SOS Order Not Executed

Hi All:

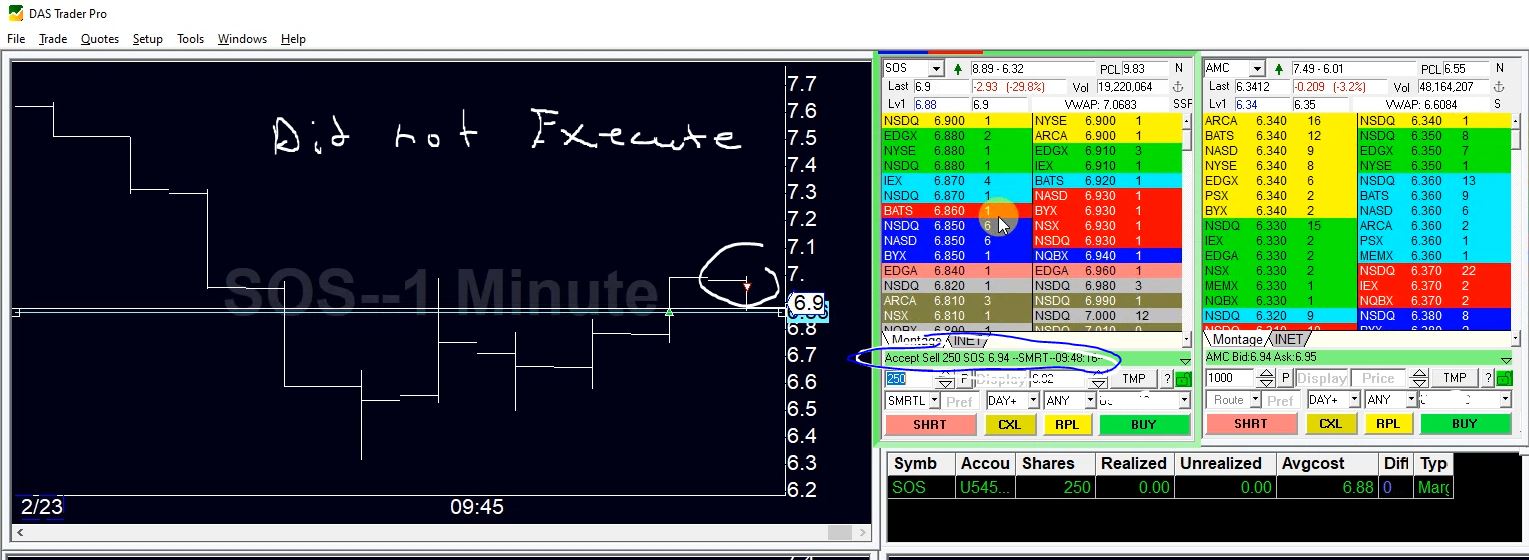

I am a fairly new day trader using DAS and Interactive brokers. Today I placed a long (250 shares) on SOS (ticker). Normally when I place orders they are executed within a second or so. I was able to go long and the order took a second to fill. After some time, I decided to exit as I was not happy with the trade itself.

I had a very hard time exiting the trade (selling to get out). The orders pretty much would not execute. It took me numerous attempts to finally exit the trade.

I contacted interactive brokers for an explanation. However, I do not really understand what they are explaining. Can anyone provide a laymen's explanation of what they are explaining below? Most importantly, how can one avoid issues like this (order not executing), or know when this could happen?

Summary: SOS Order Not Executed

IBCS 2021/02/23 16:31:25

Dear Mr. Alvarez,

The reason your order, and others, were not immediately executed is because they were being price capped at prices slightly above the bid at the time. This was a result of the substantial price move in SOS from the previous day's close.

The Central Book’s reference price filter (“Reference Price Filter”) caps prices specified in marketable securities orders where the limit price specified in the order is aggressive relative to a calculated reference price, so as to avoid causing a security or contract’s price to move beyond its normal range.

The Reference Price Filter caps prices on submitted orders to be no more aggressive (relative to the reference price) than the larger of (i) two normal bid-ask spreads or (ii) a specified percentage (depending on the product type) of the calculated reference price.

The reference price used in the filter is calculated using an algorithm that considers the following factors: (i) a volume-weighted moving average of trade prices over a several second sliding window, (ii) the last trade price, and (iii) the current NBBO. The effect of using the first factor described above (the sliding window weighted-average-price) is generally to act as a drag on the movement of the reference price, thus making the Firm’s reference price more conservative, in most cases, relative to simply pinning the reference price to the last trade price.

Customers with capped open orders must contact the IBKR order desk to expand the price cap.

Regards,

IB Trade Group

I am a fairly new day trader using DAS and Interactive brokers. Today I placed a long (250 shares) on SOS (ticker). Normally when I place orders they are executed within a second or so. I was able to go long and the order took a second to fill. After some time, I decided to exit as I was not happy with the trade itself.

I had a very hard time exiting the trade (selling to get out). The orders pretty much would not execute. It took me numerous attempts to finally exit the trade.

I contacted interactive brokers for an explanation. However, I do not really understand what they are explaining. Can anyone provide a laymen's explanation of what they are explaining below? Most importantly, how can one avoid issues like this (order not executing), or know when this could happen?

Summary: SOS Order Not Executed

IBCS 2021/02/23 16:31:25

Dear Mr. Alvarez,

The reason your order, and others, were not immediately executed is because they were being price capped at prices slightly above the bid at the time. This was a result of the substantial price move in SOS from the previous day's close.

The Central Book’s reference price filter (“Reference Price Filter”) caps prices specified in marketable securities orders where the limit price specified in the order is aggressive relative to a calculated reference price, so as to avoid causing a security or contract’s price to move beyond its normal range.

The Reference Price Filter caps prices on submitted orders to be no more aggressive (relative to the reference price) than the larger of (i) two normal bid-ask spreads or (ii) a specified percentage (depending on the product type) of the calculated reference price.

The reference price used in the filter is calculated using an algorithm that considers the following factors: (i) a volume-weighted moving average of trade prices over a several second sliding window, (ii) the last trade price, and (iii) the current NBBO. The effect of using the first factor described above (the sliding window weighted-average-price) is generally to act as a drag on the movement of the reference price, thus making the Firm’s reference price more conservative, in most cases, relative to simply pinning the reference price to the last trade price.

Customers with capped open orders must contact the IBKR order desk to expand the price cap.

Regards,

IB Trade Group

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.