ES Monday 3-10-14

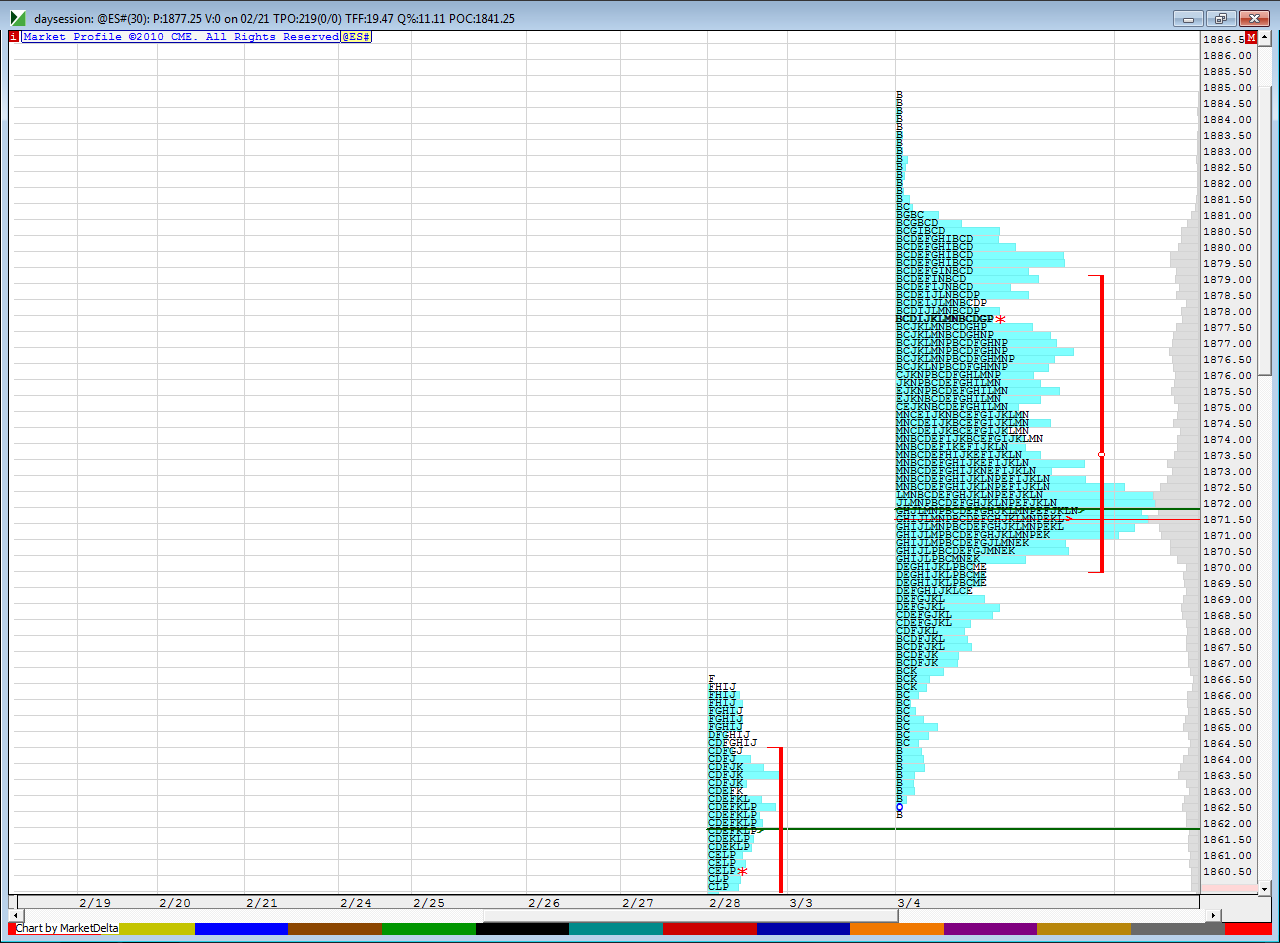

First a look at the upper half of last week...all the time and volume is at 1870 - 71.50 and will be critical coming into Mondays trade....weekly chart is still making higher highs and VPOC/POC has been higher...so as long as the 70 - 71.50 can hold price up then new yearly highs will be coming... a failure of that could eventually see us trade back down to 49.50 this week..and even lower...we have other numbers along the way.. you can find them in last weeks threads if interested

next we have just friday with the key areas marked off

last week we had combined Tuesday and wednesday into one bell curve and friday we tested into the center of that in "E, F, J, K L and N" periods..then closed above Thursdays close at 1877.75...I'm showing this only to reiterate just how important that 70- 71.50 really is...we don't want to be opening under there on Monday Morning

as i am making this video - 10:50 Eastern time the market has put in an overnight low at 71.50 so far....we have leftover targets that never printed on Friday at 1886 and 1887.50......those are the upper targets if buyers defend early this week...will look for confluence in the morning with the daily and weekly pivots.... last week we also didn't actually trade at the previous weeks close but gapped through it...not really sure if that should count...so i would expect this week to get last weeks close if we open inside the range of last week

