ES Thursday 8-17-17

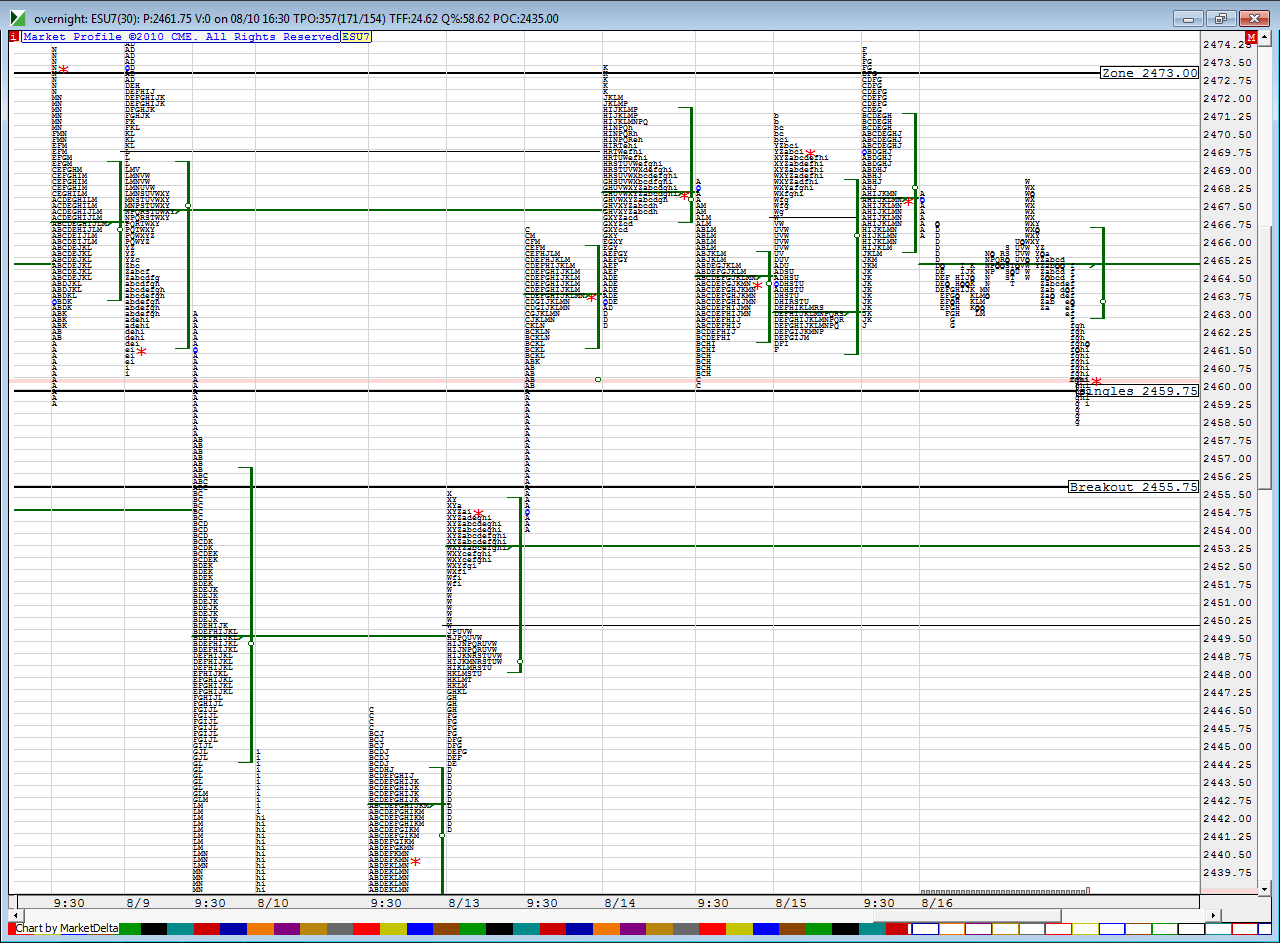

key area will be 59 - 60 and then 65- 66 on upside...further below will be breakout point of 55.75 and weekly low near 53.75...so that is a zone....I plan on covering calls sold on open as time has eaten away at the price and hoping to have a profit on those. I do not plan to wait until or if we trade 4 points below the weekly open

here are the lines....yesterdays low time, va low and overnight POC is at the 65 area

here are the lines....yesterdays low time, va low and overnight POC is at the 65 area

if you count Tuesdays dip, todays print and the overnight of last night that would be 3 tests of the single prints near that 2459.....if we dip down there again I would be very careful on the Long side....there are only so many times you can take small stabs with a pin at a balloon before it pops.....so another stab down there and i would expect that to breakdown to test down into the 53 - 56 zone and then eventually at some time soon down to 2449 - 2450

