !

Great trade.

VO. Just to ask. Did you go long when you see the first white candle 0830 or the higher close white candle at 0834.

Great trade VO and thanks for the Trailing Stop explanation (I won't mention anything about the font color you chose).

quote:

Originally posted by lordalfa

VO. Just to ask. Did you go long when you see the first white candle 0830 or the higher close white candle at 0834.

in this case LA, it was the 1st white candle because it was the higher high close.

I was hoping that all the other great traders we have would post their best trade so we can all learn.

I was thinking that your idea about best "Trade of the Week" and even best "Trade of the Day" would be a great idea.

Not only to give recognition where its due, but to inspire and educate.

Personally I know that I would feel honored to be the winner of the best trade of the week or day award.

Not only to give recognition where its due, but to inspire and educate.

Personally I know that I would feel honored to be the winner of the best trade of the week or day award.

agree mypto...step up and post

Congrats on a super trade LA and thanks for sharing.

Bear with me. This is a big image.

My entry was based on the crossover 3 and 9 ema on the 610T chart. It shows less influenced by noise.

Then I saw the ABC formed on the 5 min chart and plotted.

I took profits at 61.8% ext. 854.50 but I asked for more at 854.00.

I did move my stop but looking at the ABC, I want to trust that all the signals of previous days, the market sentiments and the fib extensions is projecting lower. So my stop stayed above 860.00.

I added on the retrace at 859.25. Just 1 contract. I was confident on the bearish weak market but who knows, never put all the eggs in 1 basket.

I took more on this big scalp at 852.25.

Took the 2nd target at 844.00 figuring that I won't want to wait for the retrace to play out. 16pts is enough. Originally it was at 161.8%, 841.75. Got imapatient, I am not giving back this gain. It was 16pts!

I played the last contract using daily pivots. Placed it just above S2 at 838.25, S2 was 838.00

Finally reached it.

I did some scalps in between. I scalp on the faster 233 Tick chart. Still easier to read than the 1 min. Though I still reference it.

50.75pt gain. This is a good haul.

A lot of what could have happened if I played the last contract to 820. But gain is a gain and we should walk away with gains, greed can work against all that work.

My entry was based on the crossover 3 and 9 ema on the 610T chart. It shows less influenced by noise.

Then I saw the ABC formed on the 5 min chart and plotted.

I took profits at 61.8% ext. 854.50 but I asked for more at 854.00.

I did move my stop but looking at the ABC, I want to trust that all the signals of previous days, the market sentiments and the fib extensions is projecting lower. So my stop stayed above 860.00.

I added on the retrace at 859.25. Just 1 contract. I was confident on the bearish weak market but who knows, never put all the eggs in 1 basket.

I took more on this big scalp at 852.25.

Took the 2nd target at 844.00 figuring that I won't want to wait for the retrace to play out. 16pts is enough. Originally it was at 161.8%, 841.75. Got imapatient, I am not giving back this gain. It was 16pts!

I played the last contract using daily pivots. Placed it just above S2 at 838.25, S2 was 838.00

Finally reached it.

I did some scalps in between. I scalp on the faster 233 Tick chart. Still easier to read than the 1 min. Though I still reference it.

50.75pt gain. This is a good haul.

A lot of what could have happened if I played the last contract to 820. But gain is a gain and we should walk away with gains, greed can work against all that work.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.