ES Wednesday 9-2-15

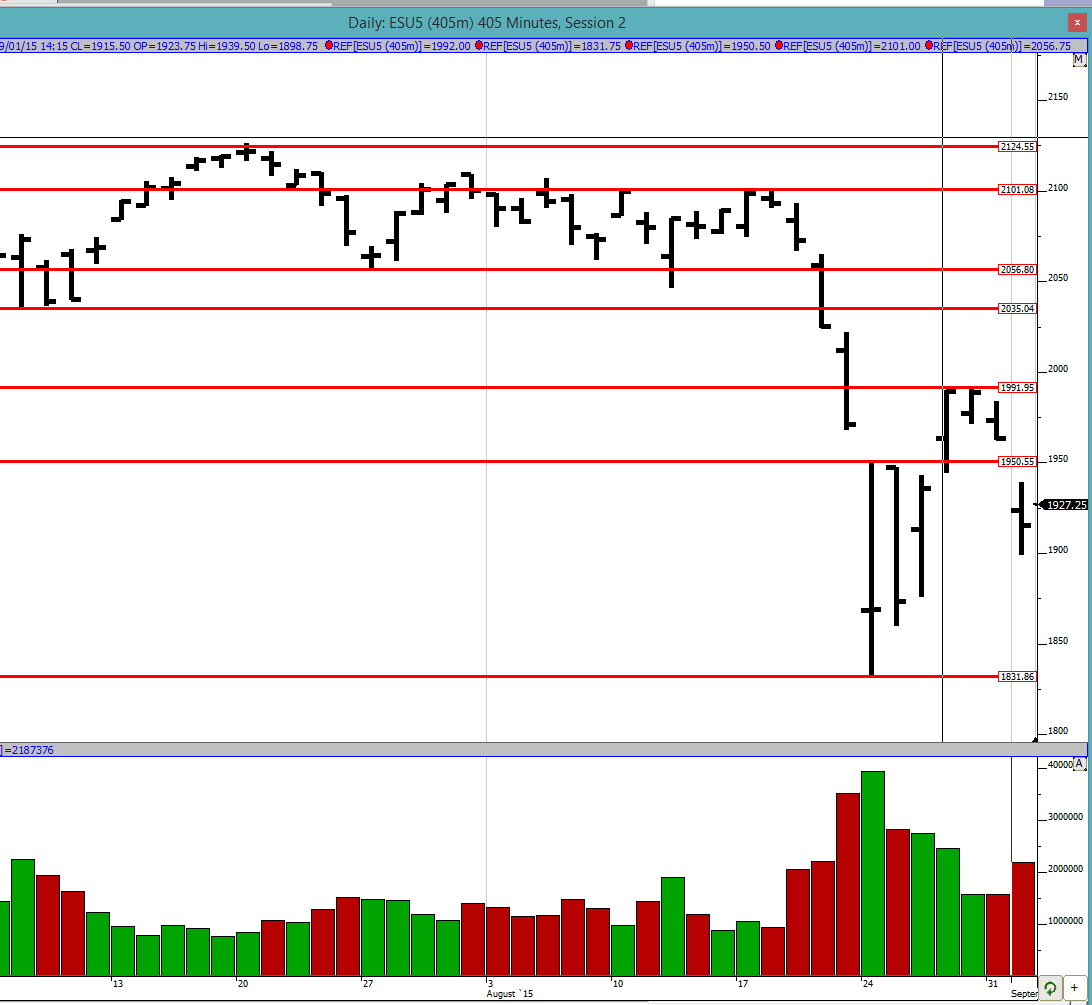

Good evening to all. Today we gapped down and were unable to close the gap. We ended up in the previous balance area of 1831 to 1950.5. we shall see if we get to the bottom end of this balance area in the near future at 1831 or not. keep in mind that we could likely close today's gap before continuing lower so I am not saying we get there tomorrow or at all, but that there is a likelihood that it could get there. All we do is look at probabilities and then look at price action. Predicting a market is a fool's errand.

Greenies: 1894, 1918.25, 1927.25, 1969.5, 1979, 1995, 2014.25, 2053.25, 2077.75

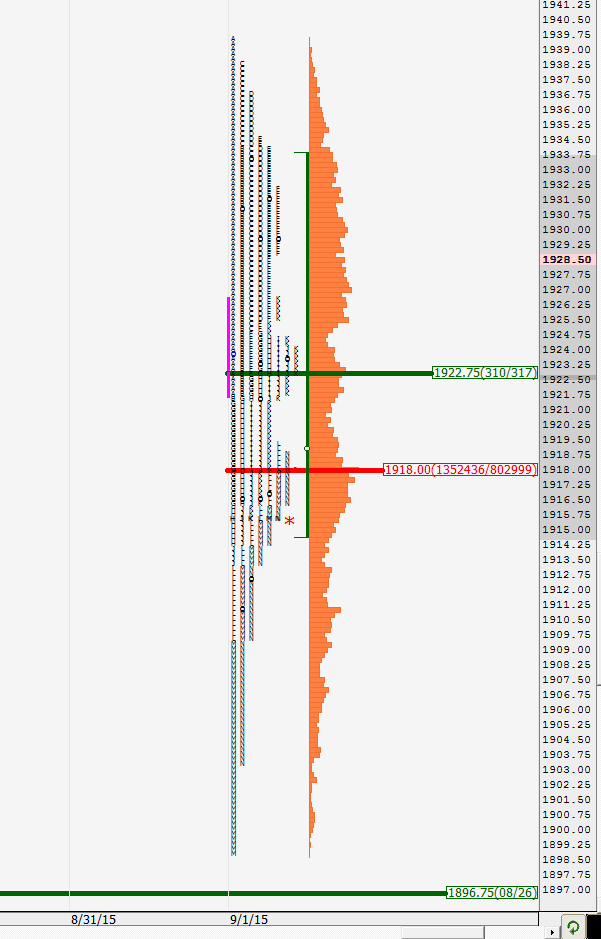

Profile:

