Opening Call for ES

I'm a former equity swing trader who has now been daytrading ES for the past month. I'm learning Market Profile, which so far has been very helpful.

Beyond MP, one of the areas that I feel I'm lacking in is knowledge in interpreting the opening call......I don't even know where to get the opening call in the first place....but I've seen more experienced e-mini traders talk about it. I know it has to do with pre-market (pre RTH) value but that's about it.

Any info regarding "opening call" and "fair value" would be much appreciated. Thanks.

Beyond MP, one of the areas that I feel I'm lacking in is knowledge in interpreting the opening call......I don't even know where to get the opening call in the first place....but I've seen more experienced e-mini traders talk about it. I know it has to do with pre-market (pre RTH) value but that's about it.

Any info regarding "opening call" and "fair value" would be much appreciated. Thanks.

From what I've heard, the opening call is a pit concept. The brokers (perhaps market makers) that are holding orders before the pit opens will establish prices that they are prepared to open at. There are traders (or clerks?) that go from broker to broker and find out what price they are going to open at and using this information they establish an "opening call" - basically an estimate of what the opening price will be.

This concept is now redundant with the introduction of continuous electronic markets which allow pre-pit opening entry. The opening call is now the electronic price just before the opening.

(Again - this is what I've gleaned from other traders - don't know how accurate it is.)

This concept is now redundant with the introduction of continuous electronic markets which allow pre-pit opening entry. The opening call is now the electronic price just before the opening.

(Again - this is what I've gleaned from other traders - don't know how accurate it is.)

I agree with daytrader, the electronic overnight session has replaced the opening call since all the news has been factored into futures prices (and the cash ETF's) on the electronic market in real-time prior to the official floor opening. In most cases the floor opening price will mirror the already established electronic market price.

I suggest you pay attention to the overnight session's high and low during the first hour or two of the new day's trading session. These price levels often play an important role at the start of the day session. Once the IB is established, the overnight high and low play a lesser role.

Fair value is used to establish the relationship of the premium of futures to the underlying cash market. This is a tool used by arb's to keep prices in the two markets aligned. There are various arb strategies based on the premium. The premium is published in real-time by most of the major data vendors. I use this table for an estimate of the day's premium range: http://www.indexarb.com/

There are a variety of ways to use the premium, one way I like to look at it is as a proxy for trading intensity. By intensity I mean the amount of energy going into the current price movement. When the premium moves outside the fair value range (or trading bands), it indicates programs are active and the intensity of the price movement is high and thus likely to be sustained in the near term. (Be aware there are exceptions to this general rule.) This is similar to how I use and view volume, in fact you will find that the premium and volume do fit together nicely using this perspective. When viewed holistically, premium helps you get a better sence of the mood of the market, it is a piece of the puzzle, not a complete solution in and of itself.

I suggest you pay attention to the overnight session's high and low during the first hour or two of the new day's trading session. These price levels often play an important role at the start of the day session. Once the IB is established, the overnight high and low play a lesser role.

Fair value is used to establish the relationship of the premium of futures to the underlying cash market. This is a tool used by arb's to keep prices in the two markets aligned. There are various arb strategies based on the premium. The premium is published in real-time by most of the major data vendors. I use this table for an estimate of the day's premium range: http://www.indexarb.com/

There are a variety of ways to use the premium, one way I like to look at it is as a proxy for trading intensity. By intensity I mean the amount of energy going into the current price movement. When the premium moves outside the fair value range (or trading bands), it indicates programs are active and the intensity of the price movement is high and thus likely to be sustained in the near term. (Be aware there are exceptions to this general rule.) This is similar to how I use and view volume, in fact you will find that the premium and volume do fit together nicely using this perspective. When viewed holistically, premium helps you get a better sence of the mood of the market, it is a piece of the puzzle, not a complete solution in and of itself.

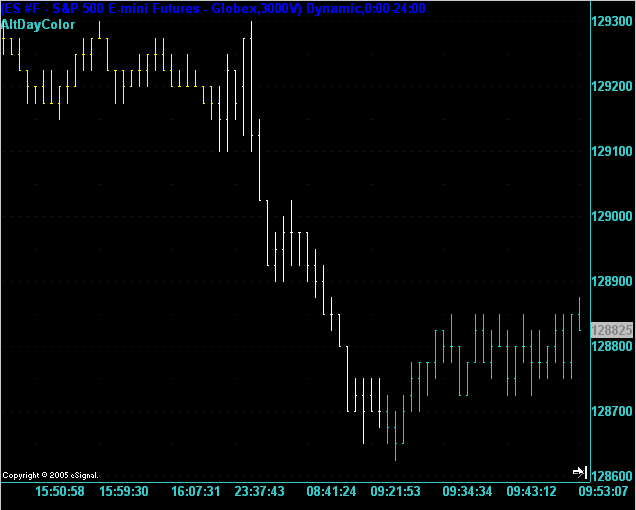

Along the lines of what pt_emini said I use the following chart type to help me understand the overnight action and prepare for the current day and compare the action from prevous to overnight to today. I don't color my bars green or red because I don't believe that helps you at all. Instead I use alternating colors for each day of trade and a third color for overnight action. I also use a Volume Chart so that each bar is weighted equally according to the volume that has moved through the market and not the time that has passed. My theory is: Why give this last 10 minute bar the same weighting/importance as the previous 10 minute bar if it only had half the number of contracts trading there?

Here is a chart of the ES from this morning that demonstrates the last few bars of yesterday, the overnight action, and today's opening action colored as I've just described and on a 3000V chart (3000V = 3,000 contracts per bar).

Here is a chart of the ES from this morning that demonstrates the last few bars of yesterday, the overnight action, and today's opening action colored as I've just described and on a 3000V chart (3000V = 3,000 contracts per bar).

Thanks for the clarification.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.