ES Friday 8-14-15

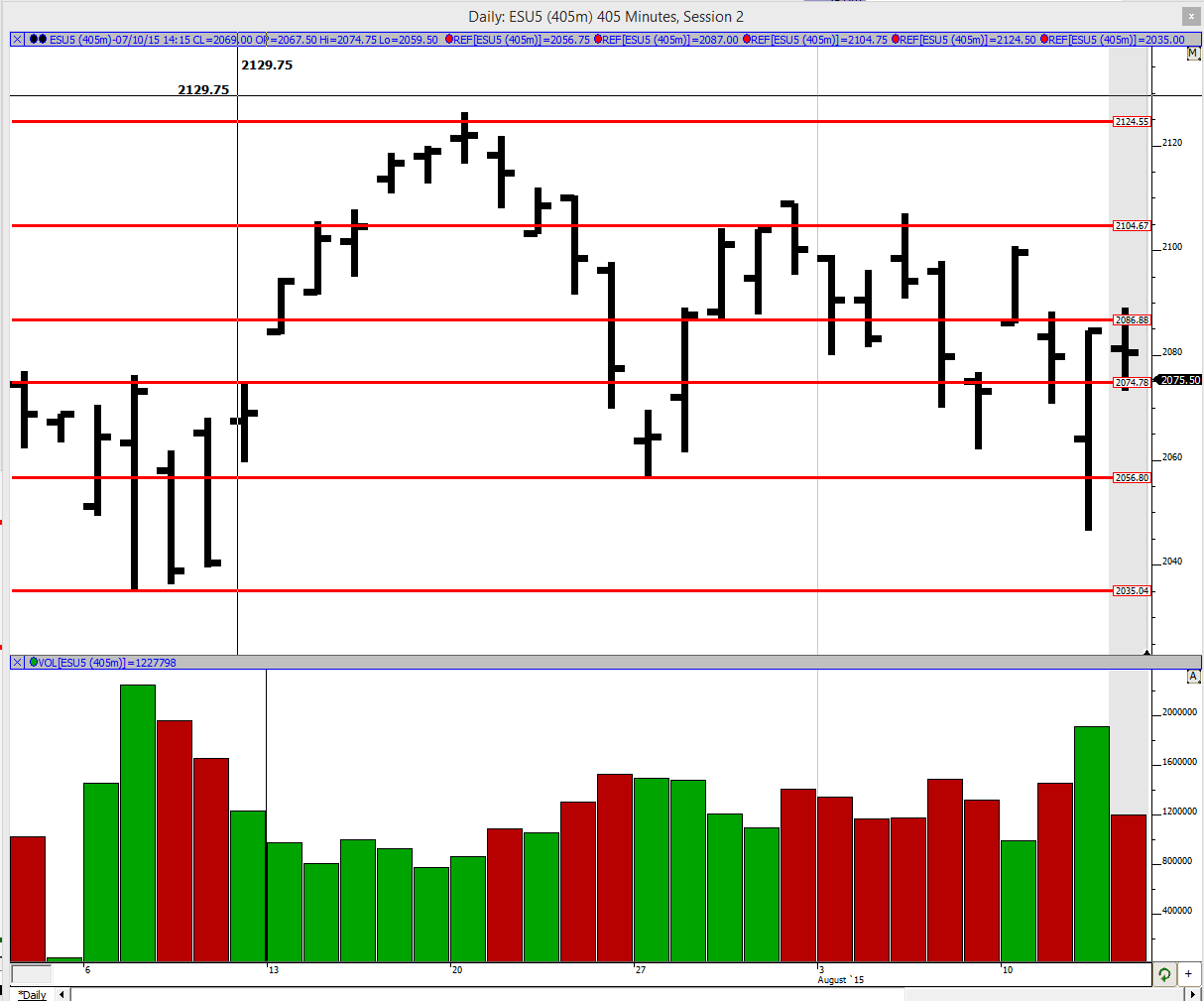

Good morning to all. Thursday was a balancing day after the large move up. The close of the day was near the open likely because the market needed to digest the large move on Wednesday. We continue trying to break out of this trading range and we shall see if that gets us anywhere on this Friday. Also we did not really hit any greenie on Thursday so that was an oddity to note.

