Pitbull setup Part II

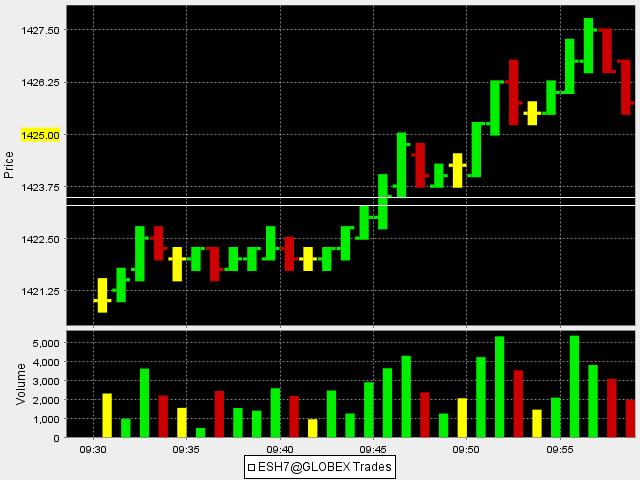

To be honest I donot know if I will be able to articulate this but I will try. This is probably more of a concept then a setup and today wasn't the perfect day but I'll attempt it anyway. Some key ideas 1) many Market profile users and traders consider areas on a price that have not been traded at on the same day more than once to be areas of low volume ( You may need to study the Single print concept to really get this) but I have noticed on the one minute time frame that prices actually push away from other prices on High Volume and you will not see price bar overlap on the one minute....some examples from today may help...but you have been warned....

You will notice on the far right of the screen that prices broke down on high volume...and left an area that was pushed away from rather quickly. Well the point of this post is to demonstrate that on many days these areas are tested as if the market particpants are saying " Hey, they broke it down from here before , lets see if they can do it again."....so from this chart you can see that the 1435 -1435.25 area was pushed away from fast. That being the case this High Volume area will need to be tested....so here is what happened soon after

Notice how the market comes back up to test this area..

Later on in the day we get another push down on high volume here is a shot of that..notice the horizontal lines drawn at the 1429.75 - 1430.25 area..there is no price bar overlap on this high volume push..so the theory being that this area should be tested...here is the push down

and here is the retest..

I have found that these are excellent areas to trade for..I have also found that on trend days this counter trend approach will kill you.

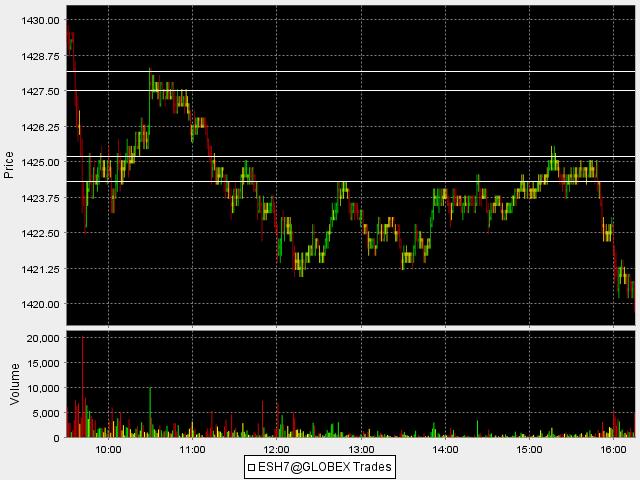

These high volume areas also become dynamic support and resistence areas for the rest of the day quite often...so here are those high push areas and how they affected the market for the rest of todays trading....this is the entire day with those horizontal push out areas left in place

Ask me questions if unclear as this is hard for me to put into words..it makes sense to me but we may need to view a few days before you can see what the H-E-L-L I'm writing about..

Bruce

You will notice on the far right of the screen that prices broke down on high volume...and left an area that was pushed away from rather quickly. Well the point of this post is to demonstrate that on many days these areas are tested as if the market particpants are saying " Hey, they broke it down from here before , lets see if they can do it again."....so from this chart you can see that the 1435 -1435.25 area was pushed away from fast. That being the case this High Volume area will need to be tested....so here is what happened soon after

Notice how the market comes back up to test this area..

Later on in the day we get another push down on high volume here is a shot of that..notice the horizontal lines drawn at the 1429.75 - 1430.25 area..there is no price bar overlap on this high volume push..so the theory being that this area should be tested...here is the push down

and here is the retest..

I have found that these are excellent areas to trade for..I have also found that on trend days this counter trend approach will kill you.

These high volume areas also become dynamic support and resistence areas for the rest of the day quite often...so here are those high push areas and how they affected the market for the rest of todays trading....this is the entire day with those horizontal push out areas left in place

Ask me questions if unclear as this is hard for me to put into words..it makes sense to me but we may need to view a few days before you can see what the H-E-L-L I'm writing about..

Bruce

12/22/2006 : 12:48:53 <<moved from pitbull thread per BruceM's request>>

"look at the 7th bar of the days high and the 4th bars low"..this should read "look at the 7th bars high and the 3rd bars low"..sorry for that typo

Bruce

"look at the 7th bar of the days high and the 4th bars low"..this should read "look at the 7th bars high and the 3rd bars low"..sorry for that typo

Bruce

12/22/2006 : 13:48:53 <<moved from pitbull thread per BruceM's request>>

Well I messed up...all these charts should have been posted to the Pitbull Part II thread.....so here is how the ES ended up for the day note how these high volume areas where s/r again today...

Well I messed up...all these charts should have been posted to the Pitbull Part II thread.....so here is how the ES ended up for the day note how these high volume areas where s/r again today...