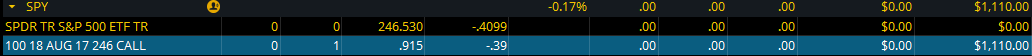

I'm posting this to show how misleading some things can be in TOS,,,this shows I had a daily profit of $1110 but the reality is that I ended yesterday with this trade being down over $700 so this trade made $360 profit .....so today it made up the $700 loss and went $360 positive so it shows how much the price really changed from one day to the next and not my net profit.......bottom line is you need to keep good records no matter what software you use

FWIW...our weekly probability played out and I am just pointing this out.....I mentioned that when we open above a weekly POC that we should trade back towards the poc of the prior week or at least trade 4 points below the open print of the week.......Today we hit 2450.25 which is 4 points below the open but here is the difficult part.....I sold calls soon after Mondays open and look what happened....we shot straight up and at one time I noticed my trade was down by $1300 on 20 contracts....I was also taking other option trades to hedge this but the draw down was very big and I want to point out the pitfalls of this type of trade.......granted I made $360 on the trade and it would have been much more if I was able to hold for that drop to 2450.25 but I wanted to just get out........it always comes down to how much pain are you willing to take on.....

on the plus side we can use the concept as a filter...so this week we could have been taking only short ES trades until we went 4 points under the open of the week...so there are many uses for the concept....I throw this crap out there so YOU ( with the sharp minds that read this banter) can come up with creative ways to make money. Hopefully some of it makes sense and these writings aren't just "words" on a website

on the plus side we can use the concept as a filter...so this week we could have been taking only short ES trades until we went 4 points under the open of the week...so there are many uses for the concept....I throw this crap out there so YOU ( with the sharp minds that read this banter) can come up with creative ways to make money. Hopefully some of it makes sense and these writings aren't just "words" on a website

Well my lower low showed up for the week. WOW. Bruce I think I will incorporate this 4 points below the open print as a target in the future. I believe you also noted this to the long side?

Thanks

Thanks

Originally posted by BruceM

FWIW...our weekly probability played out and I am just pointing this out.....I mentioned that when we open above a weekly POC that we should trade back towards the poc of the prior week or at least trade 4 points below the open print of the week.......Today we hit 2450.25 which is 4 points below the open but here is the difficult part.....I sold calls soon after Mondays open and look what happened....we shot straight up and at one time I noticed my trade was down by $1300 on 20 contracts....I was also taking other option trades to hedge this but the draw down was very big and I want to point out the pitfalls of this type of trade.......granted I made $360 on the trade and it would have been much more if I was able to hold for that drop to 2450.25 but I wanted to just get out........it always comes down to how much pain are you willing to take on.....

on the plus side we can use the concept as a filter...so this week we could have been taking only short ES trades until we went 4 points under the open of the week...so there are many uses for the concept....I throw this crap out there so YOU ( with the sharp minds that read this banter) can come up with creative ways to make money. Hopefully some of it makes sense and these writings aren't just "words" on a website

that's correct mike ...it all depends on which side of the prior weeks POC we open on.......so the simple theory is they will make some attempt off the weekly open to go try and move in the direction of the prior weeks POC........sometimes the attempt is only a feeble attempt like 4 - 5 points but that is enough to make money.......

I traded the two step today and had a $90 credit but messed up and went 5 pts wide in spx instead of 10...anyway I took profits when they were trading at $45.......I was actually hoping to have the trade go against me so I could practice with the butterfly adjustment he suggests but deep down I'm real happy the profits came quick......does he ever mention using a profit target ? Perhaps the two step should be in it's own thread....I was using 30 points as a one SD move...what did u use to calculate your one sd move ? I just used what was posted by TOS at last nights close

I traded the two step today and had a $90 credit but messed up and went 5 pts wide in spx instead of 10...anyway I took profits when they were trading at $45.......I was actually hoping to have the trade go against me so I could practice with the butterfly adjustment he suggests but deep down I'm real happy the profits came quick......does he ever mention using a profit target ? Perhaps the two step should be in it's own thread....I was using 30 points as a one SD move...what did u use to calculate your one sd move ? I just used what was posted by TOS at last nights close

Originally posted by Big Mike

Well my lower low showed up for the week. WOW. Bruce I think I will incorporate this 4 points below the open print as a target in the future. I believe you also noted this to the long side?

ThanksOriginally posted by BruceM

FWIW...our weekly probability played out and I am just pointing this out.....I mentioned that when we open above a weekly POC that we should trade back towards the poc of the prior week or at least trade 4 points below the open print of the week.......Today we hit 2450.25 which is 4 points below the open but here is the difficult part.....I sold calls soon after Mondays open and look what happened....we shot straight up and at one time I noticed my trade was down by $1300 on 20 contracts....I was also taking other option trades to hedge this but the draw down was very big and I want to point out the pitfalls of this type of trade.......granted I made $360 on the trade and it would have been much more if I was able to hold for that drop to 2450.25 but I wanted to just get out........it always comes down to how much pain are you willing to take on.....

on the plus side we can use the concept as a filter...so this week we could have been taking only short ES trades until we went 4 points under the open of the week...so there are many uses for the concept....I throw this crap out there so YOU ( with the sharp minds that read this banter) can come up with creative ways to make money. Hopefully some of it makes sense and these writings aren't just "words" on a website

The spx closed almost exactly at the 40 point expected move for the week....it will be interesting to see what happens tomorrow but for me it will be after the fact as I am taking a day off

For the Bittman I used today's SPX open and yesterday's VIX closing price. My levesl were + 1/4 SD=2475; +1/2 SD= 2487; -1/4SD = 2451 and -1/2 SD = 2439. I use the formula Bittman provided.

