ES Tuesday 1-21-14

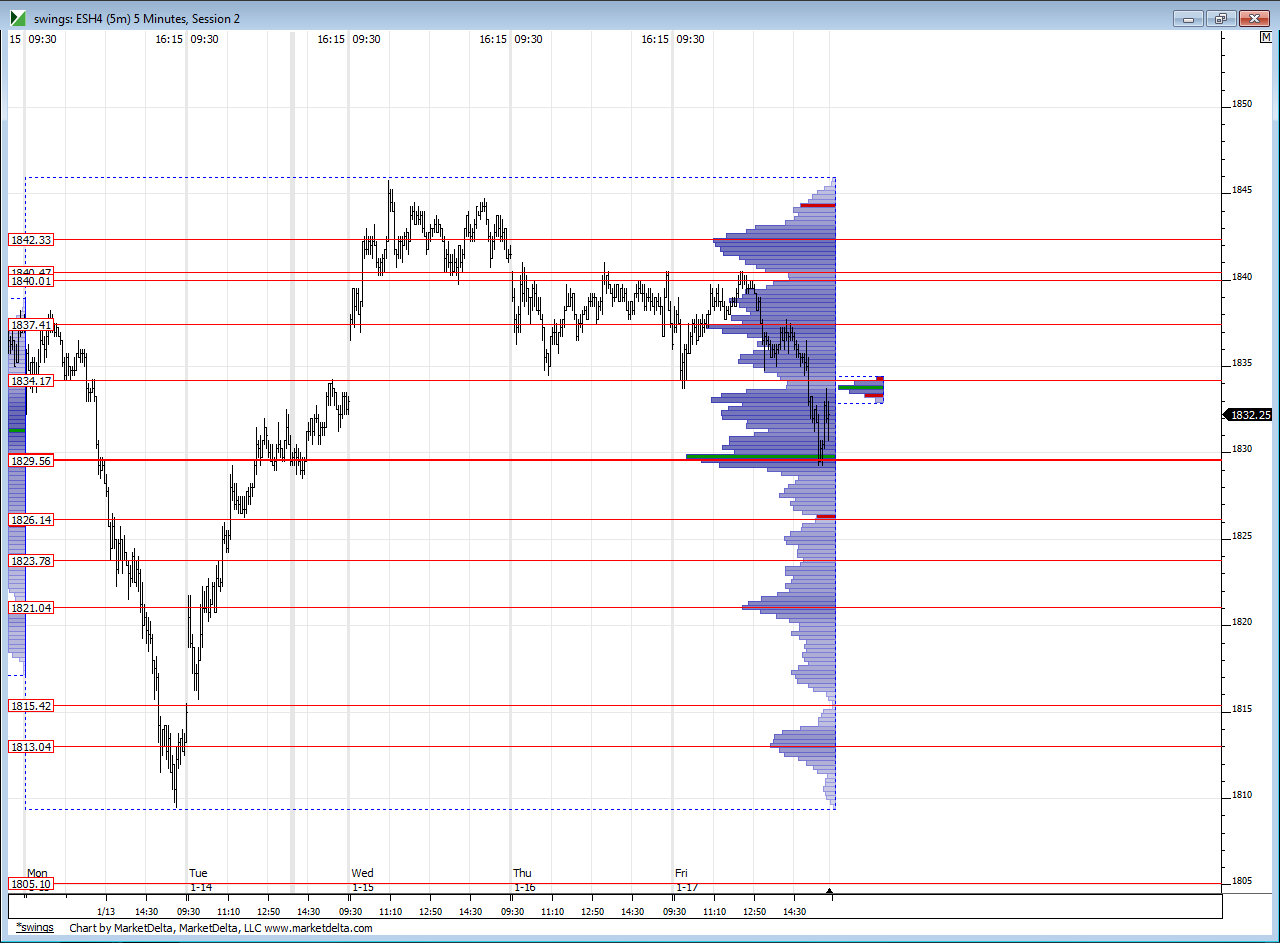

Numbers I'm watching today - particularly interested to to see if the 37 area can act as support early on today to push us out of last weeks highs....key number on the push up might be 42.50...here are some charts as I know many have other places they watch pre market videos now.....

