ES Monday 9/25/17

I like to trade Sunday night and always look for a retrace of Friday or the entire week.

Market tried to go long last by a 5 point move up, as I thought it should-LOL.

That said, any break of Friday's low is what I'm taking ( I am set at 91.75 while I go about my day) and would expect the move to run to 2480 area.

Good luck to all.

Market tried to go long last by a 5 point move up, as I thought it should-LOL.

That said, any break of Friday's low is what I'm taking ( I am set at 91.75 while I go about my day) and would expect the move to run to 2480 area.

Good luck to all.

key number zone will be 2496 - 2497 and a good long will target to 2500.....if wrong then watch 2492 and especially 2487 - 2488 on downside....low volatility will eventually lead to increase in volatility...last weeks 86 % number failed and Friday saw the daily 86 % number fail...I do not think that will happen today or this week......planning to hopefully sell back my spy 249's on the open today and also get long a vix call with about 20 - 30 days till expiry....will do this as a debit spread

poc from weekly sits up at 2504.50 which is close to current overnight high........my day trades will be only on long side but will keep it smaller as I do not want to get caught in the downdraft if/when it comes with days trades

poc from weekly sits up at 2504.50 which is close to current overnight high........my day trades will be only on long side but will keep it smaller as I do not want to get caught in the downdraft if/when it comes with days trades

starting small at fridays RTH lows and will try to target 97....in the back of my mind is the thought that low volatility will increase and I am a bit paranoid today on long side in general

last week saw no failures of the overnight midpoint...we are overdue ! something to think about

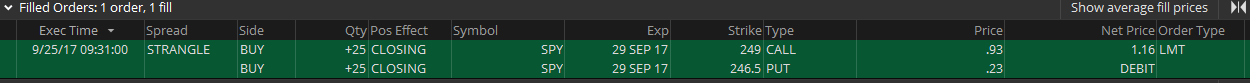

can't find any vix trade I like.....my spy just filled...I had a GTC order working at 1.27 on friday that missed filling by 3 cents...today that order was filled at 1.16...for those following this I took in 1.49 in credit and just bought it back at 1.16 on the open....so it ended with a .33 cent profit ......although profitable, with all the rolls it cost extra in commissions...luckily those are small through TOS

I went flat at 97 target on all but one contract...gonna try for plus 4 or 2499 print .....midpoint is at 99.50.....a print of 94.75 takes my runner and ends the trading day...this 96 - 97 is the line the bulls need to beat......expectation is to go 4 points above open ....but that is sometime this week.....a lot can happen in between

spx should print 2495 or 2507.50 today......it will be interesting to see if this diminished volatility causes another failure of our 86 % number

Friday there was a gap in data at 2495.75, which the market repaired today...very interesting...

spx just printed 86 % number to downside.....just an FWIW........times up for me ...see ya tomorrow...after fact stuff...we went up 4 points above open, we put in two tpo's at last weeks va low...just pointing out some of the probabilities I watch for....use them if u can...I think cash will come back to retake 2498 - 2499 but I'm not trading anymore today but if I was i would be using 93.50 as a retest point on ES off the 90 - 91...higher risk but that 93.50 is where all the big volume came in now....so somebody came in with volume before the breakout of last weeks lows...so odds favor a retest of that volume spike

Big mike...u r now short...where is stop loss on this automated trade idea ? Curious

Big mike...u r now short...where is stop loss on this automated trade idea ? Curious

damn...they sucked me into a long at 85.75 and target is 88.25.....they aren't allowed to blow through a low time spot like that and they left a single tpo at last weeks lows way up at 94...may have to play that with options....all high risk fades as volume is coming in on these down pushes..

now big volume is at 89.50 and 93.50.......

Thanks for the follow up

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.