ES Wednesday 7-8-15

Interesting day yesterday. They rejected those lows quite soundly. I guess I have been away for too long and just did not see that coming. Need to sharpen up a bit again before I can do any real trading.

The O/N has been almost 100% short, so there is a good chance that those shorts cover at the open especially if they do not get paid right away.

52.5 is the O/N VPOC which I don't necessarily follow religiously but I do find high volume nodes of interest. There is also a ledge at 49. If we get down there at the open, I would think that would be a buying opportunity but we shall see.

YD's range was very wide and we are currently trading right at its mid-pt. If we open right there, I would not know what to do but I would look for opportunities to buy i think

we shall see

The O/N has been almost 100% short, so there is a good chance that those shorts cover at the open especially if they do not get paid right away.

52.5 is the O/N VPOC which I don't necessarily follow religiously but I do find high volume nodes of interest. There is also a ledge at 49. If we get down there at the open, I would think that would be a buying opportunity but we shall see.

YD's range was very wide and we are currently trading right at its mid-pt. If we open right there, I would not know what to do but I would look for opportunities to buy i think

we shall see

NewKid-

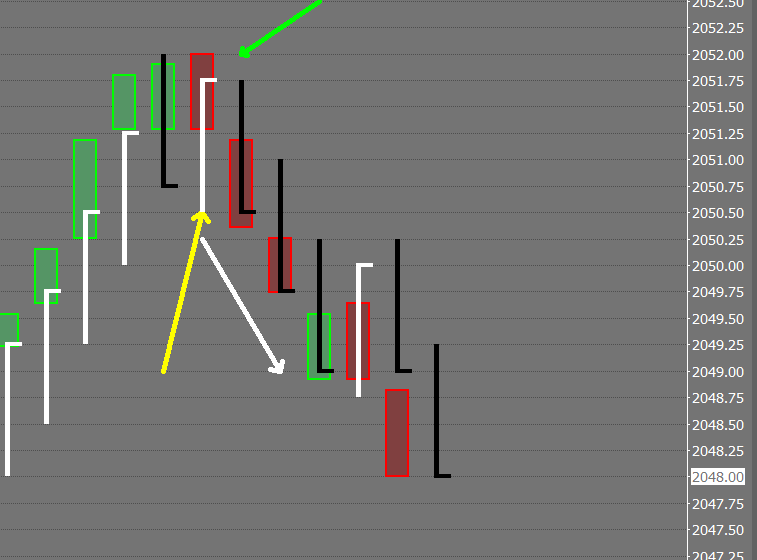

Here is an example from this morning of what I'm talking about-

Green arrow pointing to correlation going negative(red box) while ES is moving up-yellow arrow(white bar). Es then turns down-white arrow(black bars)..

Here is an example from this morning of what I'm talking about-

Green arrow pointing to correlation going negative(red box) while ES is moving up-yellow arrow(white bar). Es then turns down-white arrow(black bars)..

thanks beyondMP. are the green and red boxes cumulative delta?

Originally posted by NewKid

thanks beyondMP. are the green and red boxes cumulative delta?

No, it's a combination of unrelated but correlated markets I came up with.

I used CD,in the past but found correlated markets gave me a much better edge.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.