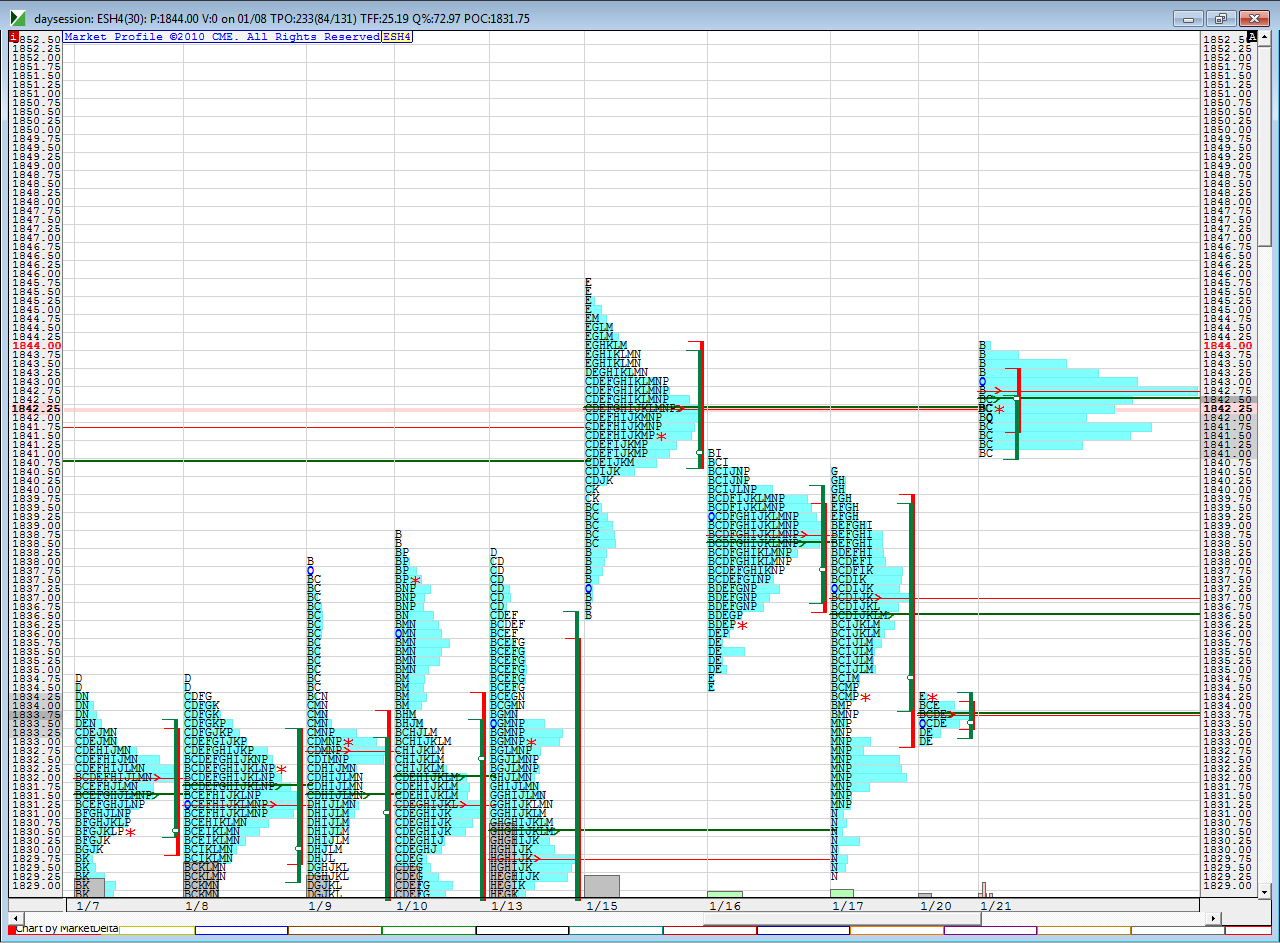

first is weekly volume profile chart and second chart is the daily with volume and time on it

first is weekly volume profile chart and second chart is the daily with volume and time on it

as a fader my plan is to try and sell above 42.50 as close to 44 as possible and will also try to sell new yearly highs above 46......will try to use 40 and 37 .50 as ultimate targets....if we sell the 46 area then then 42.50 becomes the key target to watch...

where do others watch premarket video?

