ES Wednesday 12-3-2014

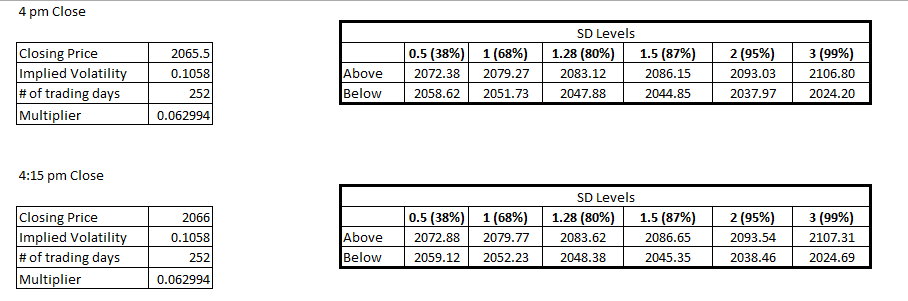

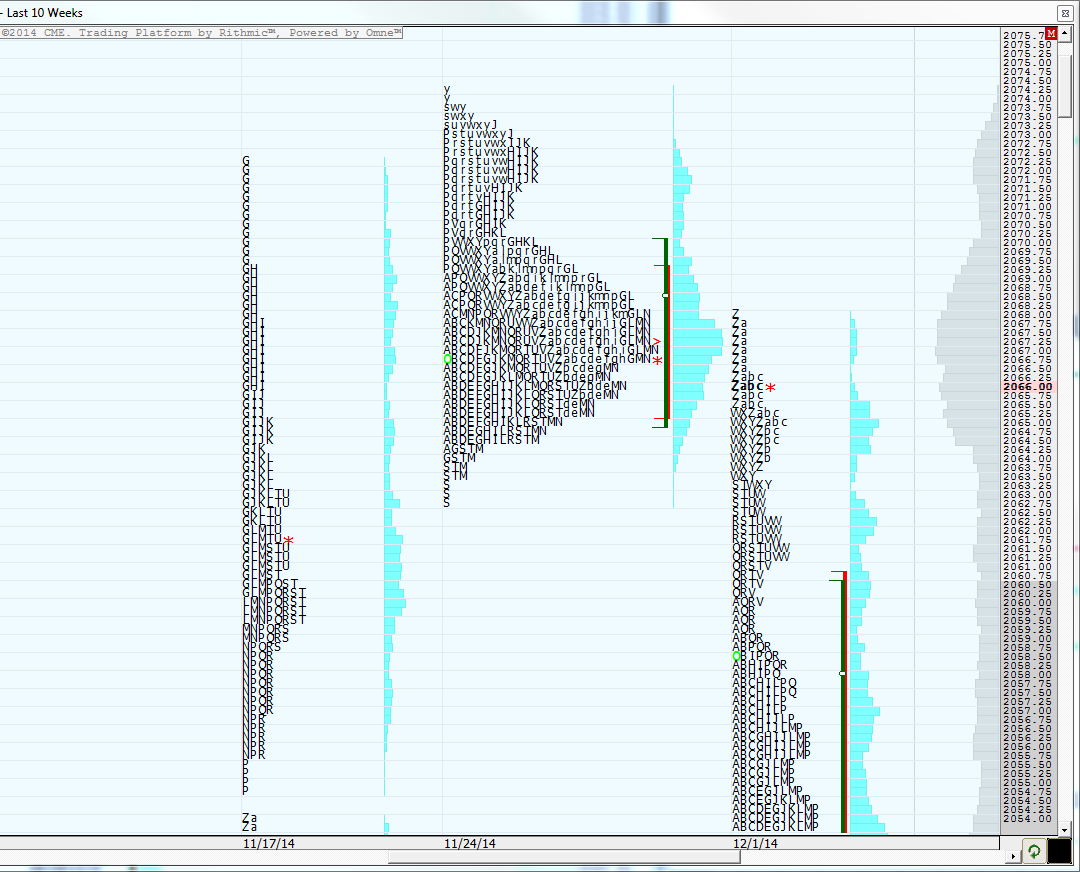

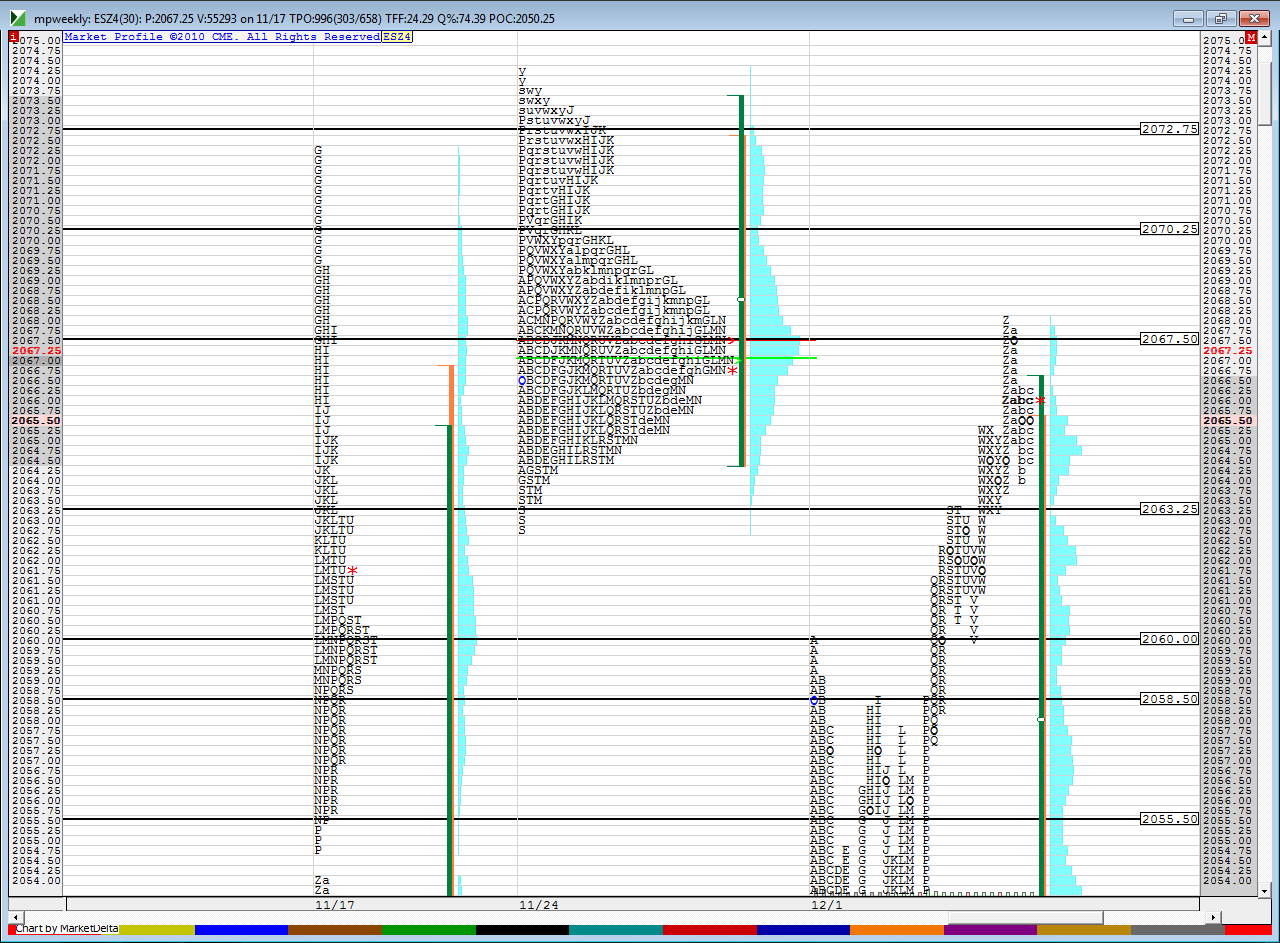

a picture of my key lines ...the video goes over the lines but also brings up some standard deviation sites etc and some qiuick options babble...keep in mind that Friday is the usually uneventful employment report........but many still get concerned......not sure we should expect too much between now and then but I'll just trade the lines and try not to think too much

it's simple today...if 69 fails they are going for 72...otherwise expect 64.50 to print...this is where volume is above and below the open,,,my money is short!

How do you know which volatility percentage to plug into the standard deviation calculator?

it hit my exit but no fill.... damn..

