ES 9-21-22

Courtesy Rob Hanna of quantifiable edges: when the $SPX closes at a 5-day low and below the 200ma just before a Fed Day

Posted on September 20, 2022 by Rob Hanna

Wednesday is a Fed Day. And a decent amount of the recent selling may be attributable to anxiety over the Fed announcement. I’ve shown Fed Days to be bullish in the past, especially when there has been a selloff heading into the Fed Day. The study below is from this past weekend’s subscriber letter. It looks at other times SPX closed at a 5-day low and below the 200ma on the day before a Fed Day.

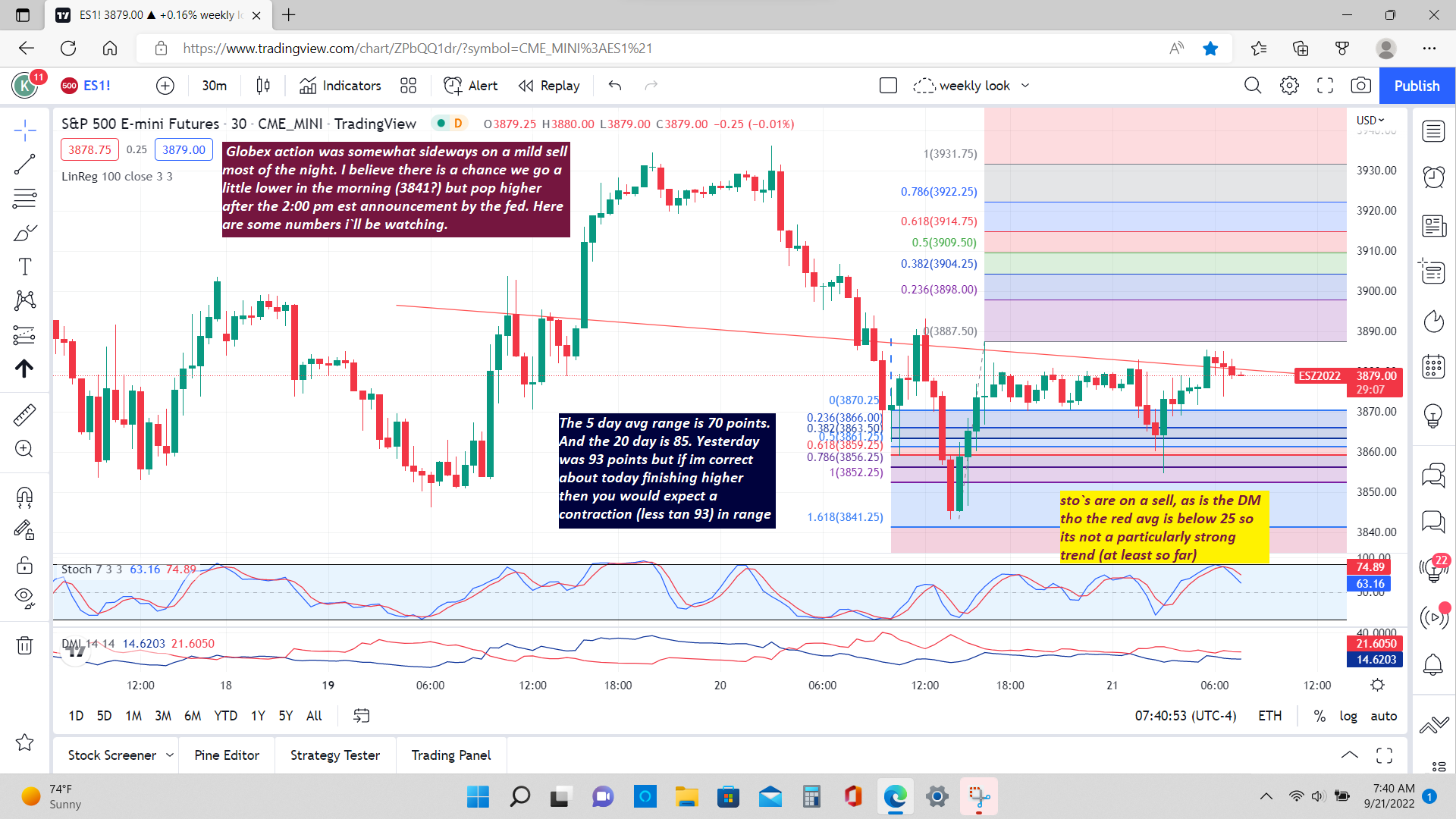

5-low < 200ma before a Fed Day since 1979.... 31 trades 19 winners 12 losers (pretty good odds) Its been even better more recently. From 2008 to now, 11 trades, 9 winners and only 2 losers. SPX would need to close below 3873 today in order to trigger this setup.(futured close was 3872.75 lol and spx was 3855.93! This is another reason i think they push it up after the 2: 00pm announcement as a relief that the hike is only 76 basis points.LOL then the next day realization that 3 75 point increases aint good for stocks!

Posted on September 20, 2022 by Rob Hanna

Wednesday is a Fed Day. And a decent amount of the recent selling may be attributable to anxiety over the Fed announcement. I’ve shown Fed Days to be bullish in the past, especially when there has been a selloff heading into the Fed Day. The study below is from this past weekend’s subscriber letter. It looks at other times SPX closed at a 5-day low and below the 200ma on the day before a Fed Day.

