ES 8-21-17

EDIT : Last weeks VA low is 2436.25 and should have been included !!

Expectation is to have the market go 4 points above opening price SOMETIME this week ( could be in the first 5 minutes today) so we can sell ATM puts and just cover them when it happens and take what we can get. This is is because last weeks POC sits above the close of last week and the projected current opening for this week. I have 42 points as a one standard deviation move until fridays close . So a longer term trader will wait until we go at least 1/2 of a standard deviation up or down to look for trades off the weekly time frames. The rest would be noise to them.

Upside keys for me

46 - 49 - big low time zone

42.5

39.50

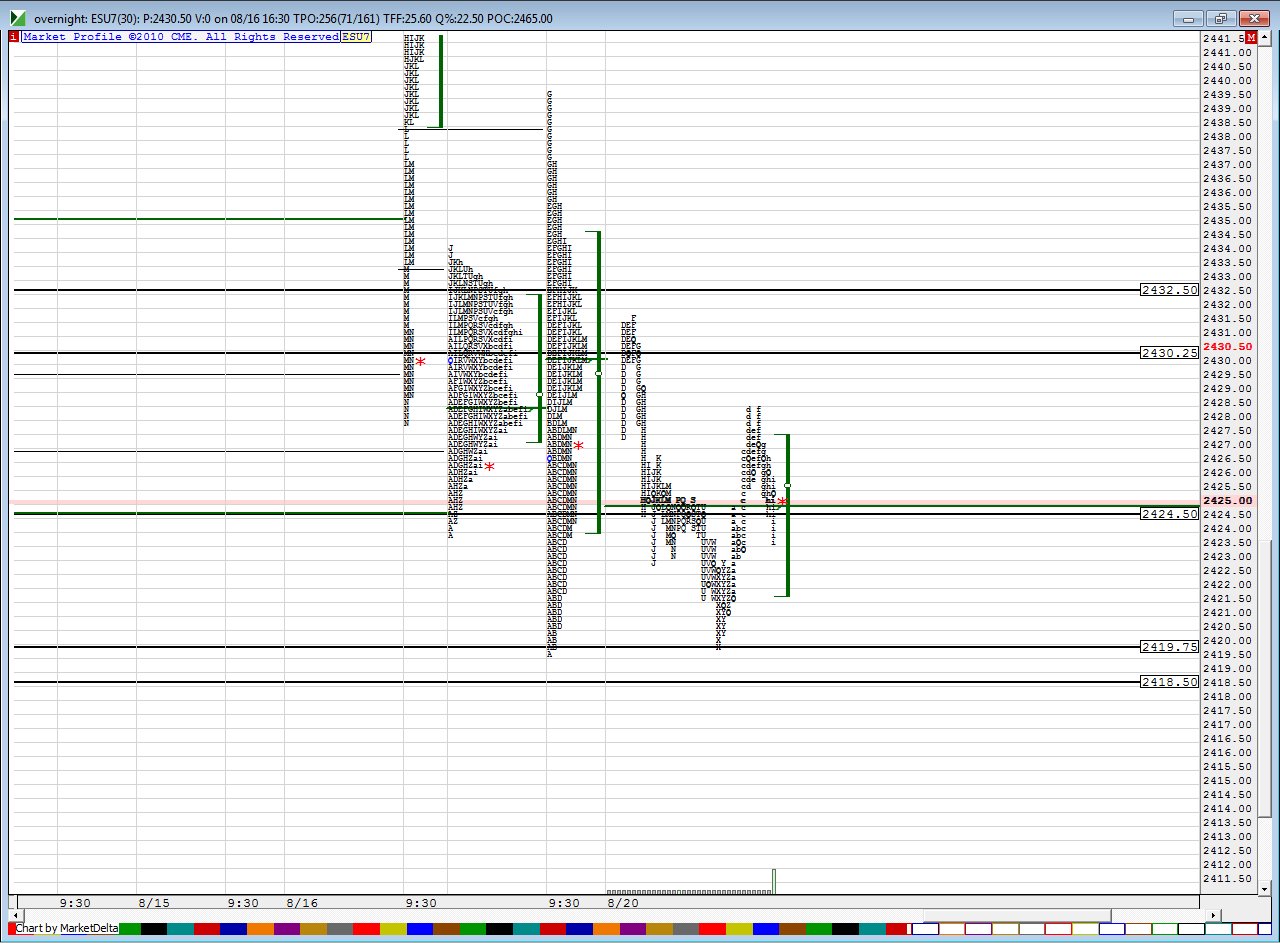

2430.25 - 32.75 ******Time, poc and Overnight high in here

then I am watching the swing at 23.75....Time spent back and forth here ...overnight POC and Fridays VA low

