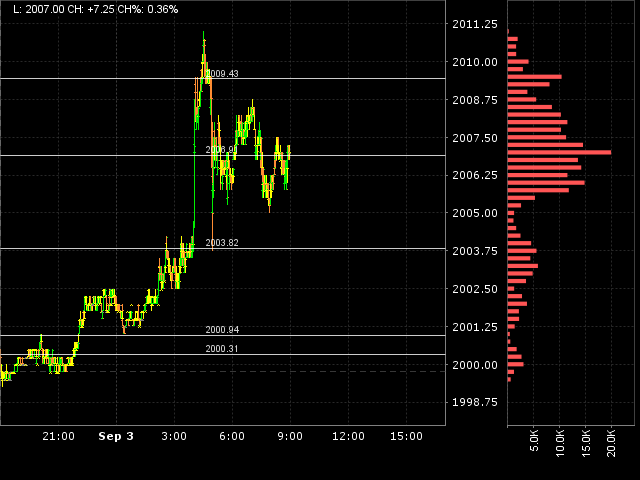

ES Wednesday 9-3-14

Wednesdays a generic 79% of gaps fill. Gaps over 5 points start having lower probabilities of filling in. I have two areas I am watching and that is the weekly pivot and HVN in the overnight at 07 - 07.50 and above there I have the O/N high, R2 level and a spot that drew in volume so we will also need to use 09.50 - 2011 as keys on a higher open out of value....below 07 area is 03.75 - 04.25 ( YD highs) and then we have VA high and an O/N low at 1999 - 2001. here is a picture of the O/N session and how I have it marked off... It seems that the 07 area is going to be the magnet price this morning......as usual I like the shorts on a first push up and but also will try smaller buys at the 2004 area and also at the 2000 area ...especially if we haven't traded to 2007 yet......if I get a good short then my idea about buys would only be taken with a very small amount of contracts...there is no sense giving money back just for the sake of taking a trade.....keep in mind yesterdays bell curve I posted of last week....we may still just need to revisit that

The key I think will be to see if we can muster up enough energy in the day session to get away from that 2007...if not we will mean revert to that number and drop back down again...employment report is Friday too

The key I think will be to see if we can muster up enough energy in the day session to get away from that 2007...if not we will mean revert to that number and drop back down again...employment report is Friday too

starting small shorts at 08.75 with a bigger plan to trade to trade more aggressive in upper zone in RTH.....07.25 is target

if this coil resolves itself to the upside then that would easily push us to the O/N highs....classic TA stuff

i'm trying to get the O/N midpoint on my measly runner but that damn 07 is a pain ...............

exiting at 05.50.....they may torture me for that midpoint and I'm not gonna let them

this coil is 4 points wide so a good break from it will either go tag 2011 or 2003.....aggressive traders will be trading right at this 2007 but I couldn't pick a side at the apex of this coil..what is interesting is where yesterdays high is and the On high is in relation to this coil projection...I think odds favor the test of YD RTH highs

the longer we coil the greater the odds of a real breakout....so selling up at the On high area or buying at the 03 - 04 area becomes higher risk IMHO...especially since we have tested the 07 so many time already

report at 10 and beige book today...that's gonna be it for me ....congrats to anyone who could actually hold for that midpoint

82 % of the time we get half gaps to print ...that would also project to YD highs.......that is a generic probability..so I'll leave it at that today...good luck if ya are playing anymore..if we can get that 07 to hold back any rallies then this thing still has a chance to go get that high of YD

Nice call on the coiling and larger break, Bruce!

Were you looking at a P&F chart, or were you just seeing that?

Thanks Bruce. Interesting stuff. I was thinking of classical Wycoff with his P&F chart prediction.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.