ES Tuesday 8-18-15

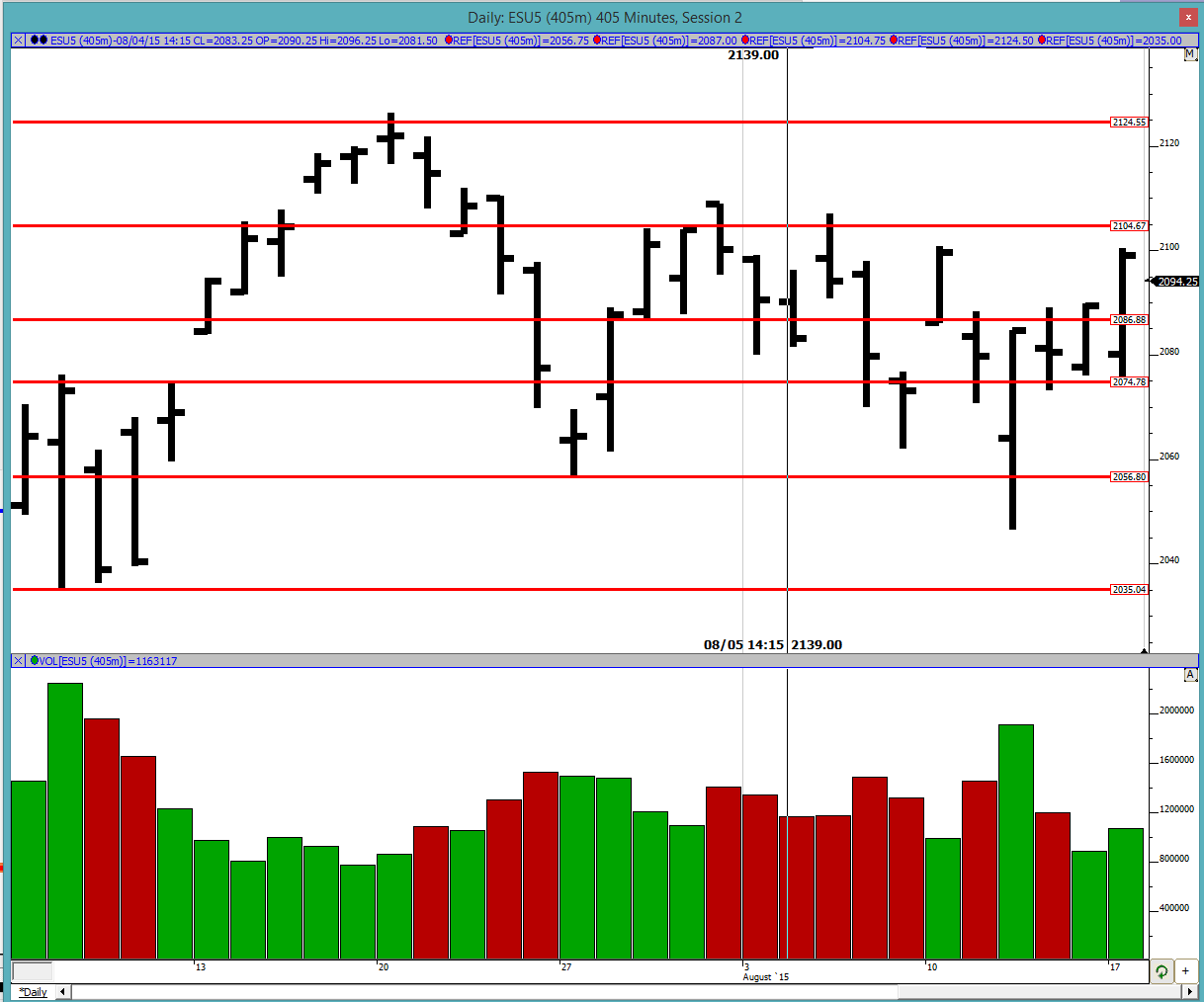

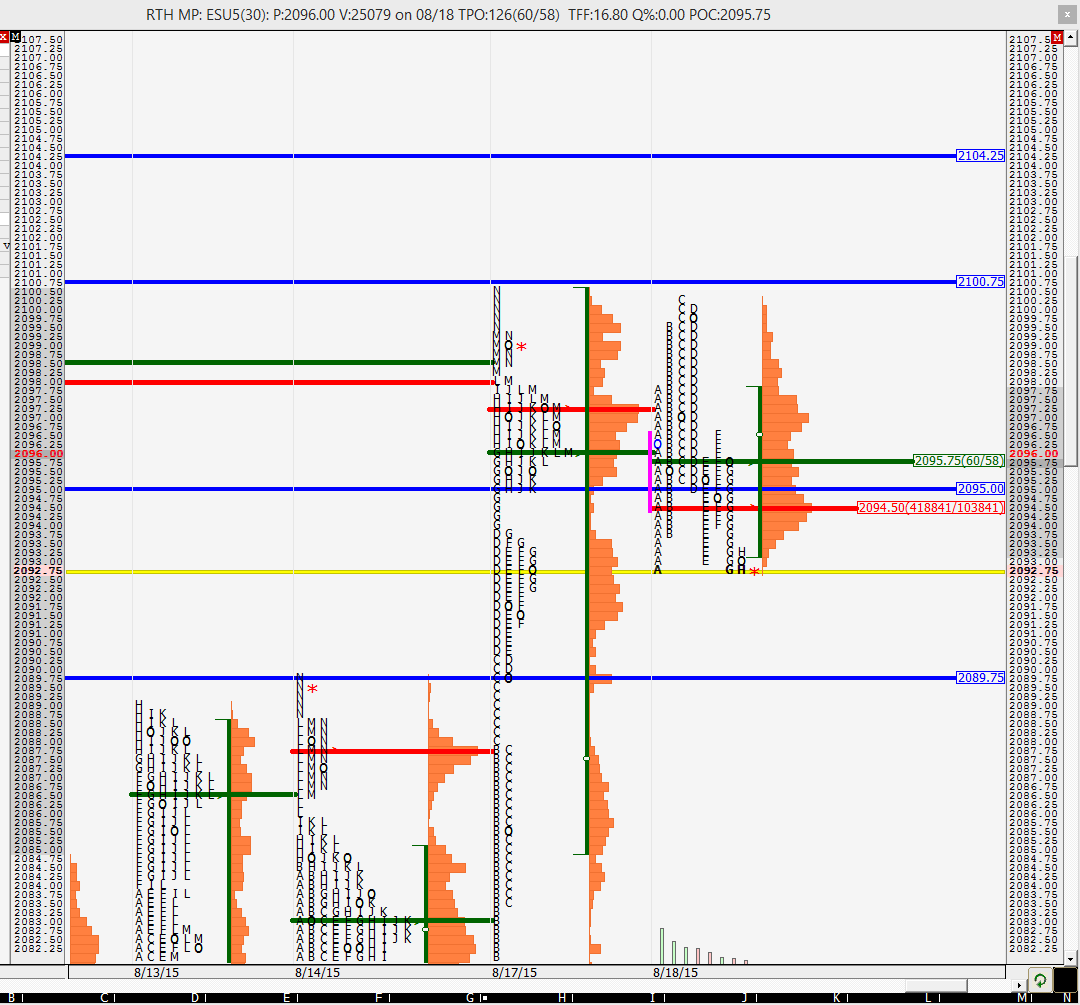

Good morning to all. We continue being in the larger trading range but broke out of the 2-day balance to the upside. As noted in the comments YD, the market attempted to break out to the downside, did not quite get there, and instead broke out to the upside. We came to within 1 tick of last week's (and 8/10's) poor high making that high more poor. So we should expect that to be cleaned up at some point. The stopping point YD at the high was very mechanical. Today we see if the market can get to 2104.75 and close above it or if we fall back into the larger trading range.

Greenies (past naked developing VPOCs): 2051.5, 2053.75, 2097.25, 2104.25, 2112.75, 2118.75 and 2123.5

