Pitbull setup Part II

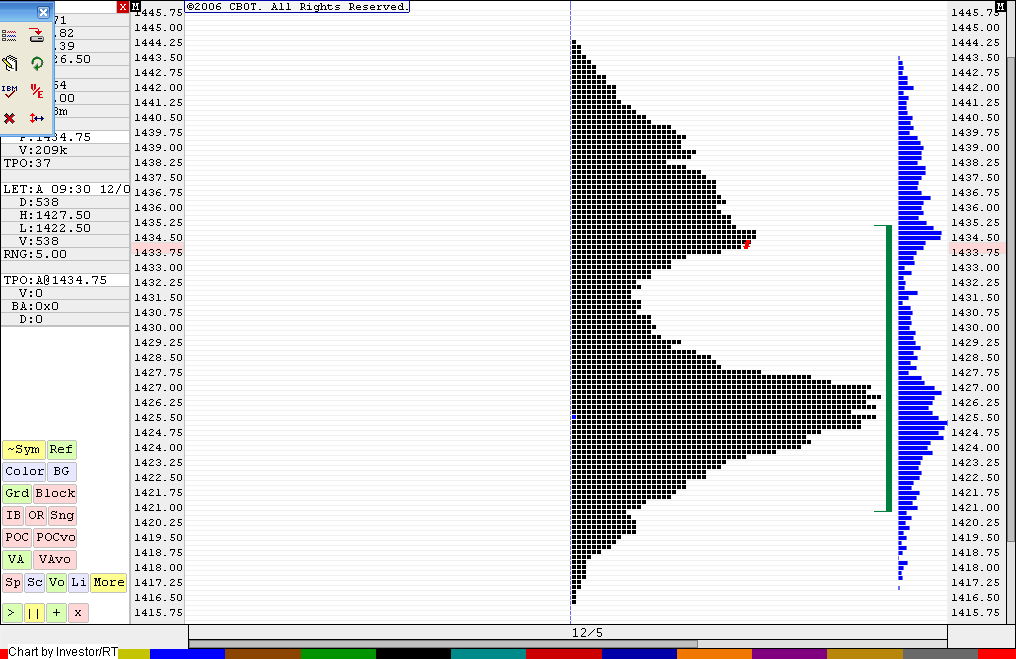

To be honest I donot know if I will be able to articulate this but I will try. This is probably more of a concept then a setup and today wasn't the perfect day but I'll attempt it anyway. Some key ideas 1) many Market profile users and traders consider areas on a price that have not been traded at on the same day more than once to be areas of low volume ( You may need to study the Single print concept to really get this) but I have noticed on the one minute time frame that prices actually push away from other prices on High Volume and you will not see price bar overlap on the one minute....some examples from today may help...but you have been warned....

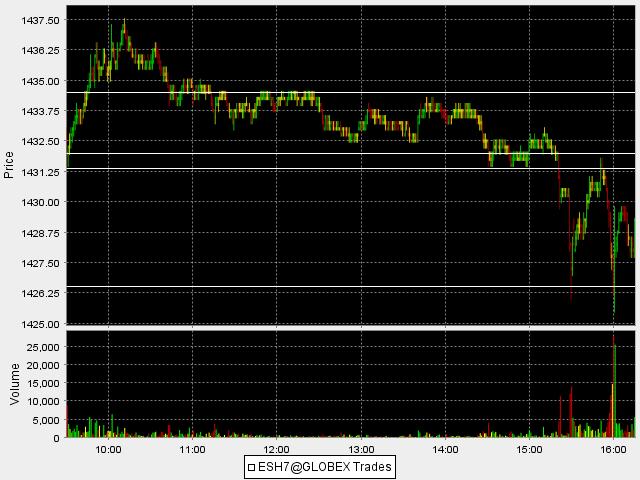

You will notice on the far right of the screen that prices broke down on high volume...and left an area that was pushed away from rather quickly. Well the point of this post is to demonstrate that on many days these areas are tested as if the market particpants are saying " Hey, they broke it down from here before , lets see if they can do it again."....so from this chart you can see that the 1435 -1435.25 area was pushed away from fast. That being the case this High Volume area will need to be tested....so here is what happened soon after

Notice how the market comes back up to test this area..

