ES Wednesday 8-12-15

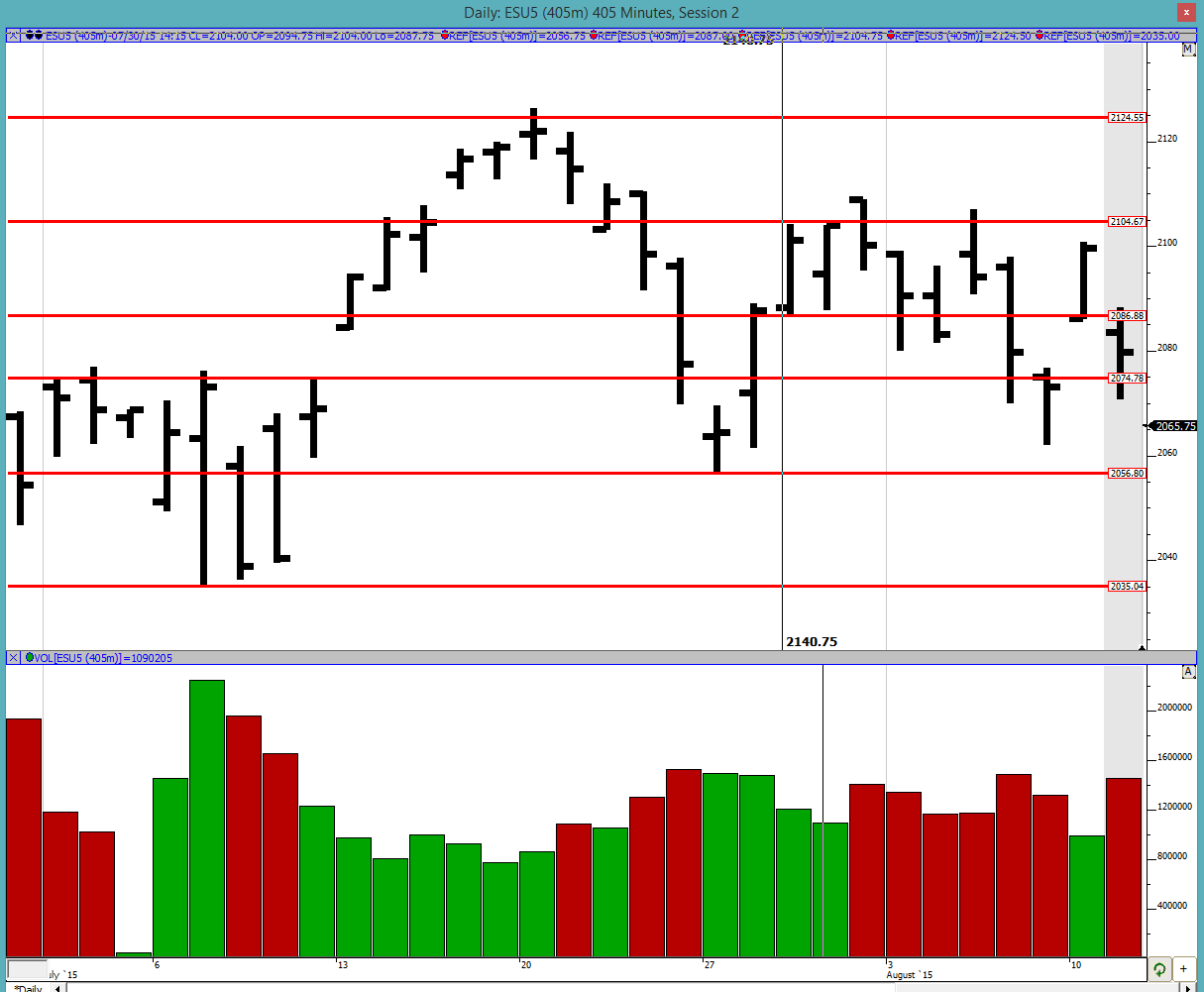

Good morning to all. Tuesday was another weak day with a strong finish. The market was unable to close outside the balance area with a strong come back towards the close. However all of that might have been negated with the weak O/N trade. 2056.75 and the O/N low are the next downside targets followed by 2035. We shall see if the markets can bounce back up or if they are going to meet those lower targets.

Greenies: 2065.5, 2077.5, 2079.75, 2084.75, 2090.25, 2092.75, 2096.75, 2098, 2104.25, 2112.75, 2118.75 and 2123.5