Greenies (past naked developing VPOCs): 2051.5, 2053.75, 2077.25, 2088, 2090.25, 2092.75, 2096.75, 2098, 2104.25, 2112.75, 2118.75 and 2123.5

Profile:

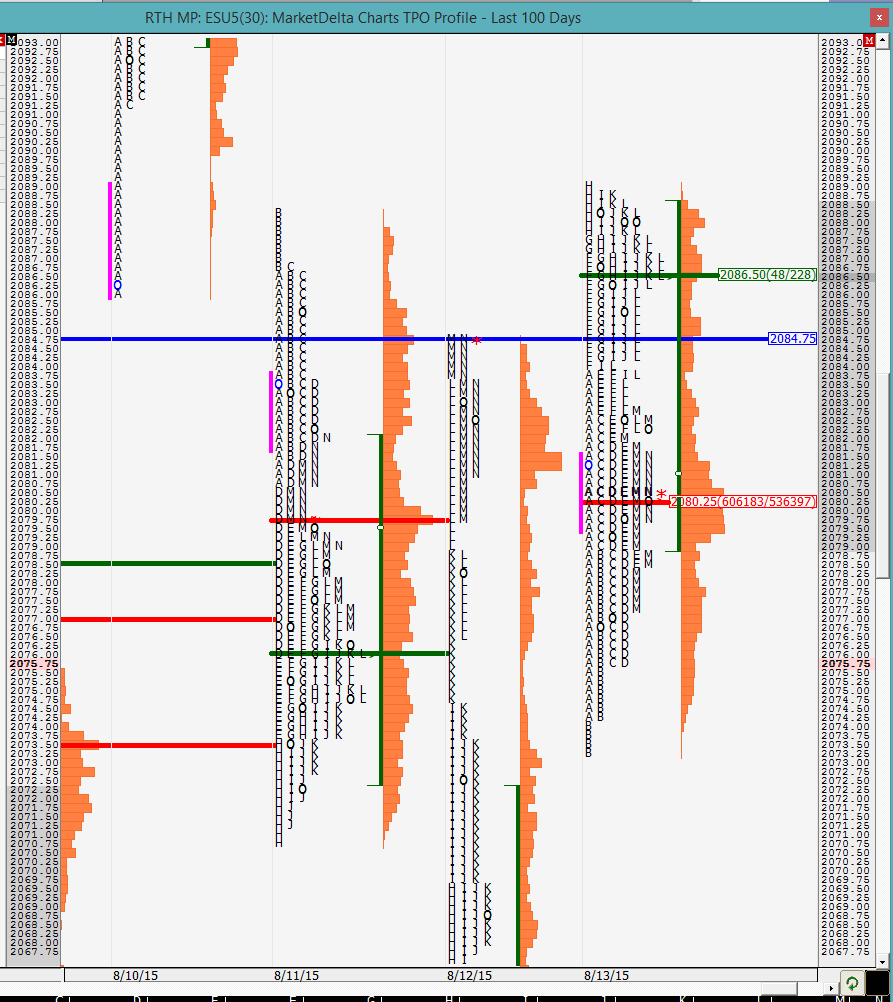

YD we made a note that there were 2 poor highs on the upper side. We ended up cleaning the one from 8/12 but left another one YD. Now we have poor highs on 8/10 and 8/13. The POC on the day ended up farther than the VPOC with the volume towards the mid-pt of the day. We can see that the market could not break above 8/11 highs by much. Was this weak selling? I am not too sure. One could look at it as that there were no new buyers there, which is not the greatest bullish sign. The profile itself is rather jagged with anomalies scattered throughout the day.

On the lower side if we are to break through YD's lows, there is not much until the VPOC from 8/12 at 2053.75. We will see in the split profile if there are any other references. On the upper side we have YD's highs, the remaining single prints from 8/10 and then the VPOC from 8/10 (2098) as references. These in addition to greenies could be possible turning or pausing points.

