ES Tuesday 8-25-2015

NewKid,

just piggyback your comments on this forum

After I heard commentators (not on this site) proclaiming that they had never seen a Locked Limit down in an overnight, I questioned their experience in the markets, because I certainly remembered a Locked Limit DOwn...

Curiosity overwhelmed me as to what the conditions were on that previous O/N Limit down, so I decided to come out of semi-retirement to look back at the only other O/N Locked Limit Down I remembered, it was back in 2008, the limit down occurred in the O/N session that followed The Jan observance of Martin Luther King Jr Holiday.

This is not meant to be a predictive analysis, it was only my curiosity (and failing memory) that compelled me to research the PA leading into the last Limit Down and to remind myself about what followed.

First of all, you can't look at the SPX cash for a retrospection of these kinds of price disruptions. Why? because the S&P 500 creates a theoretical opening for the RTH session based on information available... On a day with a huge price dislocation, many components of the S&P 500 will have delayed openings, they just do not trade at the opening bell as specialists review their resting order books to try to figure out how much risk they want to take on anbd at what prices they have resting buy orders... that's another story... the bottom line is all components of the S&P 500 do not open when the opening bell rings...

But the public wants a reading on the S&P 500 index when the market opens...So, if only one single component of the S&P 500 starts trading, the index will be calculated using that opening price and then combine it with the prior day's closing prices of all the other 499 components...Whatever gets produced as an index level is obviously not representative of the entire index, it represents one current price and 499 day old prices... eventually all the components will open and there will be a real price for the index, but historical charts only capture the price levels generated as "the index" produces them.

I used the SPY etf to capture the charts here because it is its' own separate vehicle not dependent on component to open in order to get a quote...a vehicle of itself,

Right off the bat I can tell you that the two events are kind of dissimilar in many aspects.

Look at the chart from back in 2008..and look at the current chart of the SPY.

Back in 2008, on the trade day before the limit down overnight, the SPY had closed 11.3% BELOW it's 200 day SMA. this year, down 4.9% from its 200 sma.

Lots of difference, like volume on the day of the event versus volume on the deadcat bounce day (dead cat bounce day for current market is today, AUG 25)

We have to see how big the volume is today, if it is going to follow the pattern of 2008, the volume should be higher, but as I have stated, the only reason I looked at the 2008 data is becuase that is the last time I remember having an overnight Locked LImit Down in the ES.

Plenty of differences, I can't enumerate them all, I primarillly just wanted to see what the chart looked like after the last O/N locked Limit DOwn...

The huge, enormous amount of volume generated on AUG 24 looks out of whack wityh the volume from back in 2008.

Look how close the 50 day SMA and the 200 day sma are currently versus the spread they had back in 2008.

One thing I did remember about 2008, was that eventually, (it turned out to be the 37th trade day later) the SPY actually came back and printed at the open price it had on the RTH that followed the ES's Locked Limit Down of Jan22, AND LOOK AT WHAT THE VOLUME DID O/N THAT RETEST BACK IN 2008, IT WAS THE DOWN CLOSE before THE RETEST THAT generated a volume spike, and then, on that 37th trade day later, when the SPY printed at the open of the LLD day, the volume was actually less, (but still relatively large).

the fact that the volume was smaller on the retest day relative to the day that preceded it might be a sign that on the prior down day, the weak hands vomited out their long shares, and on the day of the actual retest of the Open of the day following the Locked Limit Down overnight, it just didn't take that many willing buyers to overpower the remaining sellers and lift prices because there were fewer and fewer people making offers so price was able to power higher on less willing buyers...

The labels for volume that appear in the 2008 chart are not correct... the sizes of the histograms are correct, but the volume figure flagged on the right hand side of the chart is the volume captured from yesterday (that's the way the program posts the real, current volume, it posts the most recently captured day of volume.

