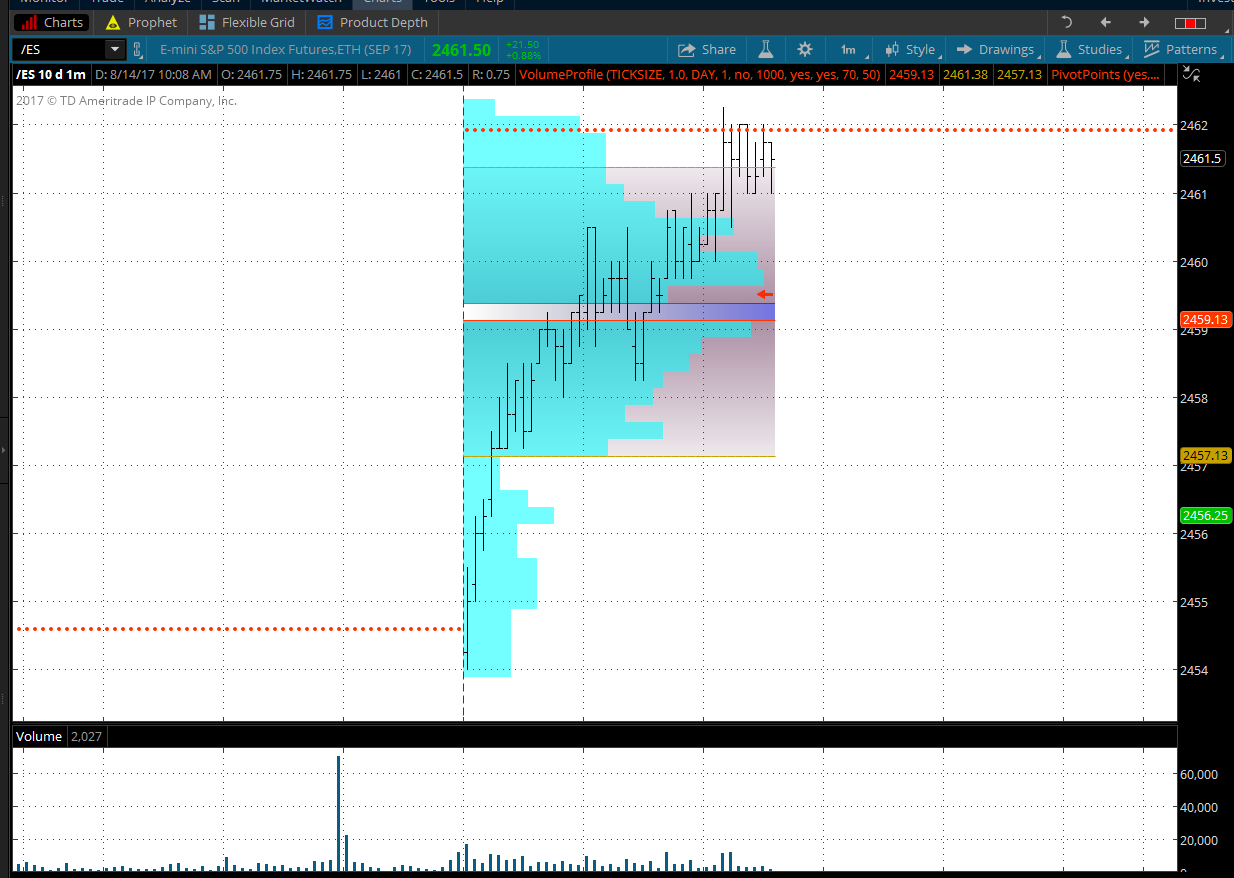

ES Monday 8-14-17

Why I am short sided and all the levels I'm watching ...key upside range is basically 56 - 59 and we should be using 50 - 51 as a magnet price today...selling calls on the open today

trades above the 55 into the 56 - 59 zone should ideally use 53.50 as a first target just to be safe and here is why.....it is basically that pullback high from last thursday

trades above the 55 into the 56 - 59 zone should ideally use 53.50 as a first target just to be safe and here is why.....it is basically that pullback high from last thursday

I'm starting short campaign at 54.50 but I have a bigger plan in RTH if we push into the 56 - 59...setting a first target at 51.75....if I add in above then 53.50 will be first target

starting RTh shorts at58 even....so far biggest one minute bar is open bar but no doubt this is high risk...watch for retest of OR high

I get nervous if we start holding up inside 59.25

well, this certainly is no fun and I need them to reject that 59.25 and not hold above

keeping in mind that they will get a floor number and that will either be the 2462 or the 2451......so I have an itchy exit finger up here...I don't want a 4 point loss from RTh entry at 58...I'd rather take the loss and try again at 62

starting new shorts at 61 and took loser on RTH shorts and that Overnight....calls sold are losing too so far...first target on shorts will be 59 to try and make up some of the loss from the 58 short...I never think much of my overnight loss as it is always small...so I concentrate on what went wrong in day session campaigns and try to make good on those failures...I will be adding at 62 if / when it prints

here is R3 and midpoint of last week....buyers will try to push for 67 if they can and us shorts want 59 - 59.50 as a retest point first...still no new one minute volume but that certainly isn't perfect

how it looks in my world and believe me it isn't fun today...gap and goes never are....here is gap right near current vpoc/poc

did anyone have issues with standard deviations...? I have 22 points and we just hit into that....spx cash is also hitting it's R3 .......I saw a recap of Kaufman and he had 41 points as a one sd band...is my think or swim off....did anyone calculate SD bands......is anyone out there ...? LOL

When shorting VIX I use XIV, inverse ETF.

I don't buy XIV often, only when VIX closes>20 and the VIX structure remains in contango.

Since XIV started at the end of 2010, my son and I have made 18 trades. 11W and 7 losses. Great part is the winners go for 50% and the losers re cut at 10%.

Huge positive expectancy.

I don't buy XIV often, only when VIX closes>20 and the VIX structure remains in contango.

Since XIV started at the end of 2010, my son and I have made 18 trades. 11W and 7 losses. Great part is the winners go for 50% and the losers re cut at 10%.

Huge positive expectancy.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.