ES Thursday 11-2-17

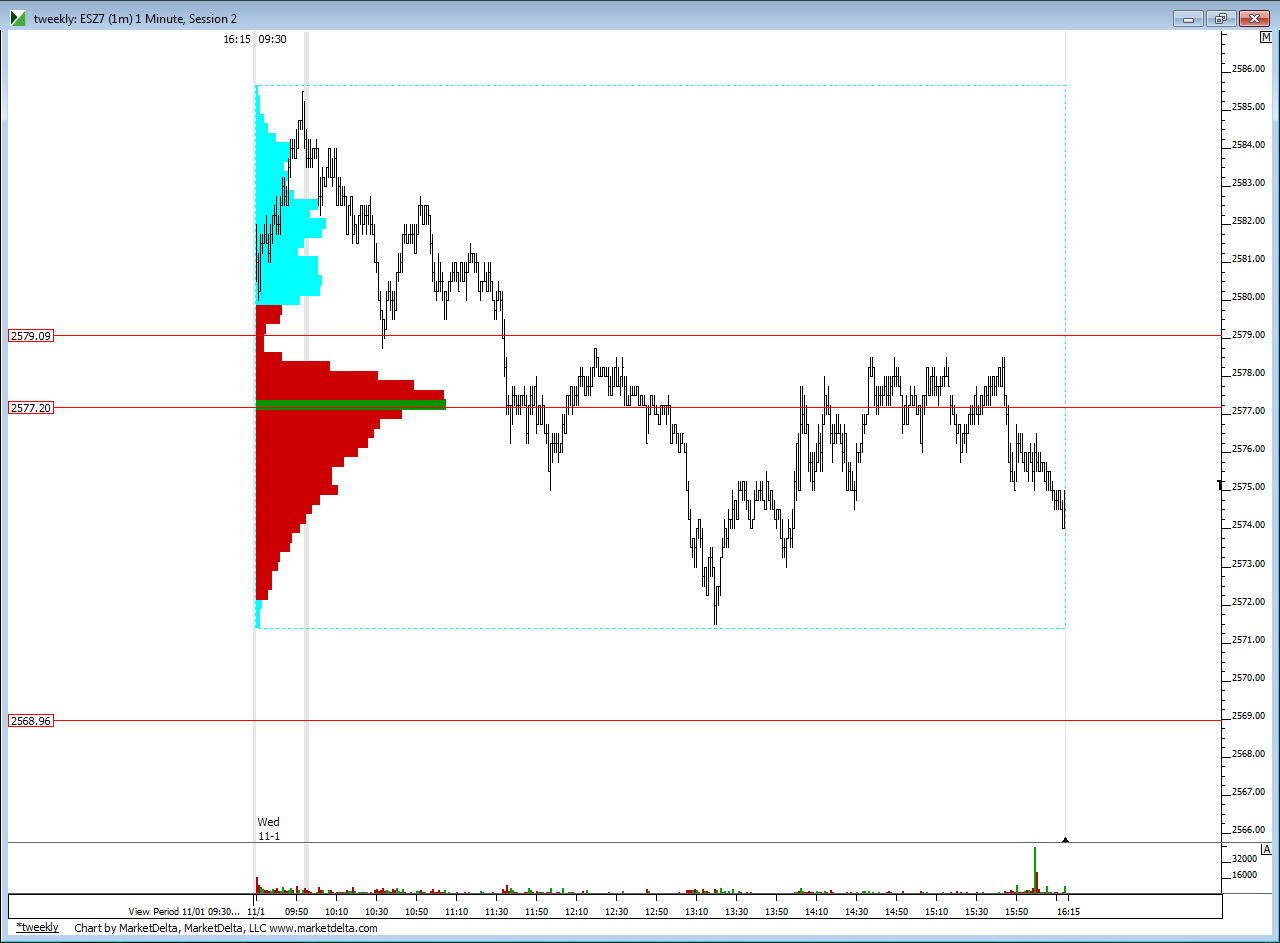

a quick look first at the area the bulls would need to try to take over....will edit with more in a few minutes

edit : areas I am watching...not mentioned on the video but the Overnight POC and Overnight midpoint goes well with the Floor trader R1 area today

most of the overnight inventory is short...Ideal for me would be a weak run down up that runs out of power at one of our key areas to adjust some of that overnight inventory

we are looking at 7- 8 points as our 86 % 1/2 sd band number off cash close of 2579

