ES Tuesday 5-17-16

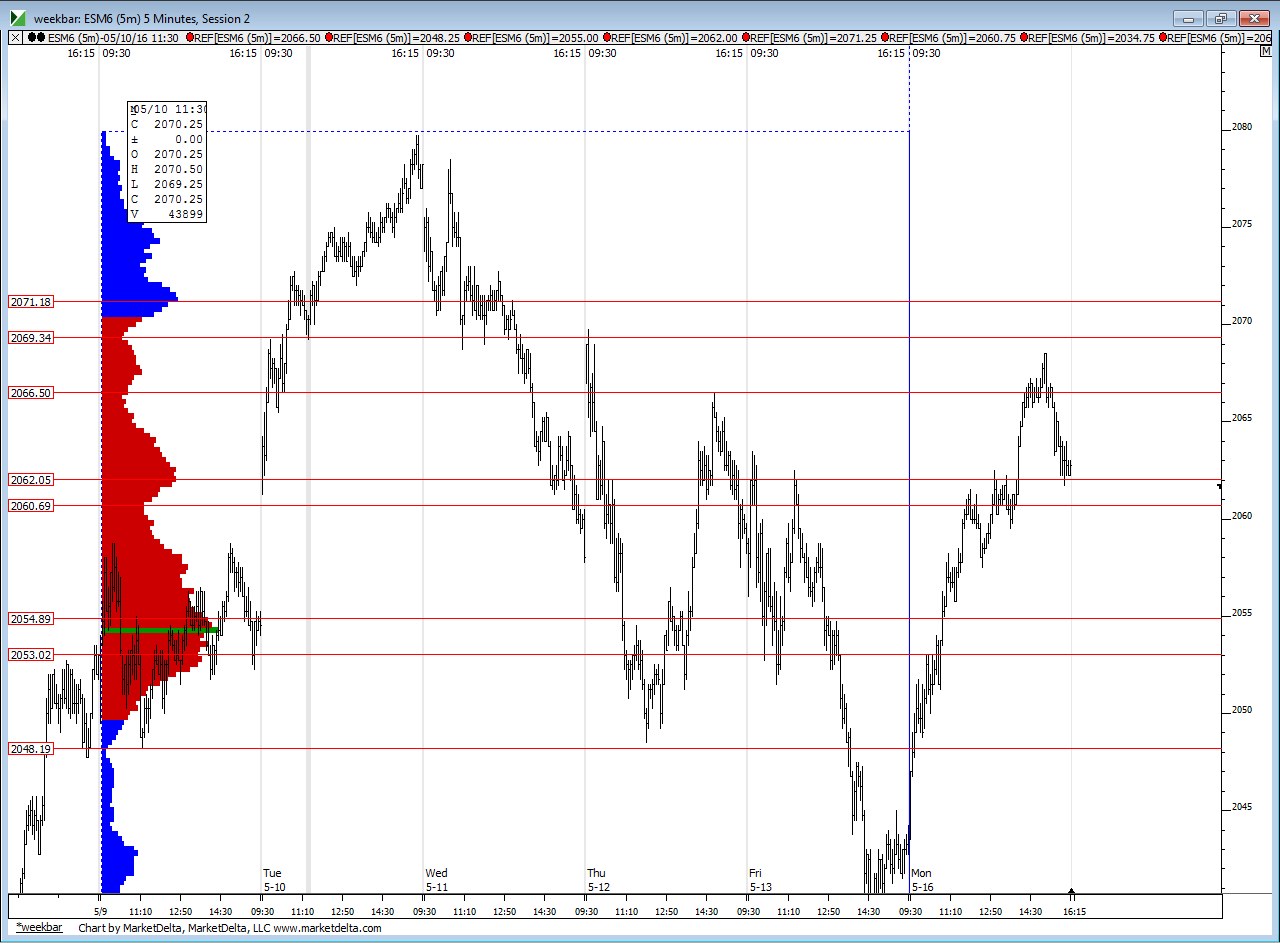

This first chart is how I have lines snapped to note the key areas from Mondays trade

second chart is the SAME chart from Mondays thread showing last WEEKS time profile areas and monday's trade against that ......Mondays areas match up well with areas formed last week. these will be in play again . Lots of the same areas

the best areas will come from areas that saw reactions on Monday from last weeks profile as confluence. We had no overnight midpoint test in Monday's rth so that will most likely be my main focus tomorrow...not planning on posting as I trade as that isn't really helpful and tomorrow I will be trading heavier

