1/27

Everything I know the computers and large traders know.

I do not know everything they know;so,I limit my trades to setups

I have seen them use and I have traded countless times.

Trades on 1/27 were based on work I first showed at MYPIVOTS almost 8

years ago and have shown multiple times since.

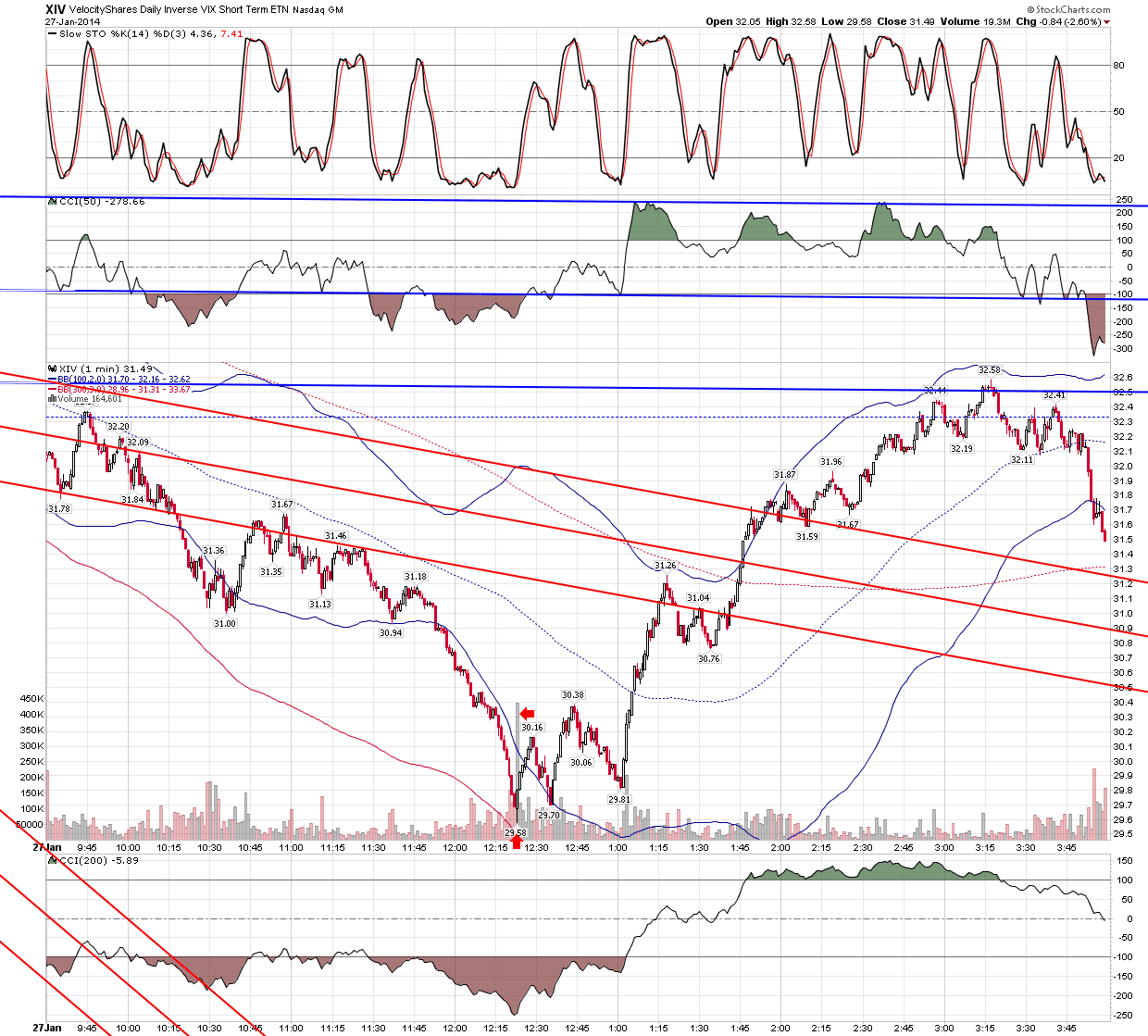

The one thing i have added in the past couple of years is an awareness

of the vix etf's and will often trade them short term derivatively as they offer a better

percentage return than trading the actual etf's.