below I have

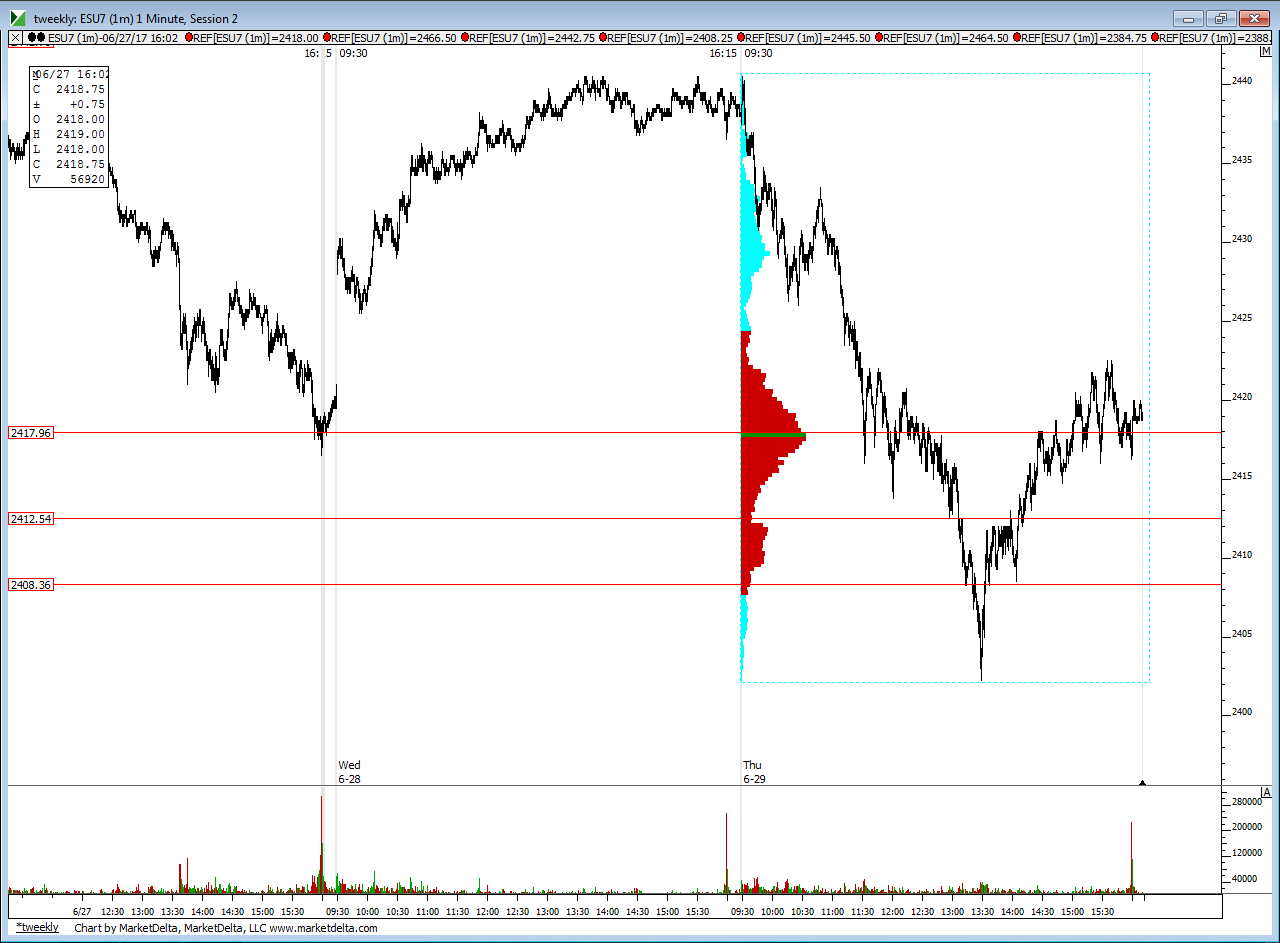

2418-2419.25 ---gotta watch last weeks lows and current overnight low...also see my favorite chart from June 29th for further downside

