ES Tuesday 7-21-15

Good morning to all. We have been one time framing for 8 consecutive days. This means that for 8 days we have not had a single day where the low of the day was lower than the previous day's low. This has been quite a sprint to new all time highs and it has to get exhausted at some point. Is that going to happen today? This move up has not been the healthiest because it has left some gaps, some untouched prominent POCs and in general a lot of anomalies. Having said that, the move up is not over until we at least stop one time framing. The market needs to pause and collect itself otherwise all this is simply bluster without substance.

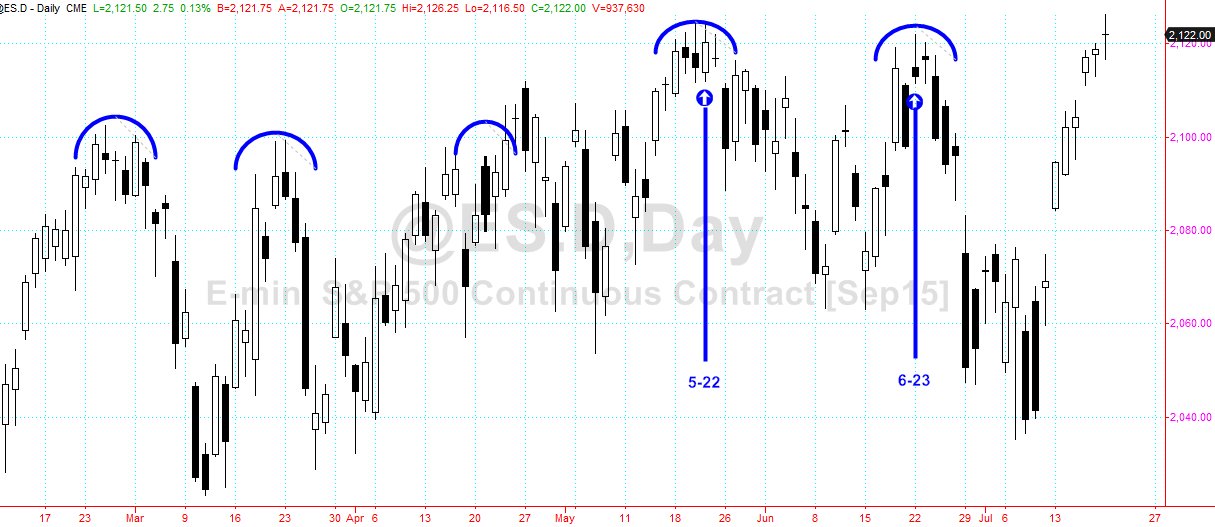

After YD's action, we essentially have a triple top formed between the highs of 5/20/521, 6/22 and 7/20. Sounds like once a month we are getting up there!

This all sounds very bullish because this is the third time we have reached this level so it would make sense that it would give away eventually. But this with everything mentioned in the first paragraph, I am not sure how bullish to be.

Today should be a telling day one way or the other. The healthiest action would be to take a pause and retreat a bit and then take out the highs convincingly with new money rolling in. As of now there is no new evidence of big money rolling in with all the action coming off of day time references.

The low of 7/20 was at the half-back (50% point) of 7/17. That makes it a weak low. Also the prominent POC of 7/17 has not been visited either in RTH or in the electronic session. Current O/N inventory is fairly neutral.

Good luck to all. I will post a little bit today and will take off after a couple of hours.

After YD's action, we essentially have a triple top formed between the highs of 5/20/521, 6/22 and 7/20. Sounds like once a month we are getting up there!

This all sounds very bullish because this is the third time we have reached this level so it would make sense that it would give away eventually. But this with everything mentioned in the first paragraph, I am not sure how bullish to be.

Today should be a telling day one way or the other. The healthiest action would be to take a pause and retreat a bit and then take out the highs convincingly with new money rolling in. As of now there is no new evidence of big money rolling in with all the action coming off of day time references.

The low of 7/20 was at the half-back (50% point) of 7/17. That makes it a weak low. Also the prominent POC of 7/17 has not been visited either in RTH or in the electronic session. Current O/N inventory is fairly neutral.

Good luck to all. I will post a little bit today and will take off after a couple of hours.

This is a test. I went to Reply to topic at the top of the page but it took me to a page that said CREATE TOPIC.

I want to see whether this posts to the Tuesday Jul 21 ES page.

