Pivot Point Calculator

A new online Pivot Point Calculator by DeltaT1 is now available on the DeltaT1 web site:

Pivot Point Calculator

DeltaT1 were heard saying: "We think that this is the most comprehensive, flexible, and simply the best, Pivot Point Calculator available. In fact we challenge anybody to show us a better one."

Add any questions and comments about it here.

DeltaT1 were heard saying: "We think that this is the most comprehensive, flexible, and simply the best, Pivot Point Calculator available. In fact we challenge anybody to show us a better one."

Add any questions and comments about it here.

Thanks for making all of this information available Guy, it's a big help.

One question: On the page where you post Woodie's pivot points it appears that you use HLC/3 for the Pivot Point. However, in the Pivot Point Calculator you use HLOO/4, which to the best of my knowledge is what Woodie advises. This of course requires calculating the Pivots after the 9:30 Open.

Just wondering if I am misinformed on Woodie's formula or not.

Thanks again,

TraderPhil

One question: On the page where you post Woodie's pivot points it appears that you use HLC/3 for the Pivot Point. However, in the Pivot Point Calculator you use HLOO/4, which to the best of my knowledge is what Woodie advises. This of course requires calculating the Pivots after the 9:30 Open.

Just wondering if I am misinformed on Woodie's formula or not.

Thanks again,

TraderPhil

Hi TraderPhil,

In looking for pivot point formulae I came across two that were attributed to Woodie.

The one that you mention (HLOO/4 to calculate pivot) is indeed one of them and requires the opening price in order to calculate it. My site isn't currently designed to update the prices at the open and for that reason I exclude that calculation but instead provide the pivot calculator so that it can be done manually if desired.

So yes you are correct. Hope that helps.

In looking for pivot point formulae I came across two that were attributed to Woodie.

The one that you mention (HLOO/4 to calculate pivot) is indeed one of them and requires the opening price in order to calculate it. My site isn't currently designed to update the prices at the open and for that reason I exclude that calculation but instead provide the pivot calculator so that it can be done manually if desired.

So yes you are correct. Hope that helps.

Guy,

Two questions:

1. I find that your Classic numbers for R3/S3 and R4/S4 come up different than a handful of the other Calculators on the internet. Any help explaining this would be appreciated.

2. I am trying to input your formula's into my own Excel spreadsheet. I am somehow making a mistake typing in your Camarilla formula's. I'm not understanding how to type "C=RANGE*1.1/12" into an Excel spreadsheet. Could you explain that formula? What is "1.1/12", "1.1/6" and "1.1/4" ?

You have done a great thing with your efforts.

Thank you,

Kevin

Side Note:

I did post this accidentally once before in a new Pivot Points file.

Two questions:

1. I find that your Classic numbers for R3/S3 and R4/S4 come up different than a handful of the other Calculators on the internet. Any help explaining this would be appreciated.

2. I am trying to input your formula's into my own Excel spreadsheet. I am somehow making a mistake typing in your Camarilla formula's. I'm not understanding how to type "C=RANGE*1.1/12" into an Excel spreadsheet. Could you explain that formula? What is "1.1/12", "1.1/6" and "1.1/4" ?

You have done a great thing with your efforts.

Thank you,

Kevin

Side Note:

I did post this accidentally once before in a new Pivot Points file.

Guy,

Dealing with Camarilla's Pivot Point Formula.

I've entered the following numbers for KLAC on the Calculator:

Open: 44.77, High: 45.95, Low: 44.03, Close: 45.52

Based on the formula, these are the numbers that came up:

PP: 45.17, R1: 45.70, R2: 45.87, R3: 46.05, R4: 46.58

PP: 45.17, S1: 45.34, S2: 45.17, S3: 44.99, S4: 44.46

Notice that the Pivot Point and S2 are the same.

How's this possible?

Thank you,

Kevin

Dealing with Camarilla's Pivot Point Formula.

I've entered the following numbers for KLAC on the Calculator:

Open: 44.77, High: 45.95, Low: 44.03, Close: 45.52

Based on the formula, these are the numbers that came up:

PP: 45.17, R1: 45.70, R2: 45.87, R3: 46.05, R4: 46.58

PP: 45.17, S1: 45.34, S2: 45.17, S3: 44.99, S4: 44.46

Notice that the Pivot Point and S2 are the same.

How's this possible?

Thank you,

Kevin

Kevin,

If you substitute into the formula then you will see that the values given for pivot point and S1-S4, R1-R4 are correctly calculated.

What you are seeing here is the result of using one type of formula to calculate the pivot point and another basis to calculate the support and resistance levels.

So the pivot point is calculated using (open + high + close) / 3 right?

Yet the support and resistance numbers are calculated using offsets from the closing price.

For this reason the pivot point can be above or below any of the support/resistance numbers. Notice that all the formula for the camarilla calculations use C (closing price) as the basis.

What would be more logical here would be to use the closing price for the pivot point and the camarilla support/resistance lines for your testing.

Does this make sense?

If you substitute into the formula then you will see that the values given for pivot point and S1-S4, R1-R4 are correctly calculated.

What you are seeing here is the result of using one type of formula to calculate the pivot point and another basis to calculate the support and resistance levels.

So the pivot point is calculated using (open + high + close) / 3 right?

Yet the support and resistance numbers are calculated using offsets from the closing price.

For this reason the pivot point can be above or below any of the support/resistance numbers. Notice that all the formula for the camarilla calculations use C (closing price) as the basis.

What would be more logical here would be to use the closing price for the pivot point and the camarilla support/resistance lines for your testing.

Does this make sense?

Hi,

is the Camarilla Equation that you use correct? I have calculated the Pivots for the DAX (O=5082.38, H=5115.65, L=5074.48, C=5110.61) and now S1 and S2 is above the Pivot.

Best regards,

Migi

is the Camarilla Equation that you use correct? I have calculated the Pivots for the DAX (O=5082.38, H=5115.65, L=5074.48, C=5110.61) and now S1 and S2 is above the Pivot.

Best regards,

Migi

quote:

Originally posted by MIGI

is the Camarilla Equation that you use correct? I have calculated the Pivots for the DAX (O=5082.38, H=5115.65, L=5074.48, C=5110.61) and now S1 and S2 is above the Pivot.

The Camarilla calculates the pivot point using the average of HLC but the support and pivot levels are calculated with the Closing price as the starting point so it is very possible for the support/resistance levels to be on the "wrong" side of the pivot point.

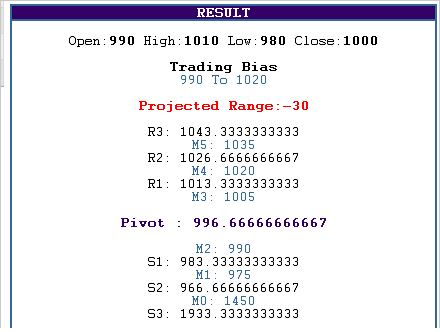

Here is a pivot calculator that provides 3 support levels and 3 resistance levels as well as the m0 thru m5 levels for a total of 13 levels. It will also give you the projected range and the projected high and low. THe URL is http://forexmastermaker.com/cal.php

Interesting... I stuck in some numbers and it came up with this result. (My inputs are at the top)

What are the M numbers? There's no explanation on the site or formula to show how they are calculated?

Why are S3 and M0 so much higher than all the other numbers?

What are the M numbers? There's no explanation on the site or formula to show how they are calculated?

Why are S3 and M0 so much higher than all the other numbers?

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.