ES Friday 8-25-17

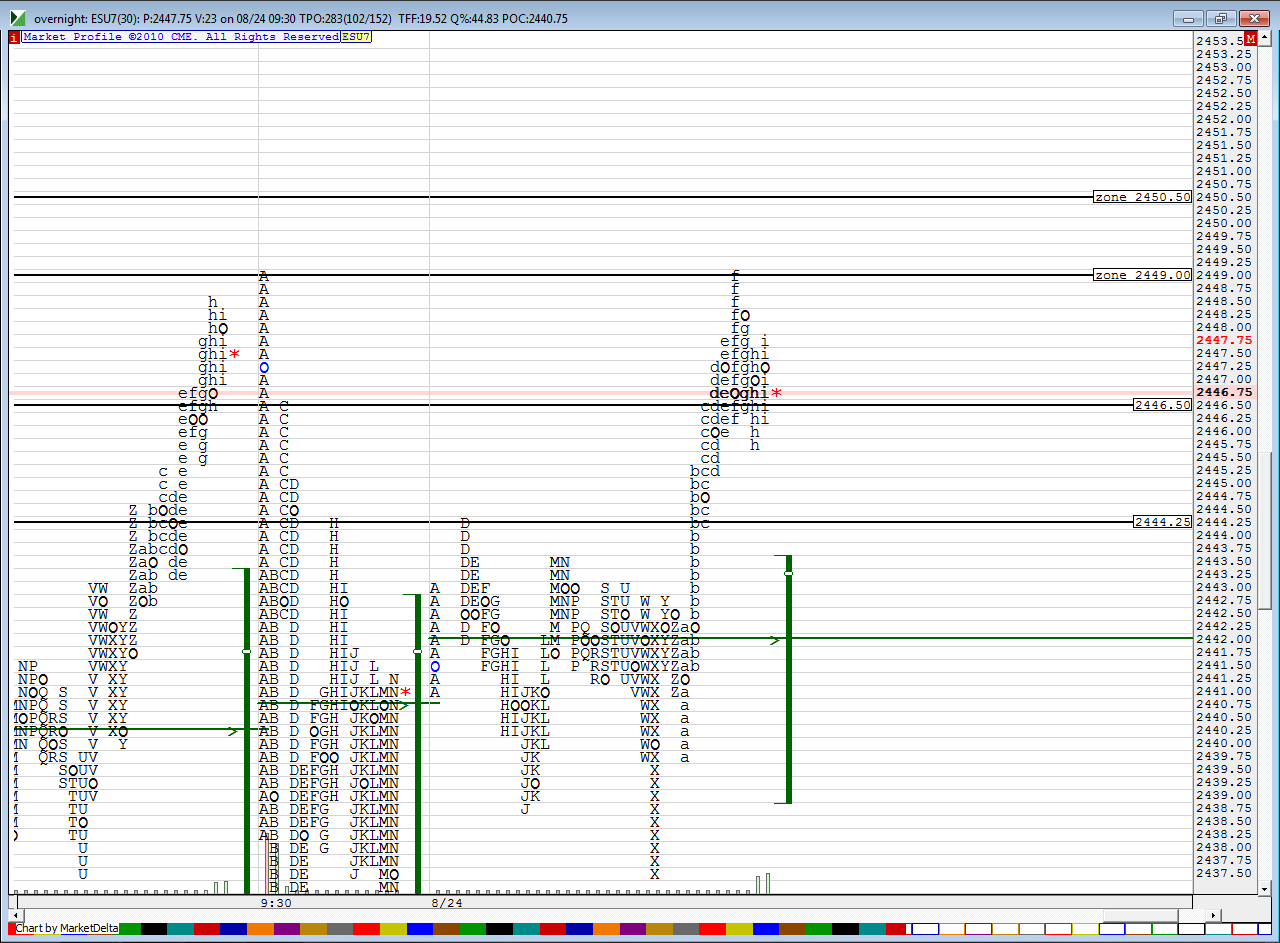

Watch 8 - 10 points up off of YD's cash close for a possible reaction...I rounded market maker move and expected move and mention those at the end of the video....then we have our standard lines......so selling 2448 and higher may be the way to fly but I would be using that 46.50 as a first target so you want to ideally be two points above that to initiate....

late today as I have children running through the room..LOL...here is how I see it

a quick hardcopy of my areas for those who have no time or desire to listen to my babble

late today as I have children running through the room..LOL...here is how I see it

a quick hardcopy of my areas for those who have no time or desire to listen to my babble

this 46.50 is a tuff one...I'm stalking shorts and really want that 44 area retest

if you failed at the 46.50 like I did then you would be trying from our upper zone as close to 50.50 as possible !