2412.50

2406.25 - 2408 - weekly S1 is here and almost 1/2 SD move would come in here

I favor upside trades this morning

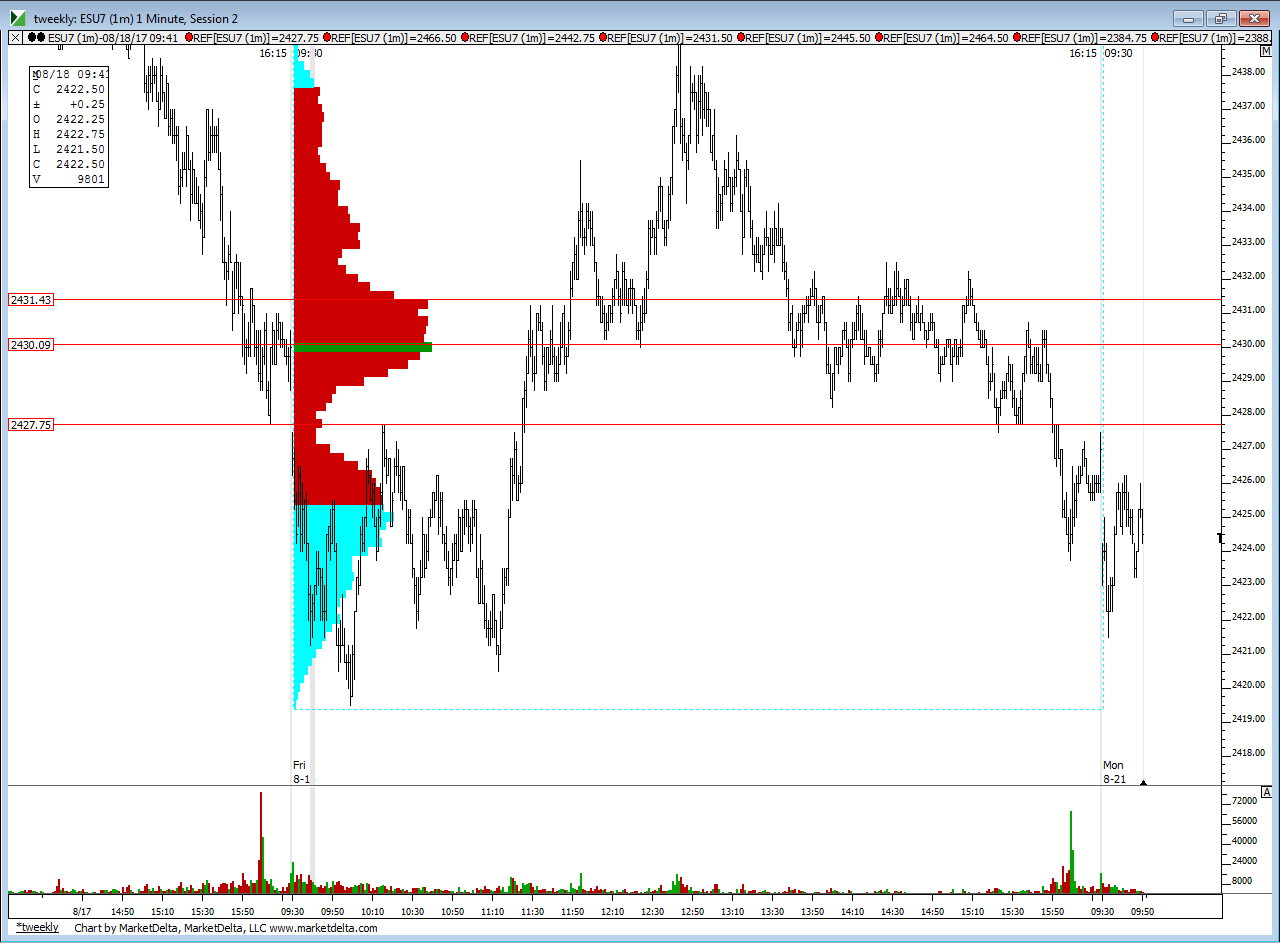

here is how I have set up my three key areas this morning....heavier black lines are the ones I snapped...hoping for a push down first today to look for buys....I think if the bigger selloff was coming then we would have seen follow through on Friday and not so much back and fill trading....odds seem to favor some reversion to upside.

Expectation is to have the market go 4 points above opening price SOMETIME this week ( could be in the first 5 minutes today) so we can sell ATM puts and just cover them when it happens and take what we can get. This is is because last weeks POC sits above the close of last week and the projected current opening for this week. I have 42 points as a one standard deviation move until fridays close . So a longer term trader will wait until we go at least 1/2 of a standard deviation up or down to look for trades off the weekly time frames. The rest would be noise to them.

Upside keys for me

46 - 49 - big low time zone

42.5

39.50

2430.25 - 32.75 ******Time, poc and Overnight high in here

then I am watching the swing at 23.75....Time spent back and forth here ...overnight POC and Fridays VA low

below I have

2418-2419.25 ---gotta watch last weeks lows and current overnight low...also see my favorite chart from June 29th for further downside

2412.50

2406.25 - 2408 - weekly S1 is here and almost 1/2 SD move would come in here

I favor upside trades this morning

here is how I have set up my three key areas this morning....heavier black lines are the ones I snapped...hoping for a push down first today to look for buys....I think if the bigger selloff was coming then we would have seen follow through on Friday and not so much back and fill trading....odds seem to favor some reversion to upside.

so I'm basically looking at that 2424.50 price as a magnet and the other areas are more like zones that I will watch to hold price back or get above/ below and hold to signal direction