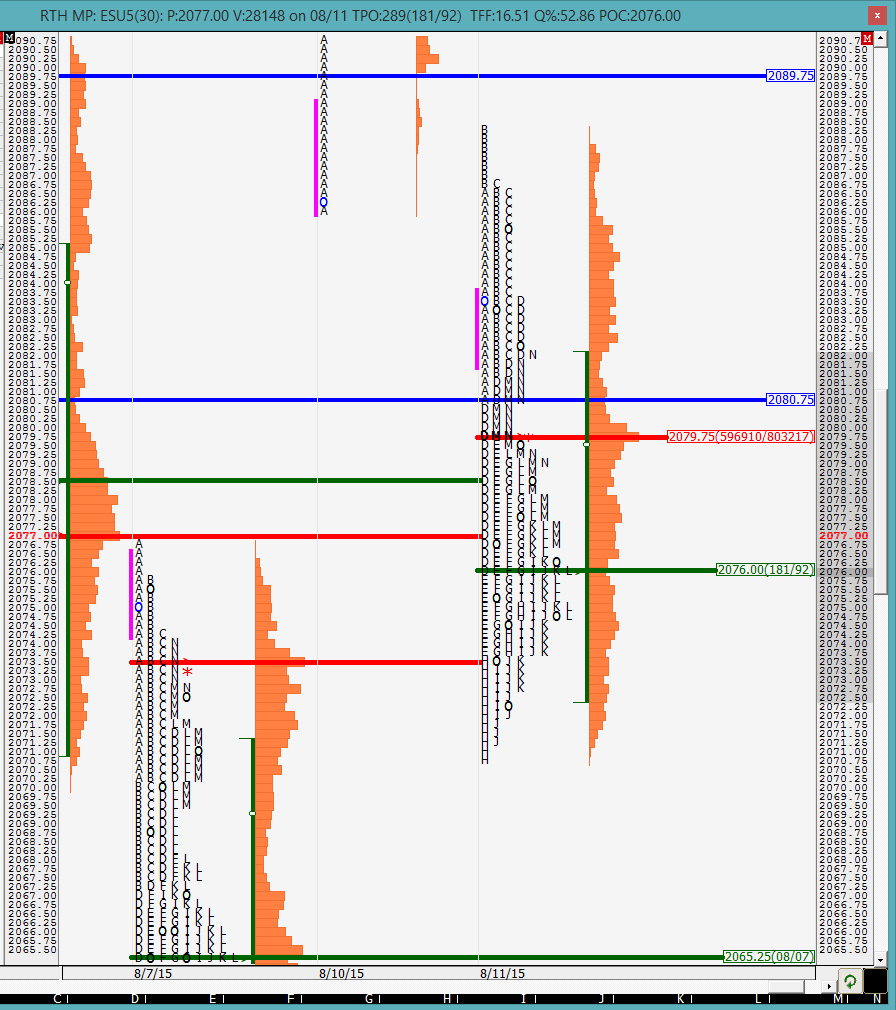

Profile: We can see that there was good excess on the highs but not the greatest on the lows. The close for the day was the same as the VPOC which was the reason for my earlier comment on the strong finish. There is a relatively prominent POC at 2076. Value was clearly lower with the gap fill. The picture below shows very nicely how the range on 8/10 was rejected. This was a typical setup for a look into range and reject trade.

On the split profile we can see how the market tried looking into the range of 8/10 in the A and B period but failed to move inside of it. C period was an inside bar and the breakout in D period was another potential setup for a short trade. We see that after J period was unable to take out the lows of the H period, the market rallied back up. If my memory is right, the VPOC was always up there in the 2080 area so the market snapped back to it towards the close.

Today we shall see how the day goes. The O/N inventory is net short. There was some action initially above YD's close but after the Asia open it was all to the downside. We did not have a test of the O/N mid-pt YD which means that there is a 95% chance we get the test today, so look out for that. The O/N has a double distribution caused by the Asia news so if prices are to move up today we would need that distribution to close. The O/N singles extend from 2071.25 to 2079.75. So if 2071.25 were to be rejected, look for a test of the O/N low at 2053.75. As of now we would open outside YD's range which is very much like the open YD so look for the same trade setup as YD i.e. look inside range and go or reject.

Lastly we look at the weekly profile and we see below that 2056.5 and 2062 are the previous weekly lows that provide a reference. A weekly naked VPOC is at 2050.5 so we have some confluence there.

Good luck to all.

Greenies: 2065.5, 2077.5, 2079.75, 2084.75, 2090.25, 2092.75, 2096.75, 2098, 2104.25, 2112.75, 2118.75 and 2123.5

Profile: We can see that there was good excess on the highs but not the greatest on the lows. The close for the day was the same as the VPOC which was the reason for my earlier comment on the strong finish. There is a relatively prominent POC at 2076. Value was clearly lower with the gap fill. The picture below shows very nicely how the range on 8/10 was rejected. This was a typical setup for a look into range and reject trade.

On the split profile we can see how the market tried looking into the range of 8/10 in the A and B period but failed to move inside of it. C period was an inside bar and the breakout in D period was another potential setup for a short trade. We see that after J period was unable to take out the lows of the H period, the market rallied back up. If my memory is right, the VPOC was always up there in the 2080 area so the market snapped back to it towards the close.

Today we shall see how the day goes. The O/N inventory is net short. There was some action initially above YD's close but after the Asia open it was all to the downside. We did not have a test of the O/N mid-pt YD which means that there is a 95% chance we get the test today, so look out for that. The O/N has a double distribution caused by the Asia news so if prices are to move up today we would need that distribution to close. The O/N singles extend from 2071.25 to 2079.75. So if 2071.25 were to be rejected, look for a test of the O/N low at 2053.75. As of now we would open outside YD's range which is very much like the open YD so look for the same trade setup as YD i.e. look inside range and go or reject.

Lastly we look at the weekly profile and we see below that 2056.5 and 2062 are the previous weekly lows that provide a reference. A weekly naked VPOC is at 2050.5 so we have some confluence there.

Good luck to all.

the high of the day and the gap close are the next upside references

new high of the day. we are now looking into the gap. next upside reference is close the gap and then the single prints from O/N mentioned earlier

well now, wasnt that lovely? closed the gap, got the O/N singles and ended positive on the day. Heck of a rally Mr.Market

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.