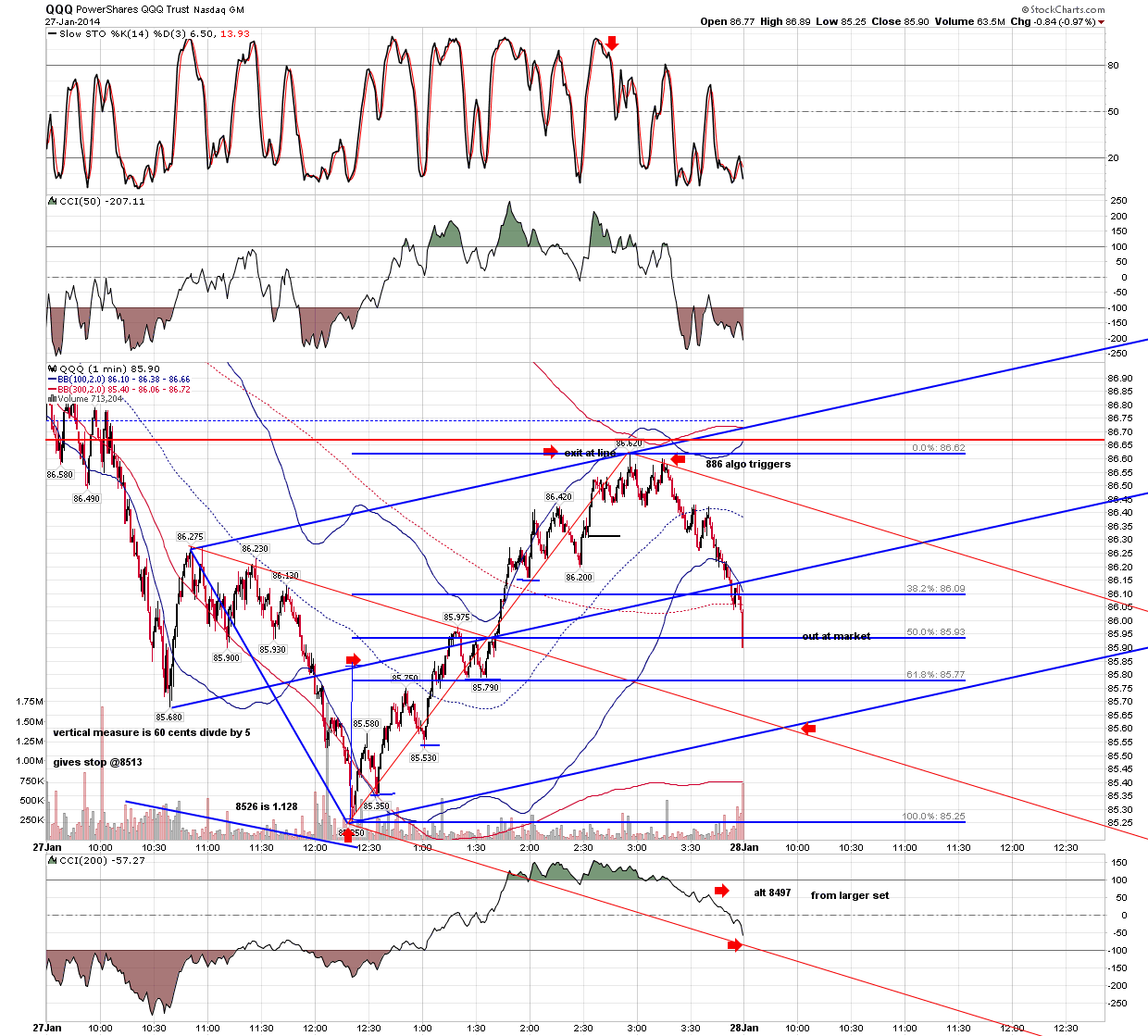

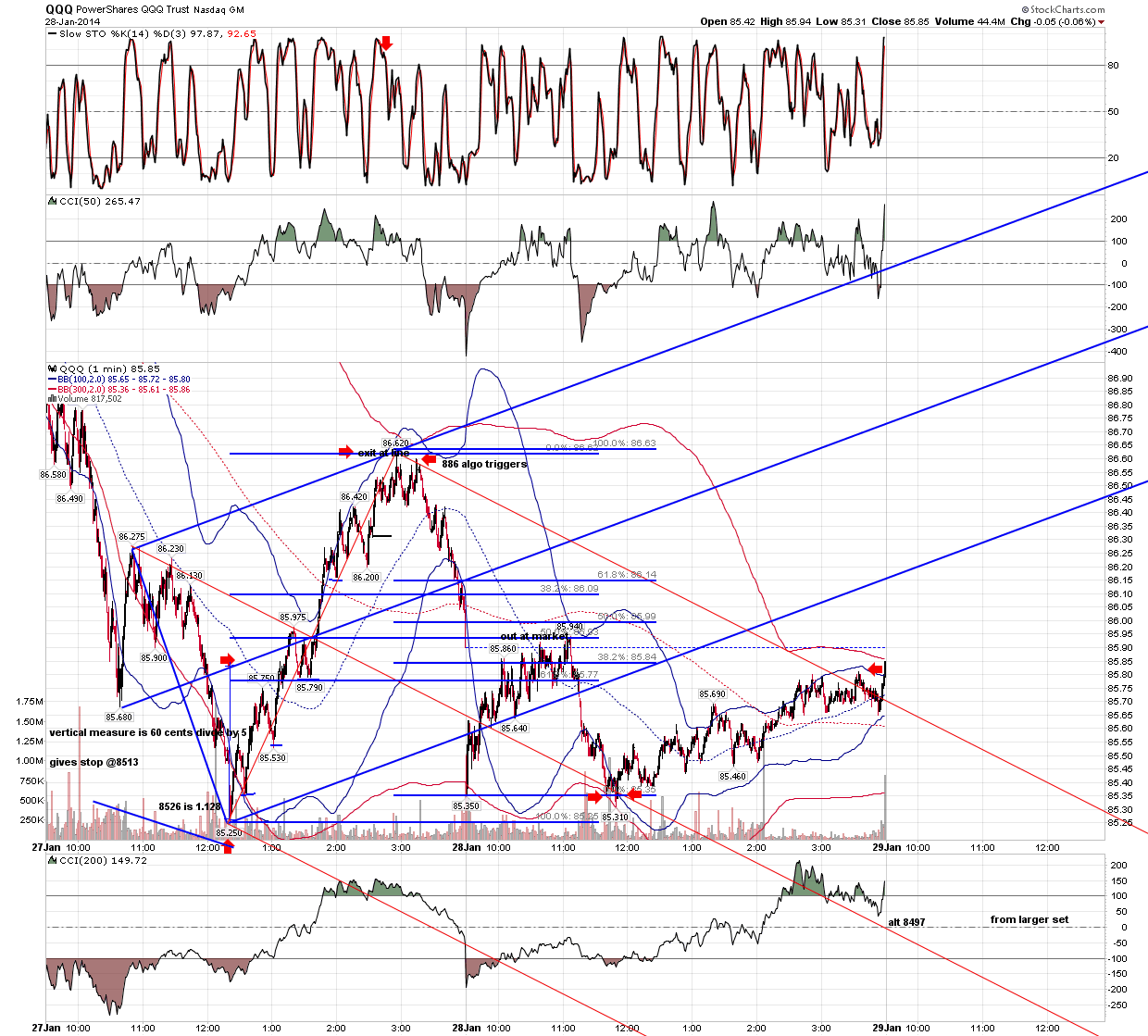

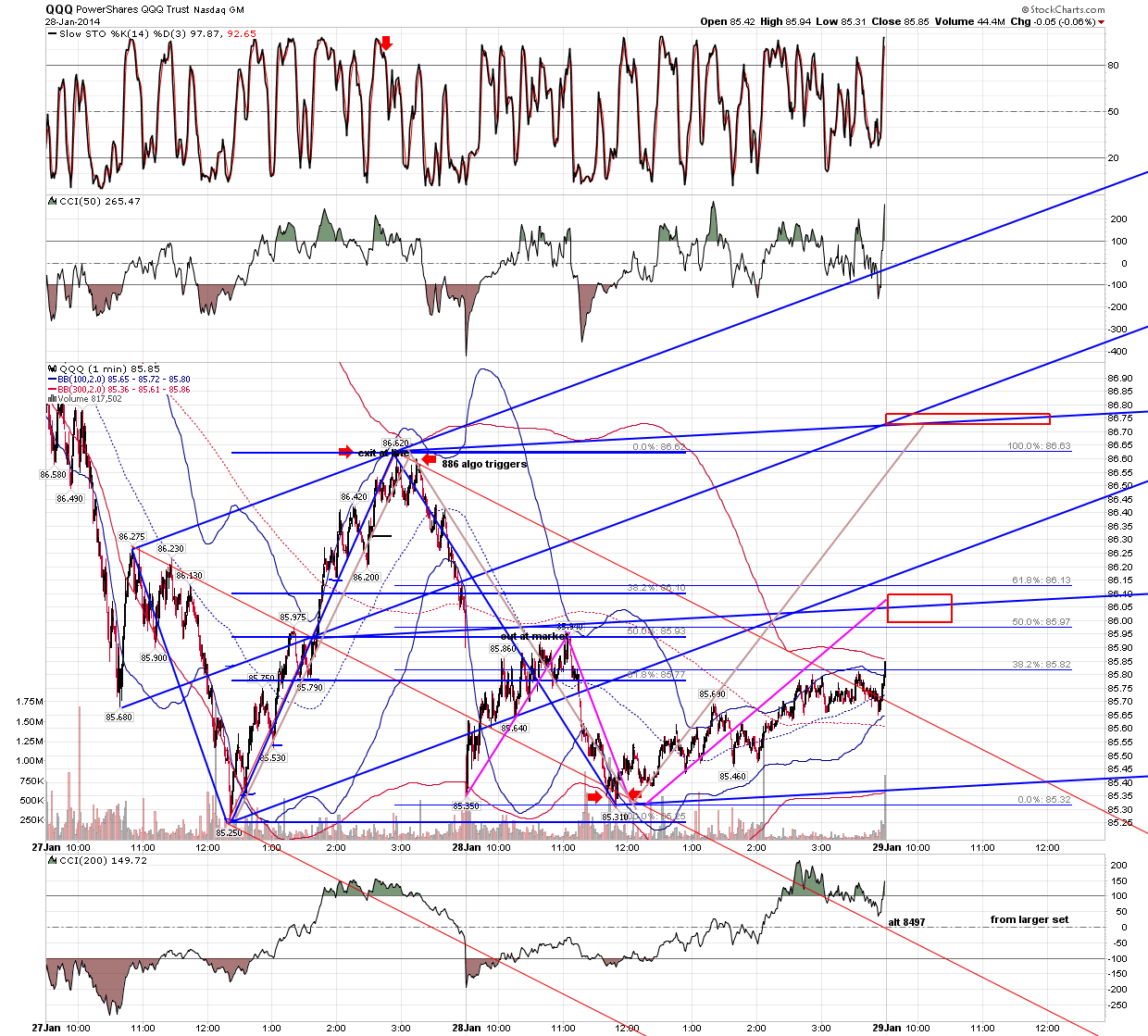

NOTE how on the exact low bar of the day, one penny from the exact price required to set

up the trade in the QQQ, the large traders stepped in and bought the inverse vix etf in size.

They knew what i knew.

Once price had hit the upside target, the computers turned price and then signaled their intent to take price down

by triggering the 886 algo, a setup that i have shown here many times.

