ES Friday 7-24-15

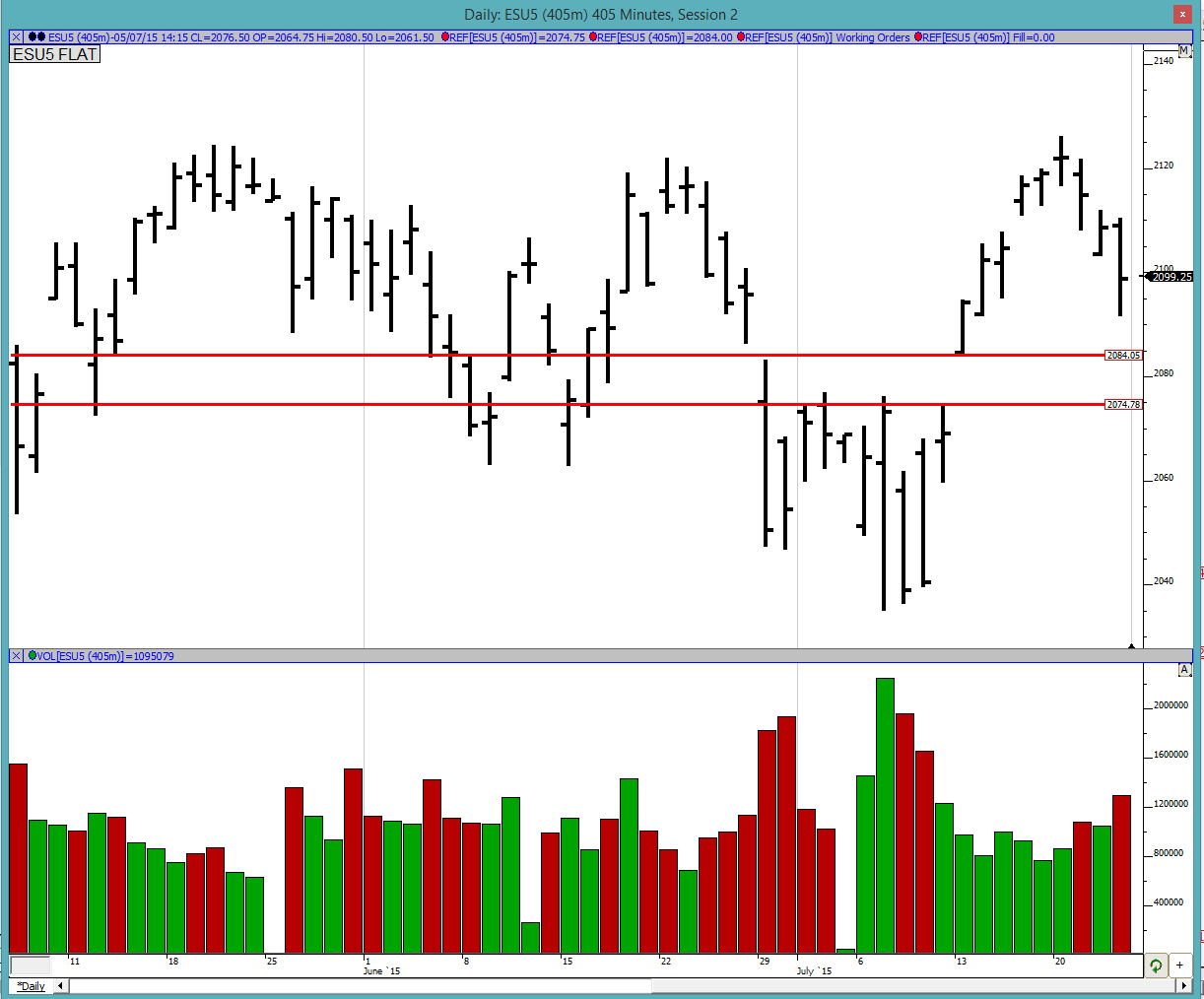

Good morning to all. YD was another down day with value clearly developing lower. Below is a daily bar chart so we can see the action. We can see that we have been one time framing lower since hitting all time highs. Apart from the greenies, we can see that 2084 is the top of the gap and after that there is a gap till 2074.75. This is likely where the market could potentially pause after 3 days of fairly heavy selling. If we did close the gap eventually then we would reenter the lower balance area below 2074.75. Else, we the buyers could potentially defend this gap and try taking the market back up to break above the triple top we currently have. This is where we are going to have to read the market action.

