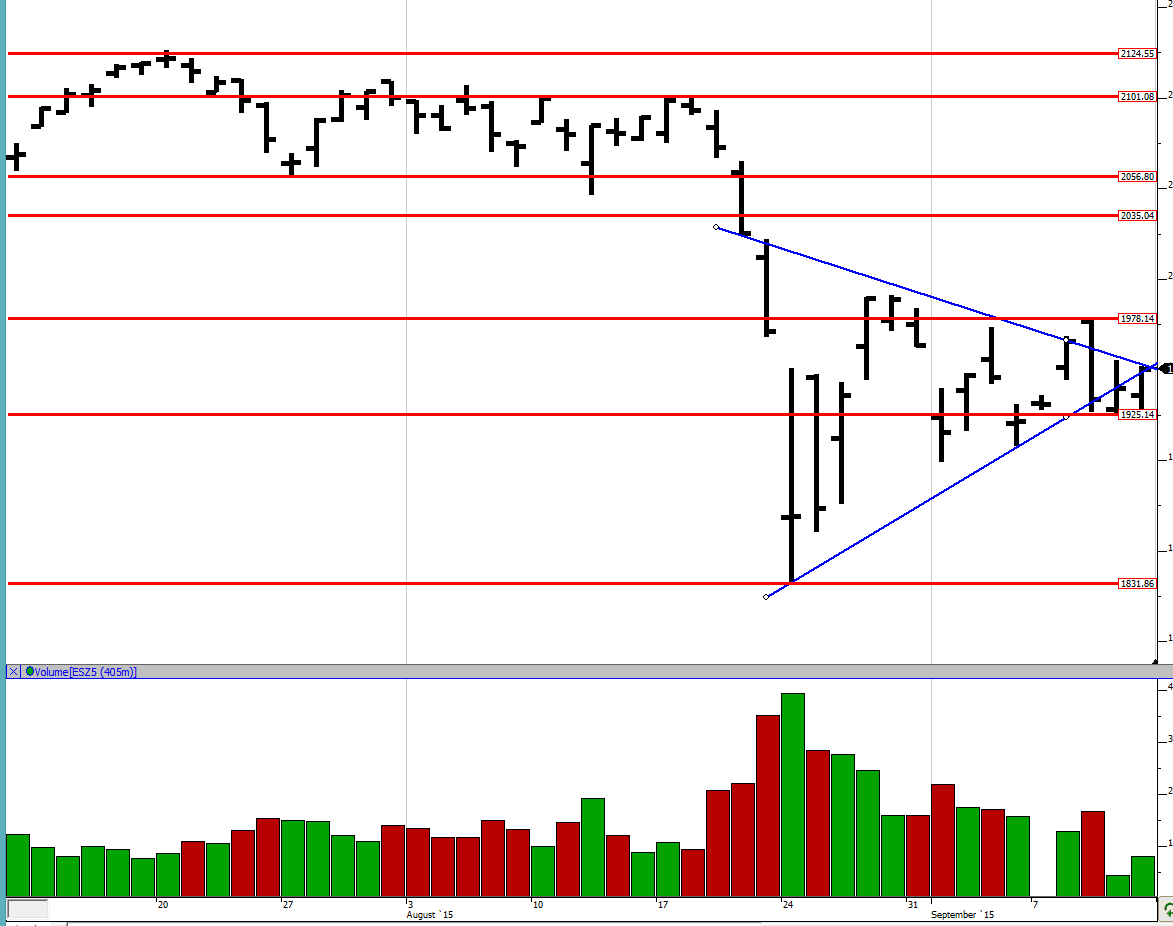

ES Monday 9-14-15

Good morning to all. Everything is now on the Dec contract, ESZ5. As we can see that we are in a 3 day balance with the balance area high being 1978.25 and low being 1925. These are also last week's high and low. We need to be on the lookout if we break out of this balance or not. I have a feeling that we are not likely to break out before Thursday's Fed meeting minutes but we shall see and keep an open mind. The break from this balance area is likely to be severe so we need to be very aware of it. There are both high risks and high rewards associated with it. Similarly, look out for a fake out as well.

Greenies: 1923, 1934.25, 1943, 1960.75, 1971.75, 1977, 1995, 2012.5, 2053

Friday was a balancing day, finishing as an inside day of Thursday. As can be seen, earlier in the day we tested the balance area low in the B period, did not find any sellers there and then rallied up the rest of the day. The POC and VPOC both migrated to above the RTH mid-pt and the close was near the highs of the day. Therefore we ended up creating a 3-day balance with more coiling prior to the expected fireworks on Thursday.

The split profile teaches us another lesson. Look at the start of the day in the A, B, C, D and E periods. We were testing the balance area/prior day low in the B period but did not get a breakthrough and there was a bounce. The C period high went right up to the B period high to the tick and the market sold off. This was a sign of weak selling as it was right at a reference. The C period low could not take out the B period low. The sellers tried again in D period with it's high matching the B and C period highs to the ticks. More weak selling and now the D period low could not take out the C period low. The sellers were getting nothing for their efforts. Sensing blood in the water, the buyers came in assuming that all those weak shorts were likely to have had their stops either above the B/C/D period highs or A period high. In the E period, they squeezed those shorts and the markets rallied taking out all those shorts. The market got overly long in the E, F and G period resulting in some inventory rebalancing in H and I periods. The I period low tried coming to those prior B/C/D highs and the market found more buyers (no sellers) and rallying again.

The O/N inventory is more long than short but not 100% so. Today would likely be a good day to get the O/N mid-pt retest as the O/N VPOC is also above of where we are. Loo out for the references mentioned earlier but the market is not likely to go anywhere before Thursday. Does not mean that there are no trading opportunities though. So good luck to all.

Greenies: 1923, 1934.25, 1943, 1960.75, 1971.75, 1977, 1995, 2012.5, 2053

Friday was a balancing day, finishing as an inside day of Thursday. As can be seen, earlier in the day we tested the balance area low in the B period, did not find any sellers there and then rallied up the rest of the day. The POC and VPOC both migrated to above the RTH mid-pt and the close was near the highs of the day. Therefore we ended up creating a 3-day balance with more coiling prior to the expected fireworks on Thursday.

The split profile teaches us another lesson. Look at the start of the day in the A, B, C, D and E periods. We were testing the balance area/prior day low in the B period but did not get a breakthrough and there was a bounce. The C period high went right up to the B period high to the tick and the market sold off. This was a sign of weak selling as it was right at a reference. The C period low could not take out the B period low. The sellers tried again in D period with it's high matching the B and C period highs to the ticks. More weak selling and now the D period low could not take out the C period low. The sellers were getting nothing for their efforts. Sensing blood in the water, the buyers came in assuming that all those weak shorts were likely to have had their stops either above the B/C/D period highs or A period high. In the E period, they squeezed those shorts and the markets rallied taking out all those shorts. The market got overly long in the E, F and G period resulting in some inventory rebalancing in H and I periods. The I period low tried coming to those prior B/C/D highs and the market found more buyers (no sellers) and rallying again.

The O/N inventory is more long than short but not 100% so. Today would likely be a good day to get the O/N mid-pt retest as the O/N VPOC is also above of where we are. Loo out for the references mentioned earlier but the market is not likely to go anywhere before Thursday. Does not mean that there are no trading opportunities though. So good luck to all.

testing the 1943 greenie/VPOC from friday

VPOC currently at 1944. My hypothesis of testing the O/N mid-pt has not yet materialized but the day is still young :) even the 1943 greenie did not hold well in the morning but the market came back to it so there is some saving grace. looking like another balancing day so far

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.