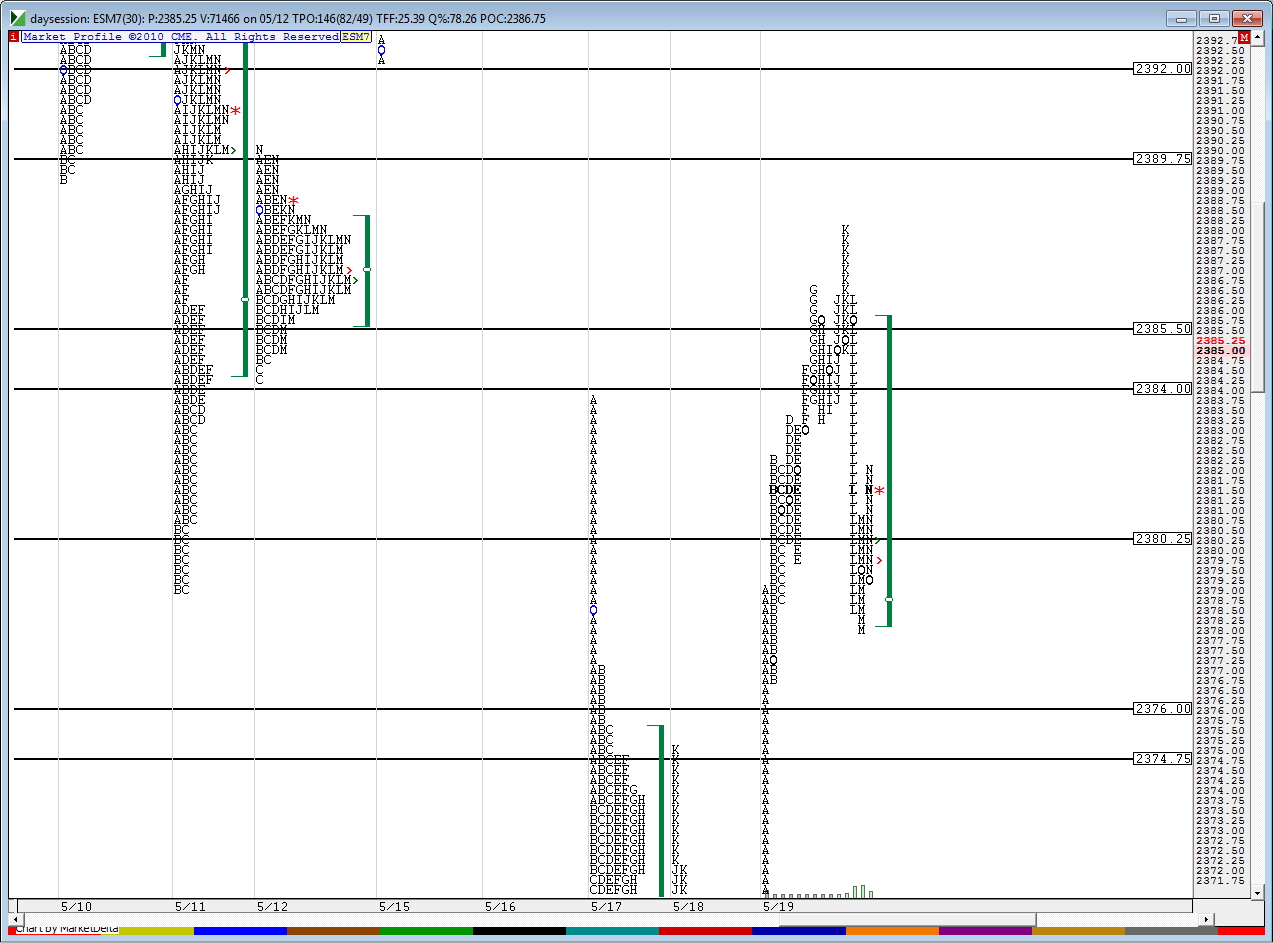

ES 5-22-19

In the process of making a second video.....options are only pricing in a 7.5 pt move as one standard deviation this morning....here are basic areas so far and my plan...starting small shorts in overnight at 84 even....looking to get back to 80 - 82 zone

some repetition but the bottom line for me is I will not be long this market early on if the midpoint of the overnight hasn't been tested. ....the best short areas to sell frm will be the 84 - 85 and then the 89.75 - 91 area...and watch the 74 - 75 on the downside if / when we retest that

here is hard copy...not much to say on weekly so didn't expand...remember options have 2388 area as a one SD move today so that adds some confluence to that zone up there

some repetition but the bottom line for me is I will not be long this market early on if the midpoint of the overnight hasn't been tested. ....the best short areas to sell frm will be the 84 - 85 and then the 89.75 - 91 area...and watch the 74 - 75 on the downside if / when we retest that

here is hard copy...not much to say on weekly so didn't expand...remember options have 2388 area as a one SD move today so that adds some confluence to that zone up there

took loss on overnight trade at OR high starting RTH shorts at 88 print....with plan to add at 89.75..targeting 84.75

revising target to 85

they don't usually open and drive two days in a row....a concept I mentioned last week...so lets see what that have here and if they can open and drive and miss On midpoint two days in a row....I'm not planning on that and I expect option sellers to step in soon and sell futures back down...but we may need to run to R1 first

no proper test of fridays highs at 88 yet..so trying to layer in above 90 and then use that 88 as a first target now....heavier I get then the quicker I am to take something off and the sooner I will take something off...amazing how often initial entry becomes a target when I add on to trades

I have 87.25 and 90 with gaps in the data...gheesh.....my least favorite probabilities

$ticks on downtrend so far today which is good for our shorts

in theory with a close of 2381.50 and a 7.5 one sd move then those who sold the 2390 Es calls will try to defend by selling futures up here.........in theory at least...but so far us sellers are losing...last add in point for me is 2392...

upper gap in data filled...now how about they go get that 87.25 !!

how I am seeing it and some conflict with that poor high

scaling heavy at 88 test

scaling heavy at 88 test

even though we have that poor high my runners are trying to be greedy...no overnight inventory adjustment, no midpoint test and that gap is still at 2387.25...and also no official test of that 2385 from my one minute chart of friday.....I'd be more confident with runners on short side if this period didn't have a matching high so far on this 30 minute bar

I'm abandoning my plan to get short if/ when all these tops get broken.....for two reasons 1) it's too late in the day and 2 ) we had a selloff friday afternoon so I don't look for many things to repeat in the market....so expecting another selloff this late would go against probabilities for me....My calls sold are under water and will evaluate them tomorrow

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.