ES Tuesday 9-1-15

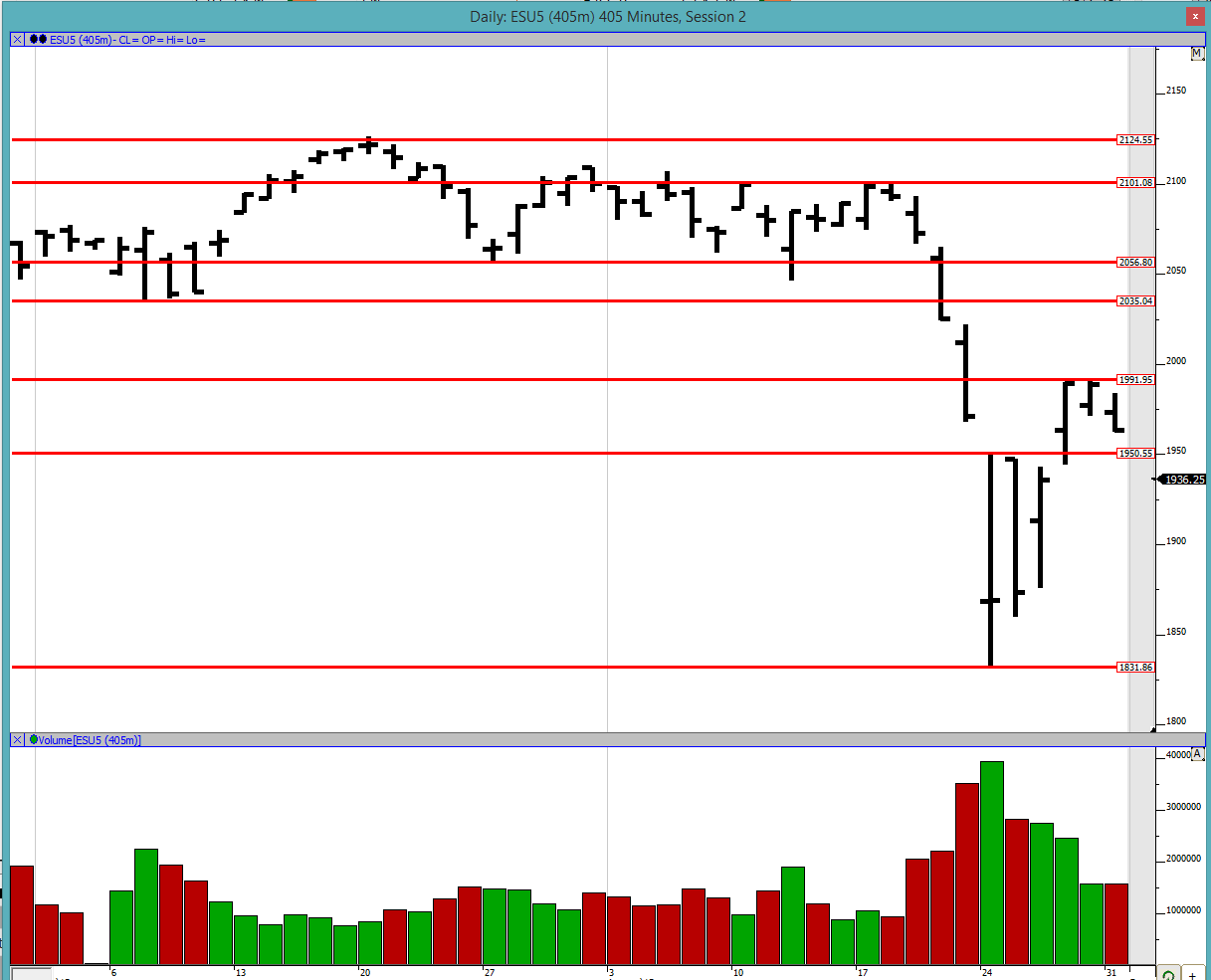

Good evening to all. It appears that we are now in another 3-day balance with 8/27, 8/28 and 8/31. The previous balance area's high (1950.5) continues to be of interest to me. We either look below the current balance area and continue lower (which would take us to the previous balance area low of 1831.75) or we look below and fail, pushing us to the current balance area high of 1992. Same goes the other way as well. Let us leave it as simple as that for now.

