EOD POC return

using the 9:30-12:00 range to figure Vol profile. if price is inside that TF range the odds of a POC return are very hi.

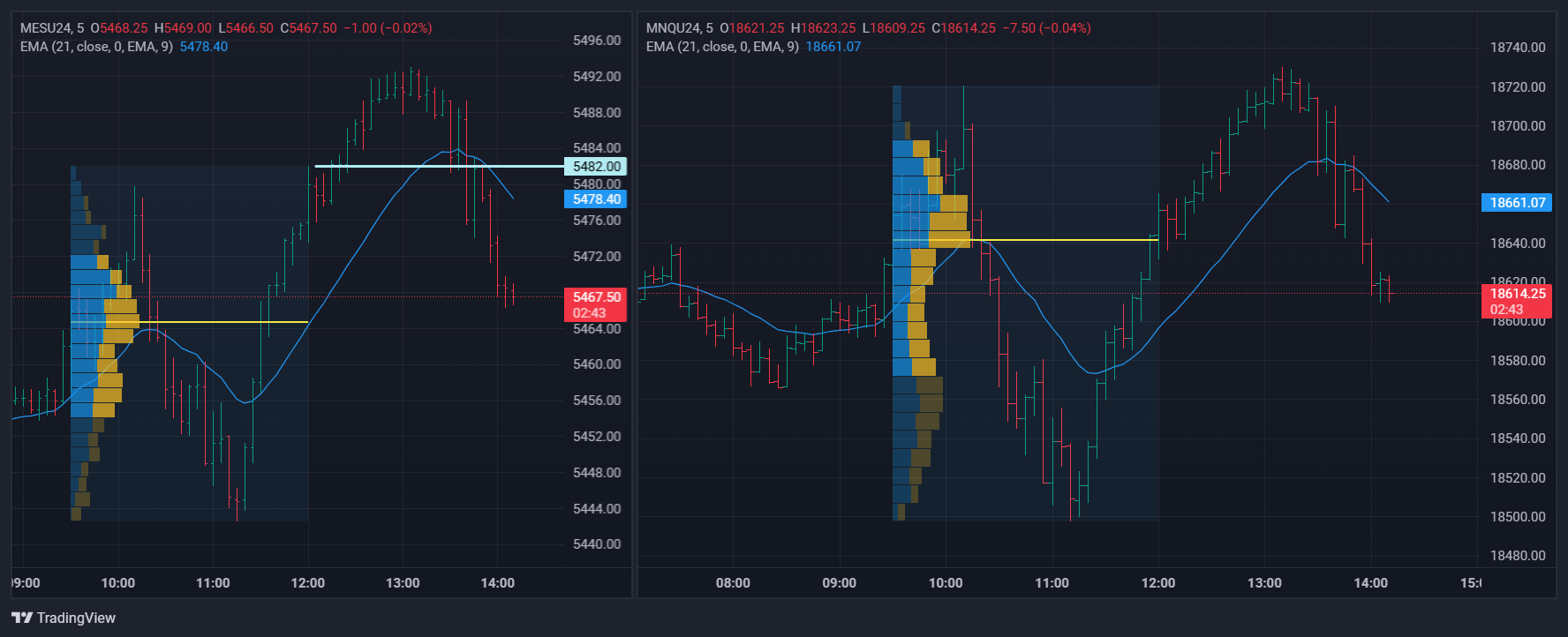

these are 5min TF notice the MES put in a nice top outside the 930-1200 range then sold off to the POC.

the MNQ barely left the range before collapsing.

if price cant reenter this range we look for range extensions aka new Lo or new Hi

these are 5min TF notice the MES put in a nice top outside the 930-1200 range then sold off to the POC.

the MNQ barely left the range before collapsing.

if price cant reenter this range we look for range extensions aka new Lo or new Hi

I use this method if i was unable make my profit target for the day. both MNQ and MES were a success so I'm done for the day finally.

I accidently stumbled across this cause i would pause every day at noon and come back after 130 and noticed this lil nasdaq nugget.

I accidently stumbled across this cause i would pause every day at noon and come back after 130 and noticed this lil nasdaq nugget.

12:20 the MNQ over shot the lower edge of the yellow up channel back into the 930-1200 TF. 120 pt advance quickly to the POC.

You are looking at this in the afternoon session of the same day?

I was done yesterday before 1030. I only trade this set up if I didn't hit my profit objective for the day as i stated earlier. today I'm a bit short of my day goals. I try to make 2k a day now. same concept applies if im trading or not the 930-1200 range must be in play for a POC return.

im using the Vol profile from 930-1200 to give me POC return targets or as a signal for late day range extension.

End-of-day (EOD) POC returns can be insightful for analyzing price action trends. By studying currency charts alongside these POC levels, traders can better spot key support and resistance areas, helping refine entry and exit points for more informed decision-making.

Great discussion on the EOD POC return! I’ve been experimenting with different strategies, and I’ve found that incorporating an ats api trading system has helped streamline my approach. It allows for automated execution based on real-time data and market trends, which enhances precision and efficiency. Has anyone here tried integrating ATS API trading with their strategies to improve their trading outcomes?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.