Here are total volume figures of relevance

volume figures are rounded

2008, day of RTH trading after overnight Locked limit down: 426 million, then next day, Jan 23 RTH, (the deadcat bounce day), volume was bigger at 512 million

2008, 36th trade day after Locked Limit Dow, (weak hands vomit) vbolume was 485 million

2008, on the 37th trade day after the locked limit down, rebound volume was 405 million

2015, yesterday, AUg 24, 2015, day of trading following the overnight Locked Limit Down had 507 million in volume for SPY

Obviously history never repeats itself exactly, there are elements of then and now that have their own importances. I just wanted to refresh my memory about what what had happened after the last Overnight ES Locked Limit Down.

Hopefully I can get the charts up in the next post.

Dead Cat bounce would be today for the current market.

just piggyback your comments on this forum

After I heard commentators (not on this site) proclaiming that they had never seen a Locked Limit down in an overnight, I questioned their experience in the markets, because I certainly remembered a Locked Limit DOwn...

Curiosity overwhelmed me as to what the conditions were on that previous O/N Limit down, so I decided to come out of semi-retirement to look back at the only other O/N Locked Limit Down I remembered, it was back in 2008, the limit down occurred in the O/N session that followed The Jan observance of Martin Luther King Jr Holiday.

This is not meant to be a predictive analysis, it was only my curiosity (and failing memory) that compelled me to research the PA leading into the last Limit Down and to remind myself about what followed.

First of all, you can't look at the SPX cash for a retrospection of these kinds of price disruptions. Why? because the S&P 500 creates a theoretical opening for the RTH session based on information available... On a day with a huge price dislocation, many components of the S&P 500 will have delayed openings, they just do not trade at the opening bell as specialists review their resting order books to try to figure out how much risk they want to take on anbd at what prices they have resting buy orders... that's another story... the bottom line is all components of the S&P 500 do not open when the opening bell rings...

But the public wants a reading on the S&P 500 index when the market opens...So, if only one single component of the S&P 500 starts trading, the index will be calculated using that opening price and then combine it with the prior day's closing prices of all the other 499 components...Whatever gets produced as an index level is obviously not representative of the entire index, it represents one current price and 499 day old prices... eventually all the components will open and there will be a real price for the index, but historical charts only capture the price levels generated as "the index" produces them.

I used the SPY etf to capture the charts here because it is its' own separate vehicle not dependent on component to open in order to get a quote...a vehicle of itself,

Right off the bat I can tell you that the two events are kind of dissimilar in many aspects.

Look at the chart from back in 2008..and look at the current chart of the SPY.

Back in 2008, on the trade day before the limit down overnight, the SPY had closed 11.3% BELOW it's 200 day SMA. this year, down 4.9% from its 200 sma.

Lots of difference, like volume on the day of the event versus volume on the deadcat bounce day (dead cat bounce day for current market is today, AUG 25)

We have to see how big the volume is today, if it is going to follow the pattern of 2008, the volume should be higher, but as I have stated, the only reason I looked at the 2008 data is becuase that is the last time I remember having an overnight Locked LImit Down in the ES.

Plenty of differences, I can't enumerate them all, I primarillly just wanted to see what the chart looked like after the last O/N locked Limit DOwn...

The huge, enormous amount of volume generated on AUG 24 looks out of whack wityh the volume from back in 2008.

Look how close the 50 day SMA and the 200 day sma are currently versus the spread they had back in 2008.

One thing I did remember about 2008, was that eventually, (it turned out to be the 37th trade day later) the SPY actually came back and printed at the open price it had on the RTH that followed the ES's Locked Limit Down of Jan22, AND LOOK AT WHAT THE VOLUME DID O/N THAT RETEST BACK IN 2008, IT WAS THE DOWN CLOSE before THE RETEST THAT generated a volume spike, and then, on that 37th trade day later, when the SPY printed at the open of the LLD day, the volume was actually less, (but still relatively large).

the fact that the volume was smaller on the retest day relative to the day that preceded it might be a sign that on the prior down day, the weak hands vomited out their long shares, and on the day of the actual retest of the Open of the day following the Locked Limit Down overnight, it just didn't take that many willing buyers to overpower the remaining sellers and lift prices because there were fewer and fewer people making offers so price was able to power higher on less willing buyers...