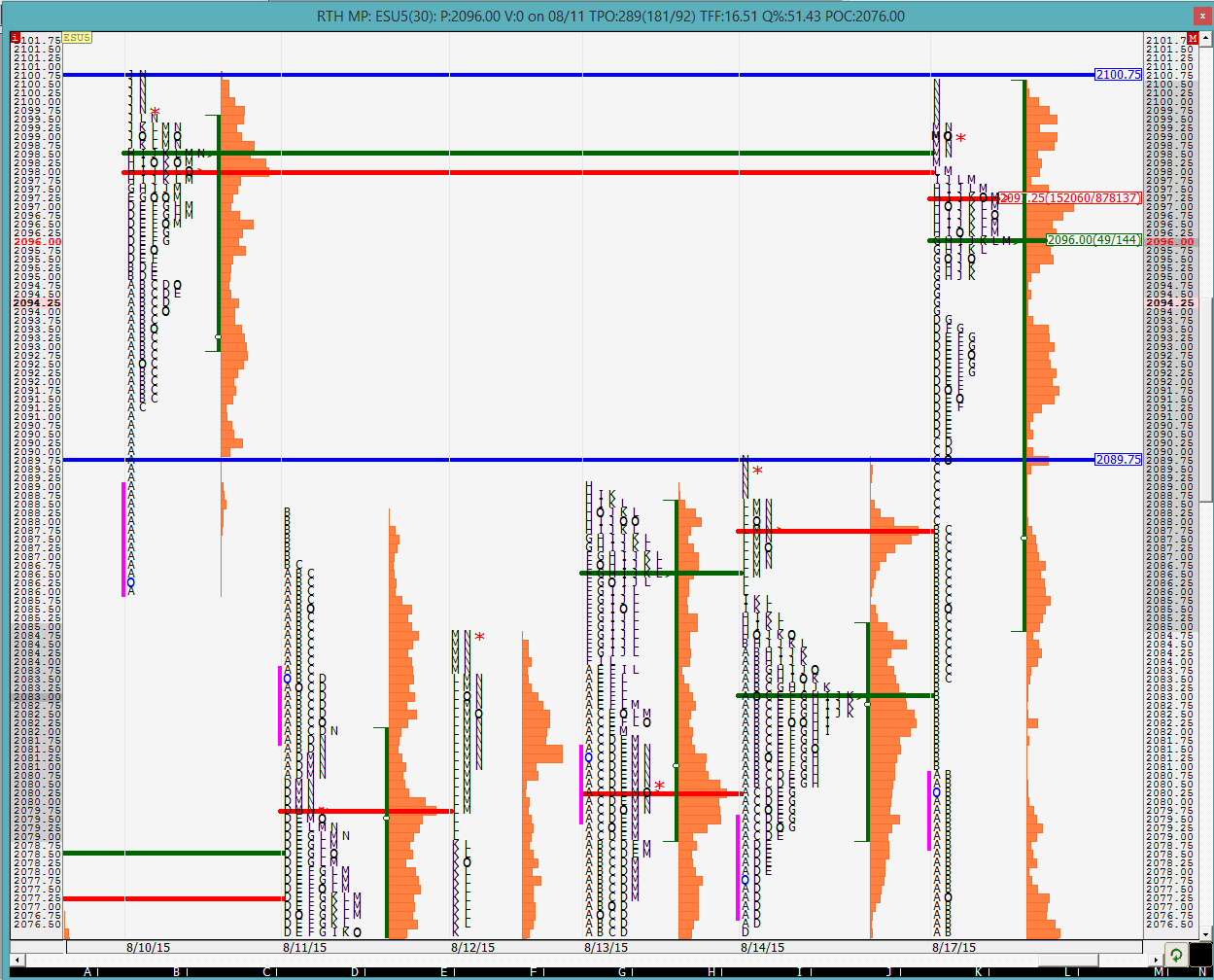

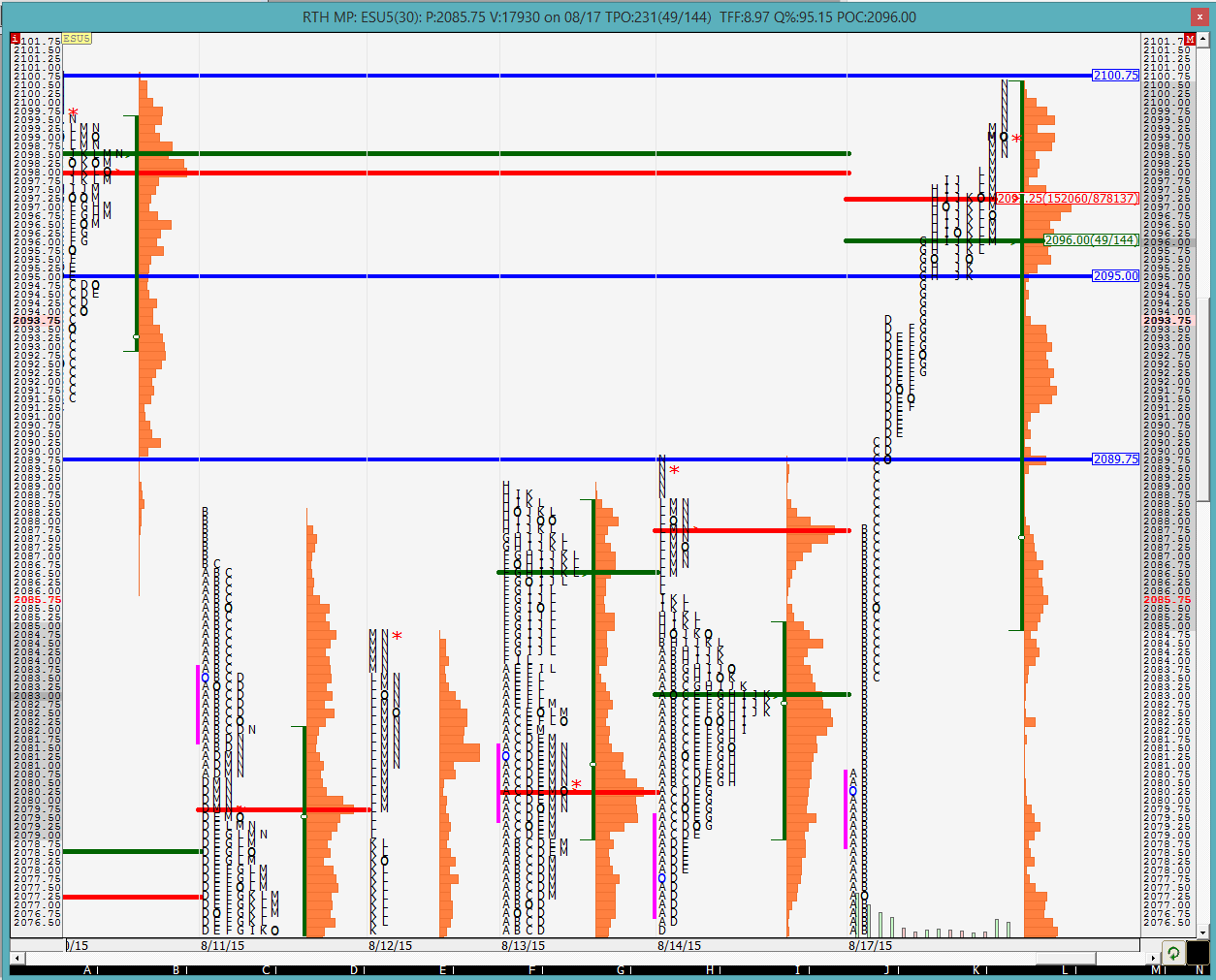

Profile: As alluded to in the comments YD, the profile was very stretched out. I count 5 distributions which is just very ugly. For those unfamiliar with the terminology, a distribution is separated by single prints. Therefore we expect these to be cleaned up over time. In the picture we can also see how YD's high coincides with the poor high from 8/10 so expect that to be repaired at some point as well. For continuation to the upside we would need to stay above the previous 2-day balance area high of 2089.75 as well. Look for some back and forth action before tomorrow's Fed meeting minutes.

On the split profile we can see that 2095 was the pull back low in H, J and K periods so that is an important line in the sand in addition to the levels mentioned earlier. 2089.75 continues to be marked. The VPOC and POC were on the upper end of YD.

The O/N inventory is fairly balanced with a majority of the action taking place inside YD's range. Currently we are closer to the ONL but we still have almost 90 mins to the open.

Good luck trading to all.

Greenies (past naked developing VPOCs): 2051.5, 2053.75, 2097.25, 2104.25, 2112.75, 2118.75 and 2123.5

Profile: As alluded to in the comments YD, the profile was very stretched out. I count 5 distributions which is just very ugly. For those unfamiliar with the terminology, a distribution is separated by single prints. Therefore we expect these to be cleaned up over time. In the picture we can also see how YD's high coincides with the poor high from 8/10 so expect that to be repaired at some point as well. For continuation to the upside we would need to stay above the previous 2-day balance area high of 2089.75 as well. Look for some back and forth action before tomorrow's Fed meeting minutes.

On the split profile we can see that 2095 was the pull back low in H, J and K periods so that is an important line in the sand in addition to the levels mentioned earlier. 2089.75 continues to be marked. The VPOC and POC were on the upper end of YD.

The O/N inventory is fairly balanced with a majority of the action taking place inside YD's range. Currently we are closer to the ONL but we still have almost 90 mins to the open.

Good luck trading to all.

we are now at 97.25 which was YD's VPOC

multiple times through the open is a sign of indecisive market

so far we looked at the VPOC from YD and the market has rejected it.

5 pt range on the first 30 mins.. not much to speak of

unable to take out ONL so far after multiple tries

more mechanical selling near the current high of the day

looks like market is shooting for cleaning up YD's and 8/10's poor high

not much happening yet.... seems like the market is trying to digest the large move from YD

market is trying to clean up that poor high. the current high is even more weak so high odds of that being taken out

poor high and poor low now in place...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.