Greenies: We have a new greenie from YD at 2097.5, our original one at 2088/89 and after that is the large gap mentioned below.

On the upside, the next greenie is at 2108.25 and 2112.75

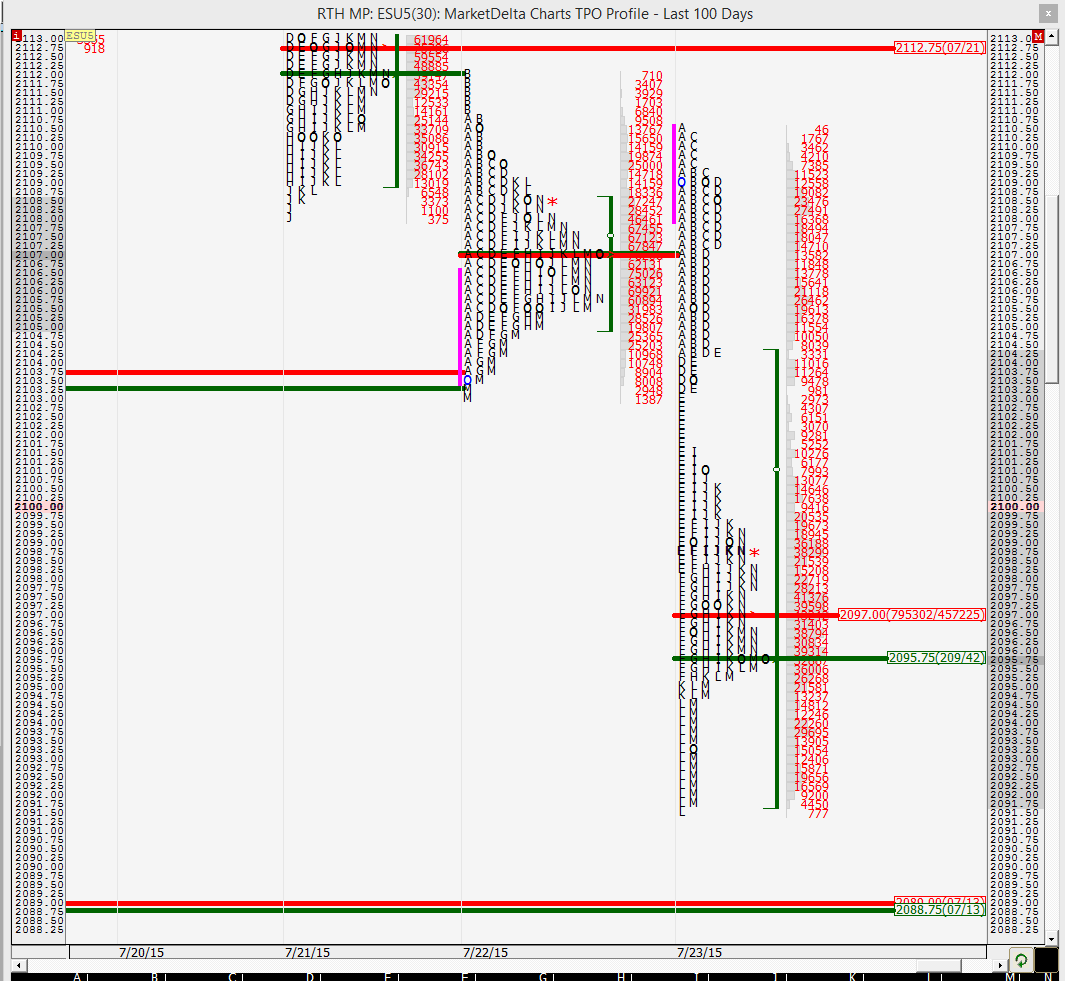

Profile: As can be seen below, YD was a double distribution day separated by the single prints in the E period. If today's action is below the top distribution (2102) then the bears are likely to be in control and try reaching at least the top of the gap. Else it would be the bulls and they would try shooting for the greenies up there.