The labels for volume that appear in the 2008 chart are not correct... the sizes of the histograms are correct, but the volume figure flagged on the right hand side of the chart is the volume captured from yesterday (that's the way the program posts the real, current volume, it posts the most recently captured day of volume.

Here are total volume figures of relevance

volume figures are rounded

2008, day of RTH trading after overnight Locked limit down: 426 million, then next day, Jan 23 RTH, (the deadcat bounce day), volume was bigger at 512 million

2008, 36th trade day after Locked Limit Dow, (weak hands vomit) vbolume was 485 million

2008, on the 37th trade day after the locked limit down, rebound volume was 405 million

2015, yesterday, AUg 24, 2015, day of trading following the overnight Locked Limit Down had 507 million in volume for SPY

Obviously history never repeats itself exactly, there are elements of then and now that have their own importances. I just wanted to refresh my memory about what what had happened after the last Overnight ES Locked Limit Down.

Hopefully I can get the charts up in the next post.

Dead Cat bounce would be today for the current market.

Here is SPY chart from 2008 (the last time I remember an overnight Locked limit down for the ES.

I have dragged and dropped the picture of 2008 here, and I'll see whether it came up.

I have dragged and dropped the picture of 2008 here, and I'll see whether it came up.

OK, DT, thanks for changing the titles of reply to topic etc, at top of forum, much easier to understand and this time zip zip zip, chef of the future, I was able to drag the charts into the pages.

Here is the current SPY view of the trade day AFTER an overnight session of ES Locked Limit Down,

Red '+' line = 200 day SMA

Blue '+' line = 50 day SMA

Magenta solid line = 20 day SMA

notice how close they are to each other, definitely different from the 2008 Locked Limit Down trading

SO, below is right now, the SPY up to yesterday

Here is the current SPY view of the trade day AFTER an overnight session of ES Locked Limit Down,

Red '+' line = 200 day SMA

Blue '+' line = 50 day SMA

Magenta solid line = 20 day SMA

notice how close they are to each other, definitely different from the 2008 Locked Limit Down trading

SO, below is right now, the SPY up to yesterday

Thanks Paul for getting this started today and for your detailed posts! I always appreciate the detailed analysis of them.

We have been down more than 9% since Thursday so there has to be a bounce at some point and so far the O/N action is supporting Paul's theory. Now it is a matter of how the RTH session plays out.