I'm on first RTH sell and that is from 70 50 LVN node....see chart above.,I have developing LVn's at 69 and 68....first On sell took gap fill but runners got clipped...my plan is to sell here and up at 72.25 if needed....

they will break 69.25 ...trying to form triple lows...that is a no- no

breakout from YD highs is still untested.....I need that to retest

single prints trying to form at YD highs...gonna get filled in I think

thanks for your comments APK...In general it would be safer to use some kind of iron condor idea and buy the further out puts and calls.like you said.....so we'd have bull put and bear call spreads working....but as you know there is a trade off then because we give up much of the premium collected by having to buy the protection. I also realize that anything could go wrong at anytime but the hope here would be that it doesn't happen in the next three days. Some other ideas would be to just exit at a loss when we get near the strike prices sold and have a stop loss in on the option. The problem with that is what happens if the move happens overnight ? I would also not wait and try to get the full premium. that would be a losing bet I think. Perhaps 33% - 50% might be doable.

I agree with you though and it would be much better to be selling spreads when volatility was very high ( we can use the vix as a gauge)....the better idea for this particular example would be to give up some time and premium by waiting an additional day if I wasn't willing to buy the protection.......so this idea would work better if we put the trade on in the last 45 minutes of tomorrows session or sometime tomorrow . This way we can manage the trade during the day session on Thursday and limit our exposure to only one overnight session...... if over time we found that doing these types of weekly option trades was worth doing in front of reports and fed meetings etc then we could set alerts at night and make sure we monitor overnight activity if we get within a certain percent of our strike price during the overnight session. No way to avoid the whipsaws but actually trading the overnight would be ok if it was to just manage our position...for example if I had got an alert that tonight we are printing ES 2050 in the overnight session from the 2072 level well then I can step in and watch the market if I needed too.....and if I needed to get short at 2030 well then I'd be a trader like I always am. Bottom line is I am not sure these trades will be worth the effort and I am certainly not arguing your point. The safest idea though is to buy the protection as u said.

my idea would be that if we can find 4- 5 ideas a month then it might be a profitable trading practice. While I am drawn to the weeklies due to my short term focus, I really want to eventually establish a portfolio each month that can achieve some balance between low volatility trading ideas and high volatility trading ideas ( like condors) and use some form of beta weighting to manage the entire portfolio. This way I MIGHT be able to achieve some consistent long term option results regardless of the volatility environment.

Thanks for the insights and I'd love to hear more as I am fascinated by the options and it's quite refreshing for me. Your points are well taken and spot on !!

I always assume that most here are doing their own research and wouldn't invest in any idea until they fully understand the risks.

as a quick aside the options we sold this morning were sold at $190 and we could currently buy them back for $165......so there will always be that greed factor as to how long do we wait on something so risky. It would also help to study what happens on the days preceeding the event you are trading and have some historical reference point.

I agree with you though and it would be much better to be selling spreads when volatility was very high ( we can use the vix as a gauge)....the better idea for this particular example would be to give up some time and premium by waiting an additional day if I wasn't willing to buy the protection.......so this idea would work better if we put the trade on in the last 45 minutes of tomorrows session or sometime tomorrow . This way we can manage the trade during the day session on Thursday and limit our exposure to only one overnight session...... if over time we found that doing these types of weekly option trades was worth doing in front of reports and fed meetings etc then we could set alerts at night and make sure we monitor overnight activity if we get within a certain percent of our strike price during the overnight session. No way to avoid the whipsaws but actually trading the overnight would be ok if it was to just manage our position...for example if I had got an alert that tonight we are printing ES 2050 in the overnight session from the 2072 level well then I can step in and watch the market if I needed too.....and if I needed to get short at 2030 well then I'd be a trader like I always am. Bottom line is I am not sure these trades will be worth the effort and I am certainly not arguing your point. The safest idea though is to buy the protection as u said.

my idea would be that if we can find 4- 5 ideas a month then it might be a profitable trading practice. While I am drawn to the weeklies due to my short term focus, I really want to eventually establish a portfolio each month that can achieve some balance between low volatility trading ideas and high volatility trading ideas ( like condors) and use some form of beta weighting to manage the entire portfolio. This way I MIGHT be able to achieve some consistent long term option results regardless of the volatility environment.

Thanks for the insights and I'd love to hear more as I am fascinated by the options and it's quite refreshing for me. Your points are well taken and spot on !!

I always assume that most here are doing their own research and wouldn't invest in any idea until they fully understand the risks.

as a quick aside the options we sold this morning were sold at $190 and we could currently buy them back for $165......so there will always be that greed factor as to how long do we wait on something so risky. It would also help to study what happens on the days preceeding the event you are trading and have some historical reference point.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.