Later on in the day we get another push down on high volume here is a shot of that..notice the horizontal lines drawn at the 1429.75 - 1430.25 area..there is no price bar overlap on this high volume push..so the theory being that this area should be tested...here is the push down

and here is the retest..

I have found that these are excellent areas to trade for..I have also found that on trend days this counter trend approach will kill you.

These high volume areas also become dynamic support and resistence areas for the rest of the day quite often...so here are those high push areas and how they affected the market for the rest of todays trading....this is the entire day with those horizontal push out areas left in place

Ask me questions if unclear as this is hard for me to put into words..it makes sense to me but we may need to view a few days before you can see what the H-E-L-L I'm writing about..

Bruce

You will notice on the far right of the screen that prices broke down on high volume...and left an area that was pushed away from rather quickly. Well the point of this post is to demonstrate that on many days these areas are tested as if the market particpants are saying " Hey, they broke it down from here before , lets see if they can do it again."....so from this chart you can see that the 1435 -1435.25 area was pushed away from fast. That being the case this High Volume area will need to be tested....so here is what happened soon after

Notice how the market comes back up to test this area..

Later on in the day we get another push down on high volume here is a shot of that..notice the horizontal lines drawn at the 1429.75 - 1430.25 area..there is no price bar overlap on this high volume push..so the theory being that this area should be tested...here is the push down

and here is the retest..

I have found that these are excellent areas to trade for..I have also found that on trend days this counter trend approach will kill you.

These high volume areas also become dynamic support and resistence areas for the rest of the day quite often...so here are those high push areas and how they affected the market for the rest of todays trading....this is the entire day with those horizontal push out areas left in place

Ask me questions if unclear as this is hard for me to put into words..it makes sense to me but we may need to view a few days before you can see what the H-E-L-L I'm writing about..

Bruce

quote:

Originally posted by BruceM

There exists currently a band from 1432 - 1431.25 on the charts....So I am trying shorts at 1435.25 as I have 36 as a resistence number ( and 1439 above that) but hope you can see the current "band" as Pt- mini has labeled it...so 32 becomes first target then 31.25 and then if real lucky today down to 1429 area..but only if lucky...

I am expanding on this with Fridays chart...I have drawn horizontal lines at this old "unfilled " band at 1432 - 1431.25..Note how this band acted as support and then became resistence after the breakdown...I have also drawn lines at 1434.50 and 1426.50...you will hopefully see the reason these areas where important from the longer term Market Profile chart which was created on the close of Thursdays trade. This is the same chart as previouly posted but it contains more data...The older chart showed how the 1439 area was resistence but as more trading took place at the lower levels it becomes apparent that the 1434.50 became a greater area of trade.. You can also see from a one minute chart ( note posted) that the bands created on the breakout down on Fridays trade where retested on the upside...

Hope this makes sense..I'm just showing this so you can see how I encorporate a few concepts....Hope all had and have a great New year

Bruce

There currently exists an unfilled band from Friday at the 1440 - 1440.50 area..I beleive there are good odds that this will be tested in overnight or Tuesdays trade.....with the market currently at 1442.50 it certainly isn't a big move by any means...

For the record I thought 1427.50 would trade on Fridays trade as there is an unfilled band there left from Thursdays trade..but the market stopped at 1428.50 in the overnight of Friday....so this will be an interesting area to see if it gets filled in soon....

Bruce

For the record I thought 1427.50 would trade on Fridays trade as there is an unfilled band there left from Thursdays trade..but the market stopped at 1428.50 in the overnight of Friday....so this will be an interesting area to see if it gets filled in soon....

Bruce

This is interesting as it points out that these bands MAY act as price attractors...Certainly not boasting but just thought I'd point out how this was filled in today Monday January 22nd..in fact the market initially stopped exactly at the 1427.50 on the emini and then popped up a bit before rolling back over but didn't go too far down.

On the market profile chart this was slightly into a buying tail from 11th of january..( see Daltons book or this forum for a description).....It should also be noted that there is a one minute band at a price of 1435 that formed today...what makes this "cool" is the fact that this is where single prints began today....anyway here is a five minute chart to show what the 27.50 did for the market today....I present it for your study or your amusement.