I had to scale my y-axis to make the entire profile fit in 1 page so I apologize for the small text. We can see that there is a good buying tail at the low end with the market rallying hard in the last 30 mins or so. Again, the VPOC which was higher became a magnet towards the close and pulled prices towards it. It is interesting to note that the VPOC of 1918 is close to the mid-pt of the day (1919). The market closed pretty close to it at 1915.5. The value was clearly lower today compared to Monday with the inability to close the gap.

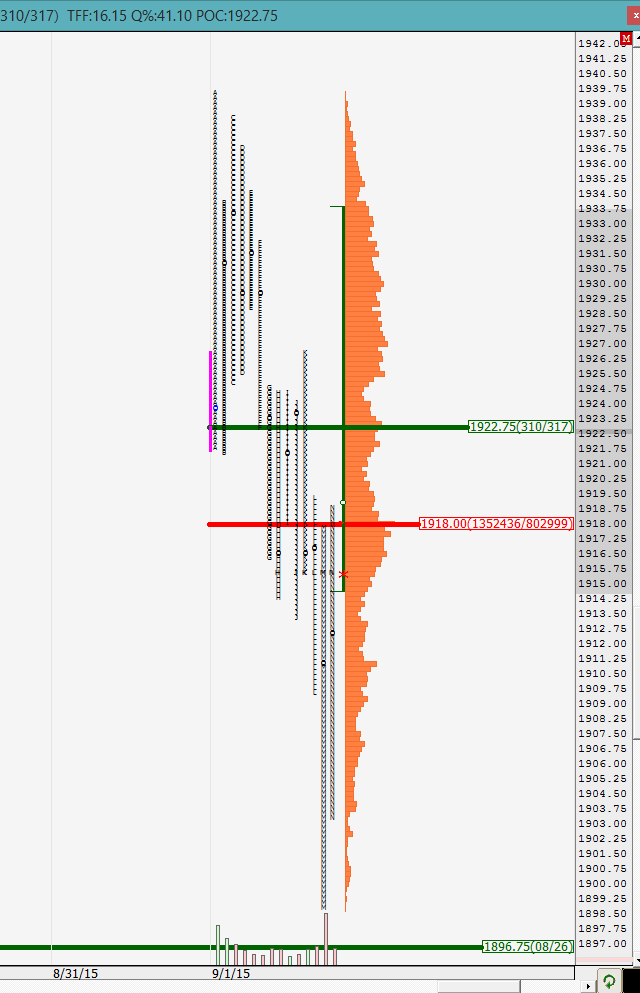

On the split profile we can see how the market kept trying to go up in the C period and could not take out A period high. Then the D period could not take out the C period high and the E period could not take out the D period high. The buyers kept coming in at lower levels but the buying simply exhausted as they moved up in price unable to take out the previous 30 min period highs. This was creating the wedge that I mentioned in the Monday trading notes. Finally when the F period came by and could not take out the E period high, the buyers finally threw in the towel and we had liquidation rest of the day with shorts piling on. There was some respite in the K period but that just seemed to be inventory adjustment with the selling commencing again until the last 30 mins or so when the market got too short and we had some frantic short covering towards the close driving prices back up to the VPOC. This is all very simple stuff as long as we can keep up with it in real time. Today I saw it more as the wedge play than the profile play but the end result is what matters. This also goes to show that no matter the approach, they all usually point at the same thing.

We shall see how the O/N plays out and come up with a plan in the morning. There are no major economic reports tomorrow.

Greenies: 1894, 1918.25, 1927.25, 1969.5, 1979, 1995, 2014.25, 2053.25, 2077.75

Profile:

I had to scale my y-axis to make the entire profile fit in 1 page so I apologize for the small text. We can see that there is a good buying tail at the low end with the market rallying hard in the last 30 mins or so. Again, the VPOC which was higher became a magnet towards the close and pulled prices towards it. It is interesting to note that the VPOC of 1918 is close to the mid-pt of the day (1919). The market closed pretty close to it at 1915.5. The value was clearly lower today compared to Monday with the inability to close the gap.

On the split profile we can see how the market kept trying to go up in the C period and could not take out A period high. Then the D period could not take out the C period high and the E period could not take out the D period high. The buyers kept coming in at lower levels but the buying simply exhausted as they moved up in price unable to take out the previous 30 min period highs. This was creating the wedge that I mentioned in the Monday trading notes. Finally when the F period came by and could not take out the E period high, the buyers finally threw in the towel and we had liquidation rest of the day with shorts piling on. There was some respite in the K period but that just seemed to be inventory adjustment with the selling commencing again until the last 30 mins or so when the market got too short and we had some frantic short covering towards the close driving prices back up to the VPOC. This is all very simple stuff as long as we can keep up with it in real time. Today I saw it more as the wedge play than the profile play but the end result is what matters. This also goes to show that no matter the approach, they all usually point at the same thing.

We shall see how the O/N plays out and come up with a plan in the morning. There are no major economic reports tomorrow.

end of the day stop hunting.... typical! :) have a good evening to all

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.