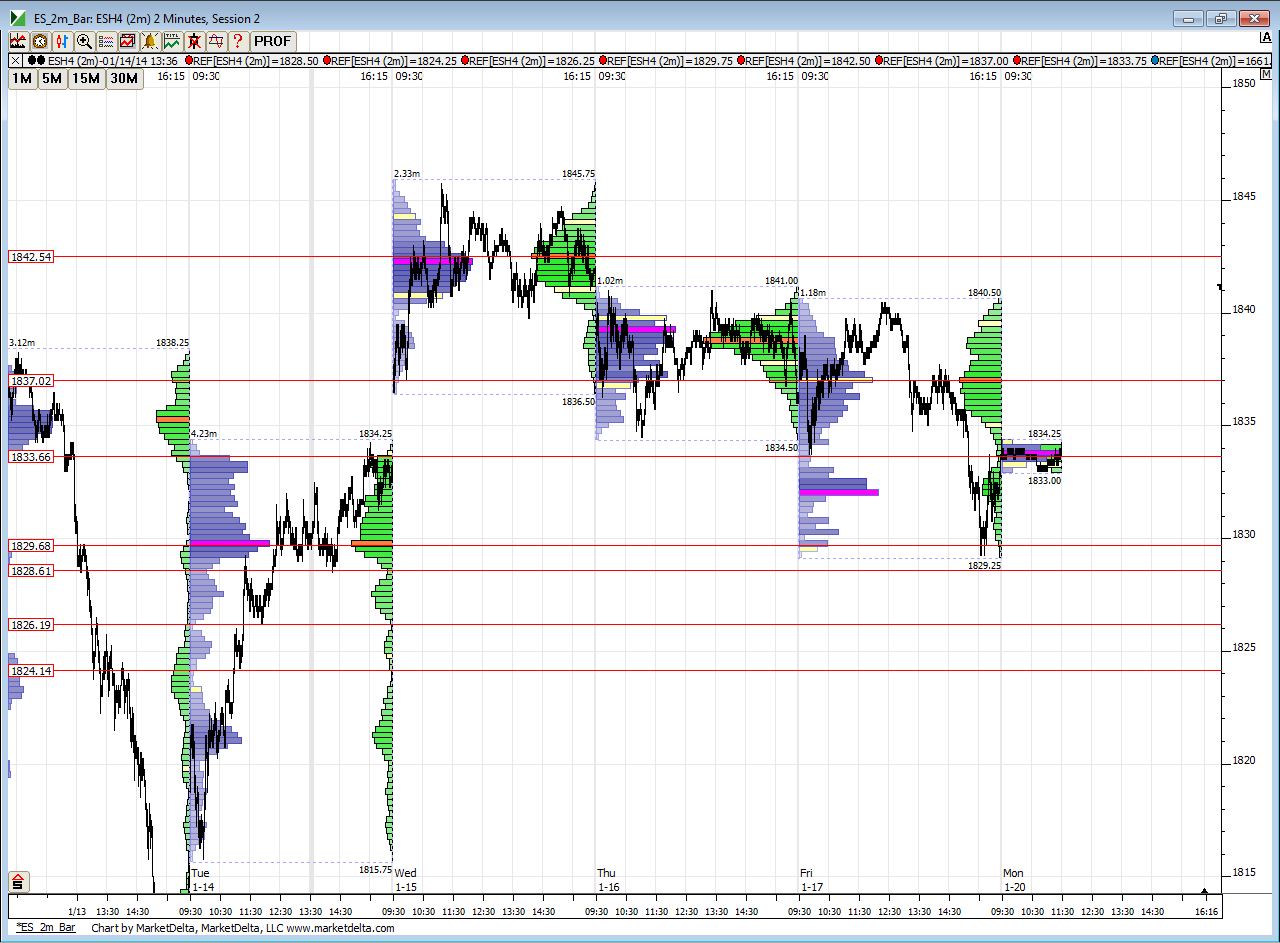

selling the 44 but we know 42.50 is so close buy so this is small...new yearly highs close buy as risk point

coming out quick at 42.50 print...will try to hold something for 40.25...this is a small package and we are at an old POC of time again

we have multiple highs at 40.50 and 41 so scaling out into that and not waiting for that 40.25....last contract is going to get greedy and try for the O/N midpoint or 39 if i don't like the action down there.....

a picture of the multiple highs, the 42.50 POC and the VA high from 1-15...hence my sells outside of the O/N highs at the 44...look at VA high from 1-15

Way to pick them clean Bruce, nice trading...

