ES 8-26-08

I'm not hopeful buyers are even capable of reaching 70.75 a fourth time only to be slammed into a new low, are you? I'm short wherever this cover-crawl peters out. 67.25 likely.

I still like 52 I measured last week. I'll do that, then. I'm certain I'll be contradicted, but isn't that what makes being right so fun. lol

Good morning, everyone!

I still like 52 I measured last week. I'll do that, then. I'm certain I'll be contradicted, but isn't that what makes being right so fun. lol

Good morning, everyone!

looks like the hurricanes not going to amount to much...good thing we are technical traders........I'd sure like to see the short traders get satisfied long before October rolls around so we can resume the bull phase of the market.....average bear markets are in the 17 - 27% range....so buying will come in, it's just a matter of time....of course we could also drop to a 40 % bear market but that's rare...and how many happen in a row to such extremes.....

This bear has drop over 20 % so far....even more on some indexes....value buyers should get interested soon...

This bear has drop over 20 % so far....even more on some indexes....value buyers should get interested soon...

This is a good time to start some rallies..from a seasonal standpoint...FWIW......so I have to agree with that 64 area Joe.....perhaps they want to close this month out on a positive note above the 1293 area.....they'll frustrate everyone just enough before they let it run a bit.....

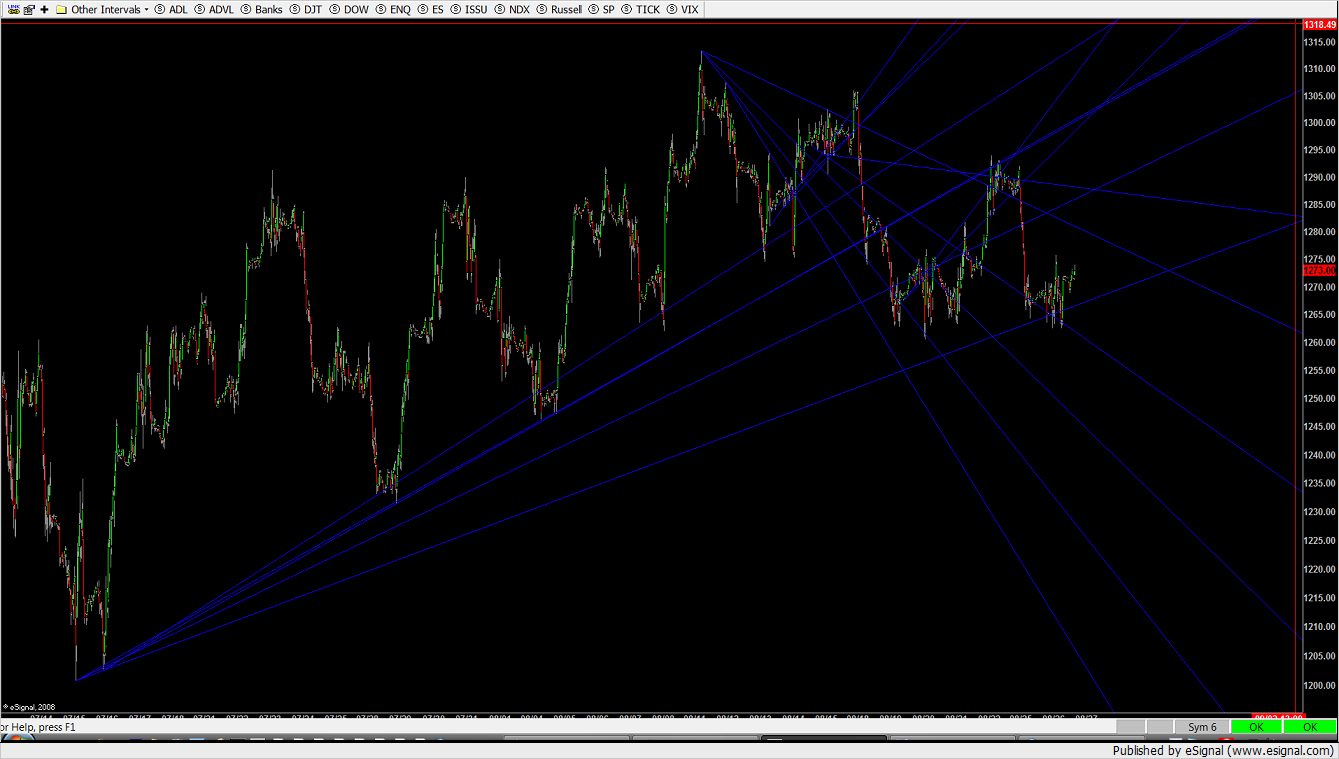

Let's talk about the technicals then. First off from 94 to here is one leg and buyers can't get out of the low 70's, again, and are being smothered underneathe their own channels. Whether or not you believe 1313.50 is a top is besides the point. What does matter is that there are now two, three peak measured moves in this bull run; one corrected 67% and this one is suckering perma-bulls into fueling a downside move strong enough to penetrate the last of the channels at the 38% mark. 64 is price satisafaction. That's obvious. But what is also telling, as well as obvious, is so is the 70's for bears and the 13 huns, 90s and 80s let out a rejective sigh I know I'll never forget. But we're poised for a rally. Okay. You trade that, then.

We'll correct to the 40s, easily, bulls will try to run up but get suffocated by their own outerlining channels and we'll head-fake our way down into new market lows. Bulls etched their prices, showed they can satisfy price amid some strong selling and will let this bounce created by big swinging dicks conservatively covering die to make a bottom. And that wont be anywhere near 1200. The bear market we're completing the c wave from and out to match, lasted 2 1/2 years and wasted 805 handles. This just started. And by God when this bear flag breaks this week if you're long don't think stops will save your hide from ruin.

