ES Wednesday 5/4/16

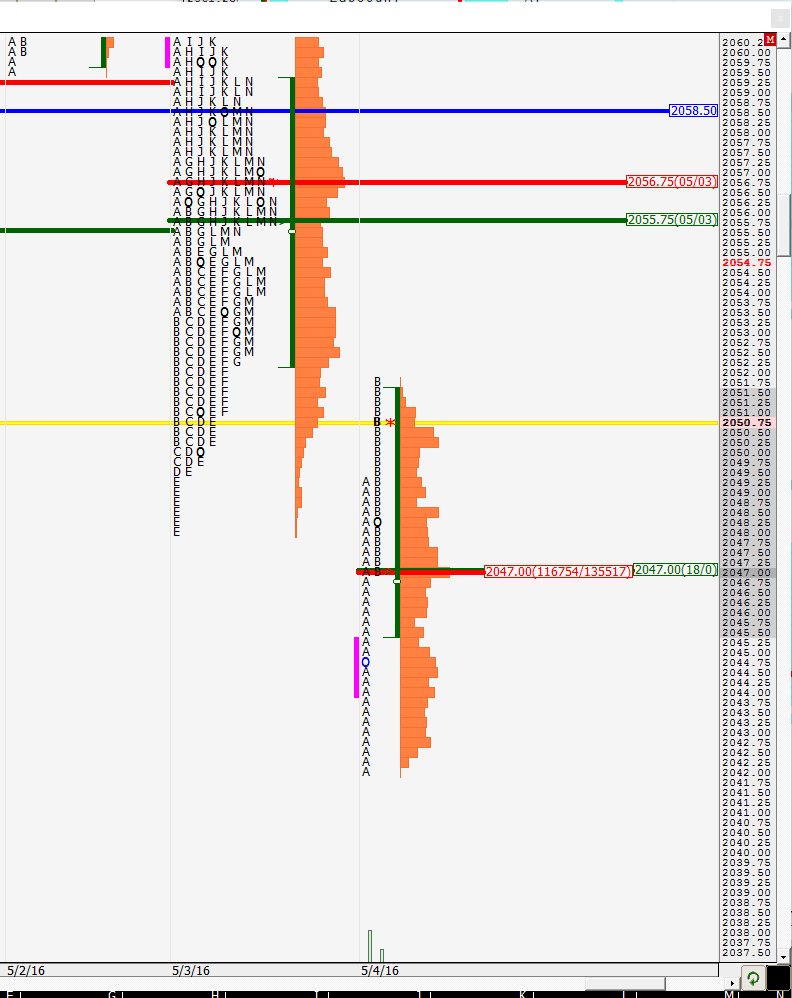

key point for me is that we had no midpoint test yesterday ! other lines are on the video but key lines including the one SD band on downside coming in at 39.75 ....so 39.75 - 41 is the critical line that bulls want to hold today....It's ok to push under but we do not want time or the daily vwap and/ or 30 minute poc to start forming under there as the day wears on......I watch the one minute bell curves to see where they are are forming too......ok here is a video and the bands screen capture

I have no choice but to hunt the long trades given the failure of the overnight midpoint test yesterday and am doing that in the 44 - 45 area ( note how that is a weekly low but also splits the S1 and S2 area today)now and also down at the 39.75 - 41 area I already mentioned.....remember the pivot concept....at least one will trade in the day session too

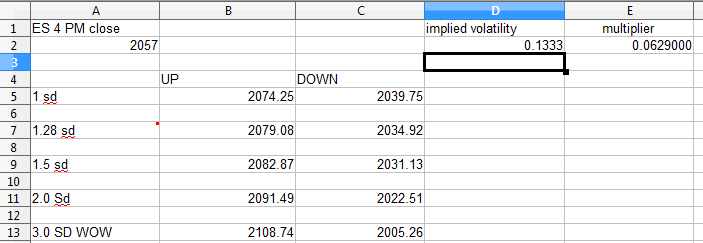

here are the bands for today.....big gap means no daily SITYS number

I have no choice but to hunt the long trades given the failure of the overnight midpoint test yesterday and am doing that in the 44 - 45 area ( note how that is a weekly low but also splits the S1 and S2 area today)now and also down at the 39.75 - 41 area I already mentioned.....remember the pivot concept....at least one will trade in the day session too

here are the bands for today.....big gap means no daily SITYS number

thanks Big Mike...( in yesterdays thread)..are u still following Bittmans weekly idea ? I tried to find him but the cboe said he retired and he doesn't answer emails....I want to know how his weekly idea for selling options has worked over time... I like the tasty ideas and I never heard them say they don't make money with earnings...I always just thought that they used a small fraction of the portfolio on earnings and kept things real tiny on those trades...interesting...I don't feel so bad now....thanks...

Daily pivots here:

R4 2101.75

R3 2086.50

R2 2071.25

R1 2064.00

PP 2056.00

S1 2048.75

S2 2040.75

S3 2025.50

S4 2010.25

We can see that the S2 lines up with the number Bruce mentioned as well the S1 lines up close to YD's low.

R4 2101.75

R3 2086.50

R2 2071.25

R1 2064.00

PP 2056.00

S1 2048.75

S2 2040.75

S3 2025.50

S4 2010.25

We can see that the S2 lines up with the number Bruce mentioned as well the S1 lines up close to YD's low.

30 min VPOC at 2047

Originally posted by BruceM

thanks Big Mike...( in yesterdays thread)..are u still following Bittmans weekly idea ? I tried to find him but the cboe said he retired and he doesn't answer emails....I want to know how his weekly idea for selling options has worked over time... I like the tasty ideas and I never heard them say they don't make money with earnings...I always just thought that they used a small fraction of the portfolio on earnings and kept things real tiny on those trades...interesting...I don't feel so bad now....thanks...

Actually have a family member doing the Bittman. I've got too many things go to keep it all straight. It goes along as it should, the probabilities do play out. I'll see if I can find Jim locally for you.

T&T do use only a small portion of a BIG portfolio for earnings but often wind up doing some very exotic and expensive stuff to deal with the problem children as they say.

Regarding your high probability that ES won't miss O/N midpoint 2 days in row, would have a guesstimate as to how often that 2nd day opportunity comes into play?

you can figure on one day a week that the midpoint doesn't print in RTH and two failures in a row probably happens less than 3 % of the time and often near holidays, Fridays and Mondays ..... .Paul and I were studying the midpoints one or two years ago ( maybe more - time goes so fast )but I haven't kept an accurate spreadsheet or exact data...I just know that it happens...sorry I can't be more help with that and I hope I addressed the question I think you were asking ..

Originally posted by Big Mike

Originally posted by BruceM

thanks Big Mike...( in yesterdays thread)..are u still following Bittmans weekly idea ? I tried to find him but the cboe said he retired and he doesn't answer emails....I want to know how his weekly idea for selling options has worked over time... I like the tasty ideas and I never heard them say they don't make money with earnings...I always just thought that they used a small fraction of the portfolio on earnings and kept things real tiny on those trades...interesting...I don't feel so bad now....thanks...

Actually have a family member doing the Bittman. I've got too many things go to keep it all straight. It goes along as it should, the probabilities do play out. I'll see if I can find Jim locally for you.

T&T do use only a small portion of a BIG portfolio for earnings but often wind up doing some very exotic and expensive stuff to deal with the problem children as they say.

Regarding your high probability that ES won't miss O/N midpoint 2 days in row, would have a guesstimate as to how often that 2nd day opportunity comes into play?

Thanks Bruce

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.