I want to see whether this posts to the Tuesday Jul 21 ES page.

looks like it did

Originally posted by PAUL9

This is a test. I went to Reply to topic at the top of the page but it took me to a page that said CREATE TOPIC.

I want to see whether this posts to the Tuesday Jul 21 ES page.

Apologies - yes it does say that - however it does work as a reply. I'll look into getting that text changed to say "reply!"

OK, I guess I have my answer.

Look at this chart, it is ES RTH only. I sas making up a chart to put into my trading journal, the document wheat the daily bars looked like at the prior two short -term tops. When I labeled the congestion zones with a date (just any date inside the congestion so I could look at Profiles), I noticed one month separation between the dates... Kind of interesting, these dates are the dates AFTER an OpEx.

Except for April, the past 5 months have experienced retracements.

I look at the current set of daily bars and see DOJI formation (indecision because the Open and the CLose are virtually the ame, neither side has taken control of the short-term market.

I am wondering whether this makes last week's RTH H (2120.00) an inflection point? Overnight inventory looks balanced.

VAL and Volume VAL created yesterday are 2119.75 and 2119.50...

naKed POC and Naked VPOC from 7-17 are 2115.50 and 2115.25 (failure at 2119-2120 area would make 2115 handle a target, wouldn't it?..

It's not easy... as NK pointed out there is VAH at 2117.50 from 7-17, but that general area was the bounse zone for yesterday, so I wonder whether it realistically has another bounce left...

In overnight, not respecting the VAL VVAL for yesterday is some sort of a tell....(like let the inventory adjust a little on upside, but if it can't push through 2120 with follow through, is this bird cooked? (After all, it is grilling season) -sorry I couldln't resist. LOL

Look at this chart, it is ES RTH only. I sas making up a chart to put into my trading journal, the document wheat the daily bars looked like at the prior two short -term tops. When I labeled the congestion zones with a date (just any date inside the congestion so I could look at Profiles), I noticed one month separation between the dates... Kind of interesting, these dates are the dates AFTER an OpEx.

Except for April, the past 5 months have experienced retracements.

I look at the current set of daily bars and see DOJI formation (indecision because the Open and the CLose are virtually the ame, neither side has taken control of the short-term market.

I am wondering whether this makes last week's RTH H (2120.00) an inflection point? Overnight inventory looks balanced.

VAL and Volume VAL created yesterday are 2119.75 and 2119.50...

naKed POC and Naked VPOC from 7-17 are 2115.50 and 2115.25 (failure at 2119-2120 area would make 2115 handle a target, wouldn't it?..

It's not easy... as NK pointed out there is VAH at 2117.50 from 7-17, but that general area was the bounse zone for yesterday, so I wonder whether it realistically has another bounce left...

In overnight, not respecting the VAL VVAL for yesterday is some sort of a tell....(like let the inventory adjust a little on upside, but if it can't push through 2120 with follow through, is this bird cooked? (After all, it is grilling season) -sorry I couldln't resist. LOL

in the first line of my post, that is supposed to read:

to document what the daily bars looked like.

to document what the daily bars looked like.

Paul, thanks for sharing. I too noticed the tops happening a month apart as noted in my first post but I did not realize they coincided with OpEx. That is intereting indeed. Today should be a good clue on whether that same retracement pattern continues or not

It can screw around for a couple of days, but you have to think that upside is limited...

that 2120 seems critical to me if it acts as a ceiling for prices.

One big problem right now is that on a first day or second day of attempted retracement, strong hands Long aren't going to be wetting their pants, and they could even come in and (sometime over next 2 days) can give it a shove to the upside just see if they can catch any sell stops by the shorts.

that 2120 seems critical to me if it acts as a ceiling for prices.

One big problem right now is that on a first day or second day of attempted retracement, strong hands Long aren't going to be wetting their pants, and they could even come in and (sometime over next 2 days) can give it a shove to the upside just see if they can catch any sell stops by the shorts.

30 min VPOC @ 18.75

current high of the day is 1 tick short of YD's settle.... looks like more day time frame sellers coming in

well that was quite a sell off in the third period.. we shall see if the selling trend continues... this might be my last post for the day..

Originally posted by day trading

Originally posted by PAUL9

This is a test. I went to Reply to topic at the top of the page but it took me to a page that said CREATE TOPIC.

I want to see whether this posts to the Tuesday Jul 21 ES page.

Apologies - yes it does say that - however it does work as a reply. I'll look into getting that text changed to say "reply!"

Paul - that problem is fixed now.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.