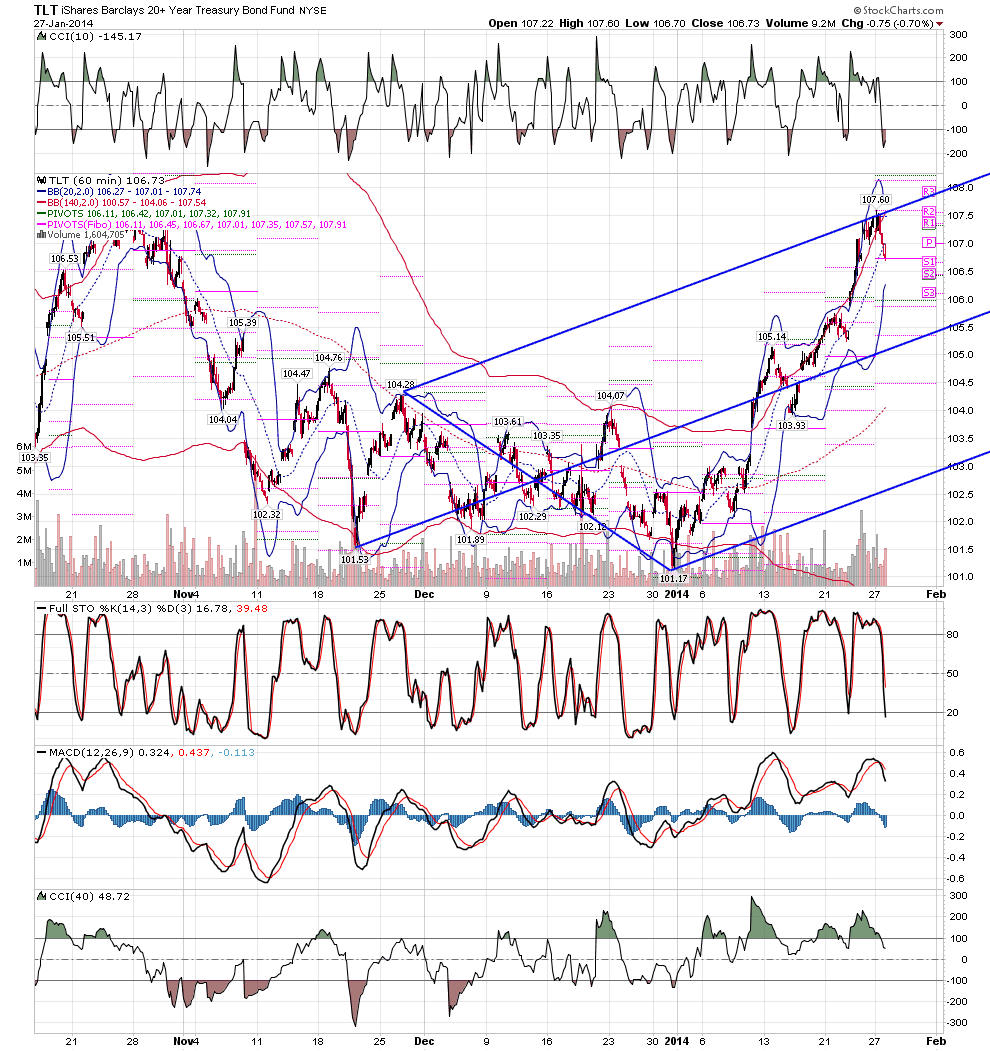

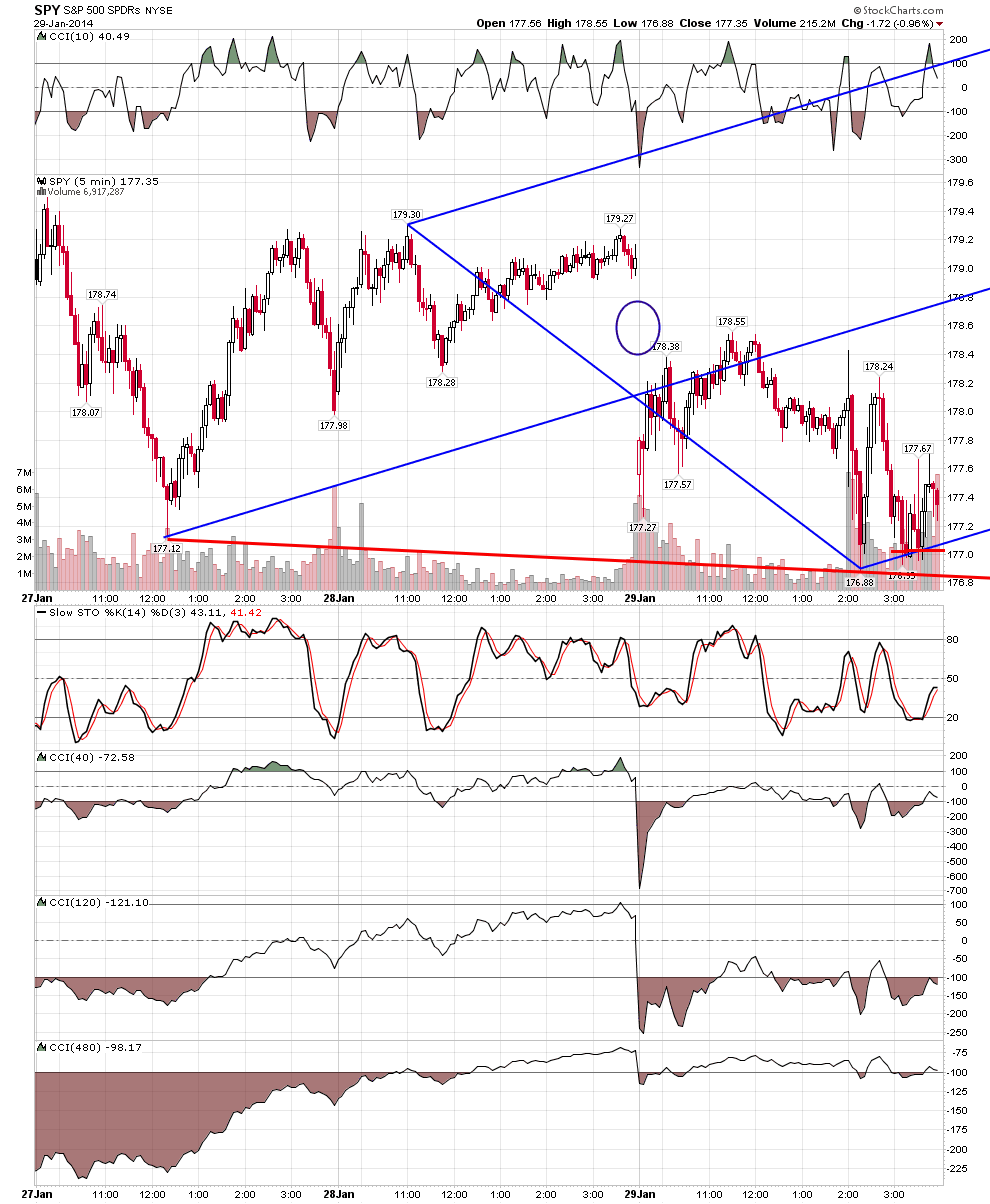

With bonds at resistance given by tools, the computers signaled their intent by first setting up the red line green set

then triggering the trade by again using the 886 algo as shown at this site for many years.