Greenies: 1894, 1969.5, 1979, 1995, 2014.25, 2053.25, 2077.75

Profile:

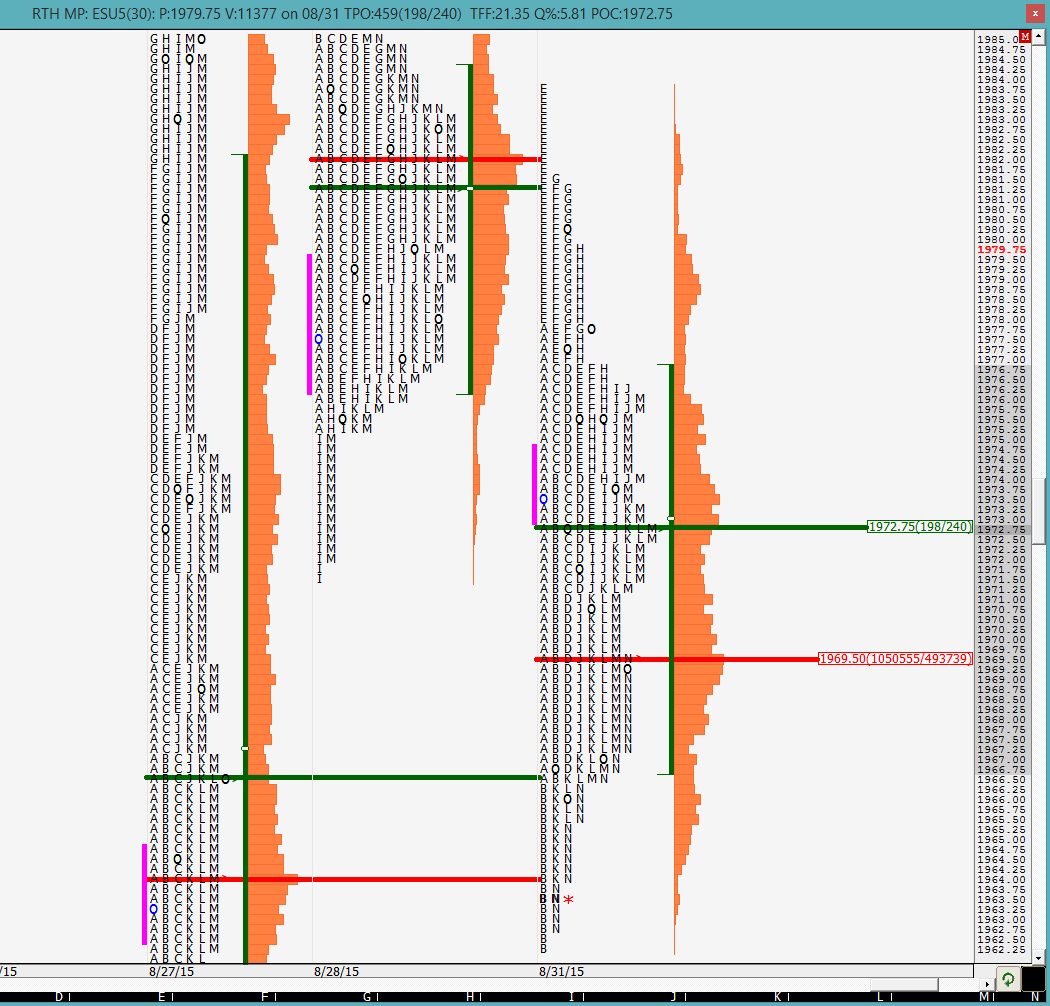

Monday looked like another balancing day but it appeared to be weaker. We see that we have a fairly prominent POC at 1972.75 and a VPOC at 1969.5. There is a good selling tail at the highs but the lows look a little suspicious with only a 2-tick buying tail. Monday again had a lot of back and forth action but closed weak with the close being towards the low of the day and outside of 8/28's range. Now we see if we get to 1831 by continuing lower, go higher and break through 1992 or continue balancing.