We can also see that we had both poor highs and poor lows YD with just 1 tick of excess on both extremes. This indicates that the day time frame traders are still firmly in control and no big money has come in yet. This means that profile references will continue being strong.

Also as mentioned earlier, the VA was clearly lower for the 3rd consecutive day so that should be noted as well.

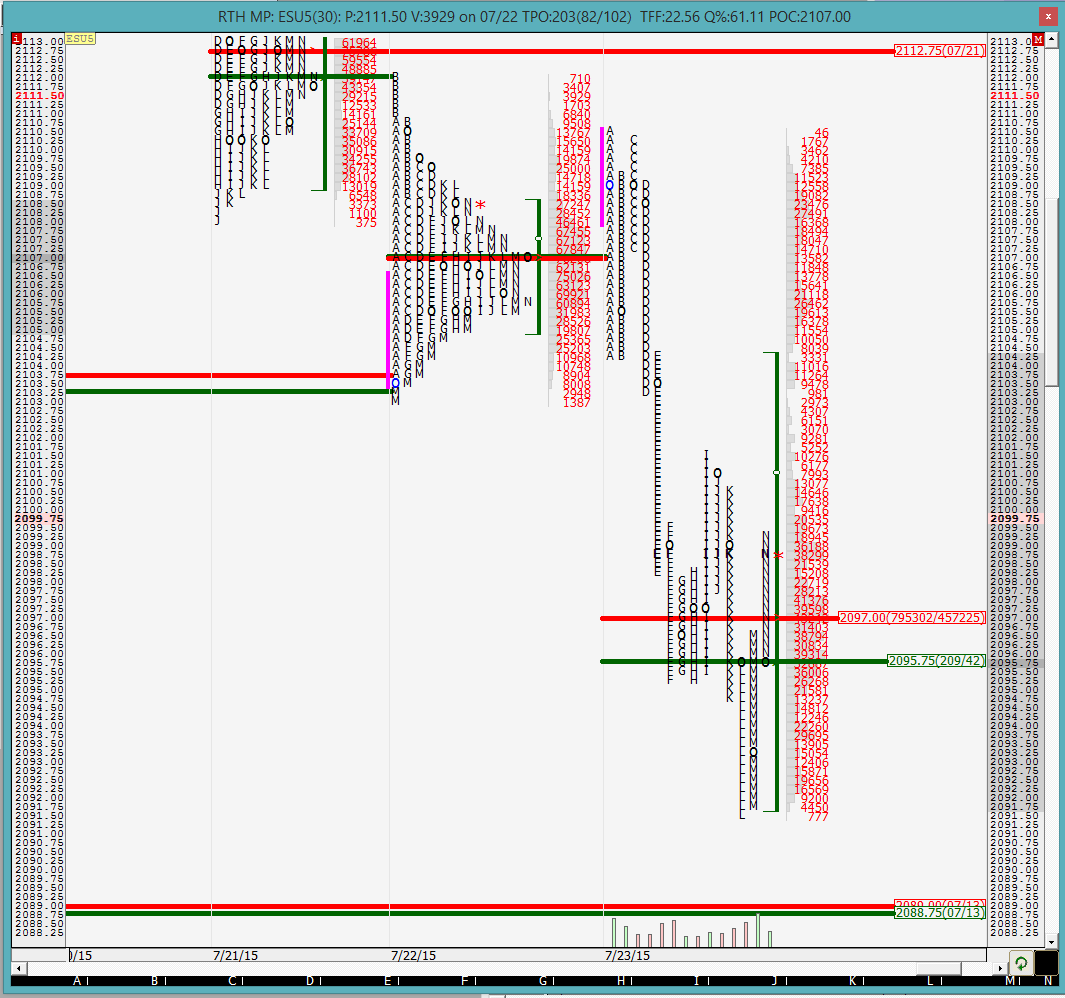

Below is a picture with the profile split. We can see that the I period high came close to closing the double distribution but failed. This level is going to be important today on what happens with the market as this is the line in sand that the sellers have drawn. This is 2101.5. So couple this with 2102 and form a band.

The O/N action thus far is fairly balanced but leaning more towards the long side. Also the O/N action has been completely within YD's VA with not much changing while the market was closed.