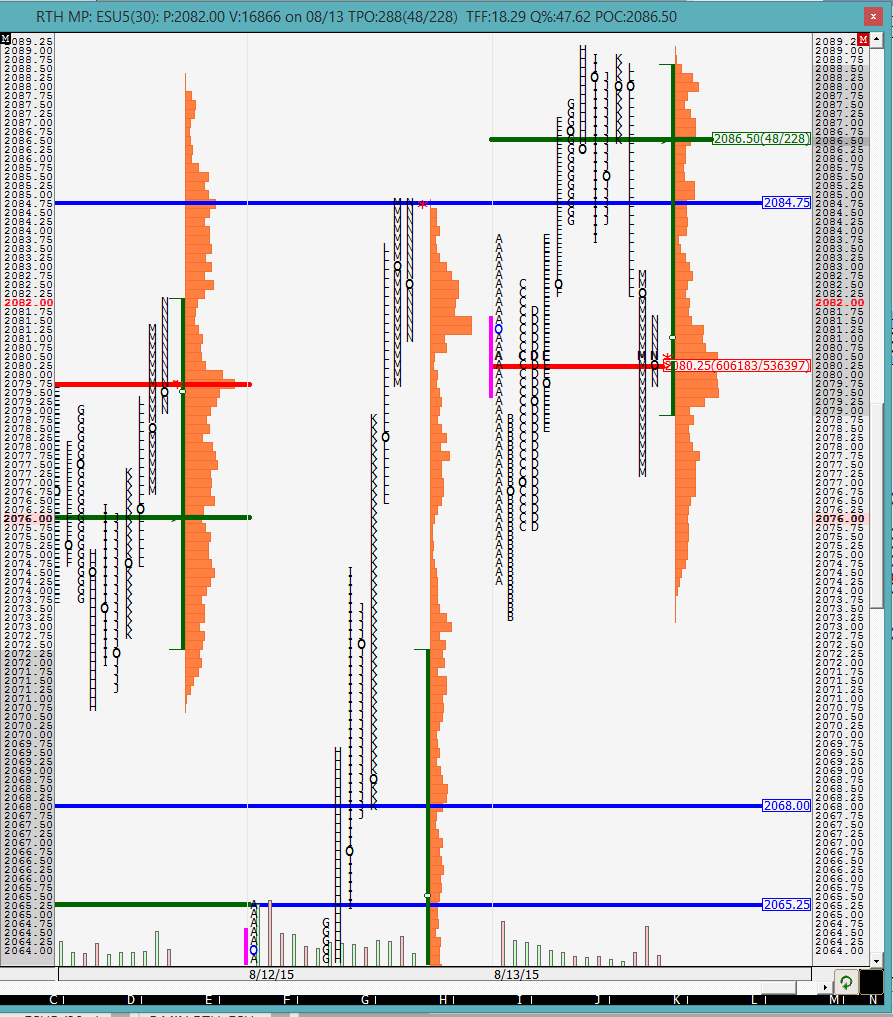

I went ahead and split both Wednesday and Thursday's profiles. For 8/12 we can see that the K and I period lows (2068 and 2065.25) could be possible turning points on the lower side. As for YD, we see that the market one time framed higher from B to H periods but then ran out of gas. When the K period high could not break through and make new highs on the day, there was a liquidation break starting from the L period. This typically happens later in the day when the buyers are not getting paid. There are a lot of folks who go flat at the end of the day and when they saw that they were not getting paid, they start liquidating and you see the action seen in L, M and N periods. You will see this time and time again.

The O/N inventory is relatively balanced. We also see that the O/N action was completely contained within YD's range. I am noting the fact that the O/N low could not break through YD's low. This could be a sign that someone is willing to defend that low. We shall see how the day unfolds.

Good luck to all.

Greenies (past naked developing VPOCs): 2051.5, 2053.75, 2077.25, 2088, 2090.25, 2092.75, 2096.75, 2098, 2104.25, 2112.75, 2118.75 and 2123.5

Profile:

YD we made a note that there were 2 poor highs on the upper side. We ended up cleaning the one from 8/12 but left another one YD. Now we have poor highs on 8/10 and 8/13. The POC on the day ended up farther than the VPOC with the volume towards the mid-pt of the day. We can see that the market could not break above 8/11 highs by much. Was this weak selling? I am not too sure. One could look at it as that there were no new buyers there, which is not the greatest bullish sign. The profile itself is rather jagged with anomalies scattered throughout the day.

On the lower side if we are to break through YD's lows, there is not much until the VPOC from 8/12 at 2053.75. We will see in the split profile if there are any other references. On the upper side we have YD's highs, the remaining single prints from 8/10 and then the VPOC from 8/10 (2098) as references. These in addition to greenies could be possible turning or pausing points.

I went ahead and split both Wednesday and Thursday's profiles. For 8/12 we can see that the K and I period lows (2068 and 2065.25) could be possible turning points on the lower side. As for YD, we see that the market one time framed higher from B to H periods but then ran out of gas. When the K period high could not break through and make new highs on the day, there was a liquidation break starting from the L period. This typically happens later in the day when the buyers are not getting paid. There are a lot of folks who go flat at the end of the day and when they saw that they were not getting paid, they start liquidating and you see the action seen in L, M and N periods. You will see this time and time again.

The O/N inventory is relatively balanced. We also see that the O/N action was completely contained within YD's range. I am noting the fact that the O/N low could not break through YD's low. This could be a sign that someone is willing to defend that low. We shall see how the day unfolds.

Good luck to all.

current high matches the O/N mid-pt... weak selling most likely

the weak selling cleaned up with newer highs

YD's VAL holding as support for now..

they are really testing that VAL. I am not sure how many more bounces it can sustain

30 min VPOC @ 79.5

we are still inside YD's range with no resolution to either side

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.