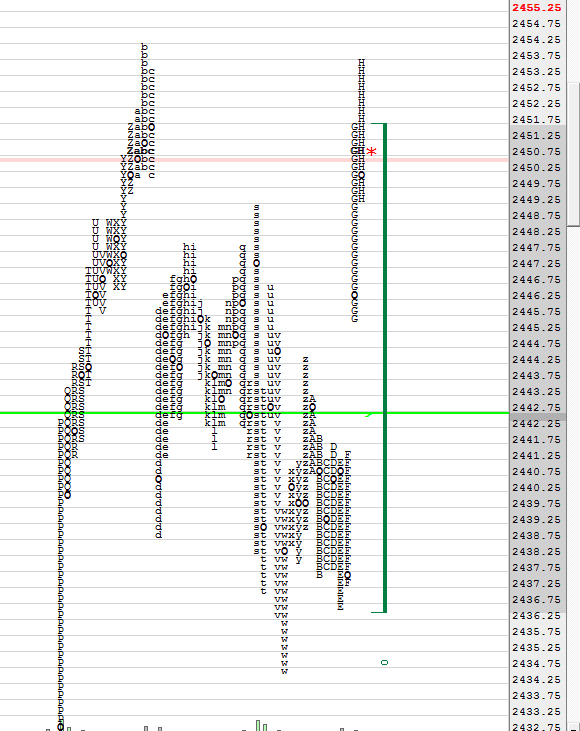

damn....I'm expecting this to pull back into weekly value......so I have two failures so far...and going off gap fill to try to get back to 48 - 49.50,,,gap fill was 53 ...I want this to get back under weekly value

u know my theories...they just aren't allowed to blow through areas....without at least attemtpting the retest...scaling heavy at 50.50...that is part of my upper zone and concern is that if buyers are gonna step back in then it might be from there

a quick look at the weekly and where the current weekly VA high is against todays trade

scaling once again at YD's highs...last runner goes for that 46.50 if lucky

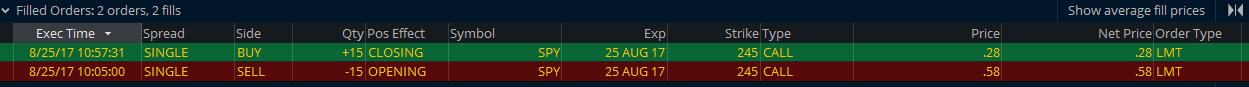

we crushed them today....we may get it wrong sometimes but in they end we will get them !!! Fired up on a friday and here was my options play beside my ES shorts....not boasting just wired up now......no more trades ...

and I'm also relieved because Tom P. came through for me.....here is what he wrote...I'm sure he won't mind me sharing it......so no more using the number in parenthesis for me...I trust Tom.....

"Hi Bruce. The Analyze tab uses the Vol index for the probability calculation. But the range on the Trade page is something that TD changed after I left there in 2010. I think it’s some proprietary formula they bought from another firm. I would use the Analyze tab, if only because the way the prob is calculated is more clear.

TP"

"Hi Bruce. The Analyze tab uses the Vol index for the probability calculation. But the range on the Trade page is something that TD changed after I left there in 2010. I think it’s some proprietary formula they bought from another firm. I would use the Analyze tab, if only because the way the prob is calculated is more clear.

TP"

look at the beautiful 44.25 test...without me but who cares...hopefully somebody else was still holding

Bruce, after seeing your minor snafu of missing an order earlier this week I was wondering if you ever use conditional orders in TOS? I have a few times but would like to get into using more so that I can set it and forget it like Ron Popeil did.

I am really trying to simplify things to get away from the computer and have 3,4 or 5 absolutely tweaked out trade types that I can teach to my wife and kids so that they can make a living in the event of my demise. Not trying to sound morbid but I would like to set up a legacy.

I am really trying to simplify things to get away from the computer and have 3,4 or 5 absolutely tweaked out trade types that I can teach to my wife and kids so that they can make a living in the event of my demise. Not trying to sound morbid but I would like to set up a legacy.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.