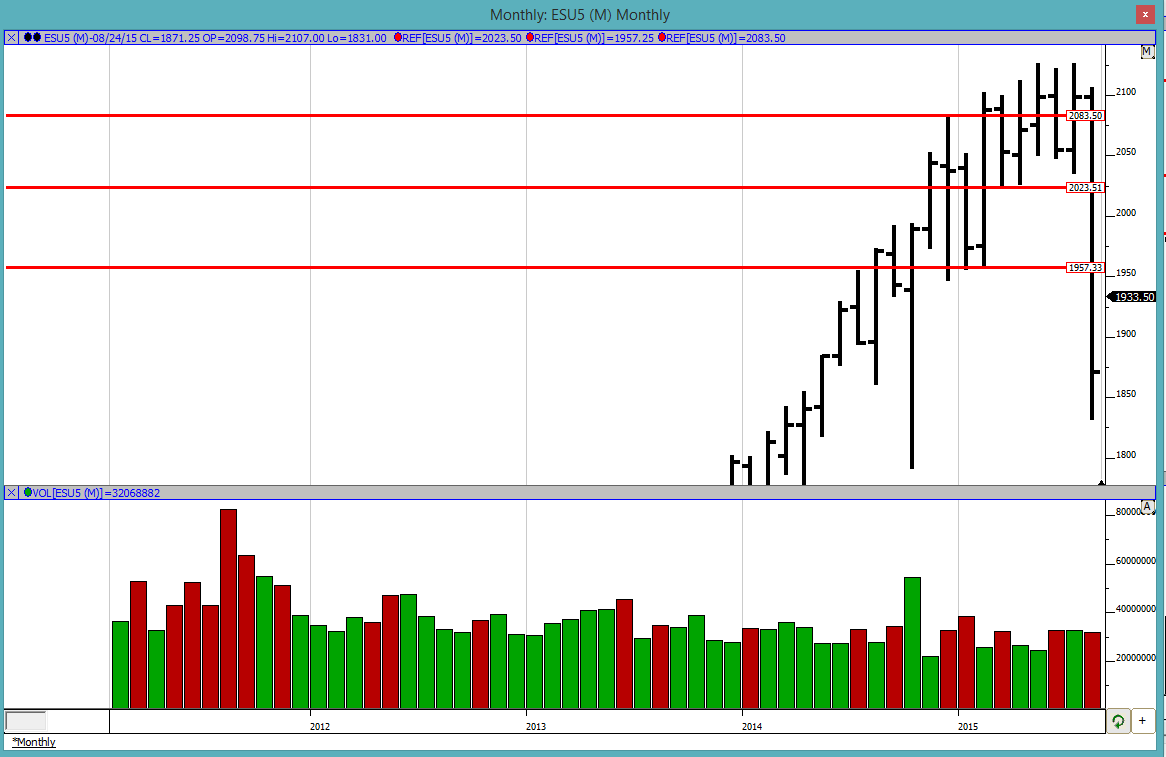

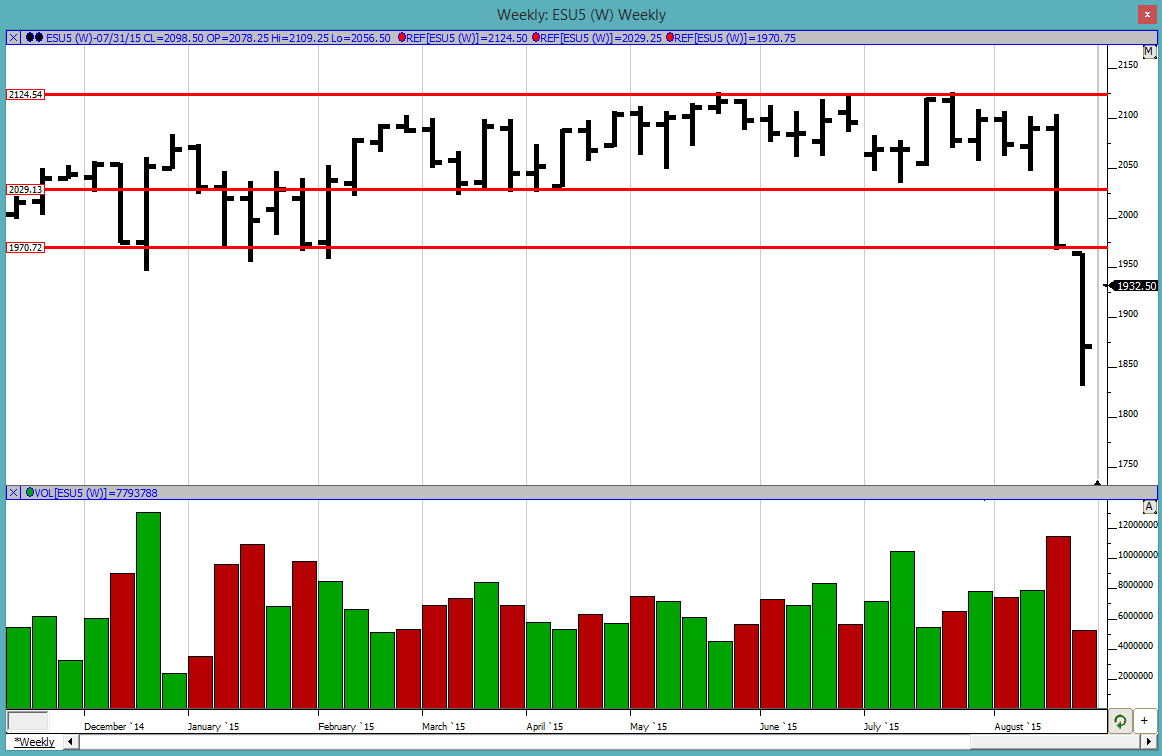

Today I would like to zoom out a bit and look at monthly, weekly and daily charts on the ES. They are pasted below with the appropriate titles on each chart. On the monthly chart we see that ~1957 is the level of the Dec, Jan and Feb lows. So it would make sense for us to test that level. We came close to testing it YD but did not quite get there. After that is the 2023 level if we can get there.

