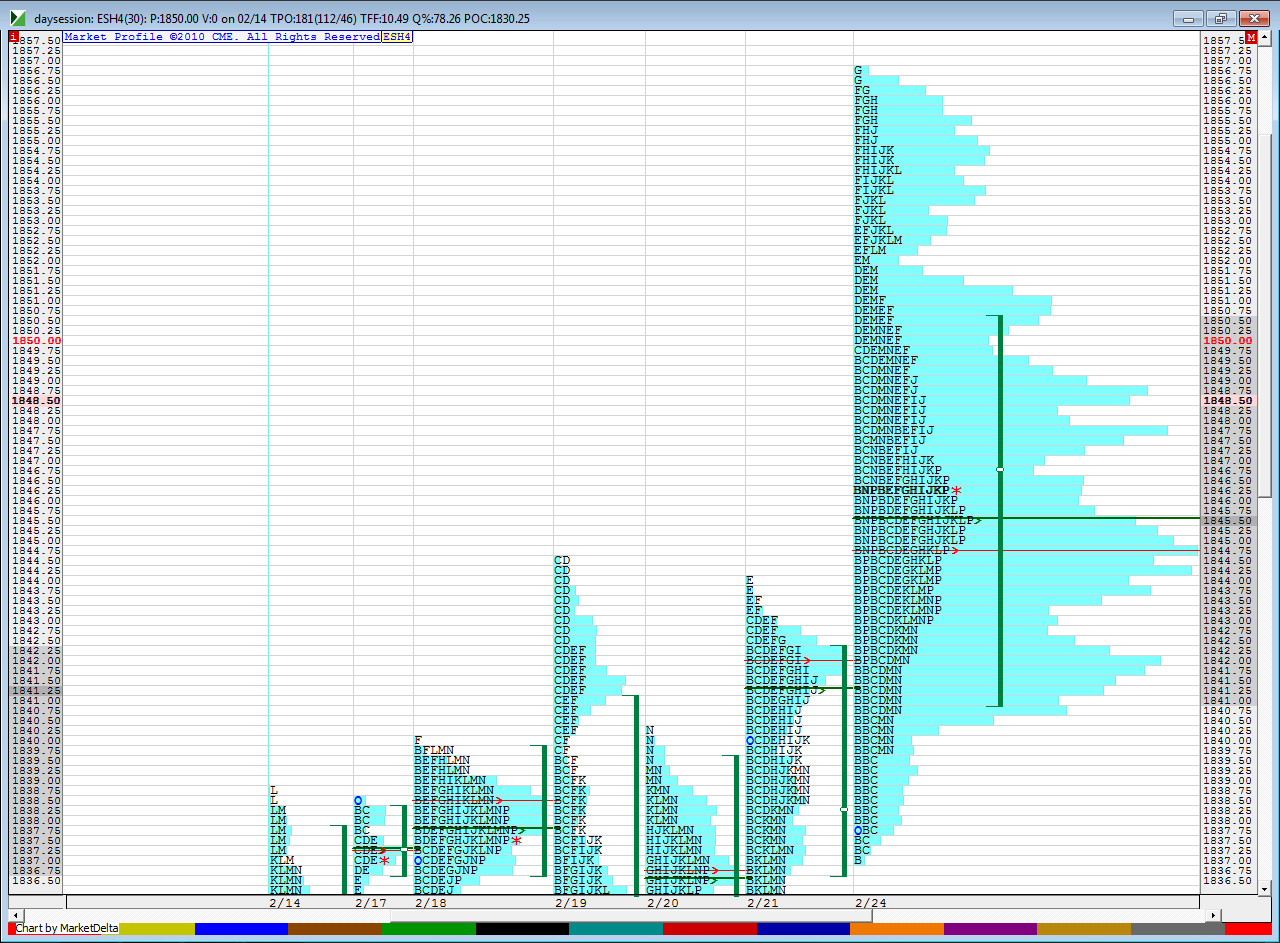

ES Wednesday 2-26-14

Not much to say...yesterday was inside of Monday so here is combined profile which has a somewhat symetric bell curve. Basically we will do one of three things and most probably know this

Dip outside a high or low of the VA or range and fail - driving back to the center,

probe outside and break out higher or lower with volume that keeps coming in to trend away

or just linger outside a high or low and only slightly expand the trading range

no rocket science there !!

we need to respect the fact that we had two tests down into one of the humps of our context chart ( see yesterdays thread) and found support both times and now value is building higher so far this week...we don't really need to think about the gap close of last week until we get back under last weeks highs again sometime..

last profile is Mon- Tuesday combined...I have O/N VPOC at 50.50...so i would try sells up there and also above the LVN spot outside of the VA highs...so 52 - 53.75 is another key for me....I'm not trading in the center today...39.75 - 41.50 is my buy fade area....good luck today..I think we may need it...I think 45-47.50 is the magnet zone for me today in RTH

Dip outside a high or low of the VA or range and fail - driving back to the center,

probe outside and break out higher or lower with volume that keeps coming in to trend away

or just linger outside a high or low and only slightly expand the trading range

no rocket science there !!

we need to respect the fact that we had two tests down into one of the humps of our context chart ( see yesterdays thread) and found support both times and now value is building higher so far this week...we don't really need to think about the gap close of last week until we get back under last weeks highs again sometime..

last profile is Mon- Tuesday combined...I have O/N VPOC at 50.50...so i would try sells up there and also above the LVN spot outside of the VA highs...so 52 - 53.75 is another key for me....I'm not trading in the center today...39.75 - 41.50 is my buy fade area....good luck today..I think we may need it...I think 45-47.50 is the magnet zone for me today in RTH

I'm curious, Bruce. Why are you avoiding the "middle" (I assume the 40-40.50 area)? That was so active YD.

Never mind, Bruce. If it opens down here I'll be avoiding initiating trades there too!

long at 40.50...keeping close stop..we don't want this at 38.50...that would be a no-no!

coming out heavy at 44.25...nice pop so take advantage of it...where is last weeks high ??? know it !!!

that went right back to day session only vwap too.......lots of volume came it to that on the lows....no runners and will probably be only trade....keep in mind we are now under the magnet zone and bulk of the two day combined bell curve

do u see what the middle is ackwired ? Just checking as I am not always crystal clear in my explanations.....middle is center of the chart I posted with all that time and volume..the 45 - 47j

Originally posted by ackwired

I'm curious, Bruce. Why are you avoiding the "middle" (I assume the 40-40.50 area)? That was so active YD.

Thanks, Bruce. The 40 was clumsy fingers. I have the 44-44.50 on my charts and spreadsheet. Sorry for the confusion. I show weekly ml at 30.75.

Speaking of spreadsheets, do you happen to know at what price that volume spike occurred on the way up from 41?

on my data it was 41 exactly...we also had volume at 45.75....so it is interesting in here...just watching now as I need to get up on a few things

Thanks, Bruce. I can usually catch them, but was busy trading and missed this one.

I hear my bike calling me. Thanks for sharing, Bruce.

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.