ES Thursday 8-18-16

I had somebody run some probabilities for me and based on my input he calculated that there is only a 2% chance that we don't hit EITHER an overnight midpoint or an overnight high or low on ANY day ...so those are damn good odds that any day will hit one of those 98 % of the time. From Wednesdays trade I think 75 - 76.50 and 71 are the lines to watch. We know we still have our old friend the 83 to watch on the upside too. Good luck. I like the work we are all putting into the OR trades. Very cool !

Let me add an official request to see if at some point somebody can backtest how often we hit a plus or minus 4 ? I assume it would be a huge percent of the time and the better question would be " how often do we hit it in the first 90 minutes of trade?" This is adding on to Big Mikes work he posted in Wednesdays thread. Gheesh...this may make me into a break out trader.

Let me add an official request to see if at some point somebody can backtest how often we hit a plus or minus 4 ? I assume it would be a huge percent of the time and the better question would be " how often do we hit it in the first 90 minutes of trade?" This is adding on to Big Mikes work he posted in Wednesdays thread. Gheesh...this may make me into a break out trader.

This can get interesting Duck and we haven't really discussed order types but some might use limit orders once a range is broken...naturally we may miss some moves like that also but just for arguments sake suppose we used limit orders and the 1.5 pt stops I mentioned when the OR was bigger than 2 points which it was today....we would have had 2 losses and then the third long would have hit the plus 4 and made maybe 2 points....so my numbers may be off a tic or two but I only bring this up so others can see other alternatives and I admit this would probably have been a best case scenario.....

but given what I layed out we would have had 3 trades - 2 losses and one win and maybe have only lost 1.25 - 1.5 points per contract today..I guess the questions comes down to how you enter and where you put your stops when the OR is bigger then 2 points

sorry today was a bad day for you and perhaps they will make up for it tomorrow...either way one has to define rules and stick to them if only trading mechanical

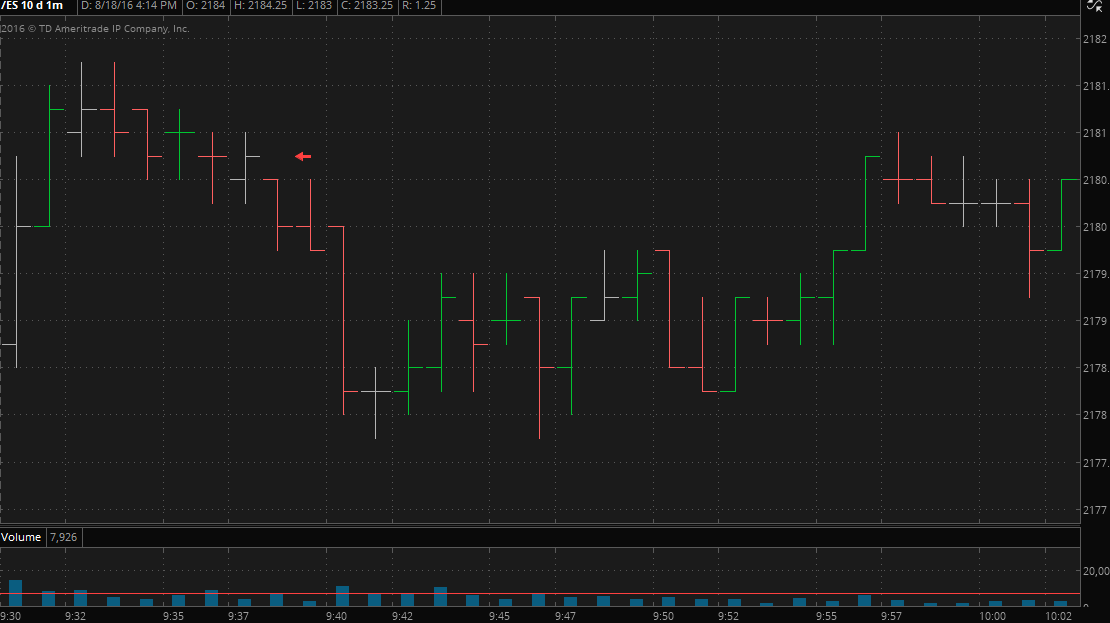

now to keep this useful I am showing the gap in the data ( see red arrow) that happened at about 9:37 at a price of 2180.75....that is why I didn't reverse and held my longs when OR low was broken....so I obviously did not trade systematically today and often do not

but given what I layed out we would have had 3 trades - 2 losses and one win and maybe have only lost 1.25 - 1.5 points per contract today..I guess the questions comes down to how you enter and where you put your stops when the OR is bigger then 2 points

sorry today was a bad day for you and perhaps they will make up for it tomorrow...either way one has to define rules and stick to them if only trading mechanical

now to keep this useful I am showing the gap in the data ( see red arrow) that happened at about 9:37 at a price of 2180.75....that is why I didn't reverse and held my longs when OR low was broken....so I obviously did not trade systematically today and often do not

Originally posted by duck

the OR trade today is down using Or trade as stop..1) long 81 stopout at 78.25..2.75 loss x 2= 5.50 2) short 78.25 stopout 81..2.75 loss x 2 = 5.50 3) long at 81 hit plus 4 at 83 for win 2x2=4

so loss 11 and gain 4 leaves loss of 7..which is way better than the loss i took..what stupid duck i am..just change the d in duck you got the right word for me..

bruce i got 4 trades with 1.5

1) long at 81 stopout at 79.50

2)short at 78.25 stopout at 79.75

3) long at 81 stopout at 79.50

4) long at 81 then plus 4 hit..

so loss of 5 which is still better than what i did and using the full OR as stop..

mike yes i wonder what i was doing too..slip back to the old days..everybody wants the good old days back when there old..lol got to joke about it but i know it was very bad and stupid of me to do what i did..

1) long at 81 stopout at 79.50

2)short at 78.25 stopout at 79.75

3) long at 81 stopout at 79.50

4) long at 81 then plus 4 hit..

so loss of 5 which is still better than what i did and using the full OR as stop..

mike yes i wonder what i was doing too..slip back to the old days..everybody wants the good old days back when there old..lol got to joke about it but i know it was very bad and stupid of me to do what i did..

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.