You guys traded the bear of 2000 to '02 did ya? Really?

Blow your own accounts and spare the new traders here. I'm sick of the perma-bull crap. This isn't going anywhere up here.

We'll correct to the 40s, easily, bulls will try to run up but get suffocated by their own outerlining channels and we'll head-fake our way down into new market lows. Bulls etched their prices, showed they can satisfy price amid some strong selling and will let this bounce created by big swinging dicks conservatively covering die to make a bottom. And that wont be anywhere near 1200. The bear market we're completing the c wave from and out to match, lasted 2 1/2 years and wasted 805 handles. This just started. And by God when this bear flag breaks this week if you're long don't think stops will save your hide from ruin.

You guys traded the bear of 2000 to '02 did ya? Really?

Blow your own accounts and spare the new traders here. I'm sick of the perma-bull crap. This isn't going anywhere up here.

Perhaps some visuals would help me on this..to be honest I can't follow it..I've tried following those who use wave analysis in the past but It just doesn't click for me.....Now I would fall into the perma - bull ( at least for now) category...but I think some downside would be constructive to further fuel the upside......

This is not meant for you specifically SPQR but I've seen so many folks who use waves not take credit when they are wrong....they instead come up with alternate counts or projections or time frames......I'd really like to see someone post consistent long term predictions in the S&P ? Can anyone do it ?

If you are the forums resident wave/measure move pro then I'd like to see a seperate thread so we can follow these predictions......

There is a sense of anger in your post as I read it......it seems the bears and bulls are both "stubborn"...the bears are more frustrated.....today the bulls won and we traded higher...it's only a matter of time that the bears get the break in prices they want...I really thought Mondays selling was going to start it but the bulls came back today to take back the sell off point...

Am I understanding you correctly that you are expecting a huge selloff that will take us way beyond the current lows ? You are expecting the bear flag to break this week? Will this new low be 50% off the highs? Is the 1300 area the high before the new lows forms....? Do you have a long term short position or is this a question about "being correct" on a market call...? I'm curious

It seems quite often we get our opinions in the way of our analysis...I'm not saying that you are doing this but in general I wonder how often our brain naturally gravitates to "evidence" to support the outcome we would "like" to see. I probably did this in my "Darlings" thread...

And to answer your question: Yes I did trade the bear market in 2000 and the one in 1987 ( not as a day trader).........and as you know I'm trading this one too......I think there is a real danger in letting our ego's into the mix....I think most here can decide if they want to be bullish or bearish...I think this sentence is a bit overdone...

"Blow your own accounts and spare the new traders here."

Now , on a lighter note....I saw the DEAD play in the late 80's and early 90's in CT.....what group where you in and what instrument do you play? Perhaps I cheered you on......I broke out my Les Paul Goldtop the other day and it was a real pleasure to play......

This is not meant for you specifically SPQR but I've seen so many folks who use waves not take credit when they are wrong....they instead come up with alternate counts or projections or time frames......I'd really like to see someone post consistent long term predictions in the S&P ? Can anyone do it ?

If you are the forums resident wave/measure move pro then I'd like to see a seperate thread so we can follow these predictions......

There is a sense of anger in your post as I read it......it seems the bears and bulls are both "stubborn"...the bears are more frustrated.....today the bulls won and we traded higher...it's only a matter of time that the bears get the break in prices they want...I really thought Mondays selling was going to start it but the bulls came back today to take back the sell off point...

Am I understanding you correctly that you are expecting a huge selloff that will take us way beyond the current lows ? You are expecting the bear flag to break this week? Will this new low be 50% off the highs? Is the 1300 area the high before the new lows forms....? Do you have a long term short position or is this a question about "being correct" on a market call...? I'm curious

It seems quite often we get our opinions in the way of our analysis...I'm not saying that you are doing this but in general I wonder how often our brain naturally gravitates to "evidence" to support the outcome we would "like" to see. I probably did this in my "Darlings" thread...

And to answer your question: Yes I did trade the bear market in 2000 and the one in 1987 ( not as a day trader).........and as you know I'm trading this one too......I think there is a real danger in letting our ego's into the mix....I think most here can decide if they want to be bullish or bearish...I think this sentence is a bit overdone...

"Blow your own accounts and spare the new traders here."

Now , on a lighter note....I saw the DEAD play in the late 80's and early 90's in CT.....what group where you in and what instrument do you play? Perhaps I cheered you on......I broke out my Les Paul Goldtop the other day and it was a real pleasure to play......

quote:

Originally posted by SPQR

What does matter is that there are now two, three peak measured moves in this bull run; one corrected 67% and this one is suckering perma-bulls into fueling a downside move strong enough to penetrate the last of the channels at the 38% mark. 64 is price satisafaction. That's obvious. But what is also telling, as well as obvious, is so is the 70's for bears and the 13 huns, 90s and 80s let out a rejective sigh I know I'll never forget. But we're poised for a rally. Okay. You trade that, then.

We'll correct to the 40s, easily, bulls will try to run up but get suffocated by their own outerlining channels and we'll head-fake our way down into new market lows. Bulls etched their prices, showed they can satisfy price amid some strong selling and will let this bounce created by big swinging dicks conservatively covering die to make a bottom. And that wont be anywhere near 1200. The bear market we're completing the c wave from and out to match, lasted 2 1/2 years and wasted 805 handles. This just started. And by God when this bear flag breaks this week if you're long don't think stops will save your hide from ruin.

You guys traded the bear of 2000 to '02 did ya? Really?

Blow your own accounts and spare the new traders here. I'm sick of the perma-bull crap. This isn't going anywhere up here.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.