On the weekly chart we again see that 1957 level spread across multiple weeks (I have my line at 1970). If we get to that balance area then look out for 2030. These is obviously the same areas just being seen on different time frames.

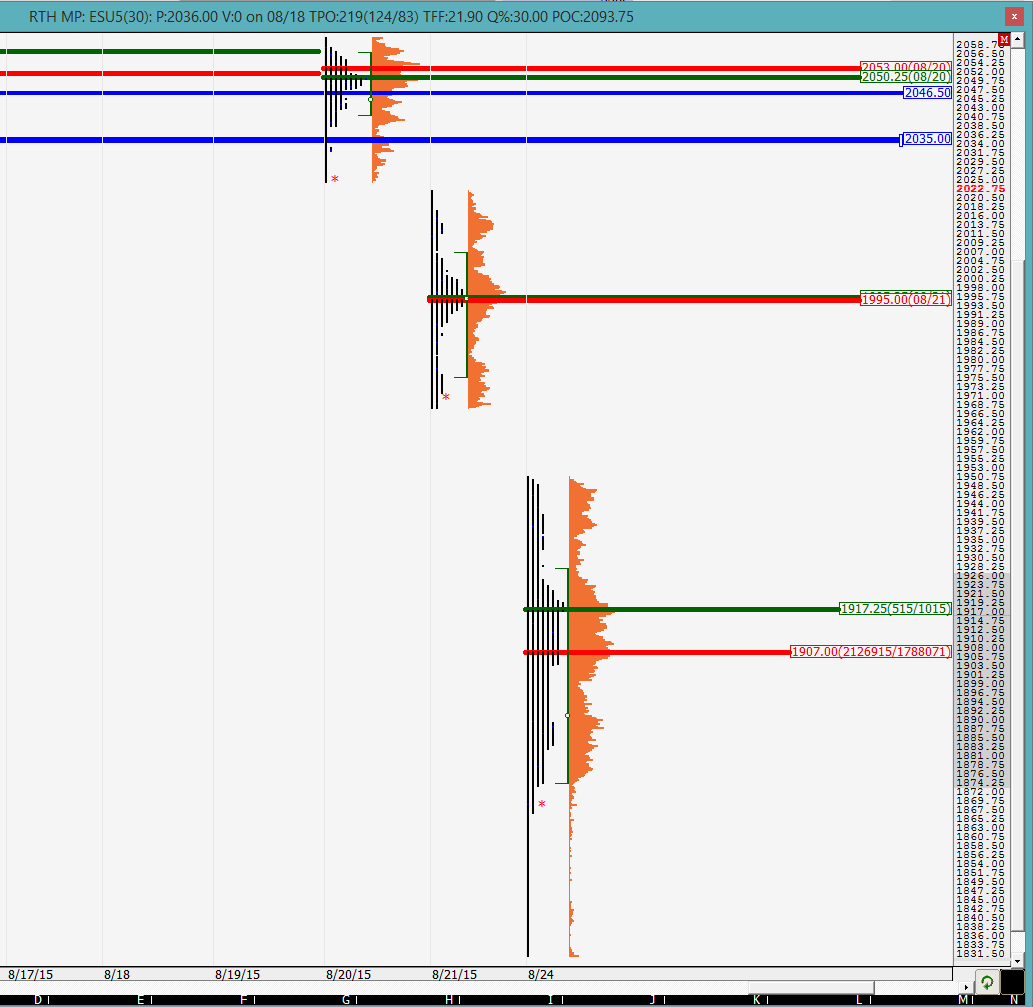

Lastly on the daily chart we again see the same levels in price. I will let the chart explain itself.

