Open Strategies

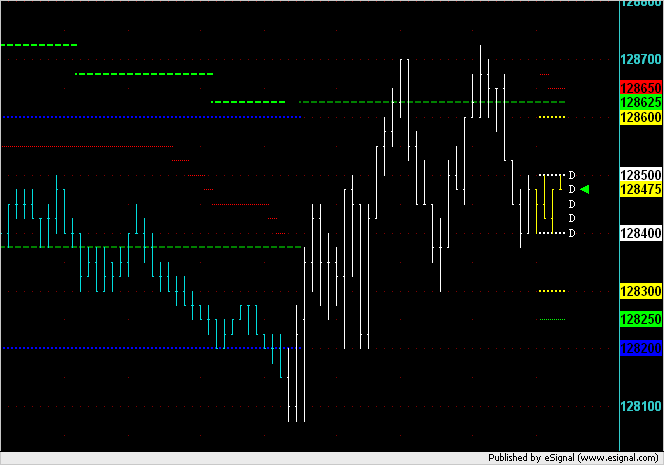

Someone made mention of the following trade setup today: When the market closes below value and the overnight session then trades up to VAL and we subsequently open at VAL then the OR trade (either direction) is a good (high probability) trade to jump on. The following chart was captured a few minutes after the market open today. It is a 3000V chart for the ES. The blue (cyan) bars show yesterday's trading, the white bars the overnight and the yellow bars today's open. The dashed green line is the VAL (final DVAL from yesterday shown as a lime dashed line.)

The exact rule is: Market needs to open within 1 point either side of VA extreme and within 5 ticks of Globex extreme made after 9am. (So this morning did not qualify for this rule.)

The exact rule is: Market needs to open within 1 point either side of VA extreme and within 5 ticks of Globex extreme made after 9am. (So this morning did not qualify for this rule.)

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.