ES Wednesday 9-16-15

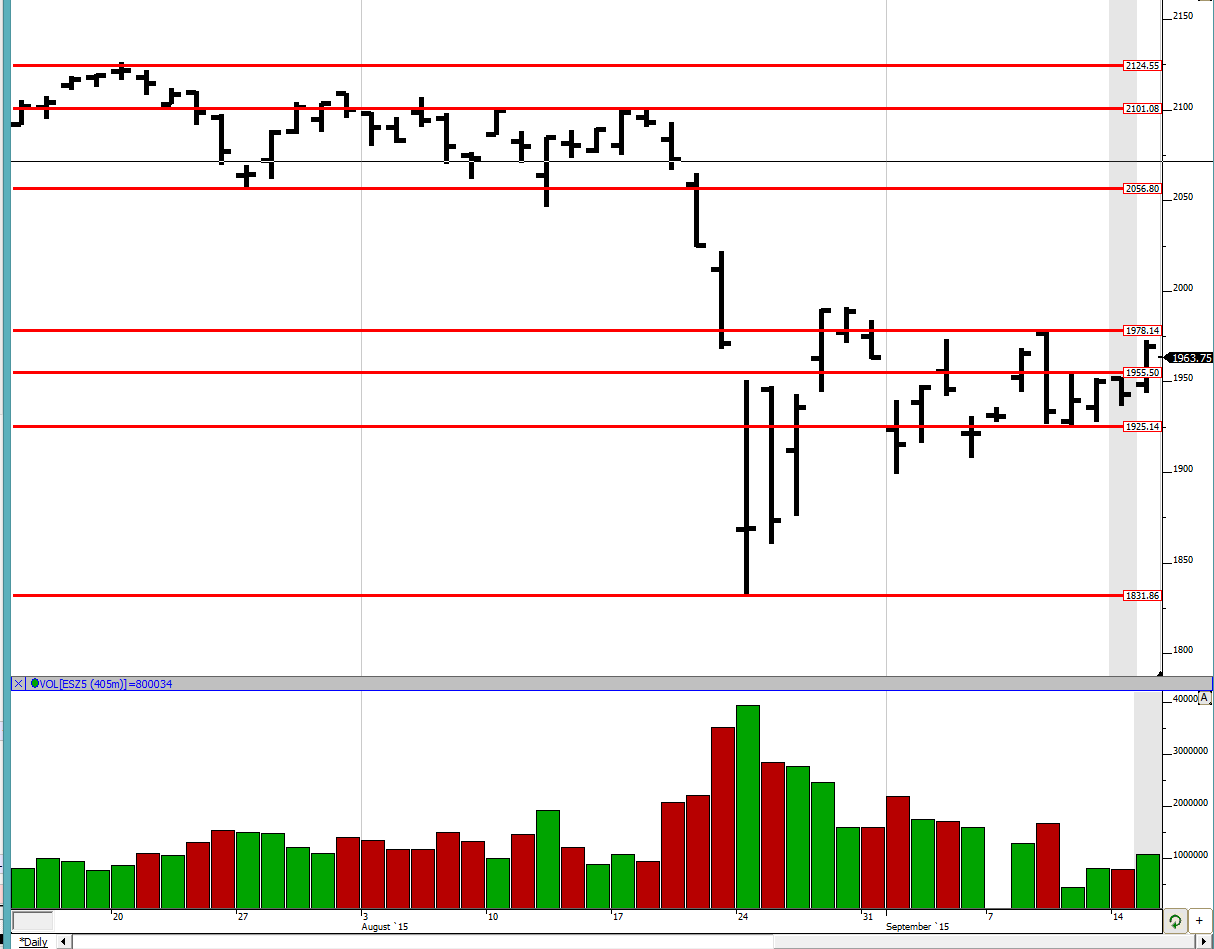

Good evening to all. Today we broke out the previous 3 day balance area (9/10, 9/11 and 9/14) and are approaching the 4 day balance area high (from 9/9) of 1978.25. We saw a breakout of the 3 day balance and we closed above it. We did not quite reach 1978.25 today but that along with the 1992 high from 8/28 are the next reference points if we are to break out of this larger balance. We have so many balance areas inside one another that sometimes we can get lost but it is imperative to keep them in mind from a larger point of view. If we do get above 1992, which I do not think can happen before FOMC, then there is a lot of place for it to move above. On the other hand, if things break down from here, then 1925, 1898.25 and 1831 are in sight. Stay flexible.