I do not know everything they know;so,I limit my trades to setups

I have seen them use and I have traded countless times.

Trades on 1/27 were based on work I first showed at MYPIVOTS almost 8

years ago and have shown multiple times since.

The one thing i have added in the past couple of years is an awareness

of the vix etf's and will often trade them short term derivatively as they offer a better

percentage return than trading the actual etf's.

NOTE how on the exact low bar of the day, one penny from the exact price required to set

up the trade in the QQQ, the large traders stepped in and bought the inverse vix etf in size.

They knew what i knew.

Once price had hit the upside target, the computers turned price and then signaled their intent to take price down

by triggering the 886 algo, a setup that i have shown here many times.

With bonds at resistance given by tools, the computers signaled their intent by first setting up the red line green set

then triggering the trade by again using the 886 algo as shown at this site for many years.

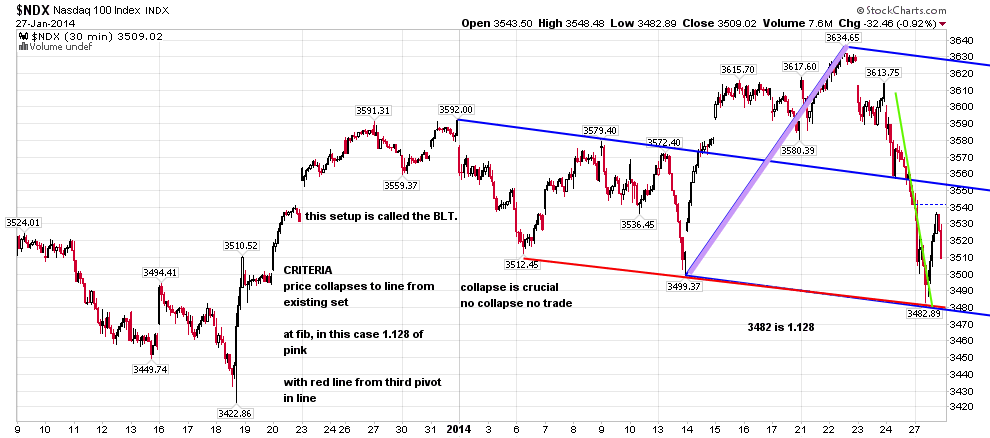

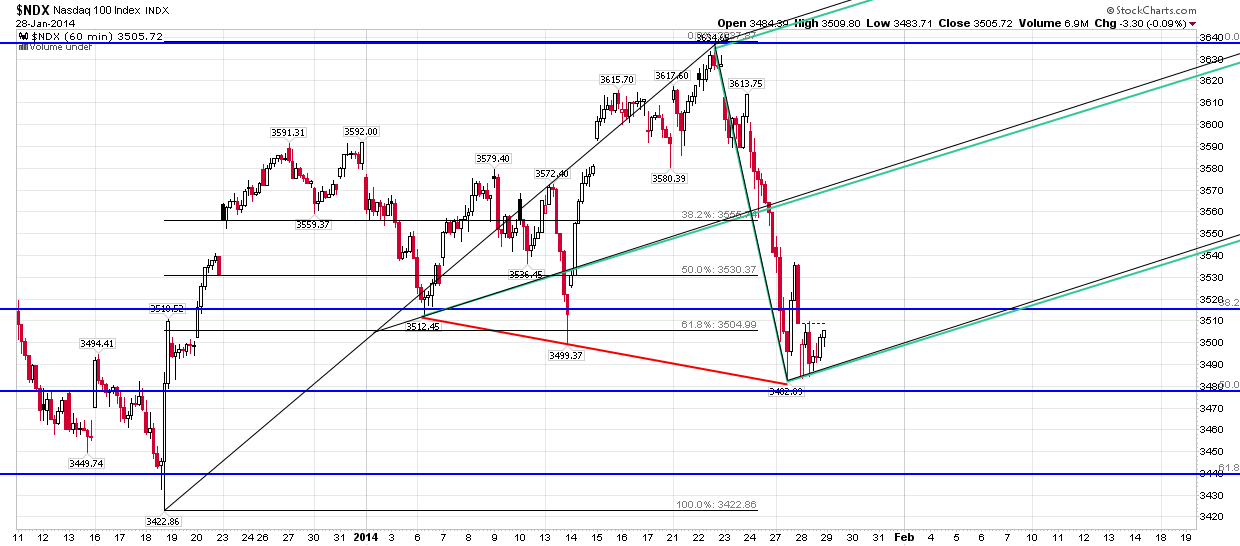

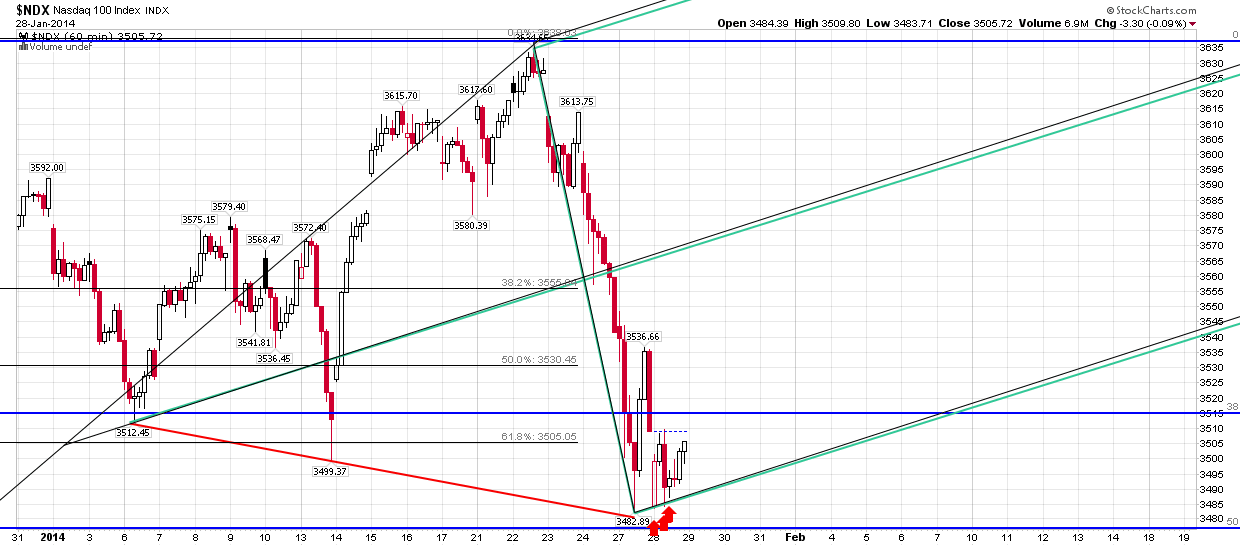

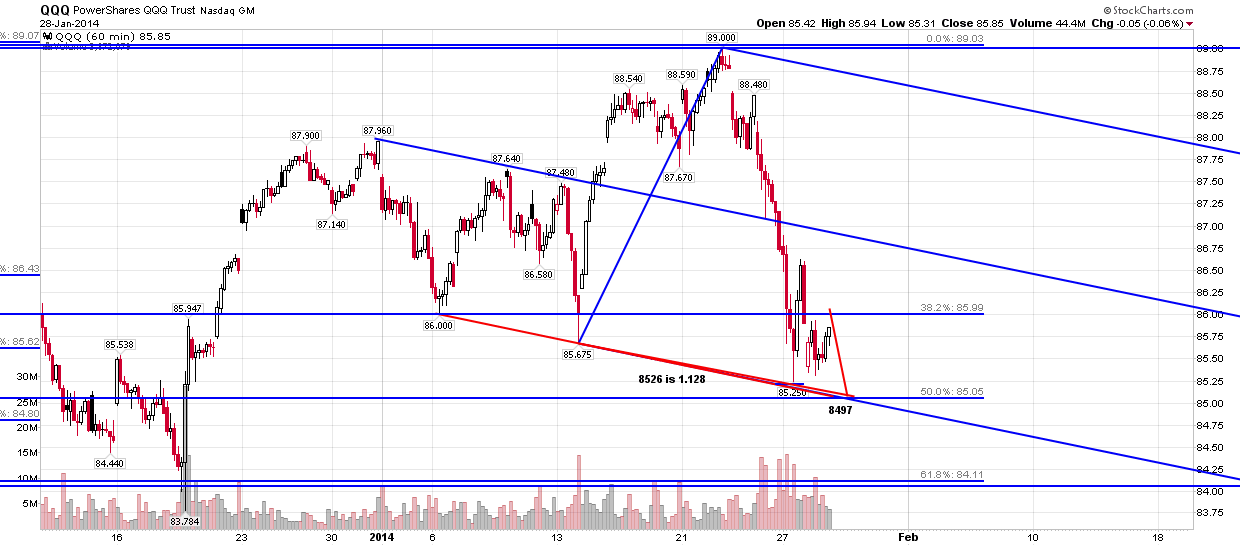

Based on the standard test and retest entry used by medianline traders,

a larger buy signal was triggered in the NDX

entry was on QQQ chart at double arrows with price at line.

