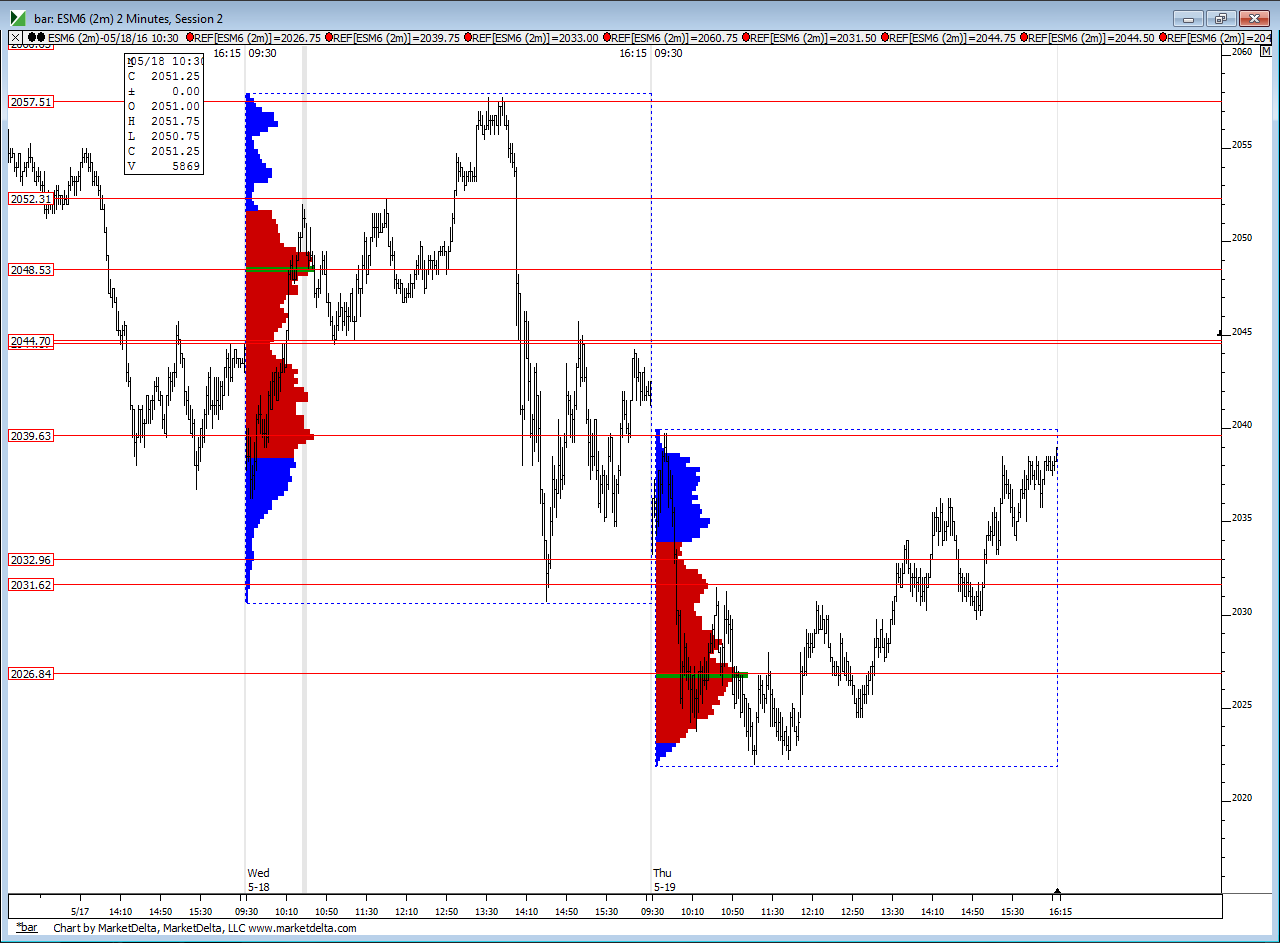

Es Friday 5-20-16

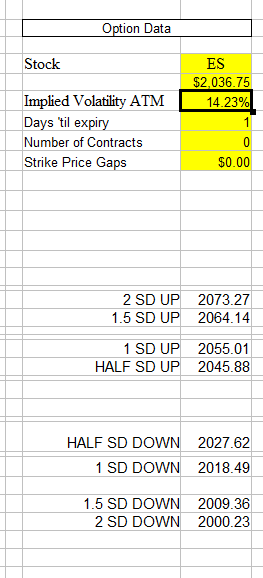

a quick pic of the lines I'm using...confluence with R1 at 45 area and pivot number at 33.50....working on a video to go over some other things and weekly bar info..so I'll edit this for anyone who wants some other ideas and video ramble...but for now my plan is to sell in 45 - 48 area and to also sell in the 50 - 52 area ( R2 and a VA high is up there). I f you get the 45 area short then I would scale at Wednesdays close just in case.

bands

1/2 SD up ( The SITYS #) comes in at 45 area too

I refined my lines a bit because I had a chart setting wrong...video covers that quickly and then goes over the weekly concept.....I'm basically asking the question "How many tpo's can we expect at prior weeks low or highs...not just the previous weeks but any weekly range we pass through.....? Would make for an interesting study

bands

1/2 SD up ( The SITYS #) comes in at 45 area too

I refined my lines a bit because I had a chart setting wrong...video covers that quickly and then goes over the weekly concept.....I'm basically asking the question "How many tpo's can we expect at prior weeks low or highs...not just the previous weeks but any weekly range we pass through.....? Would make for an interesting study

added bands in above

added video in above....started On shorts at 45.50 but plan is to add and be more aggressive above O/N high

wednesdays close and official 30 minute POC all fall in the 42 - 43.25 Range....something to keep in mind....ON midpoint is down there too

core shorts on at 47.75 and will be more aggressive at 49 if it prints.want to see this get back to 44.50 and hopefully more....

Report warning: existing home sales report at 10 EST

we really need to see them start consolidating UNDER that 47.50 which is the O/N high...simple logic tells us that there is no way runners can get to an Overnight midpoint if you can't stay UNDER it's high ...LOL ! and if you trade to the center of a bell ( which we did from Wednesday) then you want that rejection down to come fast....you don't want to be jerking around the center of a previous bell curve center for too long...so shorts shouldn't feel so confident !!!!!

I took the loser and starting new shorts at 52 to try to get back to 49....

30 min VPOC at 47.5

ok..had two wins and one loss..trying to hold for further selling but here is a video which explains some thinking....at least I try to..was working an exit so a bit more jittery...hopefully some of it makes sensei

thanks New kid..this all seems too mechanical..stopping one or two tics and leaving a ledge on one minute bars slightly above that 49 node has me looking only for shorts again...ideally from 52 and will also try at 55.......so your 47.75 vpoc would make a nice runner target and hopefully help with the magnet down

look at that, they even got the 30 minute VPOC...without me but hopefully someone got to tag that probability...ended up being an ok day but challenging...I thought it was cool how the 30 minute vpoc went well with the overnight high...that volume confirmed that area....interesting to me as a technical trader...this would be a dangerous place to trade now ,,,the buyers tried many times to get back out of the upper Low time areas from Wednesday and have failed only to fall back to the high time from that day.... I think if 51 - 52.50 can hold back buyers then we still have a chance to get back to the 2044.50 and lower......we'd also wantto see a weak low volume bounce off the R2 level that the NQ hit into...that would help

I'm not trading so this is all easy to say....hope all have a great weekend

I'm not trading so this is all easy to say....hope all have a great weekend

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.