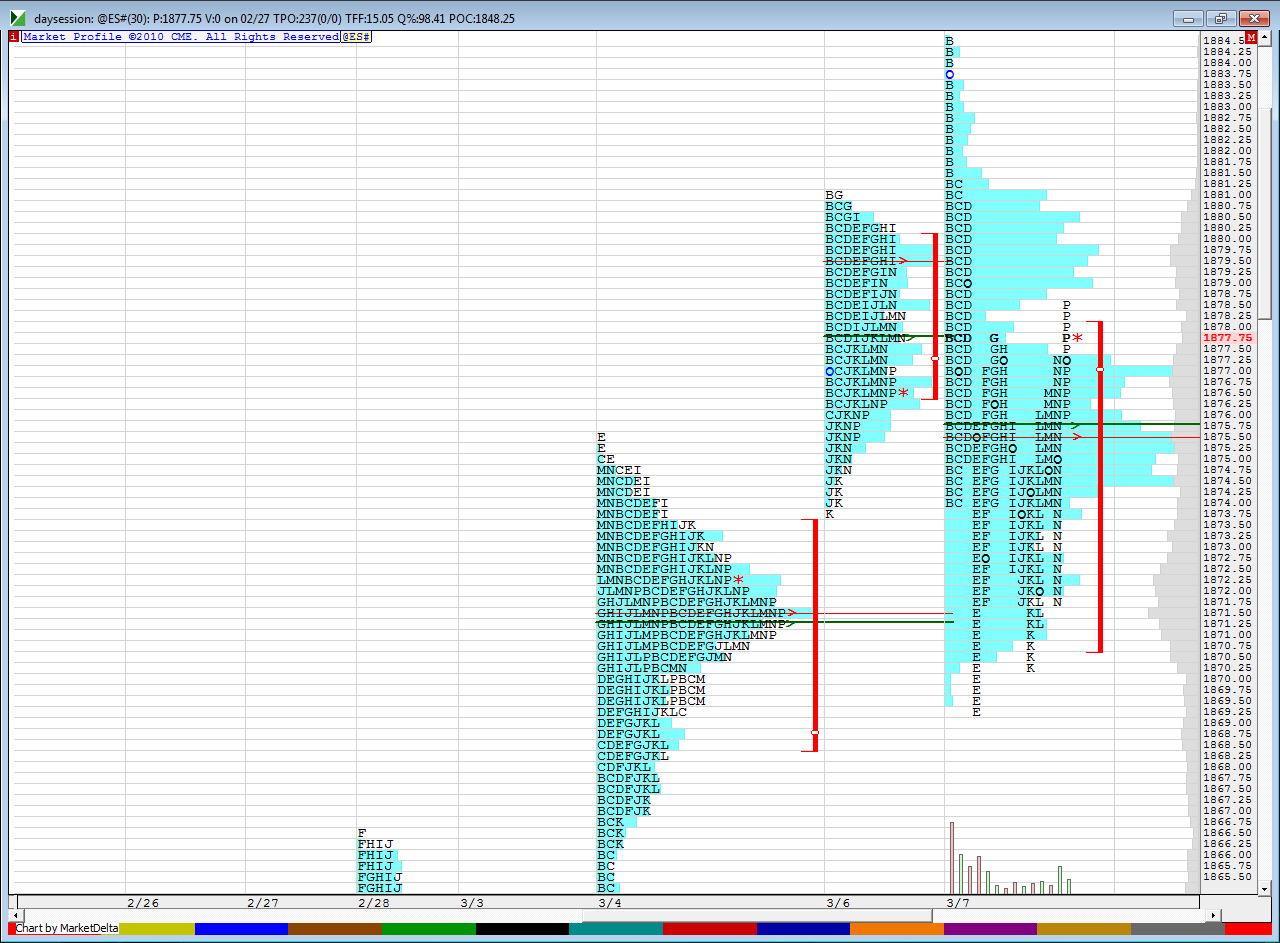

next we have just friday with the key areas marked off

last week we had combined Tuesday and wednesday into one bell curve and friday we tested into the center of that in "E, F, J, K L and N" periods..then closed above Thursdays close at 1877.75...I'm showing this only to reiterate just how important that 70- 71.50 really is...we don't want to be opening under there on Monday Morning

as i am making this video - 10:50 Eastern time the market has put in an overnight low at 71.50 so far....we have leftover targets that never printed on Friday at 1886 and 1887.50......those are the upper targets if buyers defend early this week...will look for confluence in the morning with the daily and weekly pivots.... last week we also didn't actually trade at the previous weeks close but gapped through it...not really sure if that should count...so i would expect this week to get last weeks close if we open inside the range of last week

not so impressed with the 75.50 number so I prefer to use 73.50 - 75.50 as more of a magnet area...especially if we open under and can find support at the 70 - 71.50.....weekly pivot is at 1865 and we had 66.50 as a swing high and On low is at 67.75...so that becomes a zone to me...On high stopped at one of our numbers so that becomes real important as we go forward...I still think they want 86 and higher just not sure how or when they will bring it there.....Friday was an open and drive day so I don't expect that today...we may chop around a bit especially if we open near the 73 - 75 area.....best to wait for extremes today

Just wanted to give you a shout out Bruce and thank you for the market analysis you provided. It is much appreciated on my part and many others!!!! And any one else who feels the same, let Brucemeister know with a post when ya can.

Ditto - good work Bruce!

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.