so we can expect 2429 to print this week...I'm starting very small ES longs at 2421.75...no midpoint test yet.....we may need to add under the 2418 - 2419 zone

I actually used the Overnight VA low to initiate that trade.....but it was also 2.5 points down below the open......anyone remember the pitbull window ? 2.5 points then 4 points then 5.5 points......I was hoping lower window would have come into play to reach the overnight lows.......I came all out at midpoint and don't have anything to hold because I went in small to start and never added

puts were sold at 1.30 on the spy this weeks expiry and a strike of 242.5

how my favorite chart looks from just Fridays trade...I'm posting it because it draws my attention to an area that may end up being important...that 2427.75.....that is real close to Fridays close and is a low time spot...look at Thursdays low and how they kept pushing through there without many battles ( two sided trade) going on there...you will notice there are very few one minute bars that cluster at that price...they just blew through it each time...so this is an area that my other analysis missed and I am adding it into the mix today !

the only other trade I will try today will be the long side if we come out of the overnight low and last weeks low....otherwise this will be it for me......and i will be selective on longs.

if u r on the long I would think about getting out slightly in front of half back on the day !!

I have a limit order to buy back puts at 1.05...ES should be plus 4 above open if/ when that happens today or we will have to wait for time decay

options just got filled....cool !! you are looking at just the spy trades ..ignore spx as I put those on to balance out some deltas that I sold last Friday....so my spx trade I turned into an iron condor...but today was just the spy you should be looking at

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.