ES Wednesday 8-30-17

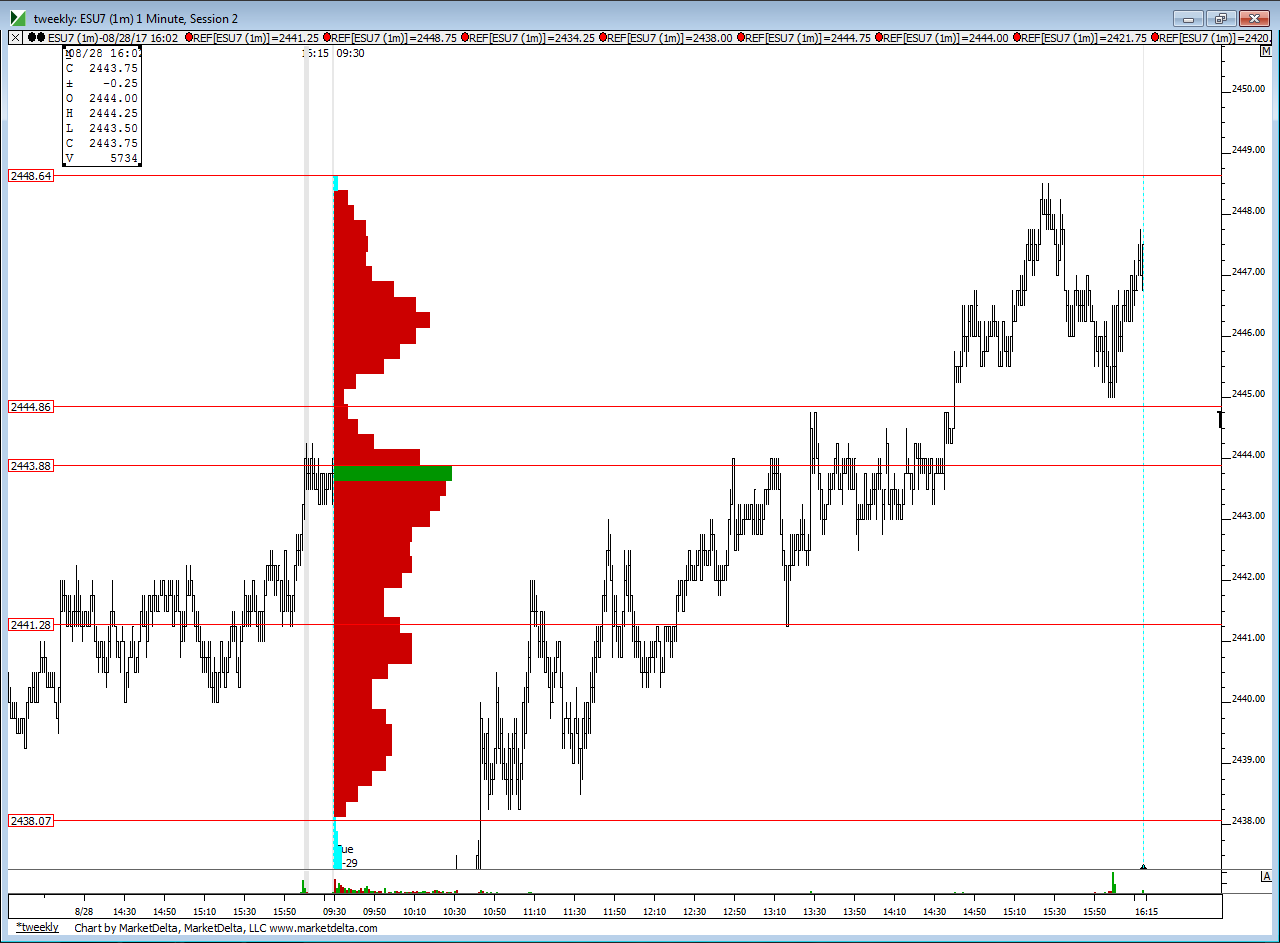

A primer, how I set up my areas and my final solution to my SD bands.....and why we need to watch 2444- 2445 today........I will be adding a second video

vid 2

with more ramble

a hard copy of the lines I feel are most important....especially that 44 area...that is critical today...I'd like to see that area fail and go down to daily pivot today

vid 2

with more ramble

a hard copy of the lines I feel are most important....especially that 44 area...that is critical today...I'd like to see that area fail and go down to daily pivot today

has Dalton ever said that a "poor " low has different odds then a "weak" low... or is it just a matter of definition?

Originally posted by Aladdin

Originally posted by BruceM

best for most to wait until after that 10 :30 report unless you had the longside from lower prices earlier and are holding runners...yes, aladdin ..yd has a poor high and now we have a poor low since it matches overnight...probably both will get cleaned up today

Bruce, current day low is a weak low.

Originally posted by BruceM

has Dalton ever said that a "poor " low has different odds then a "weak" low... or is it just a matter of definition?Originally posted by Aladdin

Originally posted by BruceM

best for most to wait until after that 10 :30 report unless you had the longside from lower prices earlier and are holding runners...yes, aladdin ..yd has a poor high and now we have a poor low since it matches overnight...probably both will get cleaned up today

Bruce, current day low is a weak low.

According to Dalton a poor low has no excess and has lower odds to hold than a weak low (which has excess).

Currently a poor day high (again).

If they can stay above 2449.50 and keep this double distribution they might be targeting 2454.25 (O/N high) and then 2458.25 (single print from 8/17)

If they can stay above 2449.50 and keep this double distribution they might be targeting 2454.25 (O/N high) and then 2458.25 (single print from 8/17)

this is interesting and implies lots.....if today's low holds then we might assume that 86 % of the time we will go 1/2 of a standard deviation up or down...but since we are moving up then we may see the 8 point move higher off of yesterdays 4 pm close...we are currently one time framing up too...I'm assuming they will get the overnight high and will work that area heavy....current target is still 49.50 ..

Click link to access uploaded file:

SCALPING part 2.pdf

SCALPING part 2.pdf

I wouldn't consider a plus 540 tick a high reading on a breakout....that happen at around 10:43.......we are in single print selling tail from last friday...I pointed that out in Mondays weekly chart but forget to mention it today.....we'll see....

a took a slight loser on this one too....I figured if those single prints held then I'd have to be ready to exit on any move higher...and in the back of my mind is the Overnight high or low probability, the floor trader number probability and we can now add in the 86 % of the time a 1/2 SD move will take place......so will need to work OT today and calls sold are losing so far...53 - 55 is my next zone to sell from

my goal is still that 49.50.....could be my downfall today but cash came within one point of 1/2 SD band....but we also need to give some room for difference in calculating the bands....so I usually just use zones anyway

my one minute profile is getting a bit top heavy...meaning that there seems to be a struggle to push up now......tricky day for me...

Current NQ day high is a weak day high because it is exactly at 8/17 day high as well as a poor day high because it has no excess.

pulled the plug one tic in front of that R1 retest...leaving two runners on and retest of 58.50 will stop these out.......would need a big sell off ( and be able to hold - which are both doubtful) to make this day positive......but at least I got one good trade today....LOL....went 1 for 5 ....selling now would be nice as my sold options could use a boost to take back some losses...will go for 52.75 on one runner and leave the other for who knows where ??? I don't know....

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.