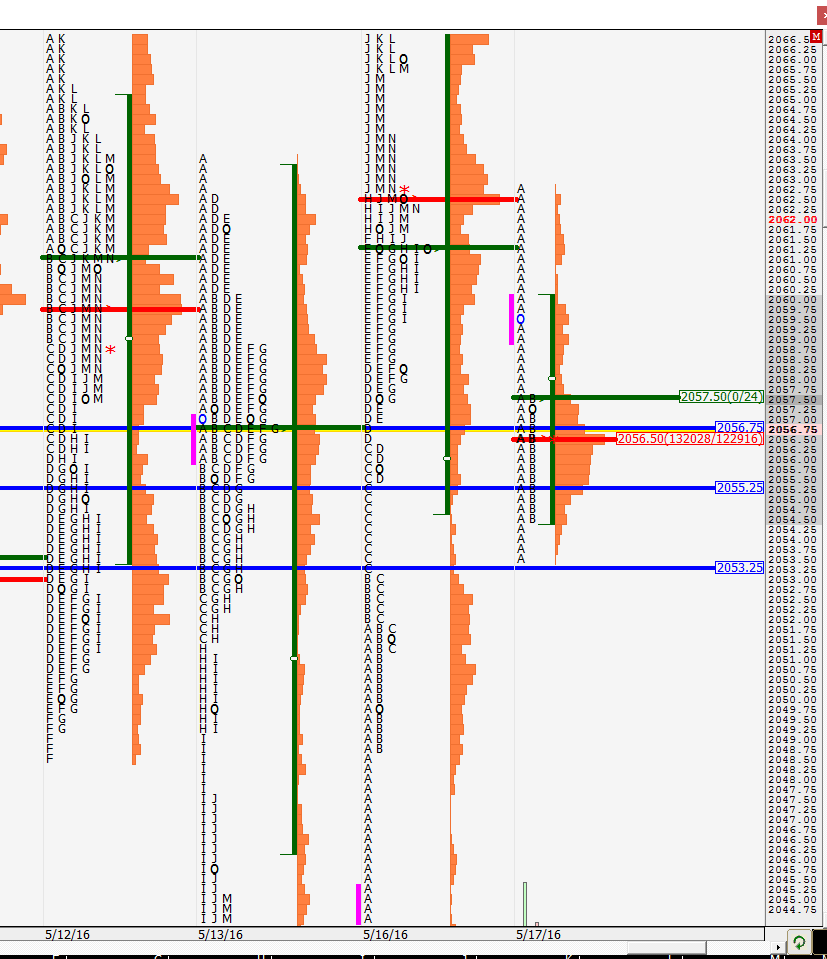

third chart is standard MP chart with Single prints snapped in, Va high and low and POC of time. singles at 56.50 and the pivot number and " price action " spot at 58 area. Closing vwap is there too at 58 .we'll see if the Overnight shines some light on things or confirms some of these areas. Only so many lines we can trade from and having lines every 2 points is unacceptable to be trading from. So these need some refinement ! I'd prefer to have at least 3 - four points between areas otherwise it's just too confusing

,

this last chart compares Fridays trade with Mondays trade. Note how low and high time prices from Friday became low and high time prices on Monday. Sometimes they switch roles ...for example Note how the 2051 and 2061 were low Time on Friday but became High time on Monday !

If I had to summarize all these charts I would be looking at Mondays trade as two separate distributions,,,not evenly balanced.....the top one has low volume/time edges at

2065 and at 2055 - these are the low time spots. Then the center or high time spot of this distribution ( bell curve) is 2060.50

the lower distribution uses the Low time spot of the upper distribution ( trying to make this as confusing as possible) that 2055 as the UPPER edge of it's bell curve and has another low time spot at 2048.50. Then the center and high time of this bell curve is at the 2051 area. So these are the Main areas for me tomorrow and how I will be thinking about price. Now usually when I do charts and ramble the night before we gap far away and all these charts become irrelevant. I hope not for tomorrow. I don't like the 58.50 number and will see if the overnight can make some sense out of that. I'd prefer to play off the edges of the bell curves

second chart is the SAME chart from Mondays thread showing last WEEKS time profile areas and monday's trade against that ......Mondays areas match up well with areas formed last week. these will be in play again . Lots of the same areas

the best areas will come from areas that saw reactions on Monday from last weeks profile as confluence. We had no overnight midpoint test in Monday's rth so that will most likely be my main focus tomorrow...not planning on posting as I trade as that isn't really helpful and tomorrow I will be trading heavier

third chart is standard MP chart with Single prints snapped in, Va high and low and POC of time. singles at 56.50 and the pivot number and " price action " spot at 58 area. Closing vwap is there too at 58 .we'll see if the Overnight shines some light on things or confirms some of these areas. Only so many lines we can trade from and having lines every 2 points is unacceptable to be trading from. So these need some refinement ! I'd prefer to have at least 3 - four points between areas otherwise it's just too confusing

,

this last chart compares Fridays trade with Mondays trade. Note how low and high time prices from Friday became low and high time prices on Monday. Sometimes they switch roles ...for example Note how the 2051 and 2061 were low Time on Friday but became High time on Monday !

If I had to summarize all these charts I would be looking at Mondays trade as two separate distributions,,,not evenly balanced.....the top one has low volume/time edges at

2065 and at 2055 - these are the low time spots. Then the center or high time spot of this distribution ( bell curve) is 2060.50

the lower distribution uses the Low time spot of the upper distribution ( trying to make this as confusing as possible) that 2055 as the UPPER edge of it's bell curve and has another low time spot at 2048.50. Then the center and high time of this bell curve is at the 2051 area. So these are the Main areas for me tomorrow and how I will be thinking about price. Now usually when I do charts and ramble the night before we gap far away and all these charts become irrelevant. I hope not for tomorrow. I don't like the 58.50 number and will see if the overnight can make some sense out of that. I'd prefer to play off the edges of the bell curves

I edited my video post to include a second video just as a follow up..we always need to see the good , the bad and the ugly with trading ideas...

disturbing how they keep getting to that 54 area and rallies getting smaller...not trading but it seems they are failling at that edge and may need to drop it down to that 51.75 line...

single print players want to try to drive it up....if they can't do it here then down we go......but that is just common sense,,,if I wasn't getting rewarded on longs I would sell out which adds fuel to the sell side

bruce your so right on the small losses. yesterday took 7 loss today made it up in one trade. today had two small losses and made ok money on one winner.. i have seen the light of small losses..lol thanks to you and newkid for your post.they are of valve to one person here.

duck

duck

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.