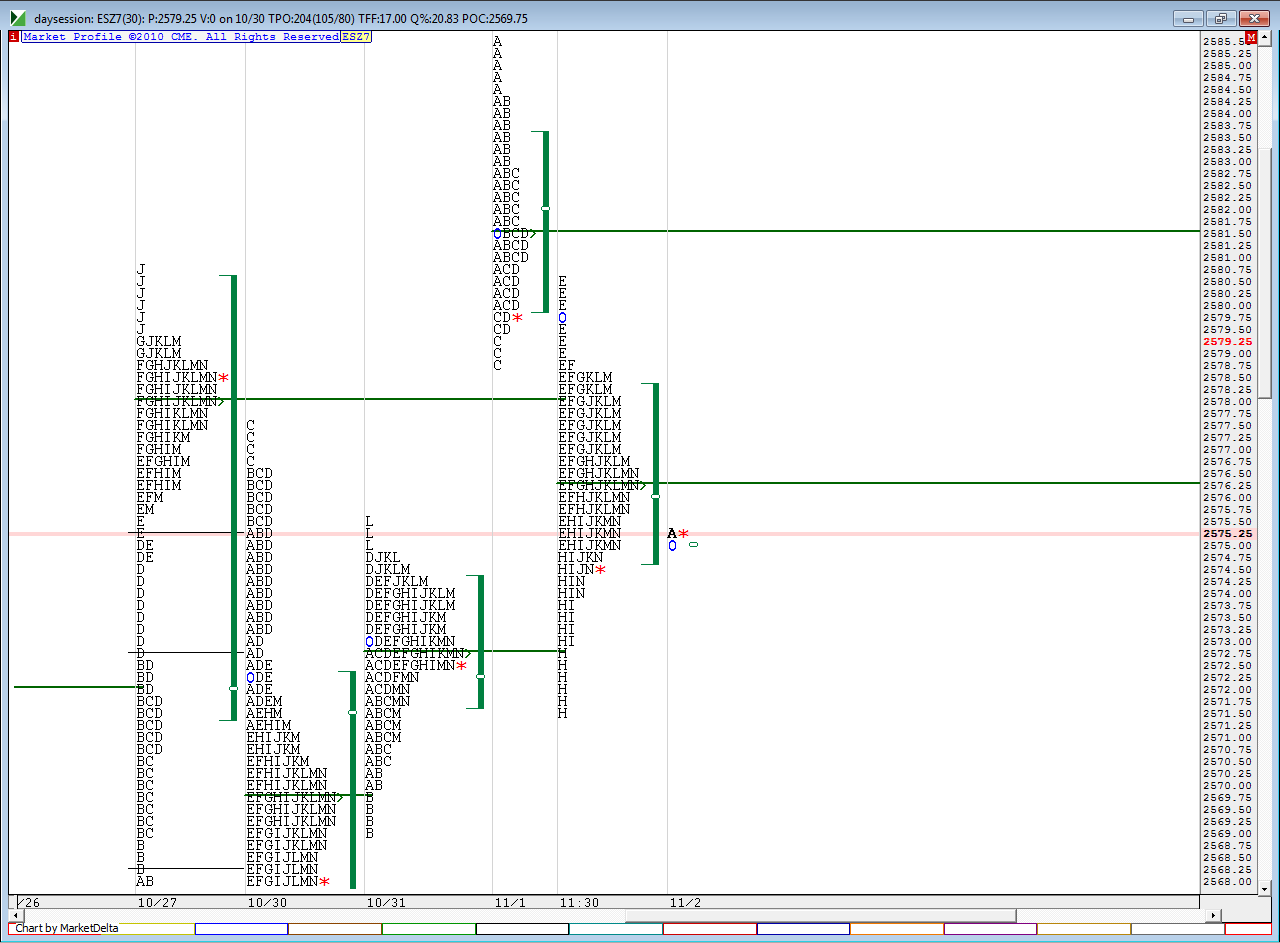

I've split out yesterdays profile to look like this..note the selling tail in "E and F" periods

edit : areas I am watching...not mentioned on the video but the Overnight POC and Overnight midpoint goes well with the Floor trader R1 area today

most of the overnight inventory is short...Ideal for me would be a weak run down up that runs out of power at one of our key areas to adjust some of that overnight inventory

we are looking at 7- 8 points as our 86 % 1/2 sd band number off cash close of 2579

I've split out yesterdays profile to look like this..note the selling tail in "E and F" periods

keeping my bias to the long side in early trade this morning

OR traders would be wise to study trades that happen when we open in the previous days value area and outside the previous days value area...I'd still like to see prints up above the current 76 and up into the 77 number this morning

it's been 50 minutes and they can't get a plus or minus 2 yet...that tells you something

<comment removed> wrong information was posted earlier.