Greenies: 1923, 1934.25, 1940.5, 1943, 1947.25, 1959.25, 1968.5, 1977, 1995, 2012.5, 2053

Profile:

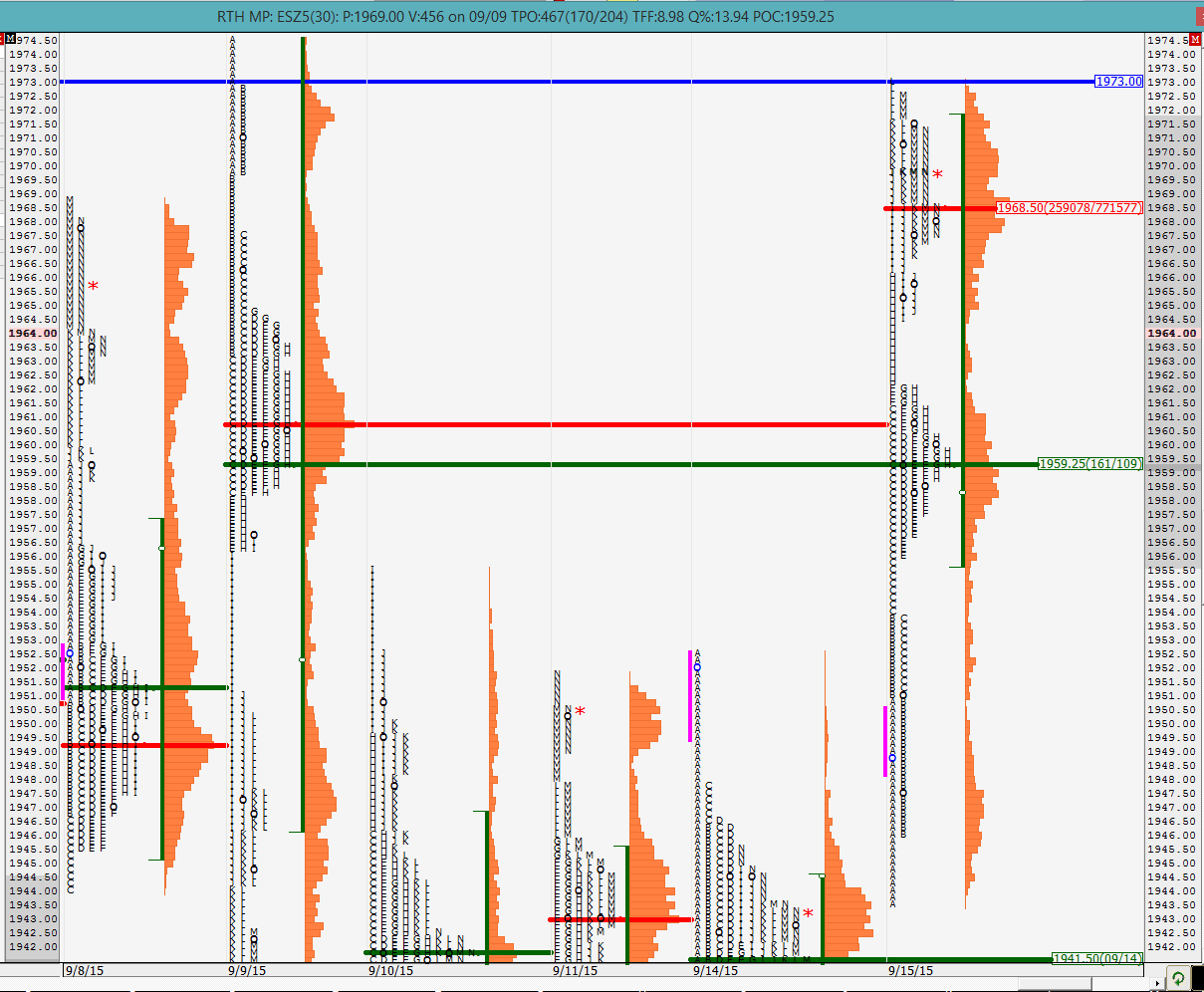

Today was a 3-distribution day as can be seen in the chart below. The POC was in the center distribution and the VPOC in the top one. Again, these tend to get cleaned up over time and not necessarily right away. Look where the high of the day is: right to the tick of the selling tail from 9/9. The market closed all the remaining distributions from 9/9 perfectly and sold off. This is another indication that it is primarily the day time traders playing right now which also means that such references work very well. We shall see in which distribution do we open RTH tomorrow and if we can sustain today's momentum into FOMC or if there is liquidation prior to that.

The split profile simply shows how today was a trend day up.

We shall come up with a plan in the morning depending on how the O/N plays out and where we open. Remember, that tomorrow is the last full day before FOMC. Good luck to all.

Greenies: 1923, 1934.25, 1940.5, 1943, 1947.25, 1959.25, 1968.5, 1977, 1995, 2012.5, 2053

Profile:

Today was a 3-distribution day as can be seen in the chart below. The POC was in the center distribution and the VPOC in the top one. Again, these tend to get cleaned up over time and not necessarily right away. Look where the high of the day is: right to the tick of the selling tail from 9/9. The market closed all the remaining distributions from 9/9 perfectly and sold off. This is another indication that it is primarily the day time traders playing right now which also means that such references work very well. We shall see in which distribution do we open RTH tomorrow and if we can sustain today's momentum into FOMC or if there is liquidation prior to that.

The split profile simply shows how today was a trend day up.

We shall come up with a plan in the morning depending on how the O/N plays out and where we open. Remember, that tomorrow is the last full day before FOMC. Good luck to all.

we are now through the single of 8/31. 8/28's range is the last frontier now

i dont think my charts have transitioned well. we are at the VPOC from 8/21 on the Sept contract. I need to look into my charts. I hate rollovers

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.