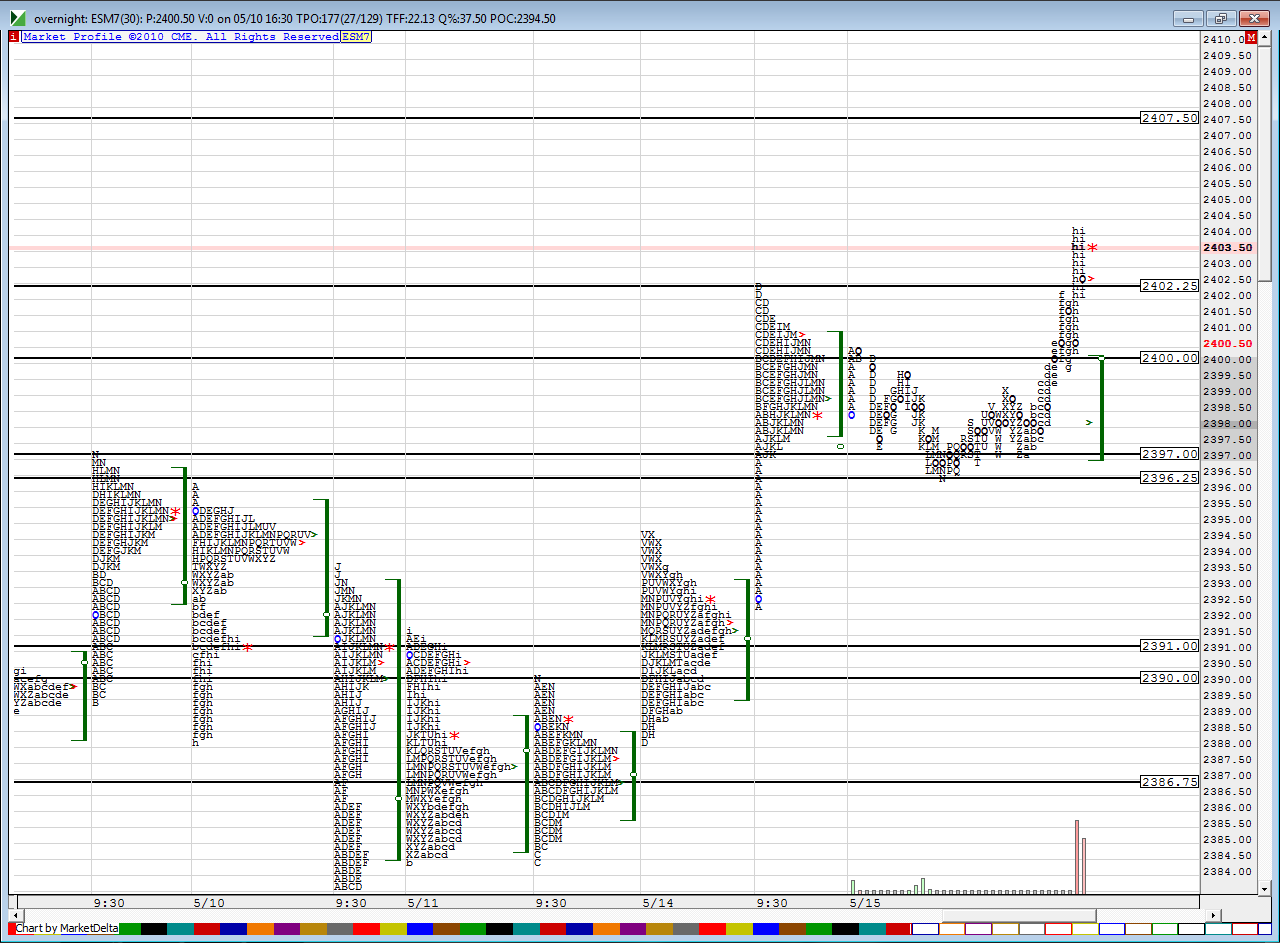

ES 5-16-17

Starting small shorts in overnight above YD's highs at 2403 with target of 2400.25...making a video while I monitor so will edit this post

edit: added Video

key things ...no overnight midpoint yesterday, gap and go so I don't expect to gap and go AND have price stay up high today...In other words, they may give the illusion of a gap and go but I don't think the buyers will be able to maintain the buying if that happens. Oftn they will make it look like things are a repeat of yesterday to suck in long players and then roll it back down...

edit: added Video

key things ...no overnight midpoint yesterday, gap and go so I don't expect to gap and go AND have price stay up high today...In other words, they may give the illusion of a gap and go but I don't think the buyers will be able to maintain the buying if that happens. Oftn they will make it look like things are a repeat of yesterday to suck in long players and then roll it back down...

I'm hoping the first push is up today to layer into shorts.....my focus today is on the overnight midpoint as an ideal target but if we need to add ( assuming they push up on the open) then will scale at the high of yesterday as a first target ..

hard copy of key areas for me today

hard copy of key areas for me today

Originally posted by BruceM

Starting small shorts in overnight above YD's highs at 2403 with target of 2400.25...making a video while I monitor so will edit this post

edit: added Video

key things ...no overnight midpoint yesterday, gap and go so I don't expect to gap and go AND have price stay up high today...In other words, they may give the illusion of a gap and go but I don't think the buyers will be able to maintain the buying if that happens. Oftn they will make it look like things are a repeat of yesterday to suck in long players and then roll it back down...

thanks

I see that gap and thanks a lot for explaining.

here is how my option trade did from yesterday..closed it on weekly poc retest a few minute ago...I made a mistake on these in that I put them in as a credit spread instead of naked....still a good trade but would have been a great trade if I didn't buy the protection....I messed it up because mentally I was planning to sell put options on a drop down yesterday so in my mind I was going to use protection on that trade because vix is low and didn't want to get crushed if we had a melt down....anyway for some reason I put this call trade on with as a credit spread...... still made a decent profit but hope can see how we retested the poc of weekly after blowing through it..

some quick comments about well defined bells and poc retests......and a subtle area that seems suspicious to me but not an official gap in the data

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.