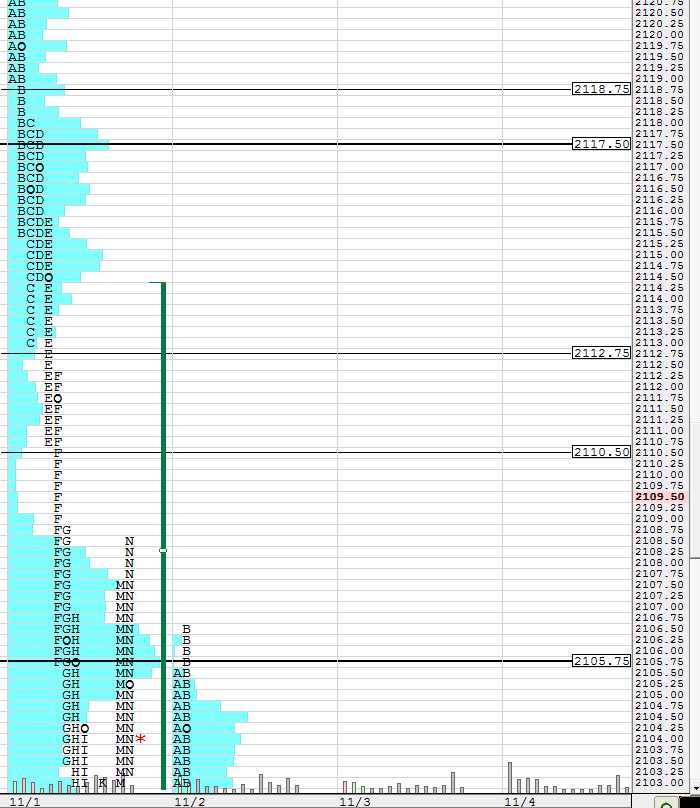

ES Monday 11-7-16

I'm trading up here with the 08.50 retest in mind...so sells from above there...we have a very thin area from November 1st that runs from 08.50 - 12.75...here is a pick from Nov 1st.....the va high from Nov 1 is 14.25 and R3 is 14.75......so good confluence...we also have single prints at 18.75 and high time at 17.50 so that is other area of confluence......so I will be looking at three different areas to short today and those are

2110.50

2112.75 - 2114.75 zone and then 2117.75 - 2118.50 zone

I will be watching where ad line opens in RTH with the assumption that we open up and EVENTUALLY come back to trade to plus 500 on the line...I am assuming adline will open strong

bottom line is to watch the profile from November 1st today closely for clues. We know they will tag the R3 or drop it way back to the R2 down at the 2099.50..I wouldn't be fooled into getting overly long today....this may turn out to all be news and election once again....I'll be covering puts sold on the open today

here is the key parts to Nov 1st

2110.50

2112.75 - 2114.75 zone and then 2117.75 - 2118.50 zone

I will be watching where ad line opens in RTH with the assumption that we open up and EVENTUALLY come back to trade to plus 500 on the line...I am assuming adline will open strong

bottom line is to watch the profile from November 1st today closely for clues. We know they will tag the R3 or drop it way back to the R2 down at the 2099.50..I wouldn't be fooled into getting overly long today....this may turn out to all be news and election once again....I'll be covering puts sold on the open today

here is the key parts to Nov 1st

right at our 2110 line and adline at 1900...strong but we will see some roll over on that .and Adline has r2 1595 so I expect to see that print in early trade..the question is really from which line will it come....doesn't mean we will have a selloff all day either...small pieces

ad line stopped going up into the ES 12.75- 14.75 zone number so we may have a chance at another good short up here even though the 08.50 test came already...they may need to fill in the low time prices between 08.50 and 12.75

i'm watching 10.50 - 11 closely on this one..OR high is here and key 10.50 number is there too.....won't be a pig on core

2112.50 has all the volume and is most important number to watch now...I'm thinking they may still need to take another push above VA high from 11-01

Ticks and ad line not in step with the new highs in ES......so I think we can expect them to retest the 12.50 line at least.....floor number is close by as this divergence unfolds

if trading this trend day up...I think now it would be best to wait and see at least one minus 500 $tick and then expect a retest of 2119.50

this is to get a short put on...I'm trying a lunchtime sell from 22.75 since I saw a minus 499 $tick and ad line is still going nowhere...

Originally posted by BruceM

if trading this trend day up...I think now it would be best to wait and see at least one minus 500 $tick and then expect a retest of 2119.50

I'm using the 2123.50 from 10-31 trade even though 11- 1 blew right through that well defined POC....this will decide if this fade idea will work up here....if not then the obvious swinghighs at the 27 - 28 area would be the bulls next target

ad line still making lower lows and lower highs and has yet to tag an R3 or an r2 level...perhaps today will be the abnormal day..3 sets of single prints on todays ES chart...I'm selling calls up here..the 216 calls on spy with 9 days to expiry...70 % chance of expiring worthlsess

I think you have a good trade their Bruce selling calls up here...

Sharks

Sharks

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.