ES Tuesday 9-5-2017

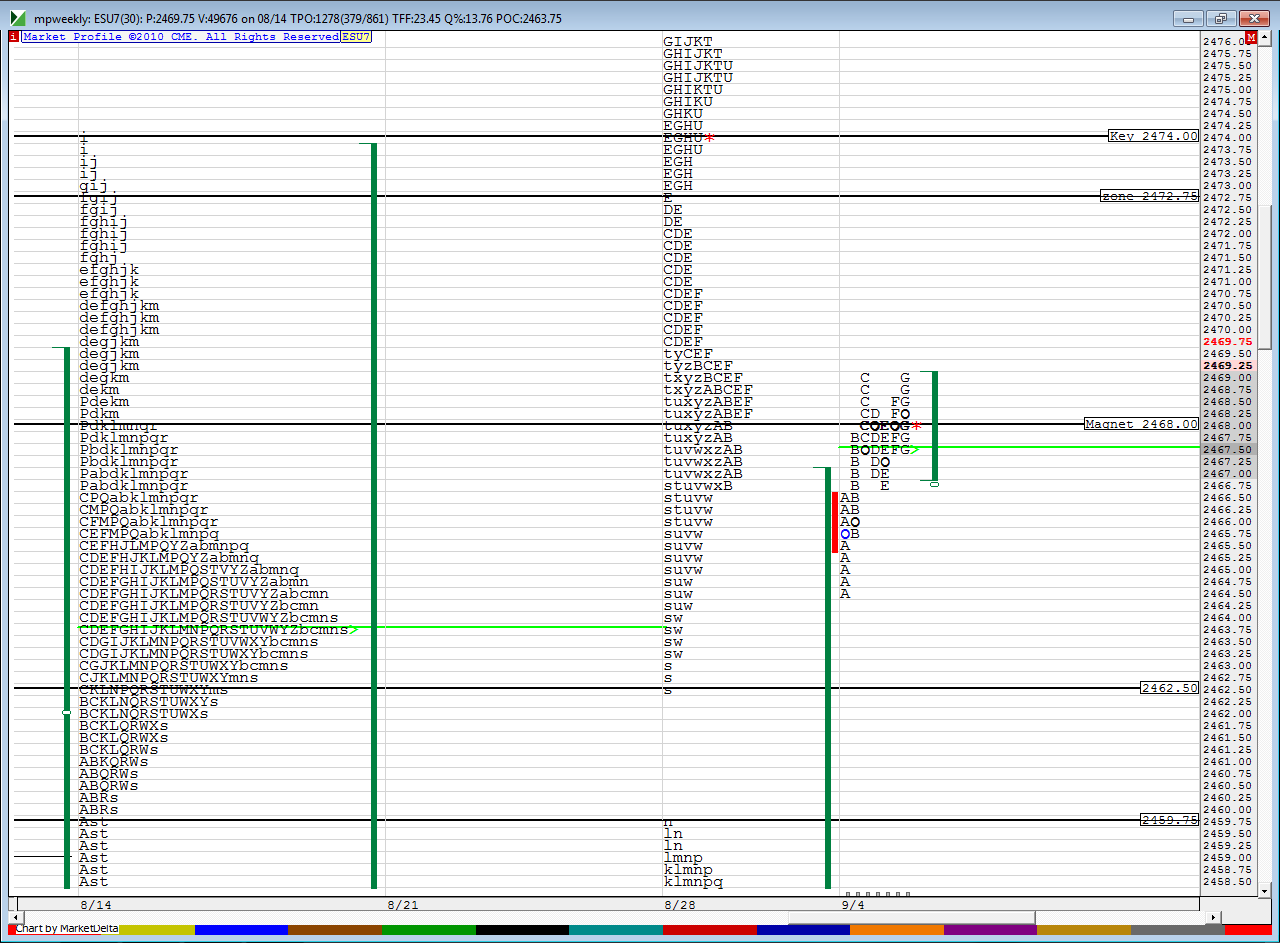

86 % chance we print either 2463 or 2489 on SPX this week,,,,my money will be towards the 2463....plan is to roll calls again to bring in cash .....here are basic zones in video form and I will edit and add a hard copy for those interested...file says Monday but meant to name it Tuesday......I do know what day it is !

outside of the overnight highs and lows these are really my key zones as we start this week.....

86 % up mark is 2489 NOT 2499 as mentioned on video!!!

outside of the overnight highs and lows these are really my key zones as we start this week.....

