Pivot point study

I did a study for the Dec 14 contract to see how many of the pivot points we hit in a day. I computed R4, R3, R2, R1, PP, S1, S2, S3, S4

The statistical study was to see how many of these points would we hit in a day. I compiled the day by number of hits. For example if we hit R1 and PP, I call it as a 2-hit day. If we hit only R1, I call it as a 1-hit day, if we hit PP, S1 and S2 I call it a 3-hit day, etc.

Keep in mind that there were some holidays within this time period so some data points might be outliers. The study was done only on RTH data.

The data collected was over 100 trading days so the numbers below can also be read as percentages

0-hit 4

1-hit 21

2-hit 49

3-hit 15

4-hit 9

5-hit 1

6-hit 1

7-hit 0

8-hit 0

The statistical study was to see how many of these points would we hit in a day. I compiled the day by number of hits. For example if we hit R1 and PP, I call it as a 2-hit day. If we hit only R1, I call it as a 1-hit day, if we hit PP, S1 and S2 I call it a 3-hit day, etc.

Keep in mind that there were some holidays within this time period so some data points might be outliers. The study was done only on RTH data.

The data collected was over 100 trading days so the numbers below can also be read as percentages

0-hit 4

1-hit 21

2-hit 49

3-hit 15

4-hit 9

5-hit 1

6-hit 1

7-hit 0

8-hit 0

Nice work - thank you!

c'mon everybody...lets vote this up.....although a small sample, this study is telling you that over the past 100 days 96 % of the time we hit at least one of the standard floor trader pivot numbers and 75 % of the time we hit at least two of them.....granted we don't know which ones will hit but we can come up with some filters. These are great stats to know and I'd like to see more.... Thanks New kid !!

I'd be curious to know a few things : Is it possible you can look at the 4 days that didn't hit and determine if they have a common denominator...? for example...

did these days come after large or small range days ? did these 4 days come after big gap openings up or down ? Did these come near a major holiday ?

I'd be curious to know a few things : Is it possible you can look at the 4 days that didn't hit and determine if they have a common denominator...? for example...

did these days come after large or small range days ? did these 4 days come after big gap openings up or down ? Did these come near a major holiday ?

I found a small error in my document. Here are the correct numbers:

0-hit 3

1-hit 21

2-hit 50

3-hit 15

4-hit 8

5-hit 1

6-hit 1

7-hit 0

8-hit 0

0-hit 3

1-hit 21

2-hit 50

3-hit 15

4-hit 8

5-hit 1

6-hit 1

7-hit 0

8-hit 0

Bruce, the common factor for the 3-days where there was no hit was that they were holidays or the holiday week.

The misses were on,

9/1/2014 - Labor day

11/24/2014 - Thanksgiving week. The range this day in RTH was 5 points and came after a 17.5 points range day on the Friday before.

11/27/2014 - Thanksgiving day

The misses were on,

9/1/2014 - Labor day

11/24/2014 - Thanksgiving week. The range this day in RTH was 5 points and came after a 17.5 points range day on the Friday before.

11/27/2014 - Thanksgiving day

great... ...I appreciate you taking the time with this

Originally posted by NewKid

Bruce, the common factor for the 3-days where there was no hit was that they were holidays or the holiday week.

The misses were on,

9/1/2014 - Labor day

11/24/2014 - Thanksgiving week. The range this day in RTH was 5 points and came after a 17.5 points range day on the Friday before.

11/27/2014 - Thanksgiving day

and while I am asking for the moon...I wonder how these statistics would hold up on weekly data...? anyone have enough data and abilities for that one ?? I know it's asking a lot

i have wondered about that too. i will see if i can get around to that at some point. i would love to find out how it would look on the weekly data set

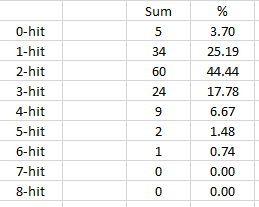

Here are the latest statistics for the daily pivot points.

The data set is a little larger to include 135 days (I might be inclined to look over a larger set later on).

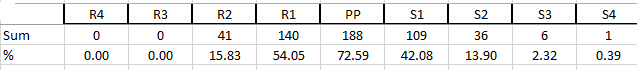

The above picture shows that 62.22% of the time we are likely to hit the daily PP number. The numbers taper off as we roll over to the R1/S1, R2/S2, etc predictably.

The above picture shows the hit rate as defined in an earlier post but this time with % as well. Interestingly the 2-hit is most likely to happen just a little than half the time at 44.44%

The data set is a little larger to include 135 days (I might be inclined to look over a larger set later on).

The above picture shows that 62.22% of the time we are likely to hit the daily PP number. The numbers taper off as we roll over to the R1/S1, R2/S2, etc predictably.

The above picture shows the hit rate as defined in an earlier post but this time with % as well. Interestingly the 2-hit is most likely to happen just a little than half the time at 44.44%

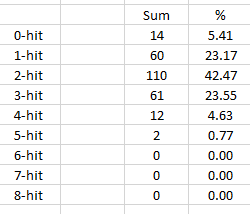

I compiled similar data for weekly pivot points.

The data set is larger here and has 259 weeks.

The above picture shows that 72.59% of the time we are likely to hit the weekly PP number. This is larger than the daily number so I find that interesting. The numbers taper off as we roll over to the R1/S1, R2/S2, etc predictably.

The above picture shows the hit rate as defined in an earlier post but this time with % as well. Interestingly the 2-hit is [bold] still [/bold] most likely to happen just a little less than half the time at 42.47%

Hope folks find this information helpful.

The data set is larger here and has 259 weeks.

The above picture shows that 72.59% of the time we are likely to hit the weekly PP number. This is larger than the daily number so I find that interesting. The numbers taper off as we roll over to the R1/S1, R2/S2, etc predictably.

The above picture shows the hit rate as defined in an earlier post but this time with % as well. Interestingly the 2-hit is [bold] still [/bold] most likely to happen just a little less than half the time at 42.47%

Hope folks find this information helpful.

great stuff...so in general with weekly numbers we hit SOME weekly number 95 % of the time...much like the daily stat...thanks

Below is a picture of the 0-hit days. Of the 14 misses, 6 of them are on holidays. So in truth, there are only 8 misses out of 259. I tried looking at range and ATR but there is no good way to filter out these misses. I see some weeks where the range is >2x the ATR and the subsequent week we still hit multiple pivot numbers due to a large range. The misses were just narrow range weeks.

I think after removing the holidays, there is a ~97% chance of hitting at least one weekly pivot number and that is pretty darn good so we shall go with that!

I think after removing the holidays, there is a ~97% chance of hitting at least one weekly pivot number and that is pretty darn good so we shall go with that!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.