OR traders using the one minute would have had 3 losses before getting a minus 4 and also tagging the S1 floor number today ...5 minute traders would have fared better these last two days.....if / when volatility picks up u may decide that the 5 minute gives you better results depending on where we open and how far away we are from one of our statistics...

when volatility expands you may find that the 5 minute range contains the plus/minus 2 and 4 numbers too often

when volatility expands you may find that the 5 minute range contains the plus/minus 2 and 4 numbers too often

seems a bit excessive on downside..i wouldn't be surprised to see a push back to 2571 - 2572 but I'd prefer to try that as close to 2562 as possible and use 2569 as a first target

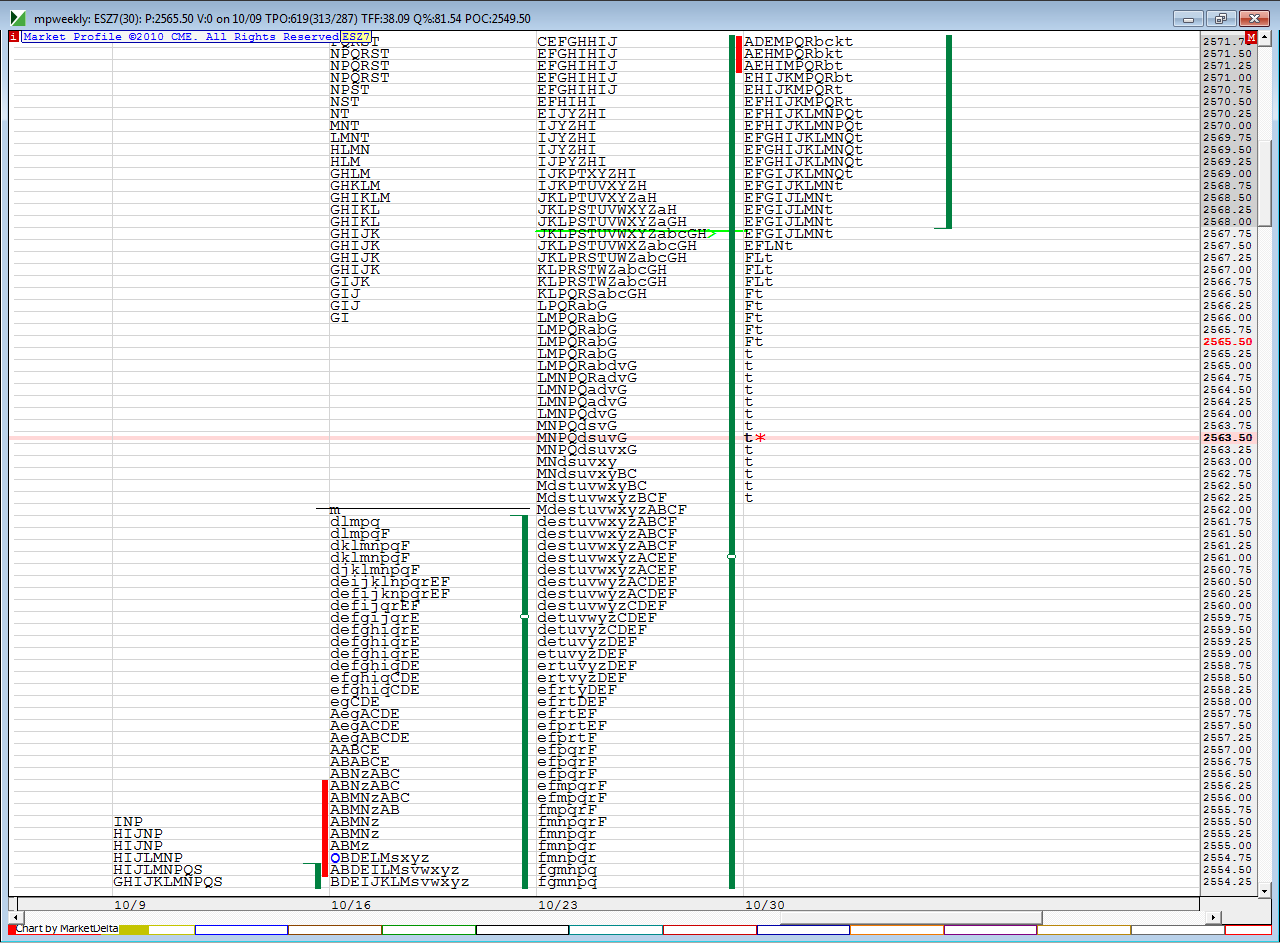

look how "F" period really sticks out on last weeks chart....that is why I mention the 2562

we also broke the O/N low on the push towards 2562

also S2 was down there...I'd like to see that hold....there are only two MAIN volume spots and that is down near the 62 - 64 and up at 71 - 72....they will retest one of them today....so keep that in mind

a recap on a bunch of things that rattle through my brain today

we may be drying up here on the forum and that may be a good thing...The OR trades will serve you well over time.......also it is so important to not let losses rattle you.......work hard to get over that if it is an issue.... look at your results from a bigger view....not just on a day to day basis....my advice would be to set a time limit...for example...just take OR trades in the morning until you get a plus or minus 2 or 4 number when Vol expands......if 11 - 11;30 comes and you aren't profitable just call it a day and wait till the next day....some may want to only do OR trades if we open out of range and /or out of value and trade bigger size on those days

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.