Duck..I don't really want to advertise too much for others out of respect for this forum....but there is a broker / volume profile educator that does long videos premarket......I know many are clients of his and follow him.......I guess they realized a good thing when they saw what we were doing here as we were more of the originators.....so I'm not gonna compete with that ..he does mega webinars on big mikes and a small fry like myself can't go up against that.....many also are involved with other educators so there are only so many videos a person can watch....posting the charts is quicker and easier and I think that most can get just as much from the chart as they would me babbling from a video anyway....perhaps I am wrong on this

overnight POC at 39 was my final hit of the exit button on this short....if I had more ammo I would have tried to hold for the further selloff to they key 37 area....but tghis was a small package and I can only do do much......nice trade for those who were able to hold

send me a PM Duck and I will find the link to those premarket videos....... I've watched a few but it is really just basic volume profile stuff going over areas...they are pretty good but also cover other markets....so it might be good for some

overnight POC at 39 was my final hit of the exit button on this short....if I had more ammo I would have tried to hold for the further selloff to they key 37 area....but tghis was a small package and I can only do do much......nice trade for those who were able to hold

send me a PM Duck and I will find the link to those premarket videos....... I've watched a few but it is really just basic volume profile stuff going over areas...they are pretty good but also cover other markets....so it might be good for some

thanks Sharks...the greed side of me is sorry I didn't have more working but opening up above that 42.50 forced me to follow my rules and not go in as heavy...for most you can see in my daysession chart why that 36 - 37 area would have been a target....once we got back inside the VA from Friday (that 39 - 40 area )then many will try to get it back to the POC from that day...just pointing that out to anyone who may be new or need a refresher on how our bell curves are suppose to work...

tricky spot here as a failure will go all the way back to the otherside of Value........I'm only shooting for 1 -2 trades a day now in the first 90 minutes......many know I have been chopping at the emini since late 1998...so I am burned out a bit and need to focus just on my high probability times to trade...hard to think that this is my 16th year at this stuff......so this one campaign is enough for me.......hope it goes well for any that remain...

compliments of Paul, there is a very high probability of returning to fridays close when we open inside a weekly range.....this doesn't tell u the day it will happen but something to think about

tricky spot here as a failure will go all the way back to the otherside of Value........I'm only shooting for 1 -2 trades a day now in the first 90 minutes......many know I have been chopping at the emini since late 1998...so I am burned out a bit and need to focus just on my high probability times to trade...hard to think that this is my 16th year at this stuff......so this one campaign is enough for me.......hope it goes well for any that remain...

compliments of Paul, there is a very high probability of returning to fridays close when we open inside a weekly range.....this doesn't tell u the day it will happen but something to think about

If I was trading I would prefer to see this push down into the LVN area at about 32-34... then try to take the fade long if we assume the gap fillers start buying back to exit also...then use 36 - 37 as a target first...just an idea.....

thanks Rburns....that rest also made me realize that I need to get control of my addiction to trading....it's one thing to have passion for something but when you start getting obsessed then you need to back away.....I also had some bad back pain meds that scrambled my brain even more....luckily I had my guitar as my therapist to pull me through !!

hope you are well and good to see some folks still around

hope you are well and good to see some folks still around

Emini Day Trading /

Daily Notes /

Forecast /

Economic Events /

Search /

Terms and Conditions /

Disclaimer /

Books /

Online Books /

Site Map /

Contact /

Privacy Policy /

Links /

About /

Day Trading Forum /

Investment Calculators /

Pivot Point Calculator /

Market Profile Generator /

Fibonacci Calculator /

Mailing List /

Advertise Here /

Articles /

Financial Terms /

Brokers /

Software /

Holidays /

Stock Split Calendar /

Mortgage Calculator /

Donate

Copyright © 2004-2023, MyPivots. All rights reserved.

Copyright © 2004-2023, MyPivots. All rights reserved.