ES 6-13-17

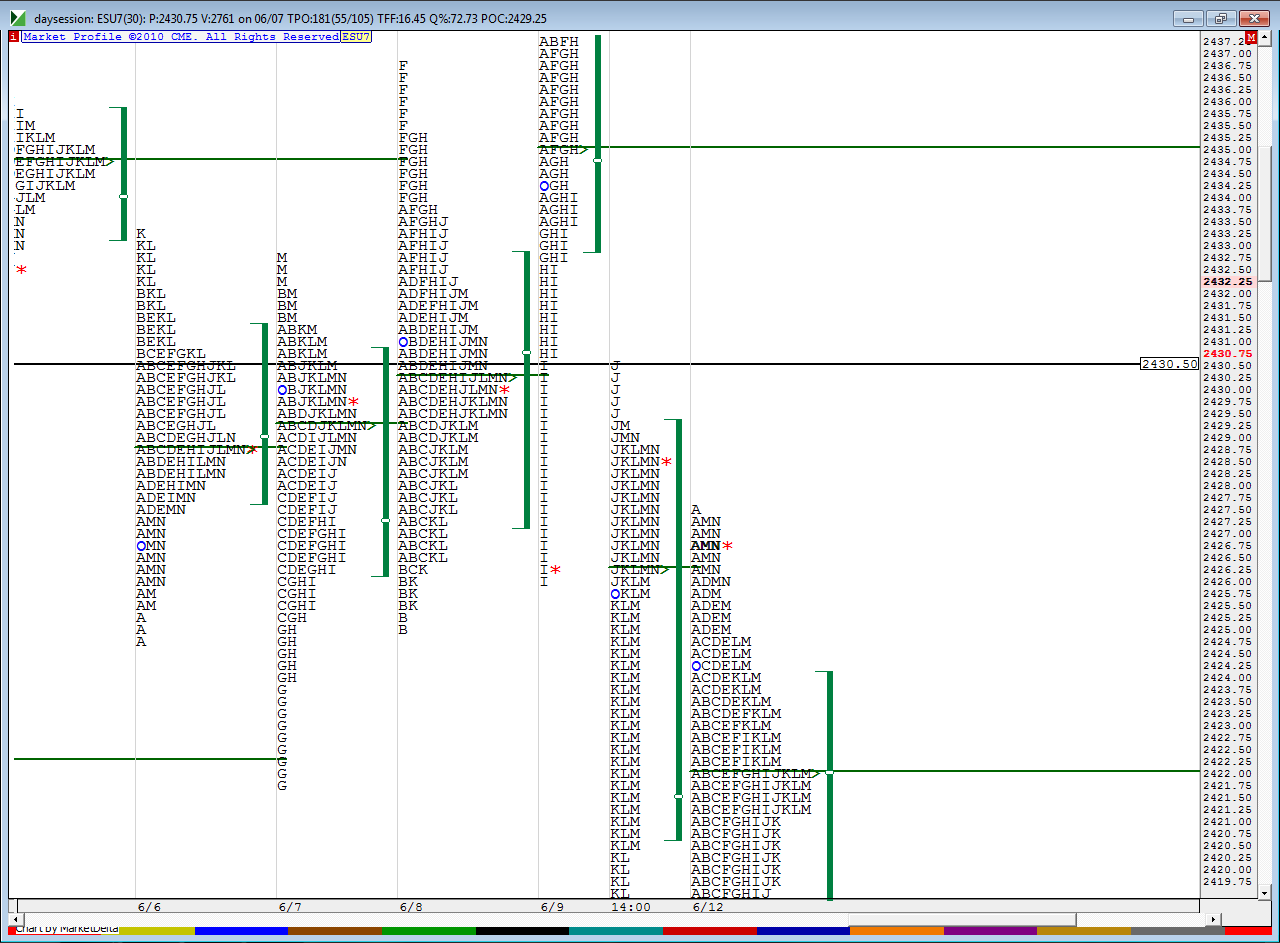

OK...end of video was trying to say that current overnight high has stopped one Point shy of R2 today at least so far....my bias is to downside as I do not think they are going to run up to the weekly R1 before printing the weekly pivot at 2428, overnight inventory is long .....and the thin area of fridays profile runs from 2429.50 - 2432.50 but the key are to me is really going to be the number at 30.75........that is key test point from up here and will look to shorts at the 32 - 34 edge now in overnight...going to add to this post and make an additional video as I am unsure if my thoughts came across

here is part two...redundant at times but want to drive home a few things and I can't always convey what runs through my simple mind

I split out the "I" and "j" period from Fridays chart to show the two separate distributions or at least the key part that fits on my screen and snapped a line at the 30.50

here is part two...redundant at times but want to drive home a few things and I can't always convey what runs through my simple mind

I split out the "I" and "j" period from Fridays chart to show the two separate distributions or at least the key part that fits on my screen and snapped a line at the 30.50

i added a second video to the above to try and clarify a few things

selling breaks above the On highs

add point will come at 35.75 if it prints but not sooner...we are 1/2 sd up for weekly options expiration...

interesting how Ym came out of fridays highs but ES is 8 points or more away from fridays highs so a big divergence up here

Hey Bruce I came in a bit late, but I am short at 2435.50 and holding 2433.50 and 2431.50 tentavely

First off at 33.50, holding for 2nd position

nice trade avid !!

what I was looking at and the reason for my add on//////also a concern about current highs

ym really needs to get back under mondays highs...my next target is 31.75 if they can roll this over

a great example today so far in hindsight as to why gaps in the data alone are high risk trades....u really need context....on closer examination I see gaps now at 33.75 , 37 even and way down at 30.75........this low volume may be playing tricks and giving us more gaps then we can handle , therefore it is so important to have some context or some other reason besides JUST a gap to take a position.......

ok, my conscience is clear now that I said that !!!

ok, my conscience is clear now that I said that !!!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.