ES Thursday 1-29-15

If my the internals of the market are working then I would expect a pop up to close higher then YD close today. For me the key will be last weeks lows...Only one tpo print there so far on 30 minute so 95 - 97 is a big magnet zone.....I would prefer to try sells 3 or more points away from those numbers so the 2001 mentioned in the video may be a good spot for first try sells and the swings in O/N at 92 and lower may be good for first try longs.....

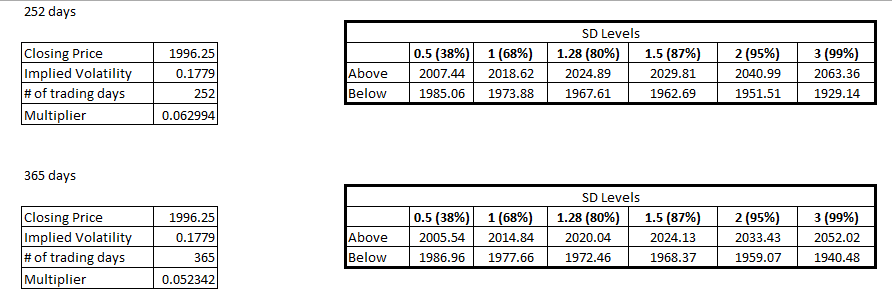

As per greenies we have them basically at the 97 area but they will try to push for another set today so I expect to see 1985 or 2018.75 in RTH......lots of obstacles in the way for the upper greenies like the 2004 , the 2007 - 2008 and then 2010.50 - 2013 zone ...all key prices for me..under 1985 I'd be watching the matching lows at 81.25 ....video babbles about the rest

As per greenies we have them basically at the 97 area but they will try to push for another set today so I expect to see 1985 or 2018.75 in RTH......lots of obstacles in the way for the upper greenies like the 2004 , the 2007 - 2008 and then 2010.50 - 2013 zone ...all key prices for me..under 1985 I'd be watching the matching lows at 81.25 ....video babbles about the rest

u either see this stuff or ya don't....and I hope u see it.....so here was what will probably be my only big campaign this morning..........exiting runners at 92 now as it was another possible inflection point

good odds they come back to 94.75 now ....billion dollar question is " where can we get a long signal ?"""

i still have to learn to see it but getting there! thanks Bruce!

the O/N low maybe?

Originally posted by BruceM

good odds they come back to 94.75 now ....billion dollar question is " where can we get a long signal ?"""

using 84.50 - 86.75 as my long zone...............keeping all small

target will be 88.50 if I can get this going here

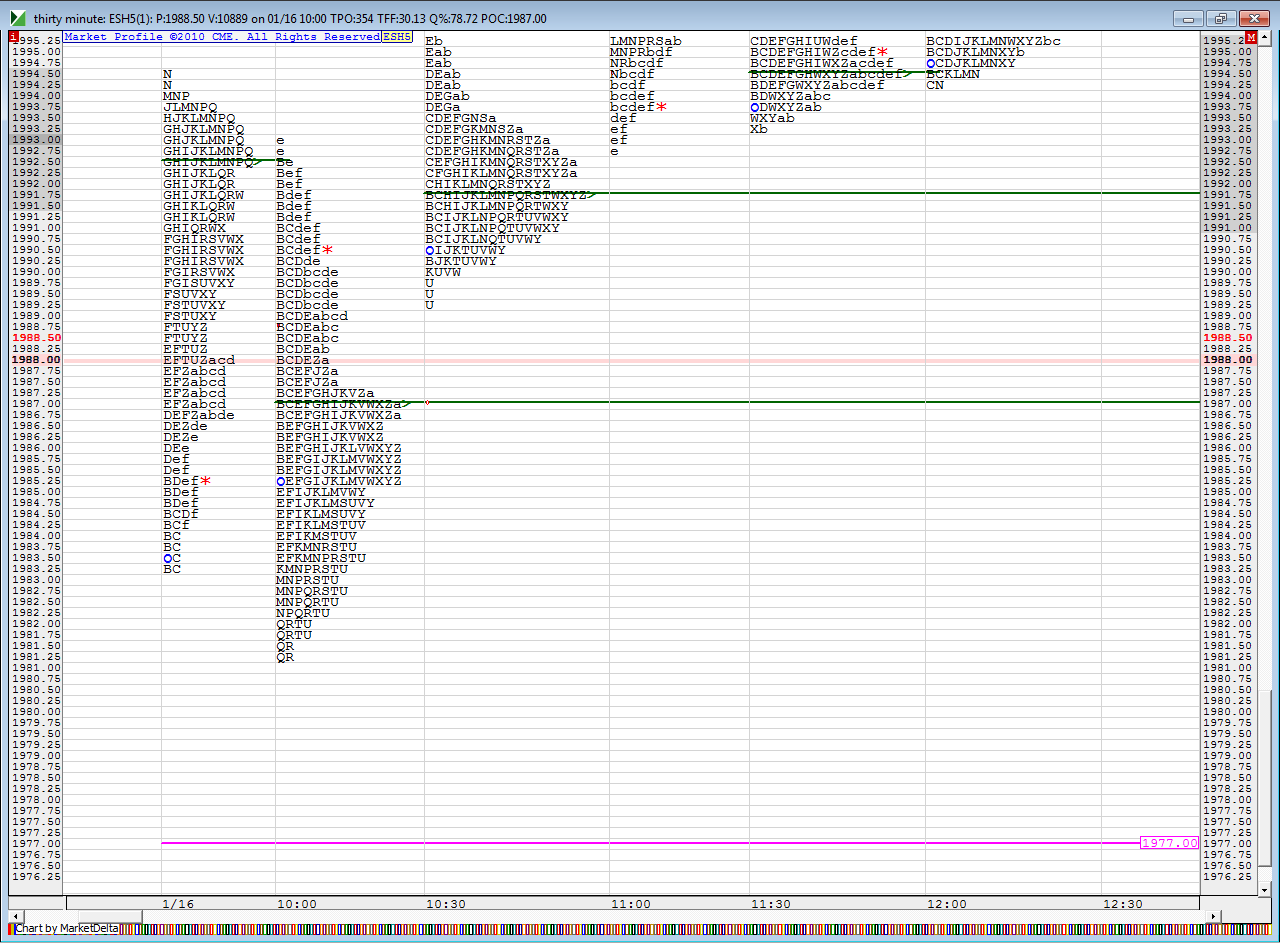

with my greenie at 84.50 and using this chart I came up with that zone.......look at 30 minute POC from 1-16

here is an ending video for today.....good luck from here...this covers 30 minute poc's from 1- 16

30 min VPOC @ 89.75

i wonder how to translate not having a lot of time TPOs at a price but high volume and vice versa? because that is exactly what happenned today. 89.75 does not have a lot of time there but had the volume and 91.5 was the opposite.

when high time and high volume match, that makes sense but what when it is the opposite?

there has to be something to learn there

when high time and high volume match, that makes sense but what when it is the opposite?

there has to be something to learn there

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.