Profile:

The chart below is the best I could do to, to be able to see the profile completely. We can see that we have VPOCs at 1907, 1995 and 2053. I am going to focus on these because they make more sense than greenies at the moment. We have a gap from YD that extends from 1950.75 to 1968. 1968 was the low from Friday and that was a poor low being 2 TPOs wide.

Good luck to all and stay safe. Not sure what these whacky markets will bring to us. The swings could continue being wild today.

We have been down more than 9% since Thursday so there has to be a bounce at some point and so far the O/N action is supporting Paul's theory. Now it is a matter of how the RTH session plays out.

Today I would like to zoom out a bit and look at monthly, weekly and daily charts on the ES. They are pasted below with the appropriate titles on each chart. On the monthly chart we see that ~1957 is the level of the Dec, Jan and Feb lows. So it would make sense for us to test that level. We came close to testing it YD but did not quite get there. After that is the 2023 level if we can get there.

On the weekly chart we again see that 1957 level spread across multiple weeks (I have my line at 1970). If we get to that balance area then look out for 2030. These is obviously the same areas just being seen on different time frames.

Lastly on the daily chart we again see the same levels in price. I will let the chart explain itself.

Profile:

The chart below is the best I could do to, to be able to see the profile completely. We can see that we have VPOCs at 1907, 1995 and 2053. I am going to focus on these because they make more sense than greenies at the moment. We have a gap from YD that extends from 1950.75 to 1968. 1968 was the low from Friday and that was a poor low being 2 TPOs wide.

Good luck to all and stay safe. Not sure what these whacky markets will bring to us. The swings could continue being wild today.

Originally posted by PAUL9

the S&P 500 creates a theoretical opening for the RTH session based on information available... On a day with a huge price dislocation, many components of the S&P 500 will have delayed openings, they just do not trade at the opening bell as specialists review their resting order books to try to figure out how much risk they want to take on anbd at what prices they have resting buy orders... that's another story... the bottom line is all components of the S&P 500 do not open when the opening bell rings...

But the public wants a reading on the S&P 500 index when the market opens...So, if only one single component of the S&P 500 starts trading, the index will be calculated using that opening price and then combine it with the prior day's closing prices of all the other 499 components...Whatever gets produced as an index level is obviously not representative of the entire index, it represents one current price and 499 day old prices... eventually all the components will open and there will be a real price for the index, but historical charts only capture the price levels generated as "the index" produces them.

I actually had CNBC on TV YD at the RTH open and I they mentioned that not all stocks had been opened. They said that they "manually open" some stocks on days like these. Even after 10 or 15 mins post-open, some stocks were not open. This was the first time I had heard that and was surprised by it.

FWIW, the commentary on CNBC was along the lines of that reality today was not as bad as it was in 2008 but the market was reacting that way. I do not put a lot of importance on what the talking heads say but just thought I would put it out there.

Of course for us, all that should matter is price action. The rest is all bogus and just talk. If the bounce started in the O/N session is to be sustained then look for continuation higher towards some of the other prices mentioned earlier. The O/N inventory is currently 100% long, so will the market want to correct it or just keep moving up as folks find these prices to be bargains?

Of course for us, all that should matter is price action. The rest is all bogus and just talk. If the bounce started in the O/N session is to be sustained then look for continuation higher towards some of the other prices mentioned earlier. The O/N inventory is currently 100% long, so will the market want to correct it or just keep moving up as folks find these prices to be bargains?

that's one of the reasons why the exchange (CME) was not able to produce a VIX until 25 minutes into the session. The S&P 500 options specialists had to go through opening rotation for the options in order to produce a VIX reading, it took a while.

I am done for the day, good luck to all.

I am done for the day, good luck to all.

looks like there is an adjustment of the O/N inventory going on right now. if the buyers come in and take out O/N high and YD high, then that would bring more confidence and more buyers in

one other thing to note was that ONH could not take out YD high, so that is something to be noted even though YD's high was so far from the close

30 min VPOC was 1932 and it has already been touched

we are one time framing lower so be careful on going long

no success yet. if they dont manage to take it out and are still hovering around it, expect a late day collapse when the buyers throw in the towel... its just a race to who gives up first

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.