Note that the BLT trade signal set is overlapped the standard

modified schiff set.

The trade will now either succeed or fail on its own merits.

stop 8524.

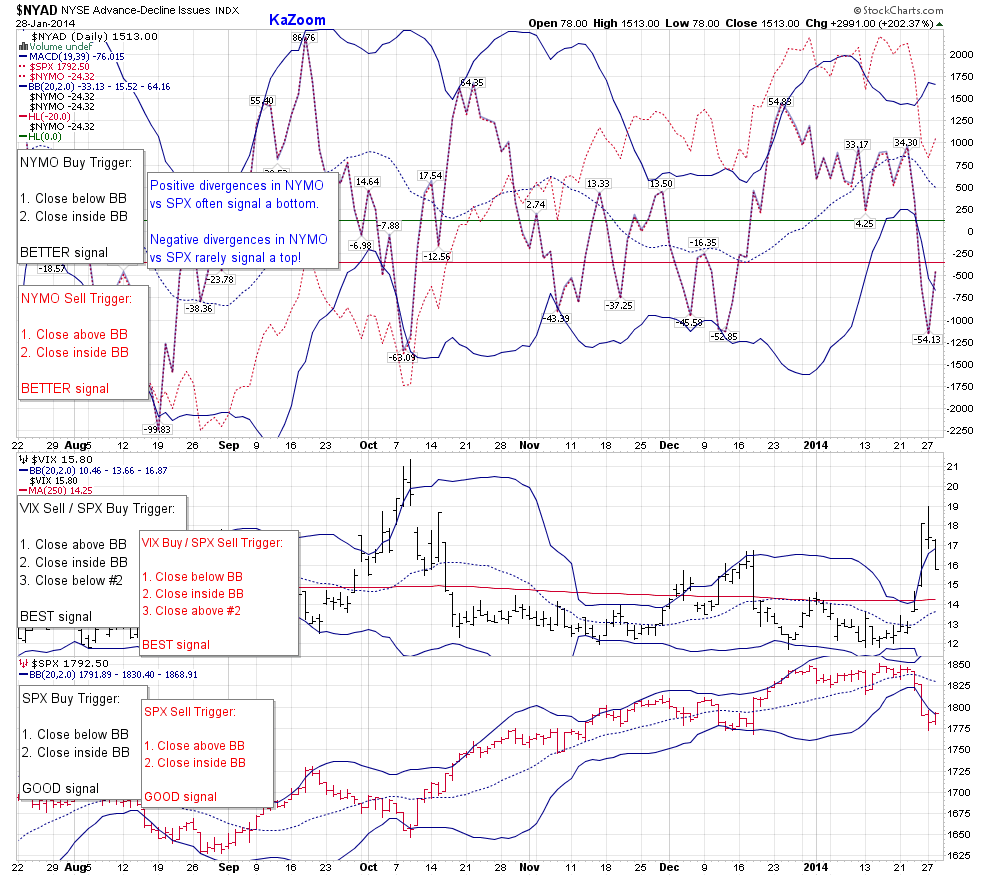

Enclosed is chart by trader KAZOOM found in the public area

at pugsma. wordpress.com that confirms trade on close.

a larger buy signal was triggered in the NDX

entry was on QQQ chart at double arrows with price at line.

Note that the BLT trade signal set is overlapped the standard

modified schiff set.

The trade will now either succeed or fail on its own merits.

stop 8524.

Enclosed is chart by trader KAZOOM found in the public area

at pugsma. wordpress.com that confirms trade on close.

If a trade is not immediately stopped out, then the number one way

a trade fails before it hits the minimum target is if an abcd sets up against the trade..

I have marked the two potential abcd on the chart.

a trade fails before it hits the minimum target is if an abcd sets up against the trade..

I have marked the two potential abcd on the chart.

Is there one more new low that would still support the bullish case?

Yes as marked...

Yes as marked...

stopped out.

reentered at pre posted 8497......with initial22 cent stop

stop now break even

price MUST get above 8568 here

stop now break even

price MUST get above 8568 here

gone from trade 8530

In late trading, the computers set up the 886 algo, triggering another trade on the long side.

we shall if this one will stick...

we shall if this one will stick...

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.