86 % up mark is 2489 NOT 2499 as mentioned on video!!!

i just deleted an option post as it didn't make sense and my roll order seems to have been messed up for some reason......investigating

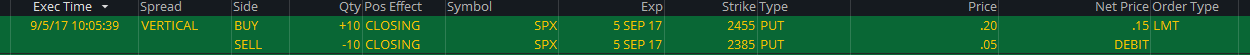

I'm trying to bring in more credit and on friday I sold puts....the only trade I did as I was suppose to take a break but my calls were down almost the full $2500 so I'm trying to bring in more credits as I wait and hope market rolls over

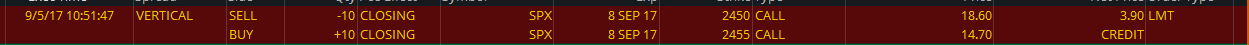

these are fridays puts......sold and then bought back today

sold on friday

bought back today

so this netted me $450 in total

remember original ( the calls I sold last week) trade took in $250 in credit per contract.....

Originally posted by BruceM

I'm trying to bring in more credit and on friday I sold puts....the only trade I did as I was suppose to take a break but my calls were down almost the full $2500 so I'm trying to bring in more credits as I wait and hope market rolls over

sold on friday

bought back today

so this netted me $450 in total

remember original ( the calls I sold last week) trade took in $250 in credit per contract.....

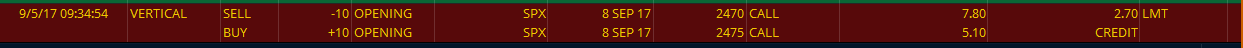

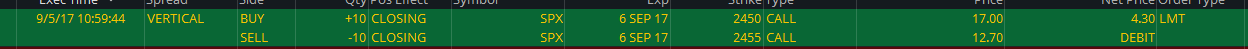

I did this one today ...got filled on exit as I was typing last post

so this netted me $700...remember I am trying to chip away at the $2500 loss...

so this netted me $700...remember I am trying to chip away at the $2500 loss...

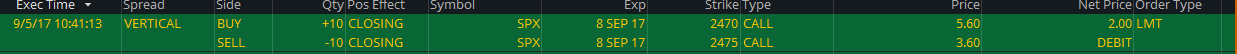

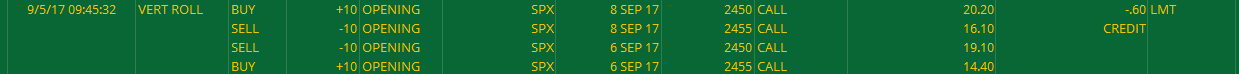

This is part of order I messed up...with all these different strikes and options my vertical roll did not do what I thought it was doing so I sold new Sept 8th calls by mistake...here is fill and here is exit....

and here is closeout of those...trying to get orders straight now

so this brought in $200...but I'm still working other orders.....these weekly options are hard to read....too many choices and opportunity to screw up order has increased for me

and here is closeout of those...trying to get orders straight now

so this brought in $200...but I'm still working other orders.....these weekly options are hard to read....too many choices and opportunity to screw up order has increased for me

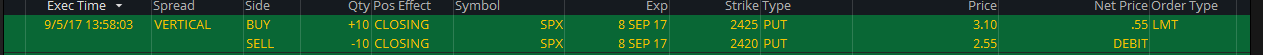

another trade I closed out

and the buy back

these brought in $400

and the buy back

these brought in $400

I'm sure most aren't following all this but the reason you are seeing some of those trades posted above a bit different is because they were part of this trade....Remember my goal today was to simply roll my Sept 5th expiration to sept 8th expiration Instead I fired in this order....and I'm not sure what happened....but note the vertical roll with two opening orders.....usually a roll is suppose to close one order and open another....but I picked sept 6th and sept 8th...crazy stuff...funny thing is I still have my option that expires today....

so to drag this on I made back $1750 of the $2500 potential loss....still working on this

I am unable to roll my call now without having to pay so I am leaving it on..cash just printed the 86 % probability down and ES is in Gap zone

I just bought back my sold calls for $3.80 and these were originally sold for $2.50 so I lost $1.30 per contract . So a $1300 loss . My plan was to take profits at 50% as per the folks at tasty trade and their guidelines but the market trended and ran away from me. the great thing is with all my mess ups and defense I was able to bring in $1750 so the trade resulted in a small profit after commissions and all that...here is the fill..

here's how I did them today....much easier then that call campaign.....!!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.