12/22/2006 : 20:54:13 <<moved from pitbull thread per BruceM's request>>

Thanks so much Bruce for taking time to go over this morning setup on my behalf. Your explanation with the 1 minute chart clears up exactly what the setup your looking for is. And now I understand the parallel this has with the single ticks concept, it is like a micro version of single ticks. I know guy has done a lot of research into the single tick concept, perhaps this work will trigger some ideas or thoughts from him.

I did notice that little air pocket at the 3rd bar low and 7th bar high as well.

Dynamic pivots is an area of research I have been interested in for some time. I really like the work your doing with these micro air pockets.

Can you cover how volume plays into this. I notice the first dynamic pivot level is accompanied by a jump into what I consider an average volume rate (5K per minute).

Thanks so much Bruce for taking time to go over this morning setup on my behalf. Your explanation with the 1 minute chart clears up exactly what the setup your looking for is. And now I understand the parallel this has with the single ticks concept, it is like a micro version of single ticks. I know guy has done a lot of research into the single tick concept, perhaps this work will trigger some ideas or thoughts from him.

I did notice that little air pocket at the 3rd bar low and 7th bar high as well.

Dynamic pivots is an area of research I have been interested in for some time. I really like the work your doing with these micro air pockets.

Can you cover how volume plays into this. I notice the first dynamic pivot level is accompanied by a jump into what I consider an average volume rate (5K per minute).

Nice observation Rich...glad you are finding this useful and hopefully it can help cofirm or negate your own work...It makes sense that these things are happening near areas where more market participants are watching..

quote:

Originally posted by austintrader

Good work Bruce. I notice that the areas of high volume coincide with the Gap (1435.25) and S1 (1430.00). Your observation supports the concept of using Pivots and other areas of support/resistance to initiate trades.

I like your naming convention of "micro version of single ticks/prints"..as far as volume is concerned I find it difficult to put a number on it because on a low volume day you could have a push up or down on obvious low volume compared to a weekly or daily one minute volume average...I think the most important part is just the fact that "they" are pushing it away.. I wish I could qualify it more for you but I can't at this point..volume is all relative..as u know

quote:

Originally posted by pt_emini

12/22/2006 : 20:54:13 <<moved from pitbull thread per BruceM's request>>

Thanks so much Bruce for taking time to go over this morning setup on my behalf. Your explanation with the 1 minute chart clears up exactly what the setup your looking for is. And now I understand the parallel this has with the single ticks concept, it is like a micro version of single ticks. I know guy has done a lot of research into the single tick concept, perhaps this work will trigger some ideas or thoughts from him.

I did notice that little air pocket at the 3rd bar low and 7th bar high as well.

Dynamic pivots is an area of research I have been interested in for some time. I really like the work your doing with these micro air pockets.

Can you cover how volume plays into this. I notice the first dynamic pivot level is accompanied by a jump into what I consider an average volume rate (5K per minute).

Thanks Bruce.

In terms of volume, I like to watch the 1 minute volume rate, the 5 minute rate is also useful. Certain levels tend to indicate certain things in relation to the start, middle and end of a trend. Try setting two volume levels on your 1 minute volume histogram, low at 5,000 and high at 10,000. It's something you might keep an eye on and see if there is a relationship to this pattern. I think you will begin to notice a corresponding volume to price relationship with your pitbull strategy as well, because the volume pattern tends to shift in a predictable way at meaningful divergence points.

Do you think this micro-singles pattern is reliable on other time frames ? For example, the ES 5 minute chart did form the same pattern at 11-11:15am Friday around the 1425.50 level. Do you prefer to look for this on just the 1 minute ? Have you studied the 3 or 5 minute time frames as well ?

In terms of volume, I like to watch the 1 minute volume rate, the 5 minute rate is also useful. Certain levels tend to indicate certain things in relation to the start, middle and end of a trend. Try setting two volume levels on your 1 minute volume histogram, low at 5,000 and high at 10,000. It's something you might keep an eye on and see if there is a relationship to this pattern. I think you will begin to notice a corresponding volume to price relationship with your pitbull strategy as well, because the volume pattern tends to shift in a predictable way at meaningful divergence points.

Do you think this micro-singles pattern is reliable on other time frames ? For example, the ES 5 minute chart did form the same pattern at 11-11:15am Friday around the 1425.50 level. Do you prefer to look for this on just the 1 minute ? Have you studied the 3 or 5 minute time frames as well ?

I like the one minute to find these as you will often find on a quick move out on a 5 miunte chart or higher time frame that when broken down they will be made up of the one minute pushes anyway....I will check into your other volume comments too Pt-emini...thanks for the ideas.....this is great stuff

Bruce

Bruce

Thanks Bruce

I will focus my attention on the 1 minute ES chart and get some practice looking for the pattern to form.

I will focus my attention on the 1 minute ES chart and get some practice looking for the pattern to form.

Here is today Tuesday the 26th..the before photo... the 16th and 17th bars mark the push out..note the higher volume

and here is the retest just before 11 am....

Ok enough of these...if anyone has any trouble spotting them let me know

Bruce

Ok enough of these...if anyone has any trouble spotting them let me know

Bruce

Thanks DT, there is the 1445 officially hit in the day session. Seems like a good place for shorts with that gap down below....we'll see...there exists a band at the 41 area so that would make a good target if this market can get some steam together on the downside

Bruce

I had to edit this again as my own post made me laugh - Imagine a 4 point move is over half the average days range now and I say that you need "steam" to get to such a target. The bottom line is that these dimished ranges are pathetic.

Bruce

I had to edit this again as my own post made me laugh - Imagine a 4 point move is over half the average days range now and I say that you need "steam" to get to such a target. The bottom line is that these dimished ranges are pathetic.

quote:

Originally posted by day trading

Good market read!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.