5-low < 200ma before a Fed Day since 1979.... 31 trades 19 winners 12 losers (pretty good odds) Its been even better more recently. From 2008 to now, 11 trades, 9 winners and only 2 losers. SPX would need to close below 3873 today in order to trigger this setup.(futured close was 3872.75 lol and spx was 3855.93! This is another reason i think they push it up after the 2: 00pm announcement as a relief that the hike is only 76 basis points.LOL then the next day realization that 3 75 point increases aint good for stocks!

Ticks and put calls are very positive here

It could be we get a fake out where we decline first to the midline or lower ,only to reverse a half hour later for a push higherinto the close. Of course the opposite is also possible, tho less likely since history says we should finish above yesterdays 3872.75 close.

Vix is slightly negative as are put calls. Tick negative but trying to rebound. I may try a buy around 3875 with a tight stop

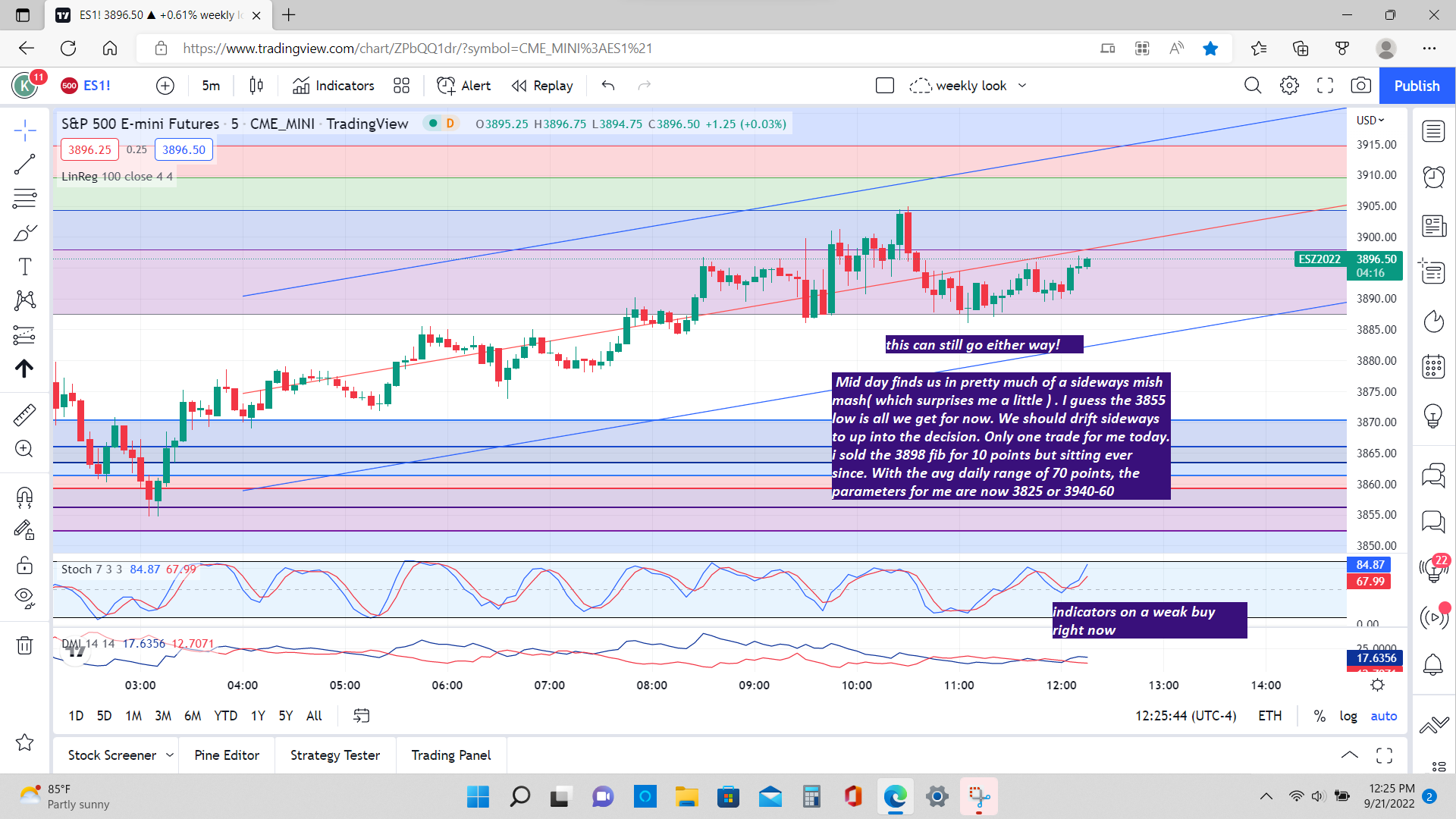

Wow. Still on the sidelines but i suspect we could get a rebound after the 2:30 fedspeak.. daily range already at 73.

And heres the push up as forecast u expect it to last a while but were not yet reversed the sell signals yet , but gettin close

1,3,5, and 15min charts are now positive . it may take the 30 min a while longer. Ticks have recovered to above zero

The bearish engulfing bar has already been negated with a bearish engulfing bar! That was supposed to be tomorrow. Lol. Ticks very negative..was going to buy 3848 at 3:30 but passed because of this . We should close above 3873 but I'm too chicken and hanging on to a good day.. c ya manana

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.