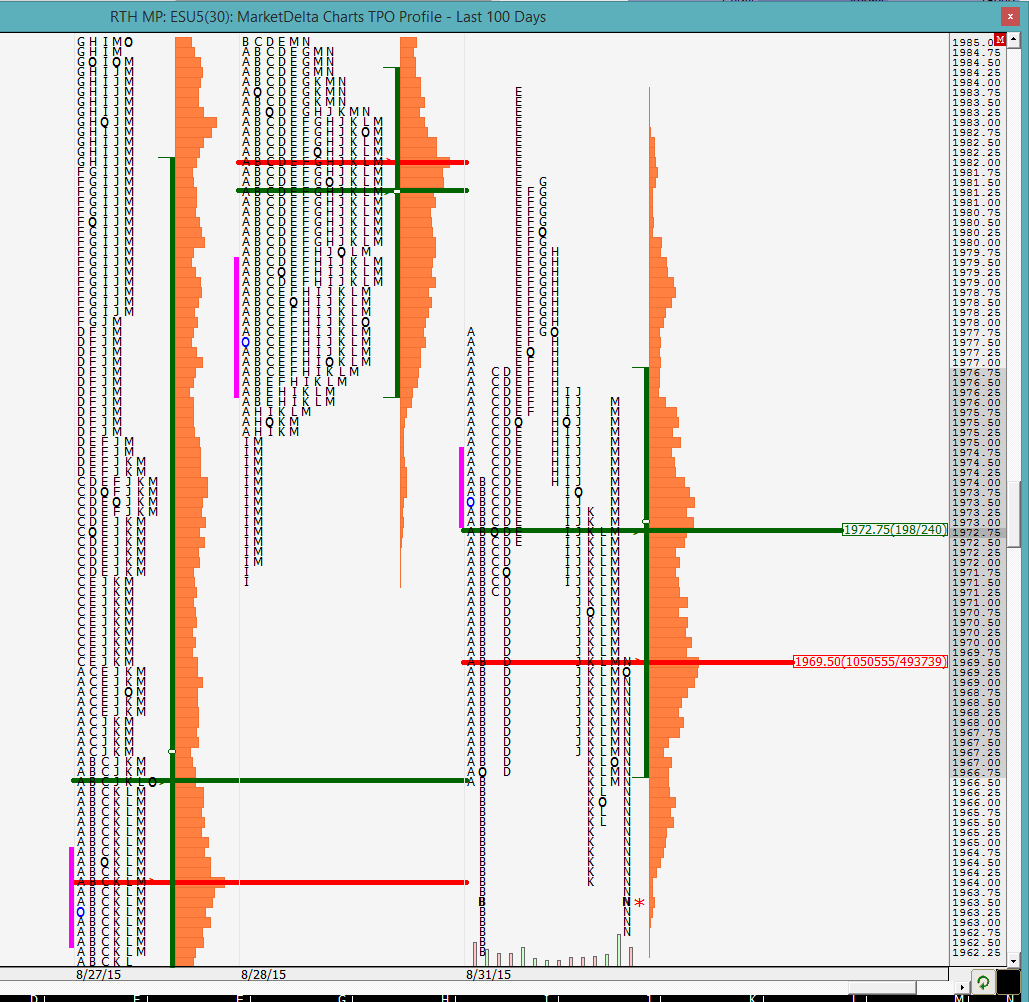

The split profile shows the back and forth action with the highs and lows being bookended by previous greenies. This means that the market is still trying to decide on what to do and neither the buyers nor sellers have much conviction. The next naked VPOC on the downside is at 1894 i.e. a greenie. Lots of single prints and thin profile on the way down so things could get volatile again. Stay alert.

Currently the markets have sold off rather hard and we shall see if the European open has any impact on it or not. As of right now we would be below the 1950.5 level so if this continues until the RTH open and if there is no buying support at the open, things could get ugly and 1894 and 1831 could very well be in play. We shall see how the O/N performs and come up with a game plan in the AM. Good luck to all.

Greenies: 1894, 1969.5, 1979, 1995, 2014.25, 2053.25, 2077.75

Profile:

Monday looked like another balancing day but it appeared to be weaker. We see that we have a fairly prominent POC at 1972.75 and a VPOC at 1969.5. There is a good selling tail at the highs but the lows look a little suspicious with only a 2-tick buying tail. Monday again had a lot of back and forth action but closed weak with the close being towards the low of the day and outside of 8/28's range. Now we see if we get to 1831 by continuing lower, go higher and break through 1992 or continue balancing.

The split profile shows the back and forth action with the highs and lows being bookended by previous greenies. This means that the market is still trying to decide on what to do and neither the buyers nor sellers have much conviction. The next naked VPOC on the downside is at 1894 i.e. a greenie. Lots of single prints and thin profile on the way down so things could get volatile again. Stay alert.

Currently the markets have sold off rather hard and we shall see if the European open has any impact on it or not. As of right now we would be below the 1950.5 level so if this continues until the RTH open and if there is no buying support at the open, things could get ugly and 1894 and 1831 could very well be in play. We shall see how the O/N performs and come up with a game plan in the AM. Good luck to all.

Here is the final picture of the wedge. Ignore the trend lines after they cross each other because the way i drew them, they were auto-extending. we can see that prices reached the VWAP and were rejected below the bottom of the wedge giving a pretty picture perfect setup. we will see how this showed up in the profile in the prep for tomorrow

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.