I had a similar trade as you from like 95 cents credit down to 20 cents, almost identical to last week.

I do not make any adjustments, I take them off if it comes back to +1/4 SD . No Bittman targets are provided, he let's them expire or hit 1/4 SD against him. Sometimes those are actually profitable given the theta decay. I take them off early if they run like this and last Thursday did. I try not to be greedy.

The better trades IMO (although I take them all) is when SPX runs up first and you sell puts. Puts are a little richer usually and when price runs up vol contracts and you get even more favorable pricing to buy them back,

[/quote]

I had a similar trade as you from like 95 cents credit down to 20 cents, almost identical to last week.

I do not make any adjustments, I take them off if it comes back to +1/4 SD . No Bittman targets are provided, he let's them expire or hit 1/4 SD against him. Sometimes those are actually profitable given the theta decay. I take them off early if they run like this and last Thursday did. I try not to be greedy.

The better trades IMO (although I take them all) is when SPX runs up first and you sell puts. Puts are a little richer usually and when price runs up vol contracts and you get even more favorable pricing to buy them back,

Originally posted by BruceM

...

I traded the two step today and had a $90 credit but messed up and went 5 pts wide in spx instead of 10...anyway I took profits when they were trading at $45.......I was actually hoping to have the trade go against me so I could practice with the butterfly adjustment he suggests but deep down I'm real happy the profits came quick......does he ever mention using a profit target ? Perhaps the two step should be in it's own thread....I was using 30 points as a one SD move...what did u use to calculate your one sd move ? I just used what was posted by TOS at last nights close

[/quote]

Additionally what I like about the 2 step is that it makes sense to me. If price runs one way it will likely not reverse quickly and severely enough to clip you.Now we probs and price action to lean on.

This is enhanced from just seeing an expected move on a Sunday and thinking it is somehow going to hold true. In other words those expectations are based on a momentary snapshot of the option prices. Once the moment is gone, so is their validity as markets move. To my way of thinking it is what limits my probability based option trades.

I have a friend who used to post here sparingly that is all in on TOS and Tastytrade but wins small and loses big with naked positions, earnings trades and no stop ES trading. We definitely have gone in different trading style directions.

This is enhanced from just seeing an expected move on a Sunday and thinking it is somehow going to hold true. In other words those expectations are based on a momentary snapshot of the option prices. Once the moment is gone, so is their validity as markets move. To my way of thinking it is what limits my probability based option trades.

I have a friend who used to post here sparingly that is all in on TOS and Tastytrade but wins small and loses big with naked positions, earnings trades and no stop ES trading. We definitely have gone in different trading style directions.

Same here, done for the week.

Originally posted by BruceM

The spx closed almost exactly at the 40 point expected move for the week....it will be interesting to see what happens tomorrow but for me it will be after the fact as I am taking a day off

I believe the discrepancy is that the TOS numbers you are using are calculated using the Implied Volatilty for that particular option chain and is different than the VIX price.

[/quote]

Originally posted by BruceM

this is interesting because the TOS expected move for one week was 30 points starting today so I had 7.5 points as 1/4 SD and used the closing price of yesterday...so I sold my calls when spx hit 2460.5 which happened in the first 5 minutes...this is a full 10 points before the Bittman opening refinement........I'm not saying one is better or worse but it will be interesting to follow as we go forwardOriginally posted by Big Mike

For the Bittman I used today's SPX open and yesterday's VIX closing price. My levesl were + 1/4 SD=2475; +1/2 SD= 2487; -1/4SD = 2451 and -1/2 SD = 2439. I use the formula Bittman provided.

I had a similar trade as you from like 95 cents credit down to 20 cents, almost identical to last week.

I do not make any adjustments, I take them off if it comes back to +1/4 SD . No Bittman targets are provided, he let's them expire or hit 1/4 SD against him. Sometimes those are actually profitable given the theta decay. I take them off early if they run like this and last Thursday did. I try not to be greedy.

The better trades IMO (although I take them all) is when SPX runs up first and you sell puts. Puts are a little richer usually and when price runs up vol contracts and you get even more favorable pricing to buy them back,Originally posted by BruceM

...

I traded the two step today and had a $90 credit but messed up and went 5 pts wide in spx instead of 10...anyway I took profits when they were trading at $45.......I was actually hoping to have the trade go against me so I could practice with the butterfly adjustment he suggests but deep down I'm real happy the profits came quick......does he ever mention using a profit target ? Perhaps the two step should be in it's own thread....I was using 30 points as a one SD move...what did u use to calculate your one sd move ? I just used what was posted by TOS at last nights close

[/quote]

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.