Bruce

On the market profile chart this was slightly into a buying tail from 11th of january..( see Daltons book or this forum for a description).....It should also be noted that there is a one minute band at a price of 1435 that formed today...what makes this "cool" is the fact that this is where single prints began today....anyway here is a five minute chart to show what the 27.50 did for the market today....I present it for your study or your amusement.

Bruce

quote:

Originally posted by BruceM

For the record I thought 1427.50 would trade on Fridays trade as there is an unfilled band there left from Thursdays trade..but the market stopped at 1428.50 in the overnight of Friday....so this will be an interesting area to see if it gets filled in soon....

Bruce

DT, where's BruceM? Did you boot him or is he just absent? I've been anticipating some followups.

I'm not sure what has happened to him. No, his account is not locked. I'm guessing that he's on vacation or something like that.

Hi Felix,

I'm here..is there a specific question you would like me to address..? Just let me know...I don't want to keep posting charts unless it helps clarify the subject matter..

Bruce

I'm here..is there a specific question you would like me to address..? Just let me know...I don't want to keep posting charts unless it helps clarify the subject matter..

Bruce

quote:

Originally posted by felix

DT, where's BruceM? Did you boot him or is he just absent? I've been anticipating some followups.

No specific question. But I've appreciated the simplicity of some of these setups. So if you have opportunity, I would like to see successful application as it occurs, if you're trading them.

Hi Felix,

I was thinking about some of your comments and perhaps this thread is mis- titled. It should probably reflect the fact that these are "observations" and not really entry methods in this thread.

I watch these areas and will try to position to see if they get "filled in" much the same way that people watch gaps, the previous days close etc just to name a few. I will also look to see if I get an entry signal at these areas. You can look at the Pitbull One and three for this or the thousands of other entry methods out there. I try to structure risk on lower time frames to achieve longer time frame profit objectives but will also "average" into trades if I feel the markets are diverging. Hope that helps.

Bruce

I was thinking about some of your comments and perhaps this thread is mis- titled. It should probably reflect the fact that these are "observations" and not really entry methods in this thread.

I watch these areas and will try to position to see if they get "filled in" much the same way that people watch gaps, the previous days close etc just to name a few. I will also look to see if I get an entry signal at these areas. You can look at the Pitbull One and three for this or the thousands of other entry methods out there. I try to structure risk on lower time frames to achieve longer time frame profit objectives but will also "average" into trades if I feel the markets are diverging. Hope that helps.

Bruce

quote:

Originally posted by felix

No specific question. But I've appreciated the simplicity of some of these setups. So if you have opportunity, I would like to see successful application as it occurs, if you're trading them.

As an example..the SP is near 1454 as I type so I think selling up here is a good idea with the Dow diverging to target the singles idea as per this thread that where created on the fed day that exist in the 1441 area and then 1436..area..just an idea..please no questions as to whether I took this trade or not...it doesn't matter...

Bruce

Bruce

quote:

Originally posted by felix

No specific question. But I've appreciated the simplicity of some of these setups. So if you have opportunity, I would like to see successful application as it occurs, if you're trading them.

well the 41 was hit today but we stopped short of taging the 36 area with a low of 37.25..I missed the last part but now there exists a band up near 45 - 46.25...It would be cool to start out Monday by filling in this band and then rolling over to get the 36...or as a second scenario we open lower on monday and tag the 36 and then come up and rally to the 45 area...we'll see...I like them for targets I think more than an area to initiate unless we have Single prints off the 30 minute as per Market profile lingo at the same time ....

Thanks DT, there is the 1445 officially hit in the day session. Seems like a good place for shorts with that gap down below....we'll see...there exists a band at the 41 area so that would make a good target if this market can get some steam together on the downside

Bruce

I had to edit this again as my own post made me laugh - Imagine a 4 point move is over half the average days range now and I say that you need "steam" to get to such a target. The bottom line is that these dimished ranges are pathetic.

Bruce

I had to edit this again as my own post made me laugh - Imagine a 4 point move is over half the average days range now and I say that you need "steam" to get to such a target. The bottom line is that these dimished ranges are pathetic.

quote:

Originally posted by day trading

Good market read!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.