Look out for those greenies and good luck to all. I will try posting as much as I can during the day.

Greenies: We have a new greenie from YD at 2097.5, our original one at 2088/89 and after that is the large gap mentioned below.

On the upside, the next greenie is at 2108.25 and 2112.75

Profile: As can be seen below, YD was a double distribution day separated by the single prints in the E period. If today's action is below the top distribution (2102) then the bears are likely to be in control and try reaching at least the top of the gap. Else it would be the bulls and they would try shooting for the greenies up there.

We can also see that we had both poor highs and poor lows YD with just 1 tick of excess on both extremes. This indicates that the day time frame traders are still firmly in control and no big money has come in yet. This means that profile references will continue being strong.

Also as mentioned earlier, the VA was clearly lower for the 3rd consecutive day so that should be noted as well.

Below is a picture with the profile split. We can see that the I period high came close to closing the double distribution but failed. This level is going to be important today on what happens with the market as this is the line in sand that the sellers have drawn. This is 2101.5. So couple this with 2102 and form a band.

The O/N action thus far is fairly balanced but leaning more towards the long side. Also the O/N action has been completely within YD's VA with not much changing while the market was closed.

Look out for those greenies and good luck to all. I will try posting as much as I can during the day.

drove right to the low of YD. that was a fast drop.. they did lean against that 2101.5 number hard and drove it down

so far YD's low has been defended but does not look very confident

looks like they are going in and filling in some of those low volume spots..

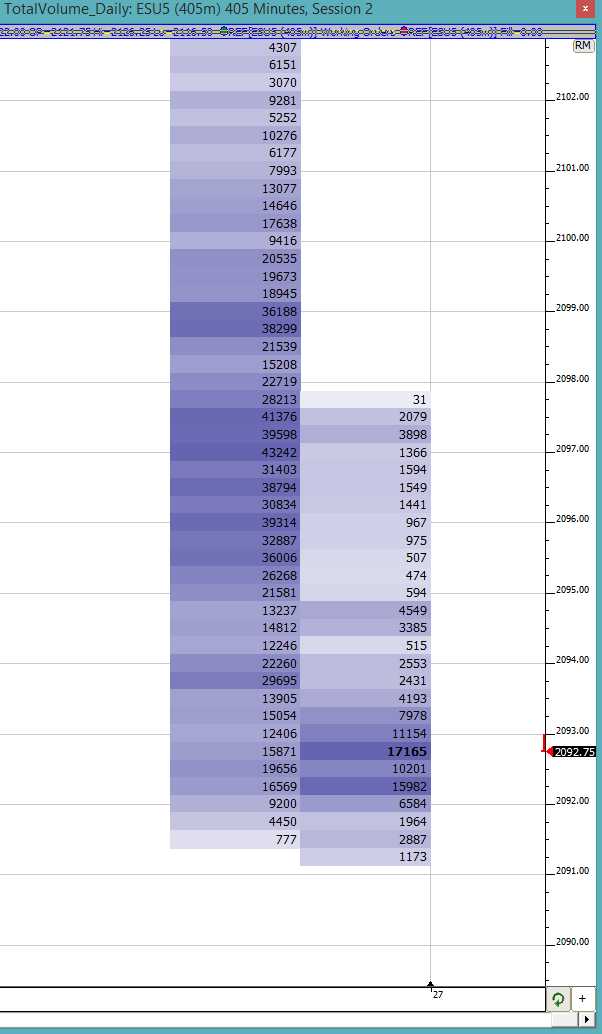

30 min VPOC at 2092.75 as well as today's low combined with YD's low forms a poor low. There was mechanical buying at YD's low it appears

and boom, we hit the 30min VPOC. Shout out to Bruce for that handy tip!

The lows still need to be cleaned up

The lows still need to be cleaned up

We have hit the greenie at 88/89. Next stop would be the top of the gap at 84 and then the gap close itself. That should pretty much be the end of the trading day for me. This is likely my last post since no one else is around to have a conversation with and I have exhausted my analysis for the day

good job nk..keep it up lots of lurking here..soon you be making video..

Awesome work NewKid - very impressive analysis. As duck says, soon you'll be BruceM #2!

Thanks guys. There is only one Bruce and I miss him! Hope he comes back soon

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.